Quit Statement

To leave the LLC, the founder (participant) must submit a written application to the organization (clause 1 of Article 94 of the Civil Code of the Russian Federation, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 18, 2005 No. 11809/04).

From the date of submission of this document, the participant’s share will pass to the organization (clause 2 of article 94 of the Civil Code of the Russian Federation, clauses 6.1, 7 of article 23 of the Law of February 8, 1998 No. 14-FZ).

The day of filing an application is one of the following dates:

- the day of its transmission to the board of directors (supervisory board), the head of the company or an employee of the organization, whose duties include transmitting the application to a competent person;

- the day on which the company received the application sent by mail.

This is stated in subparagraph “b” of paragraph 16 of the resolution of the Plenums of the Supreme Court of the Russian Federation and the Supreme Arbitration Court of the Russian Federation dated December 9, 1999 No. 90/14.

An example of an application for withdrawal of a participant from an LLC

The authorized capital of Torgovaya LLC is 100,000 rubles. It is divided into shares between three participants. One participant – A.S. Glebova - decided to leave the founders, as he wrote in a statement.

On July 16, Glebova sent a statement to Hermes by mail with acknowledgment of receipt. The society received the statement on July 23. The date of receipt of the application by Hermes is confirmed by the imprint of a calendar stamp on the notification.

Change of charter

If the founder (participant) left the LLC before the company’s charter was brought into compliance with the new edition of Law No. 14-FZ of February 8, 1998, then it is necessary to proceed as follows. Simultaneously with registering the transfer of shares, changes to the charter must be registered. This was stated in the letter of the Federal Tax Service of Russia dated June 25, 2009 No. MN-22-6/511.

Within a year from the date of filing the application for withdrawal, the organization must find new owners of the share of the founder (participant) who left the company. It can be distributed among other founders (participants), sold to one of them, sold to third parties, etc. This is stated in Article 24 of the Law of February 8, 1998 No. 14-FZ.

The new composition of the organization's participants must be reflected in the list of company participants. In addition to information about each participant, this document must contain information about the size of his share, its payment, the size of shares belonging to the company itself, the dates of their transfer to the company, etc. (Clause 1 of Article 31.1 of the Law of February 8, 1998 No. 14-FZ).

Payment of the share to the withdrawing participant

The organization is obliged to pay the founder (participant) the actual value of his share (clause 6.1 of Article 23 of the Law of February 8, 1998 No. 14-FZ).

Calculate the actual value of the share of the founder (participant) retiring from the LLC using the formula:

| Actual value of the founder's (participant's) share | = | Nominal value of share | : | Authorized capital | × | Net assets |

This calculation procedure is established by paragraph 2 of Article 14 of the Law of February 8, 1998 No. 14-FZ.

The procedure for assessing net assets was approved by order of the Ministry of Finance of Russia dated August 28, 2014 No. 84n.

Situation: what data must be used to calculate the actual value of the founder’s (participant’s) share?

Estimate the actual value of the redeemed share of the founder (participant) based on the market value of the property reflected in the balance sheet.

The actual value of the founder's (participant's) share corresponds to part of the value of the company's net assets, proportional to its nominal share. As a general rule, when buying out a share (when a participant leaves the company), this indicator is determined on the basis of the Balance Sheet data for the last reporting period before the founder (participant) approached the company with such a requirement (application). In this case, the indicators for calculating the actual value of the share must be taken from the reporting that is closest to the date of filing the participant’s request (application) to leave the company. This can be not only annual, but also interim (monthly or quarterly) reporting. This procedure follows from the provisions of paragraph 2 of Article 14, paragraphs 2 and 6.1 of Article 23 of the Law of February 8, 1998 No. 14-FZ and is confirmed by judicial practice (see, for example, the decisions of the Seventh Arbitration Court of Appeal of April 6, 2015 No. 07AP -871/2015, Arbitration Court of the West Siberian District dated August 6, 2015 No. F04-21575/2015).

Thus, from the literal interpretation of these norms it follows that the only document on the basis of which an organization must calculate the actual value of the founder’s (participant’s) share is the balance sheet. Consequently, other methods for determining the value of a company’s assets, including based on the market value of property, cannot be used.

However, it should be taken into account that the financial statements must reliably reflect the financial position of the organization (clause 6 of PBU 4/99). Subject to this rule, the book value of the property corresponds to its market value.

The withdrawing participant has the right to challenge in court the amount of the actual value of the share calculated by the company (subclause “c” of paragraph 16 of the resolution of the plenums of the Supreme Court of the Russian Federation and the Supreme Arbitration Court of the Russian Federation dated December 9, 1999 No. 90/14).

If a dispute arises between a participant and the company, the courts determine the actual value of the share taking into account the market value of the company's property. In this case, the balance sheet data is used to establish the composition of the company’s property (resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 7, 2005 No. 15787/04, dated September 6, 2005 No. 5261/05).

The rulings of arbitration courts adopted after this were overwhelmingly based on this position (see, for example, the rulings of the Supreme Arbitration Court of the Russian Federation dated March 5, 2010 No. VAS-1880/10, dated November 22, 2007 No. 14448/07, decisions of the FAS Western Siberian District dated June 24, 2010 No. A75-5643/2009, Ural District dated May 12, 2010 No. Ф09-3177/10-С4, dated March 18, 2010 No. Ф09-1603/10-С4, Far Eastern District dated March 23, 2010 No. 1365/2010, Volga District dated February 12, 2010 No. A72-4275/2008, dated February 12, 2010 No. A72-4272/2008, Central District dated February 5, 2010 No. F10-6286 /09, dated March 30, 2009 No. F10-714/09(2), North-Western District dated December 23, 2009 No. A26-3413/2008, North Caucasus District dated December 11, 2009 No. A32-16337 /2007, Volga-Vyatka District dated May 28, 2008 No. A28-278/2008-9/9).

In this situation, the organization will have to independently resolve the issue of assessing the actual value of the founder’s (participant’s) share being purchased from him. However, taking into account the established arbitration practice, the company will not violate the requirements of the law, but will avoid litigation if it evaluates the actual value of the redeemed share of the founder (participant) based on the market value of the property reflected in the balance sheet.

An example of calculating the actual value of a share when a founder leaves an LLC. The book value of the organization's net assets corresponds to their market value

The authorized capital of Torgovaya LLC is 100,000 rubles. It is divided into shares between three participants:

- A.V.'s share Lvov – 25,000 rubles;

- share of E.E. Gromovoy – 25,000 rubles;

- share of V.K. Volkova – 50,000 rubles.

Gromova decided to leave the founders. Hermes received a statement about Gromova’s release on July 16. To pay the share, the Hermes accountant calculated its actual value according to the balance sheet. According to the balance sheet for the first half of the year, the value of the organization’s net assets is 1,080,000 rubles.

The actual value of Gromova’s share, which is payable, is equal to: 25,000 rubles. : 100,000 rub. × 1,080,000 rub. = 270,000 rub.

An example of calculating the actual value of a share when a founder leaves an LLC. The book value of the organization's net assets does not correspond to their market value

The authorized capital of Torgovaya LLC is 100,000 rubles. It is divided into shares between three participants:

- A.V.'s share Lvov – 25,000 rubles;

- share of E.E. Gromovoy – 25,000 rubles;

- share of V.K. Volkova – 50,000 rubles.

Gromova decided to leave the founders. In this regard, the organization conducted an expert assessment of the market value of real estate listed on its balance sheet.

Hermes received a statement about Gromova’s release on July 16. To pay the share, the Hermes accountant calculated its actual value based on the balance sheet and expert assessment. According to the balance sheet for the first half of the year, taking into account the market value of property, the value of the organization’s net assets is 5,100,000 rubles.

The actual value of Gromova’s share, which is payable, is equal to: 25,000 rubles. : 100,000 rub. × 5,100,000 rub. = 1,275,000 rub.

Accounting for payment of the actual value of a share

May 19, 2011

Question:

How to reflect in accounting the payment to an LLC participant of the actual value of the share, as well as the transfer of the share to the remaining LLC participant?

Answer:

Legal certificate.

Any participant in an LLC has the right to leave the company by alienating his share, regardless of the consent of other participants or the company, if this is provided for by the company’s charter (clause 1 of article 94 of the Civil Code of the Russian Federation, clause 1 of article 8, clause 1 of article 26 of the Law of 08.02 .1998 N 14-FZ “On Limited Liability Companies”).

In this case, the participant’s share passes to the company, and the company, in turn, within three months from the date of receipt of the participant’s application to leave the company is obliged to pay this participant the actual value of his share in the authorized capital of the company, determined on the basis of the company’s financial statements for the last the reporting period preceding the day of filing an application to leave the company, or with the consent of this company participant, give him in kind property of the same value (clause 6.1, subclause 2, clause 7, article 23 of Federal Law No. 14-FZ). The actual value of a share in the company's authorized capital is paid out of the difference between the value of the company's net assets and the size of its authorized capital. If such a difference is not enough, the company is obliged to reduce its authorized capital by the missing amount (Clause 8, Article 23 of Federal Law No. 14-FZ). When a participant leaves the LLC, his share transferred to the company is distributed among the remaining participants while maintaining the ratio of their shares in the authorized capital of the LLC. Withdrawal of a participant from the company

On the date of receipt of an application from an LLC participant about his withdrawal from the company, the debit of account 81 “Own shares (shares)” in correspondence with the credit of account 75 “Settlements with founders” reflects the debt to this participant

in the amount of the actual value of his share .

Payment to the retiring participant of the actual value of the share

is not recognized as an expense

in accounting and is reflected in the debit of account 75 and the credit of account 50 “Cash” or 51 “Settlement accounts”.

According to paragraphs. 3 p. 1 art. 251 of the Tax Code of the Russian Federation, the value of property received as a contribution to the authorized capital is not recognized as income. Thus, based on the norm of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, payment to an LLC participant upon his withdrawal from the company of the actual value of the share within the limits of its nominal value is not taken into account as expenses. As for the amount of excess of the actual value of the share over its nominal value, these expenses are also not recognized in tax accounting, since they are not related to the implementation of activities aimed at generating income (paragraph 4, clause 1, article 252 of the Tax Code of the Russian Federation). The actual value of the share paid to the participant who left the LLC is the income of this participant, subject to personal income tax (clause 1 of article 209, clause 1 of article 210 of the Tax Code of the Russian Federation). The organization paying the income is recognized as a tax agent. In this case, the withdrawing participant does not have the right to a property tax deduction, since passes to the company not on the basis of a purchase and sale agreement (clause 6 of Article 226 of the Tax Code of the Russian Federation). The date of receipt of income is considered the day of actual payment of the actual value of the share (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). Taxation is carried out at a rate of 13%. Acquisition of a share by the remaining participant.

The distribution between the participants of the specified share is reflected by an entry in the debit of account 75 and the credit of account 81. Since the remaining participant does not pay for the shares distributed in his favor, the amount reflected in account 75 is written off, in our opinion, from the appropriate sources to the debit of accounts 84 “Retained earnings (uncovered loss)”, 83 “Additional capital”, 82 “Reserve capital”.

In our opinion, in this situation it is advisable to use account 84 “Retained earnings”. That is, when paying the actual value of a share to a participant who left the LLC, and when distributing this share among the participants who remained in the company, expenses are not reflected in accounting. A participant in the company, in whose favor the share in the authorized capital transferred to the company is distributed, receives income in kind, subject to personal income tax (clause 1 of article 210, clause 2 of clause 2 of article 211 of the Tax Code of the Russian Federation). The tax base, in accordance with paragraph 1 of Art. 211, art. 41 of the Tax Code of the Russian Federation is determined based on the actual value of the distributed shares. An organization as a tax agent is obliged to calculate and withhold the amount of personal income tax for any cash payment of income to participants (clause 6 of Article 226 of the Tax Code of the Russian Federation). If the LLC does not make payments to the participant, then it is obliged, no later than one month from the end of the tax period in which the relevant circumstances arose, to notify in writing the LLC participant (taxpayers) and the tax authority at the place of its registration about the impossibility of withholding personal income tax and the amount of tax (clause 5 Article 226 of the Tax Code of the Russian Federation). Conclusions:

The following entries must be made in accounting:

| Debit | Credit | Contents of operations |

| Operations for the withdrawal of a participant from the LLC | ||

| 81 "Own shares" | 75 “Settlements with a participant who left the LLC” | The debt to pay the actual value of the share to the participant who left the LLC is reflected |

| 75 “Settlements with a participant who left the LLC” | 68 "NDFL" | Personal income tax is withheld when paying the actual value of the share to a participant who left the LLC |

| 75 “Settlements with a participant who left the LLC” | 50 (51) | The actual value of the share was paid to the participant who left the LLC |

| Operations to transfer a share to a new participant | ||

| 75 “Settlements with the participant to whom the share has been transferred” | 81 "Own shares" | The debt of the participant to repurchase the share in the LLC is reflected |

| 84 | 75 “Settlements with the participant to whom the share has been transferred” | The cost of the share distributed between the participants is written off at the expense of the sources of formation of the property of the LLC |

Accounting: payment of shares

You can settle accounts with the founder (participant) either with money or with property (with his consent). This must be done within three months from the date the participant submits an application to leave the company, unless a different period is provided for in the charter (clause 6.1 of Article 23 of the Law of February 8, 1998 No. 14-FZ).

Reflect the payment of the actual value of the share by posting:

Debit 75 subaccount “Participant” Credit 51 (50) – the actual value of the participant’s share was paid minus the withheld personal income tax.

This follows from the Instructions for the chart of accounts.

An example of payment of the actual value of a share when the founder leaves the LLC. The book value of the organization's net assets corresponds to their market value

The authorized capital of Torgovaya LLC is 100,000 rubles. It is divided into shares between three participants:

- A.V.'s share Lvov – 25,000 rubles;

- share of E.E. Gromovoy – 25,000 rubles;

- share of V.K. Volkova – 50,000 rubles.

Gromova decided to leave the founders. Hermes received a statement about Gromova’s release on July 16. To pay the share, the Hermes accountant calculated its actual value. According to the balance sheet for the first half of the year, the value of the organization’s net assets is 1,080,000 rubles. The actual value of Gromova’s share is 270,000 rubles. (RUB 25,000 : RUB 100,000 × RUB 1,080,000).

On July 16, the accountant reflected the transfer of Gromova’s share to the company:

Debit 81 Credit 75 subaccount “Gromov’s Participant” – 270,000 rubles. – reflects the transfer of Gromova’s share to the organization.

On August 20, the Hermes cashier paid Gromova the amount due to her. Gromova is a resident of Russia. On this day, the accountant made the following entries:

Debit 75 sub-account “Gromov Participant” Credit 68 sub-account “Personal Income Tax Payments” – 35,100 rubles. (RUB 270,000 × 13%) – personal income tax is withheld from the actual value of Gromova’s share;

Debit 75 subaccount “Gromov's Participant” Credit 50 – 234,900 rub. (270,000 rubles – 35,100 rubles) – the actual value of his share in the authorized capital was paid to the participant.

Situation: is it necessary to pay the actual value of the share to the founder (participant) leaving the LLC if the net assets of the organization are negative?

No no need.

If a founder (participant) leaves the company, the organization is obliged to pay him the actual value of his share. The acquisition of a share is paid for by the company from the difference between the value of net assets and the size of the authorized capital.

This follows from paragraphs 6.1 and 8 of Article 23 of the Law of February 8, 1998 No. 14-FZ.

The actual value of the share of the founder (participant) of the company corresponds to part of the value of the company’s net assets in proportion to the size of its share (paragraph 2, paragraph 2, article 14 of the Law of February 8, 1998 No. 14-FZ).

Consequently, if the value of the company’s net assets is negative, then there are no grounds for paying the actual value of the shares.

A similar conclusion was made in the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 14, 2006 No. 10022/06, the determination of the Supreme Arbitration Court of the Russian Federation dated December 18, 2012 No. VAS-16959/12, resolutions of the Federal Antimonopoly Service of the Ural District dated January 24, 2013 No. F09-13828/ 12, Moscow District dated October 29, 2012 No. A41-30190/10, Central District dated February 9, 2012 No. A14-3376/2011.

It should be noted that a company whose net assets will be less than its authorized capital at the end of two financial years in a row (starting from the second financial year) is obliged to make a decision to reduce the authorized capital to an amount not exceeding the value of the organization’s net assets (clause 4 Article 90 of the Civil Code of the Russian Federation, paragraph 4 of Article 30 of the Law of February 8, 1998 No. 14-FZ). In this case, the authorized capital can be reduced by reducing the nominal value of the shares of all participants or by extinguishing the shares owned by the company (Clause 1, Article 20 of the Law of February 8, 1998 No. 14-FZ).

An example of how to reflect in accounting the transfer of a participant's share upon leaving an LLC. The actual share is not paid because the net assets are negative

The authorized capital of Torgovaya LLC is 100,000 rubles. It is divided into shares between three participants:

- A.V.'s share Lvov – 25,000 rubles;

- share of E.E. Gromovoy – 25,000 rubles;

- share of A.S. Glebova – 50,000 rubles.

Glebova decided to withdraw from the participants. The application for Glebova’s release was received by Hermes on July 16. As a general rule, when Glebova leaves the membership, Hermes must pay her the actual value of the share within a month. However, according to the balance sheet for the first half of the year, taking into account the market value of the property, the value of net assets turned out to be negative (-250,000 rubles).

Based on this, calculation and payment of the actual value of the share upon Glebova’s withdrawal from the LLC’s membership are not made. Within the period established by law (i.e., until November 17), Glebova did not declare her reinstatement as a member of the LLC.

In this case, the nominal value of Glebova’s share is distributed among the remaining participants in proportion to their shares in the authorized capital (by decision of the general meeting of participants).

Since Lvov's and Gromova's shares are the same, Glebova's share is distributed equally between them.

On July 16, the accountant reflected the transfer of the nominal share to the LLC with the following entries:

Debit 81 Credit 75 subaccount “Glebov’s Participant” – 50,000 rubles. – reflects the transfer of Glebova’s share to the organization at nominal value.

On November 17, the deadline for Glebova to apply for reinstatement as a participant expired:

Debit 75 subaccount “Glebov’s Participant” Credit 91 – 50,000 rub. – the nominal value of Glebova’s share is included in other income.

The accountant reflected the distribution of shares in the authorized capital of the company among the remaining participants with the following entries:

Debit 75 subaccount “Participant Lviv” Credit 81 – 25,000 rubles. (RUB 50,000: 2) – according to the decision to redistribute the share of the withdrawing participant, the transfer of the nominal share to Lvov is reflected;

Debit 75 subaccount “Gromov's Participant” Credit 81 – 25,000 rubles. (RUB 50,000: 2) – according to the decision to redistribute the share of a retired participant, the transfer of the nominal share to Gromova is reflected;

Debit 80 subaccount “Participant Glebova” Credit 80 subaccount “Participant Lvov” – 25,000 rubles. (RUB 50,000: 2) – reflects the change in the composition of participants;

Debit 80 sub-account “Glebov’s Participant” Credit 80 sub-account “Gromov’s Participant” – 25,000 rubles. (RUB 50,000: 2) – reflects the change in the composition of participants.

Since the remaining participants do not pay for the shares distributed in their favor, the amount reflected in the debit of account 75 is written off from the appropriate sources:

Debit 84 Credit 75 subaccount “Participant Lviv” – 25,000 rubles. (50,000 rubles: 2) – the nominal value of the share in the part transferred to Lvov through redistribution was written off;

Debit 84 Credit 75 subaccount “Gromov’s Participant” – 25,000 rubles. (50,000 rubles: 2) – the nominal value of the share in the part transferred to Gromovaya through redistribution was written off.

When the share of a retired participant is distributed among the remaining participants, they will have income subject to personal income tax. Since no payments are made to participants, the organization reported to the inspectorate that it was impossible to withhold tax.

Calculation of the actual share amount

You can analyze the composition of participants and the nominal value of their shares in OBC under account 80.09 “Other capital” ( Reports - Balance sheet for the account

)

Next, you need to calculate the actual share of the participant who leaves the participants using the formula:

The actual value of the participant's share = Net assets of the organization × Size of the share in the management company in %

The size of the organization's net assets can be found in the Statement of Changes in Capital as of the last day of the month preceding the withdrawal of an individual from the membership, line 3600. In our case, this is 503,000 rubles.

Actual value of the participant's share = 503,000 × 33.33% = 167,649.9 rubles

503,000 – 150,000 = 353,000 rubles, this amount is enough to pay the actual share.

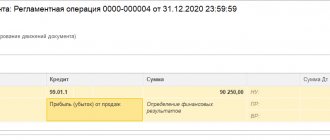

To do this, create an Operation entered manually ( Operations – Operations entered manually – Create – Operation

). There will be two entries in the operation, the first will reflect the nominal value of the share of the withdrawing participant and its transfer to the company, and the second will reflect the debt to pay the actual value of the share to the withdrawing participant.

In debit entries, indicate an individual from the Individuals directory, and in the second credit entry from the Counterparties directory, since the payment will be made to an individual as a counterparty.

Accounting: transfer of the participant's share to the organization

Upon receipt of an application for the withdrawal of a founder (participant) from the company, make the following entry in accounting:

Debit 81 Credit 75 subaccount “Participant” - reflects the transfer of the participant’s share to the organization.

This conclusion follows from the Instructions for the chart of accounts.

An example of reflecting in accounting the distribution of the share of a retired participant among the remaining participants

The authorized capital of Torgovaya LLC is 100,000 rubles. It is divided into shares between three participants:

- A.V.'s share Lvov – 25,000 rubles;

- share of E.E. Gromovoy – 25,000 rubles;

- share of V.K. Volkova – 50,000 rubles.

Volkov decided to withdraw from the membership. On July 16, his resignation letter was received by the organization. The actual value of Volkov's share is 220,000 rubles.

The following entry was made in the organization's accounting:

Debit 81 Credit 75 subaccount “Participant of Wolves” – 220,000 rubles. – reflects the transfer of Volkov’s share to the organization.

By decision of the general meeting of participants, the share of the withdrawing participant is distributed among the remaining participants in proportion to their shares in the authorized capital. Since the shares of Lvov and Gromova are the same, the share of the eliminated participant is distributed equally between them.

In accounting, the accountant reflected the redistribution of shares in the authorized capital with the following entries:

Debit 75 subaccount “Participant Gromov” Credit 81 – 110,000 rubles. (RUB 220,000: 2) – reflects the transfer of the share to Gromova based on the decision to redistribute the share of the withdrawing participant;

Debit 75 “Participant Lviv” Credit 81 – 110,000 rub. (RUB 220,000: 2) – reflects the transfer of the share to Lvov by decision on the redistribution of the share of the withdrawing participant;

Debit 80 subaccount “Participant Volkov” Credit 80 subaccount “Participant Gromov” – 25,000 rubles. (RUB 50,000: 2) – reflects the change in the composition of participants;

Debit 80 subaccount “Participant Volkov” Credit 80 subaccount “Participant Lviv” – 25,000 rubles. (RUB 50,000: 2) – reflects the change in the composition of participants.

Since the remaining participants do not pay for the shares distributed in their favor, the amount reflected in the debit of account 75 is written off from the appropriate sources:

Debit 84 Credit 75 subaccount “Gromov’s Participant” – 110,000 rubles. – the actual value of the share in the part transferred to Gromova through redistribution was written off;

Debit 84 Credit 75 subaccount “Participant Lviv” – 110,000 rubles. – the actual value of the share in the part transferred to Lvov through redistribution was written off.

When the share of a retired participant is distributed among the remaining participants, they will have income subject to personal income tax. Since no payments are made to participants, the organization reported to the inspectorate that it was impossible to withhold tax.

An example of reflecting in accounting the sale by a company of a share of a retired participant to a third party

The authorized capital of Torgovaya LLC is 100,000 rubles. It is divided into shares between three participants:

- A.V.'s share Lvov – 25,000 rubles;

- share of E.E. Gromovoy – 25,000 rubles;

- share of V.K. Volkova – 50,000 rubles.

Volkov decided to withdraw from the membership. On July 16, his resignation letter was received by the organization. The actual value of Volkov's share is 220,000 rubles.

The following entry was made in the organization's accounting:

Debit 81 Credit 75 subaccount “Participant of Wolves” – 220,000 rubles. – reflects the transfer of Volkov’s share to the organization.

By decision of the general meeting of participants, the share of the withdrawing participant will be sold to a third party at its actual value (RUB 220,000)

In accounting, the accountant reflected the sale of a share in the authorized capital with the following entries:

Debit 75 subaccount “New participant” Credit 91-1 – 220,000 rubles. – the share of the withdrawing participant is sold to the new participant;

Debit 91-2 Credit 81 – 220,000 rub. – the actual (actual) cost of the share being sold is written off;

Debit 50 (51) Credit 75 – 220,000 rub. – the share was paid by the new participant;

Debit 80 sub-account “Wolf Participant” Credit 80 sub-account “New Participant” – 50,000 rubles. – reflects the change in the composition of participants.

Situation: what value of the founder’s (participant’s) share in the authorized capital of the LLC - nominal or real - is written off in accounting when he submits an application to leave the company?

When a founder (participant) leaves the company, write off the actual value of his share in accounting.

In the debit of account 81 “Own shares (shares)”, reflect the amount of actual expenses - the amount that needs to be paid to the founder (participant) (Instructions for the chart of accounts). The LLC must pay the founder (participant) the actual value of the share (clause 6.1 of Article 23 of the Law of February 8, 1998 No. 14-FZ). Therefore, debit account 81 “Own shares (shares)” with the actual value of the share.

An example of how settlements with a participant when he leaves an LLC are reflected in accounting

The authorized capital of Torgovaya LLC is 100,000 rubles. It is divided into shares between three participants:

- A.V.'s share Lvov – 25,000 rubles;

- share of E.E. Gromovoy – 25,000 rubles;

- share of V.K. Volkova – 50,000 rubles.

Volkov decided to withdraw from the membership. On July 16, his resignation letter was received by the society. The actual value of Volkov's share is 220,000 rubles.

The following entry was made in the organization's accounting:

Debit 81 Credit 75 subaccount “Participant of Wolves” – 220,000 rubles. – reflects the transfer of Volkov’s share to the organization.

Payment of actual share

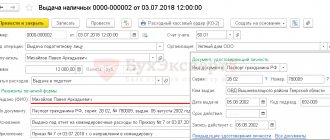

To pay the actual share to the withdrawn participant, create a document Write-off from the current account

with the view “Other settlements with counterparties” (

Bank and cash desk – Bank statements – Write-offs

).

Generates SALT for account 75.02 to verify the absence of debt to the withdrawing participant.