Recycling fee concept

The tax payable upon purchasing a car was introduced in 2012. It is established by paragraph 1 of Article 24-1 of the Federal Law of June 24, 1998 (as amended on July 28, 2012) No. 89. It is a one-time payment paid by car buyers. The money is sent to the country's budget. It is assumed that they will be used for environmental needs. In particular, for car recycling, which is required to maintain a favorable environmental situation.

The fee is paid in accordance with paragraph 3 of Article 24-1 of Federal Law No. 89 under these circumstances:

- When importing a vehicle from another state.

- When purchasing a vehicle from a person who has not paid the recycling fee for various reasons: exemption from payments, dishonesty.

The fee must be paid either by the vehicle manufacturer or the buyer.

Who can avoid paying the recycling fee?

Let's consider the circumstances under which a person is exempt from paying the fee:

- The service life of the car is more than 30 years. At the same time, exemption from the fee is relevant only if the following circumstances are met: the car is not used for commercial purposes, spare parts (body, engine) for the vehicle are original.

- The vehicle belongs to diplomatic missions, consulates, and international structures. Exemption from fees applies to all employees of these entities.

- The vehicle is imported into the Russian Federation as personal property by people participating in the program for relocating Russians from abroad.

IMPORTANT! If representatives of the last two categories sell cars, the DC is paid by the buyers of the vehicle.

How is the fee amount calculated?

You can calculate the amount you will need to pay as part of the recycling fee yourself. Resolution No. 81 provides a list of self-propelled vehicles with their classification and corresponding coefficients. To get the figure required for payment, you need to multiply 172,500 by the coefficient that corresponds to the type of your car in the table.

How is the recycling fee calculated?

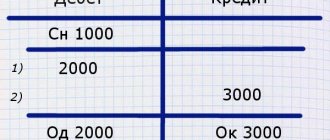

The DC is calculated using this formula:

CS = BS * K

Where:

- US – fee amount;

- BS – base rate;

- K is the coefficient used, which is determined on the basis of the List of CM sizes established by Government Decree No. 81 dated 02/06/2016.

There are only two bets:

- 20 thousand rubles for passenger cars that are not used in commercial activities.

- 150 thousand rubles for trucks, buses, as well as passenger vehicles that are used in commercial activities.

The coefficients are set by law. There are many of them, and they are determined based on the following factors:

- Dimensions.

- Weight.

- Engine capacity.

For example, the coefficient for a passenger car older than three years weighing less than 2.5 tons will be 0.88. This is the value that will be used in the calculations.

Calculation example

An imported bulldozer (weighing no more than 10 tons) with a service life of less than 3 years was purchased. The base rate will be 150,000 rubles, since special equipment will be used for commercial purposes. The coefficient for a car of the type in question is 4. The following calculations are made:

150,000 * 4 = 600,000 rubles.

This is the amount that will need to be paid when importing a car of the type in question from abroad.

Recycling fee in 2022

From April 1, 2022, a recycling fee has been introduced for trailers and semi-trailers weighing more than 10 tons. Currently, taking into account the latest changes: up to 3 years it will be 96,000 rubles, more than 3 years 1,207,500.

You can view the full current version of the regulations on the recycling fee using the links below:

| Decree of the Government of the Russian Federation of December 26, 2013 No. 1291 “On the recycling fee for wheeled vehicles and chassis and on amendments to certain acts of the Government of the Russian Federation” | |

| Government Decree of December 11, 2015 No. 1350 “On amendments to the Decree of the Government of the Russian Federation of December 26, 2013 No. 1291 | |

| Government Decree of February 6, 2016 No. 81 On the recycling fee in relation to self-propelled vehicles and (or) trailers for them and on amendments to certain acts of the Government of the Russian Federation. | |

| Government Decree of May 11, 2016 No. 401 “On amendments to certain acts of the Government of the Russian Federation” | |

| Decree of the Government of the Russian Federation dated October 6, 2017 N 1215 “On introducing amendments to certain acts of the Government of the Russian Federation and invalidating the provisions of certain acts of the Government of the Russian Federation” | |

| Decree of the Government of the Russian Federation of March 19, 2022 N 300 “On amendments to the list of types and categories of wheeled vehicles (chassis) and trailers for them, in respect of which a recycling fee is paid, as well as the size of the recycling fee” | |

| Explanation of the Ministry of Industry and Trade of the Russian Federation on the payment of recycling fees for self-propelled vehicles. | |

| Decree of the Government of the Russian Federation of May 26, 2022 N604 “On amendments to certain acts of the Government of the Russian Federation” | |

| Decree of the Government of the Russian Federation of May 31, 2022 N639 “On amendments to Decree of the Government of the Russian Federation of February 6, 2016 N81” | |

| Decree of the Government of the Russian Federation of July 11, 2019 N 884 “On amendments to certain acts of the Government of the Russian Federation” | |

| Decree of the Government of the Russian Federation of November 15, 2019 N 1457 “On amendments to the list of types and categories of wheeled vehicles (chassis) and trailers for them, in respect of which a recycling fee is paid, as well as the size of the recycling fee” |

A brief table of recycling fee rates for trucks, including tractor units, vans, cargo minibuses and trailers:

| 3 years | ||

| Vehicles with a gross weight of not more than 2.5 tons | 178500 | 189000 |

| Vehicles with a gross weight of over 2.5 tons, but not more than 3.5 tons | 300000 | 432000 |

| Vehicles with a gross weight of over 3.5 tons, but not more than 5 tons | 300000 | 456000 |

| Vehicles with a gross weight of over 5 tons, but not more than 8 tons | 313500 | 786000 |

| Vehicles with a gross weight of over 8 tons, but not more than 12 tons | 438000 | 1192500 |

| Vehicles with a gross weight of over 12 tons, but not more than 20 tons | 496500 | 1735500 |

| Truck tractors with a gross weight of over 12 tons, but not more than 20 tons | 850500 | 3469500 |

| Dump trucks with a gross weight of over 12 tons, but not more than 20 tons | 418500 | 1735500 |

| Vans, including refrigerators, with a gross weight exceeding 12 tons, but not more than 20 tons | 507000 | 1735500 |

| Vehicles with a gross weight of over 20 tons, but not more than 50 tons | 1002000 | 2035500 |

| Truck tractors with a gross weight of over 20 tons, but not more than 50 tons | 1002000 | 2035500 |

| Dump trucks with a gross weight of over 20 tons, but not more than 50 tons | 945000 | 2035500 |

| Vans, including refrigerators, with a gross weight exceeding 20 tons, but not more than 50 tons | 825500 | 2035500 |

| The recycling fee for trailers applies to everything (including refrigerators, flatbeds, vans, container ships, dump trucks, tanks, etc.) | ||

| Full trailers | 96000 | 1207500 |

| Semi-trailers | 96000 | 1207500 |

| Center axle trailers | 96000 | 1207500 |

The recycling fee for cars imported by individuals is paid in the amount of:

up to 3 years from the date of issue = RUB 3,400

more than 3 years = 5200 rub.

Full list of recycling fee rates in rubles:

| Types and categories of vehicles | Amount of recycling fee in Russian rubles | |

| Up to 3 years from the date of issue | Over 3 years from the date of issue | |

Recycling fee for a passenger car (category B, including for an electric car): | ||

| with electric motors, with the exception of vehicles with a hybrid powertrain | 32600 | 122000 |

with engine displacement: | ||

| no more than 1000 cubic meters centimeters | 48200 | 123000 |

| over 1000 cubic meters centimeters, but not more than 2000 cubic meters. centimeters | 178400 | 313800 |

| over 2000 cubic meters centimeters, but not more than 3000 cubic meters. centimeters | 281600 | 480200 |

| over 3000 cubic meters centimeters, but not more than 3500 cubic meters. centimeters | 259600 | 570000 |

| over 3500 cubic meters centimeters | 445000 | 700200 |

| imported by individuals for personal use, regardless of engine size | 3400 | 5200 |

Recycling fee for a truck (categories B, C, including truck tractor, refrigerator, van, dump truck) | ||

| with a total weight of no more than 2.5 tons | 178500 | 189000 |

| with a total weight of over 2.5 tons, but not more than 3.5 tons | 300000 | 432000 |

| total weight over 3.5 tons, but not more than 5 tons | 300000 | 456000 |

| with a total weight of over 5 tons, but not more than 8 tons | 313500 | 786000 |

| with a total weight of over 8 tons, but not more than 12 tons | 438000 | 1192500 |

| with a total weight of over 12 tons, but not more than 20 tons | 496500 | 1735500 |

| Truck tractors with a gross weight of over 12 tons, but not more than 20 tons | 850500 | 3469500 |

| Dump trucks with a gross weight of over 12 tons, but not more than 20 tons | 418500 | 1735500 |

| Vans, including refrigerators, with a gross weight exceeding 12 tons, but not more than 20 tons | 507000 | 1735500 |

| Vehicles with a gross weight of over 20 tons, but not more than 50 tons | 1002000 | 2035500 |

| Truck tractors with a gross weight of over 20 tons, but not more than 50 tons | 1002000 | 2035500 |

| Dump trucks with a gross weight of over 20 tons, but not more than 50 tons | 945000 | 2035500 |

| Vans, including refrigerators, with a gross weight exceeding 20 tons, but not more than 50 tons | 825500 | 2035500 |

Recycling fee for special vehicles (on the chassis of a category “C” truck) | ||

| special vehicles other than concrete mixer trucks (chassis-based concrete mixers) | 285000 | 1725000 |

| concrete mixer trucks (chassis-based concrete mixers) | 853500 | 2242500 |

Recycling fee for buses (category D) | ||

| with an engine capacity of no more than 2500 cc. centimeters | 214500 | 217500 |

| with electric motors, with the exception of vehicles with a hybrid powertrain | 171000 | 172500 |

| with engine capacity over 2500 cc. centimeters, but not more than 5000 cubic meters. centimeters | 342000 | 517500 |

| with engine capacity over 5000 cc. centimeters, but not more than 10,000 cubic meters. centimeters | 591000 | 759000 |

| with engine capacity over 10,000 cc. centimeters | 990000 | 1558500 |

Recycling fee for dump trucks intended for use in off-road conditions (quarry dump trucks) | ||

| with a gross weight of over 50 tons, but not more than 80 tons | 3360000 | 7668000 |

| with a gross weight of over 80 tons, but not more than 350 tons | 6195000 | 7920000 |

| total weight over 350 tons | 9165000 | 9900000 |

Recycling fee on wheeled vehicle chassis | ||

| chassis of trucks with a gross weight of not more than 3.5 tons | 300000 | 468000 |

| chassis of trucks with a gross weight of over 3.5 tons, but not more than 5 tons | 300000 | 456000 |

| chassis of trucks with a gross weight of over 5 tons, but not more than 8 tons | 313500 | 786000 |

| chassis of trucks with a gross weight of over 8 tons, but not more than 12 tons | 438000 | 1192500 |

| chassis of trucks with a gross weight of over 12 tons, but not more than 20 tons | 496500 | 1735500 |

| chassis of trucks with a gross weight of over 20 tons, but not more than 50 tons | 1002000 | 2035500 |

| bus chassis with a gross weight of not more than 5 tons | 456000 | 759000 |

| chassis of buses with a gross weight of over 5 tons | 570000 | 897000 |

Disposal fee for graders and levelers | ||

| power plant power less than 100 hp | 552000 | 1466250 |

| power plant power of at least 100 hp and less than 140 hp | 724500 | 1897500 |

| power plant power of at least 140 hp and less than 200 hp | 1035000 | 2794500 |

| power plant power of at least 200 hp | 1380000 | 4088250 |

Recycling fee for bulldozers | ||

| power plant power less than 100 hp | 690000 | 2070000 |

| power plant power less than 100 hp and less than 200 hp | 1207500 | 6037500 |

| power plant power less than 200 hp and less than 300 hp | 1449000 | 9487500 |

| power plant power less than 300 hp and less than 400 hp | 1725000 | 12075000 |

| power plant power of at least 400 hp | 2587500 | 17250000 |

Recycling fee for excavators, backhoe loaders, backhoe bulldozers | ||

| power plant power less than 170 hp | 690000 | 2932500 |

| power plant power less than 170 hp and no less than 250 hp | 1035000 | 4312500 |

| power plant power of at least 250 hp | 1380000 | 6986250 |

Recycling fee for wheeled material handlers | ||

| power plant power less than 100 hp. | 431250 | 13213500 |

| power plant power of at least 100 hp. and no more than 125 hp. | 569250 | 21614250 |

| power plant power of at least 125 hp. and no more than 150 hp. | 690000 | 21614250 |

| power plant power more than 150 hp | 759000 | 27755250 |

Recycling fee for tamping machines and road rollers | ||

| power plant power less than 40 hp | 120750 | 552000 |

| power plant power of at least 40 hp and less than 80 hp | 293250 | 1259250 |

| power plant power of at least 80 hp | 379500 | 1673250 |

Recycling fee for front and fork loaders | ||

| power plant power of at least 5.5 hp. and less than 50 hp | 172500 | 1035000 |

| power plant power of at least 50 hp and less than 100 hp | 345000 | 1725000 |

| power plant power of at least 100 hp and less than 200 hp | 690000 | 2932500 |

| power plant power of at least 200 hp and less than 250 hp | 776250 | 3450000 |

| power plant power of at least 250 hp and less than 300 hp | 862500 | 5175000 |

| power plant power of at least 300 hp and less than 400 hp | 1207500 | 6037500 |

| power plant power of at least 400 hp | 2501250 | 12075000 |

Recycling fee for self-propelled cranes, with the exception of cranes based on the chassis of wheeled vehicles | ||

| power plant power less than 170 hp | 1983750 | 7641750 |

| power plant power of at least 170 hp and less than 250 hp | 3915750 | 16473750 |

| power plant power of at least 250 hp | 5226750 | 41072250 |

Recycling fee for pipe-laying cranes | ||

| power plant power less than 130 hp | 1725000 | 5175000 |

| power plant power of at least 130 hp and less than 200 hp | 2760000 | 8625000 |

| power plant power of at least 200 hp and less than 300 hp | 3622500 | 12075000 |

| power plant power of at least 300 hp | 4312500 | 17250000 |

Recycling fee for trailers not for public roads | ||

| trailers with a carrying capacity of more than 10 tons | 172500 | 1207500 |

| semi-trailers with a carrying capacity of more than 10 tons | 172500 | 1207500 |

Recycling fee for trailers and semi-trailers | ||

| Full trailers | 96000 | 1207500 |

| Semi-trailers | 96000 | 1207500 |

| Center axle trailers | 96000 | 1207500 |

Recycling fee for road maintenance vehicles (other self-propelled road and municipal vehicles), with the exception of road maintenance vehicles built on the chassis of wheeled vehicles | ||

| power plant power less than 100 hp. | 483000 | 1880250 |

| power plant power of at least 100 hp. and less than 220 hp | 707250 | 2846250 |

| power plant capacity of more than 220 hp. | 810750 | 3329250 |

Recycling fee for forestry machines | ||

| power plant power of at least 20 hp. and less than 100 hp | 1380000 | 8625000 |

| power plant power of at least 100 hp. and less than 300 hp | 2501250 | 10350000 |

| power plant capacity of more than 300 hp. | 3105000 | 12075000 |

Recycling fee for forwarder vehicles | ||

| power plant power of at least 20 hp. and less than 100 hp | 1380000 | 8625000 |

| power plant power of at least 100 hp. and less than 300 hp | 2501250 | 10350000 |

| power plant capacity of more than 300 hp. | 3105000 | 12075000 |

Recycling fee for front-end timber loaders and skidders (skidders) for forestry | ||

| power plant power of at least 20 hp. and less than 100 hp | 1380000 | 1725000 |

| power plant power of at least 100 hp. and less than 300 hp | 2501250 | 7762500 |

| power plant capacity of more than 300 hp. | 3105000 | 10350000 |

Recycling fee for all-terrain vehicles, ATVs, snow and swamp-going vehicles | ||

| with an engine capacity of less than 300 cc. centimeters | 69000 | 120750 |

| with an engine capacity of at least 300 cc. centimeters | 120750 | 224250 |

Recycling fee for snowmobiles | ||

| With an engine capacity of less than 300 cc. centimeters | 69000 | 120750 |

| with an engine capacity of at least 300 cc. centimeters | 120750 | 224250 |

Recycling fee for agricultural wheeled tractors | ||

| The power of the power plant is more than 5.5 hp. and no more than 30 hp. | 69000 | 310500 |

| The power of the power plant is more than 30 hp. and no more than 60 hp. | 86250 | 379500 |

| The power of the power plant is more than 60 hp. and no more than 90 hp. | 120750 | 517500 |

| The power of the power plant is more than 90 hp. and no more than 130 hp. | 258750 | 1207500 |

| The power of the power plant is more than 130 hp. and no more than 180 hp. | 431250 | 1725000 |

| The power of the power plant is more than 180 hp. and no more than 220 hp. | 517500 | 2587500 |

| The power of the power plant is more than 220 hp. and no more than 280 hp. | 655500 | 3450000 |

| The power of the power plant is more than 280 hp. and no more than 340 hp. | 862500 | 3795000 |

| The power of the power plant is more than 340 hp. and no more than 380 hp. | 1155750 | 4312500 |

| The power of the power plant is more than 380 hp. | 1552500 | 6900000 |

Recycling fee for agricultural crawler tractors | ||

| The power of the power plant is no more than 100 hp. | 258750 | 1207500 |

| The power of the power plant is more than 100 hp. and no more than 200 hp. | 431250 | 1725000 |

| The power of the power plant is more than 200 hp. | 1552500 | 4830000 |

Recycling fee for grain harvesters | ||

| The power of the power plant is more than 25 hp and not more than 160 hp. | 414000 | 1518000 |

| The power of the power plant is more than 160 hp. and no more than 220 hp. | 621000 | 2277000 |

| The power of the power plant is more than 220 hp. and no more than 255 hp. | 948750 | 3036000 |

| The power of the power plant is more than 255 hp. and no more than 325 hp. | 1121250 | 3795000 |

| The power of the power plant is more than 325 hp. and no more than 400 hp. | 1466250 | 5161200 |

| The power of the power plant is more than 400 hp. | 2070000 | 7841850 |

Recycling fee for self-propelled forage harvesters | ||

| The power of the power plant is no more than 295 hp. | 862500 | 2201100 |

| The power of the power plant is more than 295 hp. and no more than 401 hp. | 1587000 | 4554000 |

| The power of the power plant is more than 401 hp. | 2484000 | 9108000 |

Recycling fee for self-propelled agricultural machines | ||

| Self-propelled plant protection sprayers with a power plant power of more than 100 hp and no more than 120 hp. | 345000 | 1725000 |

| Self-propelled plant protection sprayers with a power plant power of more than 120 hp. and no more than 300 hp. | 1380000 | 5175000 |

| Self-propelled plant protection sprayers with a power plant power of more than 300 hp. | 2760000 | 6900000 |

| Self-propelled mowers | 690000 | 2528850 |

Dump trucks designed for off-road use | ||

| power plant power less than 650 hp | 3864000 | 8818200 |

| power plant power of at least 650 hp. and less than 1750 hp | 7124250 | 9108000 |

| power plant power of at least 1750 hp. | 10539750 | 11385000 |

Where should I pay the tax when importing a car from abroad?

If the payment is made when importing a car from another state, the funds are collected by the Federal Customs Service. Payments must be made within the customs clearance period. You will also need to pay a recycling fee. In order to do all this, you need to come to the customs office at your place of residence. You need to take the following documents with you:

- Recycling fee calculation form (must be completely completed).

- PTS for the car for which payments are made.

- Copies of papers that confirm the compliance of the machine’s characteristics with the data specified in the calculation (for example, a certificate of conformity, relevant expert opinions, accompanying documents).

- Vehicle purchase and sale agreement.

- Payment documents confirming payments.

- If a trusted person is involved in the procedure, a power of attorney will be required for him. After providing all these documents, specialists check the accuracy of the calculations performed, the authenticity of the papers, and payments to the FC account. After this, a mark is placed in the PTS about the payment of the recycling fee.

IMPORTANT! Bank details for transferring funds are posted on the FCS website.

Section 1. Amount of recycling fee payable to the budget

Section 1 is intended to reflect the total fees payable on all vehicles for which Section 2 is completed.

Line 010 reflects the budget classification code (BCC), in accordance with which the recycling fee is paid.

Line 020 indicates the code of the municipality (OKTMO) on the territory of which the fee is paid.

Line 030 automatically calculates the amount of the recycling fee payable to the budget:

page 030 = ∑ page 170 section 2

When calculating line 030, values in line 170 that are greater than or equal to zero are taken into account. For negative values in line 170, in line 030 .

Where should I pay the fee when purchasing a car without a mark in the title?

In the vast majority of cases, the recycling fee is paid by the manufacturer. The buyer transfers money only if he imports a car from abroad or the fee on the vehicle has not been paid by the previous owner. In the second case, payments are made to the Federal Tax Service. You need to go to the official website of the Federal Tax Service and find the appropriate section on fees. In it you can:

- Find out budget classification codes.

- Complete the calculation of the CS in the prescribed form.

- Make an appointment at your local Federal Tax Service.

Details for payment to the Federal Tax Service can also be found on the official website of the tax office. After payment of the fee has been made, you need to visit the tax office with these papers:

- US calculation form (completed).

- Title certificate for the car for which the fee is paid.

- Documents confirming the purchase of the car, and all other papers specified in the previous section.

FOR YOUR INFORMATION! The fee will also have to be paid to persons who assembled the car themselves. In this case, copies of the vehicle title that was used in the design of the new car are provided to the Federal Tax Service.

A note in the PTS about payment of the recycling fee

After payment of the fee, the corresponding mark is placed in the PTS. You need to pay attention to it both after making a payment and when purchasing a car. A mark is placed in the “special notes” section of the PTS. Differs in red color. Why is its presence so important? The mark indicates that the fee has been paid and there is no need to pay it again. She can only be absent if the following circumstances exist:

- PTS for a domestic car was issued before September 1, 2012.

- Imported cars were imported into the Russian Federation before September 1, 2012.

In both cases, no fee needs to be paid. For this reason, the absence of a mark should not be alarming.

Liability for non-payment of fees

Failure to pay the recycling fee in itself does not entail any sanctions. Even fines are not applied to violators. However, this does not mean that ignoring the law will go unpunished. A car that does not have a red mark on its title cannot be registered. In turn, for vehicles that are not registered (Article 12.1 of the Code of Administrative Offenses of the Russian Federation), a fine is imposed:

- 500-800 rubles – first violation.

- Up to 5,000 rubles or deprivation of a driver’s license for up to 3 months – repeated violations.

For this reason, it is more profitable to pay the fee.

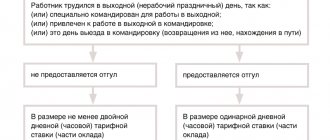

Who is exempt from the fee?

The legislation defines cases when the owner of a vehicle may be exempt from paying the recycling fee. Such situations include the following cases:

- The vehicle is more than thirty years old, but subject to the following conditions: the car must not be used for commercial purposes and it must have original spare parts - frame, body, engine.

- The car is at the disposal of the diplomatic mission or consulate, including employees and their families.

- The car was imported into Russia as personal property of citizens who are participants in the program for the voluntary resettlement of compatriots from foreign countries.

In the first case, the fee is not payable at all, and in the next two cases it will be charged to the buyer.

Legal entities have their own fee payment procedure and tariffs.

Recycling fee in PTS

A special mark is placed in the vehicle passport or PTS, which indicates payment of the mandatory fee. In some cases, this mark may be missing. This is possible in the following cases:

- if the PTS was issued before September 1, 2012, or the car was imported into Russia before the established date;

- when purchasing a vehicle in another country with subsequent delivery to the Russian Federation.

In the first case, there is no need to worry, since the obligation to pay the fee does not arise. In the second case, the obligation to pay the fee is borne by the buyer, as the person who imports the car into Russia.

It must be remembered that if the title of a car for which the fee is not charged, the grounds for exemption from this payment must be indicated.

There are situations when the title for a domestically produced car was issued from 09/01/2012 to 12/31/2013 inclusive. Then the PTS may contain another note - about accepting obligations for recycling.

To eliminate possible difficulties in the future, you will need to make sure that at the time of issuing the PTS, the recipient was excluded from the register of organizations paying funds for the future disposal of the vehicle. Information about this point is posted on the official website of the Ministry of Industry and Trade of the Russian Federation, where special attention is paid to the date of exclusion from the register.

In the absence of such a label in the PTS, for the reasons specified in the law, it is considered that the owner of the vehicle deliberately avoided paying the recycling fee. In this case, the buyer of the vehicle will have to pay.

Calculation and rates of recycling fees

To calculate the contribution, the standard formula is used ∑US = BS × K , where:

- ∑US – size of the recycling fee;

- BS – base rate;

- K – coefficient for calculating the amount.

The tariff or coefficient is set in accordance with the approved List of recycling fee amounts. This list was approved by Decree of the Government of the Russian Federation No. 1291 of December 26, 2013. The basic indicator for different groups of cars is determined differently:

- passenger cars not intended for commercial use – 20 thousand rubles;

- trucks, buses and cars for commercial use – 150 thousand rubles.

For example, the coefficient for a car older than three years and weighing up to 2.5 tons is 0.88. This means the amount of the recycling fee is 20,000.88 rubles.

A special calculator for individuals will help you determine the amount of the fee to be paid. This tool works online. To calculate, just enter all the parameters of the car and get the total amount. An online calculator is necessary so that individuals can independently calculate the contribution and pay it according to the accepted BCC to the state revenue.

Car enthusiasts who are inclined to purchase reliable, durable and affordable “Japanese” cars are interested in the question: how much does customs clearance of a car from Japan cost? All information about the procedure and cost of customs clearance can be found on our website. Customs clearance calculator for cars from Belarus is here. But be careful, as demand increases supply, and with it, cases of fraud!

What should I do if the fee is paid in a larger amount?

In this case, a request for a refund will be left. It is sent to the authority where the tax was paid. In addition to the document, you must provide the following documents:

- Payment documents evidencing payment of the fee.

- Confirmation that the fee was paid in excess (for example, the difference between the calculation carried out and the amount indicated in the payment order).

- The application is reviewed within a month. After this, a decision is made. If the authorized body refuses to return, the refusal must be justified.

ATTENTION! You can apply for a refund of the overpaid amount within three years from the date of payment. However, this is best done faster, since the funds are not indexed. That is, after three years they will be issued in the same amount as they were paid. It is very likely that inflation will “eat up” a large amount of money.

Most legal entities and individuals do not face the need to pay the tax. However, if it does occur, you need to figure out the order in which funds are transferred. There are many nuances. In some circumstances, funds are transferred to one authorized body, in others - to another. After making payments, you must save the payment document. He will confirm the fact and amount of payment, if required.