Generating income is the main goal of commercial activity. When creating an economic society, the participants pursue precisely this. However, the founders cannot freely dispose of the company’s money. The owners have the right to claim only dividends. The distribution of profits in 2022 is made in accordance with Law 14-FZ dated 02/08/98. Violation of the rules can result in lengthy disputes with regulatory authorities.

Features of profit distribution

It is fundamentally important to distribute profits correctly. This must be done in such a way that the efficiency of the enterprise increases, not decreases. Let's consider the basic principles of fund distribution:

- The company's profit is directed to the needs of the enterprise, and is also paid to the state budget. That is, taxes are paid on this money.

- Profit tax is paid at a rate set by law. She can't change.

- Most of the profits should be directed to the enterprise budget for accumulation. The rest goes to various company expenses.

- Proposed expenses must be agreed upon by the majority of LLC participants.

What accounting data is used when filling out line 1370 “Retained earnings (uncovered loss) ” when preparing annual reporting?

The enterprise must pay taxes and various contributions, after which the state cannot interfere in decisions on the distribution of money.

What can retained earnings from previous years ?

Let's look at which funds the money goes to:

- Savings fund . This fund accumulates funds to ensure the stable operation of the company and its independence from creditors. If a company has free funds of its own, it is not subject to bankruptcy. For example, if a company received very little income in one month and therefore cannot pay its existing debt, funds to pay off the debt are taken from the fund. It also finances research work, issue of shares, personnel training, and purchases new property.

- Consumption Fund . Funds from this fund go to social needs. For example, this could be payment of bonuses, financing of travel packages, purchase of medicines for employees, and various allowances.

- Reserve fund . Reserves are needed to reduce the risks of an enterprise when conducting various transactions. They will be needed in case of unforeseen situations. That is, if the company makes a small profit in one period, expenses can be covered from the reserve fund.

Part of the funds, as a rule, remains undistributed. This money is directed to the authorized capital of the company.

Specific areas of spending

There are two areas where net profit goes:

- Accumulation of enterprise reserves. Increasing the volume of property.

- Consumption. Spending money on specific needs.

Let's look at examples of spending net profit:

- Purchase of new equipment.

- Repair of existing equipment.

- Increasing the working capital of the enterprise, which is “eaten up” by inflation.

- Payment of loans and debts. Payment of interest on debt.

- Measures aimed at protecting the environment from pollution.

- Payment of bonuses.

- Organization of charity events.

- Calculation of motivating bonuses to employees.

- Payment of debts to creditors and banks.

- Payment of taxes.

- Payment of various sanctions.

- Retraining of employees.

Almost all of these expenses are optional. Spending occurs at the will of the enterprise management. First, the money is directed to priority purposes. For example, a company has only obsolete equipment. Therefore, first of all, funds should be allocated to updating equipment.

How can net profit be distributed?

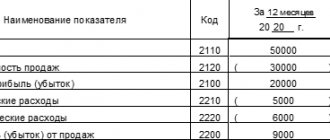

Net profit (hereinafter referred to as PE) is profit after paying all taxes and other obligatory payments.

The owners of the company have the right to distribute it. To do this, a general meeting is held, a protocol is drawn up and a decision is made on the distribution of net profit. Possible directions for distribution of private equity must be specified in the company's charter. It is also necessary to fix the timing of distribution and the amount of allocated profit - this can be a clearly defined percentage of undistributed profit or an indication that the amount will be determined when a decision is made.

The distribution of profits in LLCs and JSCs has its own characteristics. Which ones exactly, ConsultantPlus experts explained in detail. Full trial access to K+ is available for free. If you distribute profits in an LLC, this Ready Solution will help you, and if you are a JSC, then this material will help you.

Based on the decision of the founders, the state of emergency can be directed to:

- Dividend payments are the most common method of distributing PE. Restrictions on the accrual and payment of dividends are specified in Art. 29 Federal Law dated December 8, 2008 No. 14-FZ “On Limited Liability Companies” and in Art. 43 Federal Law dated December 26, 1995 No. 208-FZ “On Joint-Stock Companies.”

For information on income tax on dividends, see the material “How to correctly calculate the tax on dividends?”

- Repayment of last year's losses.

- Increasing the authorized capital (AC).

The decision to increase the capital of an enterprise can be made only on the basis of annual reporting. After such a decision is made, it is necessary to register changes in the constituent documents. Based on the certificate of state registration of changes, the increase in the capital is reflected in the accounting of the enterprise.

- Creation or replenishment of reserve capital and other funds.

Based on paragraph 1 of Art. 35 of Law No. 208-FZ, joint-stock companies are required to create a reserve fund of at least 5% of the capital. Only LLCs have the right not to do this (Clause 1, Article 30 of Law No. 14-FZ).

Also, societies can create accumulation, consumption, social, charitable and other funds.

- Other goals.

Do you have any doubts about the distribution of net profit? Find the answer on our forum! For example, here you can find out what to do with accrued but not paid dividends.

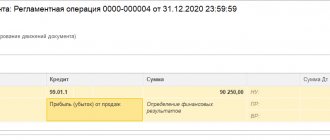

Accounting for distributed profits

Spending on taxes is deducted from the profit received. The tax base is determined based on the information set out in line 1 “Calculation of tax on real profit”. When deducting tax, the following entries will be used:

- Debit account 99 – the amount of profit is recorded.

- Credit to account 68 “Tax calculations”.

The company may receive extraordinary profits. For example, they appear when insurance companies pay compensation. In this case, the following wiring applies:

- Credit to account 99 “Profit”.

- Debit account 76-1 “Insurance settlements”.

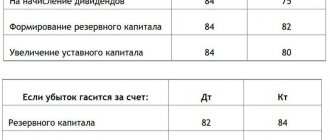

Let's consider all the transactions used when distributing funds:

- DT84 KT70, 75 – transfer of dividends to the owners of the company.

- DT84 KT82 – formation of a reserve fund.

- DT84 KT80 – increase in authorized capital.

- DT84 KT51, 52, 55 – financing of events that are not directly related to the activities of the enterprise (for example, charity concerts).

- DT84 KT01 – recording the valuation of fixed assets.

- Internal notes on account 84 “Retained earnings” - the direction of undistributed funds to finance the development of the enterprise, covering debts of previous years.

- KT84 – fixation of the balance of undistributed funds that are included in the authorized capital.

Each posting must be supported by primary documents. Each line displays a certain amount.

How to receive dividends

All participants who were included in a special register at the time the decision on payment was made have the right to receive income and accrue dividends to the LLC. The issue with the founders is also resolved, but with regard to the latter there may be many nuances in the statutory documents.

The situation is more complex when distributing payments between holders of different shares. The latter must be included in a special register, drawn up in a list for a certain date.

Recent changes in legislation have an important nuance: when shares are sold after the day the register for dividend payments was compiled, their former owner retains the right to receive this type of income for the previous period.

The order depends entirely on the type of shares: for ordinary and preferred shares, interest on net profit is paid separately.

Various controversial issues

When distributing funds, a number of controversial issues may arise:

- New LLC members have appeared . How to make payments if new participants appeared right before the distribution of funds? They should receive the funds in the standard manner. That is, in accordance with the size of the share. The procedure for dividing funds is established by the LLC Charter.

- Increase in capital volume . Increasing the authorized capital is relevant if it is necessary to increase the company’s attractiveness to investors and other external parties. A given amount of capital is needed to engage in a certain activity. It can be increased due to profit. However, before sending funds to the management company, you must pay taxes, various fees, and fines. The decision to change capital is made at a meeting of participants.

- Cancellation of a decision made at a meeting . Issues regarding the direction of money are resolved at the general meeting. The decision that is supported by the majority of participants will be made. However, it may be revised at an extraordinary meeting. If you need to reconsider a decision, you need to contact a judicial authority. The statement of claim is filed by those participants whose rights have been violated.

If controversial issues arise, one should focus on external and internal sources of law. That is, this is legislation, as well as company regulations.

Content

- Types of dividends

- Source for calculating dividends

- How is the decision to pay dividends to an LLC made?

- When a decision cannot be made

- Deadline for dividend payment in LLC

- Dividend payment form

- How to receive dividends

- Calculation of LLC dividends

- How to pay dividends to the founder of an LLC

- Dividends on preferred shares

- Dividend payment

- Responsibility for non-payment of dividends

In what cases is it prohibited to distribute profits?

Profits are distributed in accordance with the decision made at the meeting of the LLC. However, in some cases, profits cannot be spent at your own discretion. Consider these cases:

- The authorized capital has not been fully paid.

- The participant who leaves the LLC is not transferred funds in the amount of his share.

- There are signs of bankruptcy. This is relevant even if bankruptcy proceedings are not carried out against the enterprise.

- If the money is spent, the company will show signs of bankruptcy.

- The amount of net assets (that is, the funds remaining after paying all taxes and other obligatory payments) should not be less than 10,000 rubles. This is the minimum limit specified by law.

ATTENTION! The general director is responsible for ensuring compliance with all these rules. In case of violations, responsibility will fall on him.

Decision to pay dividends

The decision to pay dividends is made by the general meeting of shareholders on the recommendation of the board of directors. A sample solution is given in the berator, it may look like this.

The General Meeting of Shareholders may decide to pay both annual and interim dividends.

The decision to pay interim dividends can be made within three months after the end of the relevant reporting period (Q1, half-year and 9 months).

Decisions made by shareholders are documented in the minutes of the general meeting. A list of persons entitled to dividends is attached to the protocol. Sample Protocol.

Concept of dividends

The term “dividends” is practically absent from the Civil Code of the Russian Federation. It can only be found in Article 102 of the Civil Code of the Russian Federation, in which these payments are attributed exclusively to joint-stock communities. However, this is a broader concept. It is also not in the Federal Law of 02/08/1998 No. 14, where the corresponding payments are called “profit distribution”. Dividends are mentioned in Federal Law No. 208 dated December 26, 1995. The law states that joint stock associations have the right to announce the payment of funds for placed securities. A similar right is set out in paragraph 1 of Article 43 of the Tax Code of the Russian Federation.

Article 43 of the Tax Code of the Russian Federation provides the most complete definition of dividends. This is any income that is paid by a joint stock company to its participants when distributing income.

Profit is calculated only after all taxes have been paid. Participants receive funds in proportion to their share in the authorized capital. The larger this share, the larger the dividends will be. The scope of this concept also includes money that was received in foreign countries, if in the legislation of the latter this income is considered dividends.

Can shareholders decide to pay dividends from previous years' profits ?

It is important to distinguish dividends from other types of payments for tax purposes. These will include not only money transferred to the shareholders of the JSC, but also funds transferred to various commercial structures.

IMPORTANT! Dividends can be transferred to shareholders only during the existence and activity of the joint-stock company. Funds are paid to the participants of the company upon its liquidation. However, according to paragraph 2 of Article 43 of the Tax Code of the Russian Federation, if the amount of payments does not exceed the shareholder’s contribution to the authorized capital, the money will not be considered dividends. This means, according to paragraph 1 of Article 251 of the Tax Code of the Russian Federation, that funds are not subject to income tax.

Sources of dividends

The JSC has the right to pay funds on placed securities once every:

- one block;

- half year;

- 9 months of the financial year;

- the entire financial year.

Question: At the time of payment of previously distributed dividends to the JSC, it became known about the death of one of the shareholders. How to pay the dividends due to him? What is the procedure for assessing their personal income tax? View answer

If the JSC has announced the release of funds, it is obliged to make all relevant payments. Typically, dividends are issued in the form of cash. However, if the charter of the joint-stock company contains appropriate instructions, payments are made in the form of ownership.

The source of dividends is the profit of the joint-stock company, on which all taxes have already been paid. That is, net profit is taken into account. Its size should not contradict the financial statements. There is a special form of dividends - on preferred securities. Funds for them can be accumulated from special funds of the joint-stock company.

How is personal income tax paid on dividends ?

The decision to issue funds is made at the general meeting of shareholders. The recommended dividend amount is set by the board of directors. Payments, according to paragraph 3 of the Federal Law No. 134 dated October 31, 2002, should not exceed this amount.