The term “extension” is used both in business relationships and in everyday life. You can extend the supply contract,

Art. 178 of the Labor Code of the Russian Federation guarantees resigning employees financial resources to support them during the period of employment

In what form should I submit the 2-NDFL calculation? According to clause 1 of Art. 230 Tax Code of the Russian Federation

How to go on another vacation and quit immediately after it: Art. 127 Labor Code of the Russian Federation

Payers of water tax Payers of water tax are legal entities and individuals, including

What labor legislation standards should be followed when introducing and recording summarized working time recording? How

VAT (Value Added Tax) is the most difficult to understand, calculate and pay

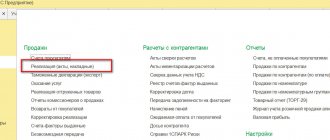

What to do in case of blocking To eliminate the problem and restore solvency, first

Payer category code in the declaration: why is it needed and where is it indicated Taxpayer category code in

List of expensive cars for 2022 Every year no later than March 1, the Ministry of Industry and Trade publishes