Water tax payers

Water tax payers are legal entities and individuals, including individual entrepreneurs, who, on the basis of a license, are engaged in:

- water intake;

- use of the water area (except for timber rafting);

- use of hydropower resources;

- timber rafting.

At the same time, water tax payers also include those who continue to use surface water bodies on the basis of licenses or water use agreements issued during the period of validity of the old Water Code of the Russian Federation, which became invalid on January 1, 2007.

The tax base

For each type of water use recognized as an object of taxation, the tax base is determined by the taxpayer separately in relation to each water body.

- When water is withdrawn, the tax base is determined as the volume of water taken from a water body during the tax period.

- When using water areas of water bodies, with the exception of timber rafting in rafts and purses, the tax base is determined as the area of the provided water space.

- When using water bodies without water abstraction for hydropower purposes, the tax base is determined as the amount of electricity produced during the tax period.

- When using water bodies for timber rafting in rafts and purses, the tax base is determined as the product of the volume of wood rafted in rafts and purses during the tax period, expressed in thousands of cubic meters, and the rafting distance, expressed in kilometers, divided by 100.

When users of a water body are not recognized as taxpayers

The new Water Code of the Russian Federation, which came into force in 2007, does not provide for licensing for the use of surface water bodies. Instead, the possibility of using a water body has been introduced either under a water use agreement or under a decision to provide it for use.

Both documents are issued by the authority of the constituent entity of the Russian Federation in whose ownership the water body is located. Payments for them represent a rent for the use of a water body (non-tax payment), and not a water tax.

Some types of water use are not subject to water tax, which can be divided into four groups:

- activities inextricably linked with a water body (fish farming, fishing, shipping, construction, irrigation, mining);

- activities subject to another tax (extraction of mineral and thermal waters);

- activities related to water protection;

- if benefits are provided for the type of activity (ensuring fire safety, defense needs, recreation for the disabled and children).

Targeted delimitation of water use is a condition for applying the benefit

VN rates for the purpose of water abstraction from water bodies are divided:

- for general ones (clauses 1–1.1 of Article 333.12 of the Tax Code of the Russian Federation);

- reduced - they are established in clause 3 of Art. 333.12 of the Tax Code of the Russian Federation exclusively for calculating tax when withdrawing water to supply the population.

If you take water from a source simultaneously for general production needs and for water supply to the population, you can take advantage of a reduced VN rate, provided that you differentiate the water according to the purpose of use.

This distinction should be:

- formalized in a separate license for the use of subsoil - with a clarification in it of the purpose of using the extracted groundwater (“water supply to the population”) and a mandatory indication of the permitted (maximum permissible) volume of water taken;

- technologically supported (meters installed, accounting documentation of the volumes of water transferred for various needs organized).

We will describe below what VN rates should a taxpayer apply if the specified conditions for delineation are not met.

Water tax rates

Water tax rates for the main types of water use are established in clause 1 of Art. 333.12 Tax Code of the Russian Federation. They depend on the region of use of the facility, and for water intake, also on its type (surface or underground). The legislation also provides a preferential rate for water withdrawal for the purpose of water supply to the population (clause 3 of Article 333.12 of the Tax Code of the Russian Federation).

Starting from 2015, the water tax rates specified in paragraph 1 of Art. 333.12 of the Tax Code of the Russian Federation, must be applied with adjustment by increasing coefficients, the values of which for the period from 2015 to 2025 are given in clause 1.1 of Art. 333.12 Tax Code of the Russian Federation. In 2020, the increasing coefficient is 2.31.

From 2026, the increasing coefficient will become calculated and will be determined by the actual change in consumer prices for the year preceding the year in which the corresponding calculated coefficient began to be applied. Each subsequent coefficient will be applied to the actual water tax rate for the previous year. The bet calculated taking into account the odds must be expressed in whole rubles.

Annual increasing coefficients must also be applied when calculating rates in cases of mandatory application of other increasing coefficients:

- 5-fold - with above-limit water intake;

- 10-fold - when withdrawing groundwater for further sale;

- 10 percent - in the absence of means of measuring the volume of water taken.

Since 2015, the preferential water tax rate provided for water withdrawal for the purpose of water supply to the population has been increased. Systematic growth is also planned for it during 2015–2025, but it is expressed not in coefficients, but in specific ruble values. In 2022 - 162 rubles. for 1 thousand cubic meters m of collected water (clause 3 of Article 333.12 of the Tax Code of the Russian Federation) and is applied throughout the entire Russian Federation, regardless of the subject.

For water tax rates, see the material What are the water tax rates for 2022.

From 2026, a calculated increasing coefficient depending on changes in consumer prices will also begin to be applied to this rate in a manner similar to that introduced for water tax rates for main types of water use.

Tax rates

Water tax rates according to the Tax Code of the Russian Federation are set in rubles per unit of the tax base.

Rates depend on the type of water use and are set for economic regions, river basins, lakes and seas:

- when drawing the world's water;

- when using the water area;

- when using water bodies without water intake for hydropower purposes;

- when using water bodies for the purpose of rafting wood in rafts and purses;

- When water is withdrawn in excess of established water use limits, rates for such excess are set at five times. In the absence of approved quarterly limits, quarterly limits are calculated as 1/4 of the approved annual limit.

The water tax rate for the withdrawal (withdrawal) of water resources from water bodies for water supply to the population is established:

- from January 1 to December 31, 2015 inclusive - in the amount of 81 rubles per one thousand cubic meters of water resources taken (withdrawn) from a water body;

- from January 1 to December 31, 2016 inclusive - in the amount of 93 rubles per one thousand cubic meters of water resources taken (withdrawn) from a water body;

- from January 1 to December 31, 2022 inclusive - in the amount of 107 rubles per one thousand cubic meters of water resources taken (withdrawn) from a water body;

- from January 1 to December 31, 2022 inclusive - in the amount of 122 rubles per one thousand cubic meters of water resources taken (withdrawn) from a water body;

- from January 1 to December 31, 2022 inclusive - in the amount of 141 rubles per one thousand cubic meters of water resources taken (withdrawn) from a water body;

- from January 1 to December 31, 2022 inclusive - in the amount of 162 rubles per one thousand cubic meters of water resources taken (withdrawn) from a water body;

- from January 1 to December 31, 2022 inclusive - in the amount of 186 rubles per one thousand cubic meters of water resources taken (withdrawn) from a water body;

- from January 1 to December 31, 2022 inclusive - in the amount of 214 rubles per one thousand cubic meters of water resources taken (withdrawn) from a water body;

- from January 1 to December 31, 2023 inclusive - in the amount of 246 rubles per one thousand cubic meters of water resources taken (withdrawn) from a water body;

- from January 1 to December 31, 2024 inclusive - in the amount of 283 rubles per one thousand cubic meters of water resources taken (withdrawn) from a water body;

- from January 1 to December 31, 2025 inclusive - in the amount of 326 rubles per one thousand cubic meters of water resources taken (withdrawn) from a water body.

Starting from 2026, the water tax rate for the withdrawal (withdrawal) of water resources from water bodies for water supply to the population is determined annually by multiplying the water tax rate for this type of water use, which was in force in the previous year, by a coefficient taking into account the actual change (on average for the year) of consumer prices for goods (work, services) in the Russian Federation, determined by the federal executive body exercising regulatory functions in the field of analysis and forecasting of socio-economic development, in accordance with state statistical reporting data for the second year preceding the year tax period.

At the same time, neither the Government of the Russian Federation nor the legislative bodies of the constituent entities of the Russian Federation can change the rates determined by the Tax Code (increase or decrease).

The total tax amount is determined as the result of adding the tax amounts calculated for all types of water use.

Procedure for calculating water tax

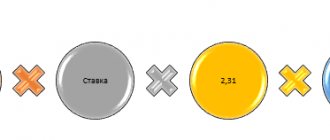

The rate for the main types of water use is determined by multiplying the water tax rate specified in paragraph 1 of Art. 333.12 of the Tax Code of the Russian Federation, and all coefficients that must be taken into account for its calculation.

Water tax in 2022 is calculated using the formula:

Where:

- volume of water - volume of water within the limit specified in the license;

Attention! If the limit is set for a year, it must be divided by 4. If a daily limit is set, then to determine the quarterly limit, you need to multiply it by the number of days in the quarter (letter of the Federal Tax Service dated January 22, 2015 No. GD-4-3 / [email protected] ).

- rate - base rate, approved. Art. 333.12 Tax Code of the Russian Federation.

- 2.31—increasing factor in 2022.

If water is taken above the limit, then a rate increased by an increased coefficient is applied for water taken above the limit. The formula for above-limit water intake will look like this:

An example of water tax calculation can be found here.

From 2026, the use of the coefficient will also become mandatory for the preferential water tax rate established for water withdrawal for the purpose of supplying the population.

Where in the Tax Code is it written about water tax benefits?

The Tax Code of the Russian Federation is structured in such a way that for many taxes you don’t need to search for a long description of benefits - they are highlighted in a separate article. For example:

- for transport tax - in Art. 361.1;

- for land tax - in Art. 395;

Find out what an individual entitled to a “land” benefit should do to receive it.

- for corporate property tax - Art. 381;

- property benefits of individuals - Art. 407.

Attention! Taxpayers are required to report benefits for land and transport taxes to the Federal Tax Service using a special form. See details here.

The code is silent about the benefits of the water tax - in Chapter. 25.2 of the Tax Code of the Russian Federation there is no separate article called “tax benefits”. At the same time, in the articles of this chapter you can still find “preferential” elements, namely:

- transfer of operations using water bodies that are completely exempt from water tax (WT);

- reduced water supply rates for certain categories of water consumers.

Such tax breaks can be classified as VN benefits, although they are not directly called that in the code. Let's tell you more about them.

Results

Payers of water tax are legal entities, entrepreneurs and individuals who collect water on the basis of a license. They must submit a water tax return quarterly and pay the amount received to the budget at the location of the water body no later than the 20th day of the month following the reporting quarter.

Sources:

- Tax Code of the Russian Federation

- Water Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Deadlines for calculation and payment of water tax

The water tax report is quarterly, and the tax is also calculated quarterly, taking into account the data generated over the last 3 months.

The amount is calculated directly in the tax return, which is submitted to the Federal Tax Service no later than the 20th day of the month following the reporting quarter. Tax payments are also made within the same time frame. If there is no object of taxation, then the obligation to file a declaration does not arise in this case (letter of the Ministry of Finance of Russia dated June 23, 2016 No. 03-02-08/36474).

Find out how to calculate and pay water tax from a typical situation from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

For information about what other report is generated in connection with water use, read the material “Procedure and sample for filling out the 2-TP Vodkhoz form (nuances).”

Types of taxable water use

The obligation to pay water tax is determined not only by the presence of a license to use a water body or the fact of use itself, but also by the type of water use. We are talking about taxable types when:

- water intake from the facility;

- use of its water area (but not for timber rafting);

- timber rafting;

- use of water resources for hydropower purposes.

However, in some cases, the listed types of water use will not be taxable.

Read more about the features of classifying objects as subject to or exempt from water tax in the article “Water tax: tax base, payers, rates”.

In relation to these types of water use, detailing them by the nature of the objects used and their belonging to certain regions or objects, the Tax Code of the Russian Federation (clause 1 of Article 333.12) establishes the amount of applied rates. Bets are assessed differently.

Which tax reporting contains information about “water” benefits?

If you are VT payers, it is obligatory for you to submit a declaration for this tax. Among the general set of information necessary to determine the amount of VN, separate lines are provided for preferential situations - they are located in section 2 of the declaration:

| Line of section 2 of the water tax return | Decoding |

| 040 | Enter here the data on your water use license (series, number and type of license) if you are applying for a reduced rate in connection with water intake for the needs of the population |

| 070 | Enter in this line the indicator of the volume of water taken from the water body for purposes not recognized as an object of taxation (according to clause 2 of Article 333.9 of the Tax Code of the Russian Federation) |

| 080 | Indicate here the purpose of water intake in coded form - when supplying water to the population, enter the number “1” |

| 110, 120 | Reflect the tax rate per 1,000 m3 - when taking water for the needs of the population, take it from clause 3 of Art. 333.12 Tax Code of the Russian Federation |

The water tax declaration form can be downloaded here.

Results

Among the tax benefits for the water tax, one can mention those provided by clause 2 of Art. 333.9 of the Tax Code of the Russian Federation the possibility of not paying tax in certain cases (if the withdrawn water is used to eliminate the consequences of accidents, ensure fire safety and for other reasons).

If water is withdrawn for the needs of the population, reduced tax rates can be applied. To do this, you need to issue a license and organize a record of the volumes of water actually transferred to the population.

Expert opinion on the question of whether it is possible to apply benefits in the absence of a license

According to experts from the Ministry of Finance, if an enterprise does not carry out a targeted delimitation of the use of water extracted from a natural body (it is not formalized in a separate license and is not provided technologically), the water tax payer does not receive the right to pay a tax at a reduced rate in honor of the extraction of water for the needs of the population – the full volume of water used is subject to taxation on a general basis. This provision is enshrined in Letter of the Ministry of Finance dated October 12, 2016 No. 03-06-05-02/59547. The Ministry of Finance insists that if the enterprise supplying the population with water does not have a license, the water tax cannot be transferred to the budget at a reduced rate.

Russian courts take a different opinion, since the text of Chapter 25.2 of the Tax Code of the Russian Federation does not say that a taxpayer using water for water supply to the population is required to obtain a license for the extraction of water from natural resources in order to calculate the tax at a preferential rate. But the courts agree with the opinion of the Ministry of Finance regarding the need to take into account the volumes of water used specifically for the purpose of water supply to people - the volumes of water subsequently transferred to the population must be documented.

Legislative acts on the topic

| Ch. 25.2 Tax Code of the Russian Federation | Cases of exemption from water tax, reduction of rates for certain categories of water consumers |

| Letter of the Ministry of Finance of the Russian Federation dated 09.09.2013 No. 03-06-05-02/36943 | On the need for separate accounting of water used for production needs and water supply to the population, in order to receive water tax benefits |

| Resolution of the Federal Antimonopoly Service of the North Caucasus District dated May 28, 2008 No. F08-2818/2008 | The courts disagree with the position of the Ministry of Finance on the need to obtain a license for water use in order to obtain the right to take into account the preferential rate of water tax |

| FAS Resolution No. 17AP-10284/16 dated 09/06/2016 | On the need for separate accounting of water used for production purposes and for supplying the population |