What to do if blocked

In order to eliminate the problem and restore solvency, it is first necessary to clarify what the decision is related to. You can check the restrictions and suspensions on your current account on the website of the Federal Tax Service - the tax service, upon request, provides information about the resolution that serves as the basis for the freeze.

Based on this information, you can decide on the further sequence of actions. The current Code contains provisions defining the time frame within which applied sanctions must be lifted after the taxpayer has complied with all the necessary requirements. The standard time allotted for the adoption of a resolution is one business day from the moment of confirmation, however, as practice shows, the wait can be prolonged - therefore it is better to control key processes in a timely manner, eliminating the possibility of an unpleasant situation.

Inspection rules

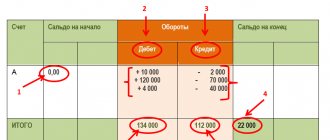

All tax reports submitted to the Federal Tax Service are subject to desk audit. In doing so, pay attention to the following:

- the logical nature of the obligation to submit such reports;

- correct application of rates;

- validity of benefits;

- correctness of arithmetic calculations;

- correlation with information from other taxpayer reports submitted to the Federal Tax Service;

- linkage with other data available to the Federal Tax Service;.

- the presence of sharp fluctuations in the size of the tax base;

- validity and consistency of changes when submitting an updated declaration.

If questions arise, the inspection will request clarifications (clause 3 of Article 88 of the Tax Code of the Russian Federation) and the necessary primary documents (clauses 6, 8, 8.1, 8.3 of Article 88 of the Tax Code of the Russian Federation). It is in the interests of the taxpayer to respond to such a request in a timely manner, attaching to the explanations copies of documents confirming his correctness and transcripts of accounting data.

Possible reasons

As a rule, when trying to check the blocking of an organization’s current account, it turns out that the restrictions applied by the tax authorities were the result of one of the following violations:

- Failure to comply with deadlines for filing a declaration. Such a measure provides for the seizure of the entire amount of funds on the balance sheet of a legal entity. In this case, it is possible to carry out operations in accordance with the legislation of the Russian Federation, for example, payment of taxes, payment of wages, etc.

- Failure to pay taxes assessed by the Federal Tax Service. In this case, the inspectorate has the right to block part of the money corresponding to the amount of underpaid tax, regardless of which company accounts they are stored in. A typical problem is the overly “diligent” implementation of the Federal Tax Service’s resolution, when the amount indicated for withholding is frozen several times, as a result of which its size actually increases. To unblock it, it is recommended to promptly send an application to the tax authority with a request to restore access.

- Failure to provide receipts for acceptance of electronic documents. One of the responsibilities of organizations is to confirm receipt of notifications sent by the Federal Tax Service - for example, about an scheduled visit, or a request to provide clarification on existing issues. The regulations provide six working days for this procedure. If another 10 days pass after the specified period, but no action has been taken by the company, the law allows for the possibility of blocking.

Ensuring a resolution on bringing to justice adopted following the results of desk or field events.

In the case of individuals, there is a fairly wide range of grounds, so checking tax decisions to suspend transactions on accounts requires analysis of several sources at once. Such factors include:

- Conducting illegal business activities, as well as work without formalizing labor relations between the employee and the employer.

- Failure of the individual entrepreneur to comply with the deadlines for scheduled reporting, including situations where actual activities were not carried out for the specified period.

In order to avoid more serious consequences, it is recommended to quickly clarify the actual reason for freezing money, and, if justified, take the necessary measures to eliminate it.

A convenient remote access banking system that provides secure access to your accounts at MORSIKY BANK (JSC) for making payments and transfers using a computer and the Internet.

On-site inspection is the quintessence of control

For a desk check you do not need any special solution. Such a check begins by default in response to one or another report from an individual entrepreneur.

You still have to manage to get an on-site audit for one or several taxes at once. It is carried out by decision of the head of the inspection or his deputy. As a rule, on the territory, on the premises of the taxpayer.

The risks of a travel visit can be assessed independently using a number of formal criteria. These are industry average tax burden indicators. At the beginning of May, the Federal Tax Service published new data - for the past 2022. See the numbers on the “Control work” subsite in the “Concept of a planning system for on-site tax audits” section. There are also indicators of return on sales and assets. All data is presented by type of economic activity.

The deviation of the level of tax burden from its average level in a particular industry is one of the criteria for independent assessment of tax risks. If there is a large scatter in the values or sharp jumps in any direction, the risk of an on-site inspection increases significantly.

The main focus is traditionally on VAT, possible business fragmentation and salary taxes.

Should “small” individual entrepreneurs with insignificant turnover be afraid of an on-site inspection from the Federal Tax Service? Hardly. Provided that the entrepreneur is conscientious: he pays all required taxes on time and reports on time. And here the most pressing question arises: which entrepreneurs are considered “small”? Each region has its own guidelines and standards. Of course, they are not listed in the public domain anywhere.

What matters is the amount of taxes that can be added. If there is nothing to take from the individual entrepreneur, additional charges will be ridiculous (read: the check will be ineffective), then the likelihood of an on-site check tends to zero.

In the first two years, almost all individual entrepreneurs can work calmly. The fact is that on-site inspectors have the right to check a period not exceeding three calendar years preceding the one in which the decision to check was made. In this case, they usually look at two or three years at a time. Therefore, if the individual entrepreneur is a beginner, the auditors will definitely not come to him right away.

A subtle point: now more and more on-site inspections are carried out in relation to individuals without individual entrepreneur status. This happens when the tax authorities see signs of entrepreneurship in the activities of a “physicist”. For example, I built a non-residential building and sold it. Or systematically rents out non-residential premises. An illustrative case is the ruling of the Supreme Court of the Russian Federation dated January 28, 2021 No. 309-ES20-22246, which was included in the Review of the Federal Tax Service - clause 7 of the letter dated April 6, 2021 No. BV-4-7/4549.

Individual entrepreneurs may face on-site inspections by the Social Insurance Fund and the Pension Fund of the Russian Federation. Often, funds cooperate with the Federal Tax Service and attack together. Therefore, if an inspection from the Federal Tax Service is unlikely, then the funds are unlikely to be interested in a specific individual entrepreneur.

an unscheduled on-site inspection from the fund if the fund has received a complaint from an employee.

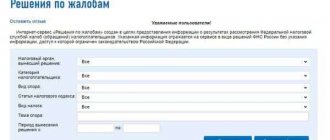

Checking account blocking on the Federal Tax Service website

The simplest method by which you can clarify the presence of restrictive measures is to use the official service provided by the Federal Tax Service. The algorithm for obtaining the necessary background information for both organizations and ordinary citizens is quite simple and includes the following steps:

- Using a browser, open the page located at service.nalog.ru and select the section “System for informing banks about blocking, suspension of account transactions and the status of processing electronic documents.”

- Oh, and enter the TIN of the legal entity and the BIC of the bank in the additional fields of the form.

- Confirm sending the data, after which a table will appear on the screen indicating the restrictions imposed.

It is important to note that the application reflects only basic details, such as date, number and code of the departmental body. To clarify the specific reasons for each of the identified sanctions, you should contact the department at your place of registration or residence.

Open an account and get 6% on your account balance!

Alternative verification methods

There are other methods that allow you to check account suspension, restrictions and blocking not only on the Federal Tax Service website. So, for example, the “Traffic Light” service is available to clients of SEA BANK, thanks to which they can obtain information about potential and existing counterparties and reduce business risks. The service not only warns about possible problematic aspects, but also provides an assessment based on two parameters:

- Adequacy. For some categories of counterparties (for example, individual entrepreneurs), there is not enough information in open sources for a comprehensive conclusion. For these, a message will be displayed indicating the need for additional verification.

- Materiality. This is the ability of a fact to influence relations with a counterparty. For example, a bankruptcy notice is a significant fact, but a traffic police fine is not. The most significant facts are marked in red.

This is a convenient method for those who prefer safety and reliability, since timely information based on current data eliminates the occurrence of unforeseen situations.

Counter check - when it’s not you who is being checked

There is no such thing as a “counter check” in the Tax Code. This is one of the types of other tax control measures. A “meeting” is carried out as part of an on-site or desk inspection of your counterparty. Or your counterparty's counterparty. That is, this is already the second link if you go along the chain of counterparties. There may be more distant links.

The bottom line is that the tax office checks the documents of the audited counterparty with yours to ensure the reality of the transaction.

Your task in the event of an oncoming meeting is to submit documents at the request of the tax authorities within the deadline specified by them. This is 5 or 10 working days, depending on the type of inspection. You should not ignore the requirement, even though they are not checking you personally. For violation of the deadline - a fine of at least 10,000 rubles. And if a fine under Article 129.1 of the Tax Code (failure to provide information) is added to liability under Article 126 of the Tax Code (failure to provide information), there will be 15,000 rubles.

A high risk of counter checks arises if an individual entrepreneur works with dubious suppliers or buyers. Therefore, at the negotiation stage, it is important to check your counterparty in order to avoid relationships with problematic ones.

What happens when account operations are suspended

The PC freezing procedure involves several successive stages:

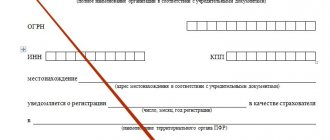

- Consideration by the controlling agency of the existing grounds and issuance of an appropriate order within the framework of the procedural regulations.

- Sending a notification to the bank that services the company or individual, suspending restrictions on the account.

- Sending a copy to the taxpayer, with receipt of confirmation of information in the form of a signature.

- Fulfillment by the bank of the presented requirement and subsequent transfer to the tax service of information about the amount of funds remaining at the disposal of the company or individual.

The decision to block a current account based on the results of an inspection by the Federal Tax Service can be made by the immediate head of the body, as well as his deputy. The standard template for drawing up resolutions is approved by the provisions enshrined within the framework of the order published on July 14, 2015 N ММВ-7-8/284, while an electronic form is sent to the credit institution.

There are a number of operations that can be carried out on the account if there are blocks by the Federal Tax Service. This list includes:

- Calculations for wages and severance pay.

- Payment of existing child support obligations.

- Repayment of insurance premiums and imposed fines for non-payment of taxes.

- Compensation for damage to health.

You can clarify information about the reasons for blocking your Federal Tax Service account, the duration of the ban and the amount of debt, as well as check the tax information about existing debts online. Moreover, even a resolution on suspension is not a basis for a ban on the transfer of mandatory fees, as well as the implementation of priority transactions, the procedure for the execution of which is regulated by the norms of the Civil Code.

How to restore access to blocked funds

The most common factor that determines the application of sanctions by tax authorities is late payment of mandatory fees. In theory, the notification service about the blocking of a current account by the Federal Tax Service provides for notification of regulated entities, but in practice the procedure is not implemented properly in all cases, especially if the amount of debt due to which the ban is imposed does not exceed several rubles. In such situations, you should remain calm and act consistently.

Step 1. Clarify the reasons

For any decision taken by government departments, there must be an appropriate basis provided for in the legislative provisions. As you already know, information about accounts blocked by the Federal Tax Service is available on the website - checking the suspension by banks does not take much time. Having received the details, contact the responsible authority at the place of residence or registration of the organization and find out exactly which operations were not performed properly.

Step 2: Fix problems

The procedure for restoring access to your own money depends on how justified the requirements of the tax service are. In the event that the reason for the restrictive measures are actually violations, be it non-compliance with instructions, a violation of the electronic document flow cycle, or untimely filing of a declaration, it will be enough to correct the mistakes made. If the internal audit does not confirm the legitimacy of the claims, the proceedings will have to be carried out in court.

Step 3. Informing about execution

Upon satisfaction of claims, a corresponding notification should be promptly sent to the inspectorate, without waiting for an independent response from the department. The basis for canceling the arrest is a decree, which the bank is obliged to execute within one business day. Taking into account all the nuances of interaction, the total duration of the access restoration procedure does not exceed 72 hours from the moment of providing data on the elimination of previously identified violations.

Step 4. Monitoring progress

You can find out more about lifting the suspension on your account on the tax website or find out directly from the Federal Tax Service about the deadlines for making and executing the decision. In case of non-compliance with the established regulations, it is necessary to submit a written statement to the head of the department, outlining general information about the current situation.

Open an account and get 6% on your account balance!

FAQ

Whois is a publicly available database of information about the owners of IP addresses and domains. Checking the IP details will provide information about its membership in the subnet, autonomous system, its owner and its contacts. Checking the domain name will show the owner, registrar, expiration date of registration, as well as the owner’s contacts, unless prohibited by the rules of the domain zone. The Whois program operates over the TCP protocol and port 43, but web interfaces are more popular. Access to Whois data is free and free.

To find out where the desired server is located, simply enter its domain name in Whois. The service will convert the name into an IP address and display its owner and contacts. The Country and Address fields will indicate the location of the server. This way you can find the site location by IP address.

The registration period of a domain can be checked by its address in the Whois service. The “Paid by” field will show the date on which the domain was delegated. The “Release Date” field is the date after which the domain can be registered by anyone if the owner does not renew it.

Whois services will help you find out how old a domain is. Enter the desired address and in the basic domain information, find the “Created” field. The difference between the current date and the date of registration (creation) will be the age of the domain.

Timing for resumption of inspections

In accordance with the resolution of the Government of the Russian Federation, the Federal Service for Economic Supervision published an official notice on the restoration of the standard procedure for the implementation of control procedures. Previously, due to epidemiological restrictions, this practice was temporarily suspended, but starting from 2022, conducting on-site events, monitoring the accrual and payment of mandatory fees, as well as assessing ongoing commercial transactions between interdependent entities are carried out in full. In addition, the deferment of control over the installation of cash terminals and compliance with the regulations for conducting cash transactions was not extended - these measures are also being implemented by the department from January 1.

SEA BANK (JSC) projects for salary transfer can be convenient and interesting for any enterprises and organizations, regardless of the number of employees working in them.

What is a tax audit

The most important task of the tax authorities of the Russian Federation is to monitor the fulfillment by taxpayers of such duties as:

- accrual of all necessary taxes in respect of which the taxpayer has such an obligation;

- correctness of tax calculations;

- justification for applying benefits;

- timely payment of taxes.

One of the tools for such control is a tax audit (subclause 2, clause 1, article 31 of the Tax Code of the Russian Federation), which is divided into 2 types (clause 1, article 87 of the Tax Code of the Russian Federation):

- Desk, in which the Federal Tax Service Inspectorate comprehensively checks the submitted reports.

- An on-site visit, which, as a rule, is carried out on the territory of the taxpayer and involves not only studying the originals of the primary report that served as the basis for calculating taxes, but also checking the availability of property.

Find out the details and nuances of tax audits from our section “Tax audits and their types in 2020–2021” .

Zero reporting

Tax legislation provides for a mandatory procedure for providing reports on the activities of organizations and individual entrepreneurs - even in cases where they are not actually carried out. If information is submitted untimely, appropriate sanctions may be applied to violators, including account blocking. Identification of facts of non-compliance with deadlines, as well as incorrect completion of documentation, is the basis for a decision to freeze funds sent for execution by a credit institution.

It is worth noting that in such situations, the Federal Tax Service, as a rule, requires a personal visit to the inspection by the general director or an individual entrepreneur in order to serve him with a resolution on the imposed administrative fine. Pension and social insurance funds, as well as statistical departments, have the right to apply identical measures. The amount of the penalty, depending on the number of violations detected, varies from one to five thousand rubles.

It is also possible that electronic reporting is sent to the Federal Tax Service.

Similar sanctions are provided for non-compliance with accounting regulations and are established for each zero report. In this regard, it is recommended to adhere to current requirements and provide timely and complete reporting. This will help avoid additional time and financial costs.

SEA BANK (JSC) offers small, medium and large businesses to use the international corporate Visa Business card.

You might also be interested in:

Online cash registers Atol Sigma - how to earn more

How to make a return to a buyer at an online checkout: step-by-step instructions

MTS cash desk: review of online cash register models

Scanners for product labeling

Shoe marking for retail 2022

Online cash register for dummies

Did you like the article? Share it on social networks.

Add a comment Cancel reply

Also read:

How the tax office will check online cash registers. Fines in 2021

Tax checks on cash registers resumed in 2022 - the moratorium imposed due to the sudden outbreak of the Covid-19 virus pandemic has ended and from now on control activities will take place as usual.

The main goal of these checks, as before, is to motivate entrepreneurs and organizations to use online cash registers when making payments to consumers, as well as to increase the amount of incoming tax payments. If violations are detected during inspections, the Tax Service will... 948 Find out more

Online cash registers for small businesses

By mid-2022, online checkouts for small businesses will be a must-have for everyone.

These are the requirements of Federal Law 54-FZ, updated in November 2022. From now on, entrepreneurs who decide to install an online cash register for small businesses (or improve the existing one accordingly) are required to comply with the following conditions: use only a fiscal drive, and not an ECLZ; add new details to the checks; enter into an agreement with the fiscal data operator... 759 Find out more

Economic census of small businesses - new report to Rosstat in 2021

The economic census of small businesses, according to government decree, should be conducted again in 2022.

Rosstat will conduct continuous static monitoring of all enterprises that fall under the category of small and medium-sized businesses. This means that all individual entrepreneurs, small and micro organizations are required to submit reports to the Federal State Statistics Service containing certain information about their enterprises collected for 2022. Open a current account for… 947 Find out more

Digital platform for small and medium-sized businesses in 2021

The Russian Ministry of Economic Development will launch a digital platform for small and medium-sized businesses by the end of 2022. The project is currently being tested, but the final version will be launched by the end of December this year. Thanks to the development of a digital platform for business, entrepreneurs and enterprises will be able to gain access to ordering the necessary services using this platform: searching for purchases, obtaining preferential lending conditions, receiving subsidies, as well as...694 Find out more