Violations of reporting procedures

This group includes:

1. Late submission of the declaration (Article 119 of the Tax Code of the Russian Federation). It threatens to impose a fine on the company in the amount of 5% of the tax reflected for payment in the declaration. It is charged for each month of delay (both full and incomplete). In this case, the minimum fine is 1,000 rubles. (even if there are no accruals), and the maximum is 30% of the accrued tax (which is equivalent to 6 months of delay).

See also:

- “Amounts of fines for failure to submit tax reports”;

- “What is the size of the fine for failure to file a VAT return in 2020-2021?”

2. Violation of the method of sending the declaration (Article 119.1 of the Tax Code of the Russian Federation). Applies to companies required to submit electronic reports (clause 3 of Article 80 of the Tax Code of the Russian Federation). This:

- largest taxpayers;

- enterprises with an average workforce of more than 100 people.

If the declaration is sent to the tax authorities in any other way, the company will be fined. The fine amount is 200 rubles.

Penalty for late submission of VAT returns

Failure to submit VAT and submitting a report late will result in warnings, fines and even blocking of accounts if the report is 10 working days late.

When to submit a declaration

No later than the 25th day of the month following the expired quarter. In 2021 the deadlines are as follows:

- 1st quarter - April 26, 2022 (the deadline is postponed if the last day of delivery falls on a weekend);

- 2nd quarter - July 26, 2021;

- 3rd quarter - October 25, 2021;

- 4th quarter - January 25, 2022.

If you submitted a VAT return on paper, although you should have done it electronically, the tax office will not accept the report and it will be considered unsubmitted. The deadlines will not be frozen for the time you spend reworking and resubmitting. In this case, if you file a paper return on the deadline, you are guaranteed to have to pay a late fee.

Who will be punished for being late?

The following will be responsible for delay:

- organizations and entrepreneurs (including tax agents) - fine under Art. 119 Tax Code of the Russian Federation;

- officials of the organization (director, chief accountant, etc.) - warning or fine under Art. 15.5 Code of Administrative Offenses of the Russian Federation.

An entrepreneur cannot be fined twice for one violation, so he will only pay a fine under the tax code and will not be held administratively liable.

Amount of fine and calculation procedure

Fine under Art. 15.5 Code of Administrative Offenses of the Russian Federation - from 300 to 500 rubles. Its size is determined by the court. Everything is simple here, no nuances.

Fine under Art. 119 of the Tax Code of the Russian Federation - 5% of the amount of VAT not paid on time according to the declaration. Interest is charged for each month of delay, including incomplete payments. The tax office will calculate the fine, but we will explain the algorithm so that you understand how it is formed. To calculate, you need to know the amount of unpaid tax and the number of full and partial months that have passed since the date on which the deadline for filing the report expired. The formula is as follows:

Fine = Unpaid VAT × 5% × Number of full and partial months that have passed since the date of delay

It is important to remember that the tax can be paid in three equal payments - no later than the 25th day of each of the three months following the reporting quarter. This means that the fine is calculated only on the amount of tax that has not already been paid on time.

Example. The organization submitted a declaration and paid tax for the 1st quarter of 2022 on May 5, and not on April 26, as expected. The amount of tax declared in the declaration for payment is 300,000 rubles. But on the date of submission of the report, only the deadline for paying the first ⅓ of the payment had passed. This means that to calculate the fine they will take 100,000 rubles - ⅓ of 300,000 rubles.

The delay amounted to one incomplete month - from April 26 to May 5.

The fine will be: 100,000 rubles × 5% × 1 month = 5,000 rubles.

When calculating the amount of the fine, there are also restrictions - it should not be less than 1,000 rubles and more than 30% of the amount of unpaid VAT. The minimum fine is paid if:

- the tax was paid on time, but the declaration was late;

- in the declaration, the amount of VAT payable is 0 rubles or the tax is claimed for reimbursement;

- on the date of payment of VAT there was an overpayment that covered the amount of tax.

Non-payment of tax

This group also includes two types of violations:

1. Non-payment or payment of tax not in full (Article 122 of the Tax Code of the Russian Federation) due to errors in calculating the tax base or due to non-payments. In the most common cases, the fine is 20% of the underpaid amount (Clause 1 of Article 122 of the Tax Code of the Russian Federation).

IMPORTANT! There will be no fine if the correct amount of tax is indicated in the declaration, but the tax is not transferred to the budget on time (clause 19 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57). In this case, the tax office will only charge a penalty for late payment. Our calculator will help you calculate the amount of the penalty.

If the situation concerns an understatement of the base for transactions between interdependent persons, then they will be fined 40% of the underpaid tax - at least 30,000 rubles. (clause 1 of article 129.3 of the Tax Code of the Russian Federation). But it can be avoided if the company proves that the prices for such transactions corresponded to market prices (clause 2 of Article 129.3 of the Tax Code of the Russian Federation).

If a company does not take into account the income of a controlled foreign company in its profit, it will be assessed a fine in the amount of 20% of the underpaid tax - at least 100,000 rubles. (Article 129.5 of the Tax Code of the Russian Federation).

If the tax authorities prove a deliberate understatement of the tax base, then the culprit will be charged 40% of the underpaid tax (clause 3 of Article 122 of the Tax Code of the Russian Federation).

IMPORTANT! Company officials may face criminal liability if the amount of arrears is significant (Article 199, 199.1 of the Criminal Code of the Russian Federation).

From punishment under Art. 122 of the Tax Code of the Russian Federation, the law exempts a responsible participant in a consolidated group of taxpayers if the distortion occurred through the fault of one of its participants who reported incorrect facts for the preparation of reports (clause 4 of Article 122 of the Tax Code of the Russian Federation). In this case, the punishment under Art. 122 of the Tax Code of the Russian Federation will be incurred by the participant guilty of distorting data (Article 122.1 of the Tax Code of the Russian Federation).

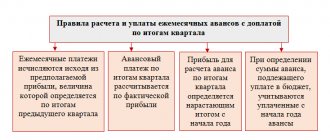

2. If a taxpayer fails to pay income tax on time, he will be charged a penalty.

EXAMPLE of calculating penalties from ConsultantPlus: At the end of the year, the organization calculated income tax in the amount of: 45,000 rubles. for payment to the federal budget; 255,000 rub. for payment to the regional budget. For a complete example, see K+. It's free.

The calculated tax amounts were paid on April 30.

3. Failure by a tax agent to withhold and pay tax (Article 123 of the Tax Code of the Russian Federation). This applies to companies paying, for example, dividends. The fine is 20% of the tax amount.

Fines belonging to this group are assessed only on the amounts of taxes that were not paid at the time of the inspection (office or on-site). If the tax is paid before the audit, albeit late, then penalties are charged on the tax paid late. However, the issue of calculating fines does not apply to advance payments of income tax. Only penalties are charged on them.

For information on income tax on dividends, read the article “How to correctly calculate the tax on dividends?”

Get free trial access to the materials of the ConsultantPlus system and study expert comments on the legality of bringing to responsibility for non-payment of tax under Art. 122 and 123 of the Tax Code of the Russian Federation.

Responsibility for failure to submit an advance payment calculation

In paragraph 17 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57, it is explained that from the provisions of paragraph 3 of Art.

58 of the Tax Code of the Russian Federation, significant differences arise between a tax and an advance payment, i.e. an advance payment for a tax, which, unlike a tax, is paid not based on the results, but during the tax period. Accordingly, from the interrelated interpretation of this norm and paragraph 1 of Art. 80 of the Tax Code of the Russian Federation, a distinction is made between two independent documents - the tax return submitted at the end of the tax period, and the calculation of the advance payment submitted at the end of the reporting period.

In this regard, the courts must proceed from the fact that established by Art. 119 of the Tax Code of the Russian Federation, liability for untimely submission of a tax return does not cover acts expressed in failure to submit or untimely submission of the calculation of advance payments based on the results of the reporting period, regardless of how this document is named in a particular chapter of Part 2 of the Tax Code of the Russian Federation.

Please note that liability for failure to provide such documents is established by Art. 126 of the Tax Code of the Russian Federation.

In the letter of the Federal Tax Service of Russia dated August 22, 2014 No. SA-4-7/16692 it is explained that since from the interrelated interpretation of clause 3 of Art. 58 of the Tax Code of the Russian Federation and clause 1 of Art. 80 of the Tax Code of the Russian Federation follows a distinction between two independent documents - the tax return submitted at the end of the tax period, and the calculation of the advance payment submitted at the end of the reporting period, then established by Art. 119 of the Tax Code of the Russian Federation, liability for untimely submission of a tax return does not cover acts expressed in failure to submit or untimely submission of the calculation of advance payments based on the results of the reporting period, regardless of how this document is named in a particular chapter of Part 2 of the Tax Code of the Russian Federation.

At the same time, Art. 119 of the Tax Code of the Russian Federation does not cover such violations as the submission of a tax return in paper form in a situation where the submission of a declaration in electronic form was required.

Violations of accounting rules

A number of violations that lead to sanctions under Art. are directly related to income tax. 120 Tax Code of the Russian Federation. This refers to gross violations of the procedure for accounting for expenses, income and taxable items. These include (clause 3 of article 120 of the Tax Code of the Russian Federation):

- missing primary;

- lack of tax accounting registers;

- constant (more than one case during the year) errors in recording transactions in tax registers.

Even if there is no distortion of the tax base, the following may be punished:

- for 10,000 rubles. (Clause 1 of Article 120 of the Tax Code of the Russian Federation), if violations were present during one tax period (year);

- for 30,000 rub. (Clause 2 of Article 120 of the Tax Code of the Russian Federation), if they occur over more than one tax period (year).

If such violations lead to an underestimation of the tax base, the fine will be 20% of the underpaid tax - at least 40,000 rubles. (clause 3 of article 120 of the Tax Code of the Russian Federation).

Failure to provide data for tax control

The income tax fine may also include sanctions under Art. 126 and 129 of the Tax Code of the Russian Federation, which establishes punishment for failure to send information necessary for tax control, or documents related to the calculation of the taxable base, which confirm the validity of its value.

Failure to comply with the deadline for submitting documents may result in a fine of 200 rubles. for each paper not submitted on time (clause 1 of Article 126 of the Tax Code of the Russian Federation).

In case of refusal to submit documents or sending distorted data, the fine may be 10,000 rubles. (clause 2 of article 126 of the Tax Code of the Russian Federation).

In case of refusal or evasion to submit documents or when submitting distorted data on a controlled foreign company, the fine will be even greater - 100,000 rubles. (Clause 1.1 of Article 126 of the Tax Code of the Russian Federation).

If a company does not send inspectors the information they need to carry out control actions, then it may be fined under Art. 129.1 Tax Code of the Russian Federation:

- for 5,000 rub. (Clause 1 of Article 129.1 of the Tax Code of the Russian Federation) for a single offense;

- for 20,000 rubles. (Clause 2 of Article 129.1 of the Tax Code of the Russian Federation), if the violation occurred more than once during the year.

If the information in the notification of controlled transactions is not submitted (or is distorted), this will entail a fine of 5,000 rubles. (Article 129.4 of the Tax Code of the Russian Federation).

Failure to provide or distortion of information about participation in foreign companies will result in a fine of 50,000 rubles. for each foreign company (clause 2 of article 129.6 of the Tax Code of the Russian Federation).

In case of failure to provide or distortion of information in the notification about controlled foreign companies, a fine of 100,000 rubles may be applied. for each controlled foreign company (clause 1 of Article 129.6 of the Tax Code of the Russian Federation).

With regard to submitting documents for tax control purposes, it should be borne in mind that data transmitted to tax authorities upon request regarding another organization can later be used to check the company that responds to the request. Therefore, the reliability of the information provided is extremely important. In this case, the organization can use the right not to resubmit documents that have already been submitted once (clause 5 of Article 93 and clause 5 of Article 93.1 of the Tax Code of the Russian Federation), but for this purpose it is necessary to have confirmation of the fact of their sending.

About the specifics of collecting fines in case of failure to provide documents for a counter-inspection, read the article “What is the fine for failure to provide documents for a counter-inspection?”

Responsibility for failure to submit an advance payment calculation

In paragraph 17 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57, it is explained that from the provisions of paragraph 3 of Art.

58 of the Tax Code of the Russian Federation, significant differences arise between a tax and an advance payment, i.e. an advance payment for a tax, which, unlike a tax, is paid not based on the results, but during the tax period. Accordingly, from the interrelated interpretation of this norm and paragraph 1 of Art. 80 of the Tax Code of the Russian Federation, a distinction is made between two independent documents - the tax return submitted at the end of the tax period, and the calculation of the advance payment submitted at the end of the reporting period.

In this regard, the courts must proceed from the fact that established by Art. 119 of the Tax Code of the Russian Federation, liability for untimely submission of a tax return does not cover acts expressed in failure to submit or untimely submission of the calculation of advance payments based on the results of the reporting period, regardless of how this document is named in a particular chapter of Part 2 of the Tax Code of the Russian Federation.

Please note that liability for failure to provide such documents is established by Art. 126 of the Tax Code of the Russian Federation.

In the letter of the Federal Tax Service of Russia dated August 22, 2014 No. SA-4-7/16692 it is explained that since from the interrelated interpretation of clause 3 of Art. 58 of the Tax Code of the Russian Federation and clause 1 of Art. 80 of the Tax Code of the Russian Federation follows a distinction between two independent documents - the tax return submitted at the end of the tax period, and the calculation of the advance payment submitted at the end of the reporting period, then established by Art. 119 of the Tax Code of the Russian Federation, liability for untimely submission of a tax return does not cover acts expressed in failure to submit or untimely submission of the calculation of advance payments based on the results of the reporting period, regardless of how this document is named in a particular chapter of Part 2 of the Tax Code of the Russian Federation.

At the same time, Art. 119 of the Tax Code of the Russian Federation does not cover such violations as the submission of a tax return in paper form in a situation where the submission of a declaration in electronic form was required.

Results

Fines for violations of tax laws are quite numerous, and not every taxpayer can avoid them. But in some cases, the legislation allows you to get rid of fines (for example, by paying arrears and penalties before filing an updated declaration or proving that there was no understatement of the tax base for a transaction between related parties, and prices corresponded to market prices) or reduce their size.

In what cases can you expect a reduction in the fine, read the material “Circumstances Mitigating Liability for a Tax Offense”.

Sources:

- Tax Code of the Russian Federation

- Criminal Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.