Why do you need an extract from the balance sheet?

What kind of explanations and extracts accountants have to compile in the course of their work!

Some of them must be designed according to strictly established standards, others - in any form. One of these “arbitrary” documents is an extract from the balance sheet. There is no specific form for it - each statement is unique and depends on what information and in what volume the user requires.

Let us dwell on the most common situation when an extract from the balance sheet is needed in connection with the company’s decision to exercise the right not to pay VAT (Article 145 of the Tax Code of the Russian Federation).

NOTE! This right is granted by paragraph 1 of Art. 145 of the Tax Code of the Russian Federation for those whose revenue excluding VAT for the previous 3 months in a row did not exceed 2,000,000 rubles.

About how to obtain exemption under Art. 145 of the Tax Code of the Russian Federation, read this material .

Do I need to print statements?

Frequently asked question: if you have an online bank, should you print statements and keep paper versions? There is no clear answer. But taking into account the trend in the development of electronic document management, storing bank statements on paper, provided that you work in the Internet bank, does not seem to be a rational and necessary action. Moreover, the bank is obliged to store information for at least 5 years.

On the other hand, if there are production needs, bank statements can be printed.

Here is a sample bank statement for an organization's current account. As you can see, there are no special differences compared to a personal account statement.

A bank statement for an individual's account and a legal entity's current account differ in a more detailed description of the purpose of the payment and the payer.

bank statements in word at the beginning of the article.

Preparing data for extract

In order not to pay VAT legally, the company needs to collect a package of documents and submit it to the tax authorities (clause 6 of Article 145 of the Tax Code of the Russian Federation). This package also includes an extract from the balance sheet. But in fact, the information that should be given in it cannot be taken from the balance sheet. To do this, you need to collect data on revenue, and you can get it from accounting registers.

For more information about how revenue is related to the balance sheet, read the article “How is revenue reflected in the balance sheet?” .

To fill out the statement, you will need data on the volume of goods (work, services) sold. This should also include revenue from transactions taxed at a 0% rate.

NOTE! Officials insist on the mandatory inclusion in revenue of proceeds from transactions not subject to VAT, transactions that are not subject to VAT, as well as from the sale of goods (work, services), the place of sale of which is not the Russian Federation (letter of the Ministry of Finance dated January 29, 2013 No. 03- 07-11/1592, dated 10/15/2012 No. 03-07-07/107, Federal Tax Service of Russia for Moscow dated 04/23/2010 No. 16-15/43541), although the judges do not agree with them (clause 4 of the resolution of the Plenum of the Supreme Arbitration Court RF dated May 30, 2014 No. 33, resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 27, 2012 No. 10252/12, etc.).

There is no need to take into account the prepayment received (letter of the Federal Tax Service of the Russian Federation for Moscow dated April 23, 2010 No. 16-15/43541), revenue from activities on UTII (letter of the Federal Tax Service dated May 12, 2014 No. GD-4-3 / [email protected] ) or goods transferred free of charge (letter of the Ministry of Finance of the Russian Federation dated September 30, 2013 No. 03-07-15/40261).

When the information for the statement is prepared, you can begin filling it out.

What is a bank statement

A bank statement is a register of account transactions over a certain period of time. In this case, we mean any account: both a current account belonging to a legal entity or individual entrepreneur, and a personal bank account registered to an individual.

Non-cash payments, as well as payments using bank cards, have become widespread not only among organizations, but also among individuals. People increasingly prefer cards to cash, especially during the coronavirus pandemic. Small businesses represented by the self-employed are moving to the Internet and massively receiving payments for their services on cards. Therefore, it is important to be able to obtain summary information on inflows and outflows made to a bank account. This is precisely the function that a bank statement performs.

Let's look at what a bank statement looks like and how the information in it is structured below.

Extract from the balance sheet: fill out the form

Let's give an example. The management of Salut LLC decided to exercise its right under Art. 145 Tax Code of the Russian Federation. The accountant collected information about revenue and prepared an extract.

In Federal Tax Service No. 19 for the city of Moscow

INN 7702678342 Checkpoint 770201001

Extract from the balance sheet

The revenue of Salut LLC for 3 months, from 10/01/2018 to 12/31/2018 (excluding VAT), amounted to 1,540,000 rubles.

Revenue breakdown by month:

Revenue from sales of goods (works, services) excluding VAT, rubles

Electronic statements

Should statements be printed or can they be stored electronically? There is still no definite answer, just as there is no law that would prohibit companies from storing account information in electronic form.

On the contrary, the Law “On Accounting” states that primary documents can be stored on a computer.

But which is better: electronic or paper statement?

? Some trends indicate in favor of the electronic document:

- some banks provide services remotely and can send account information via the Internet;

- For companies with several accounts, it is easier to systematize information and store it on a computer than to reproduce piles of papers in the archive;

- To store paper reports, you will need to staple them and prepare an inventory, and only save the electronic document in a folder.

Companies choosing electronic document management must keep security in mind. You cannot store information on third-party servers or in cloud storage

. In this case, the information may get to the attacker. It is better to buy a separate electronic medium on which the archive will be visited.

Entertainment expenses: general information

Representation expenses include:

- expenses for holding an official reception for negotiators;

- transportation costs for delivering company representatives to the venue of official events and back;

- costs of catering during official meetings and negotiations;

- costs for the services of translators who take an active part in the negotiations and are not full-time employees of the simplified company.

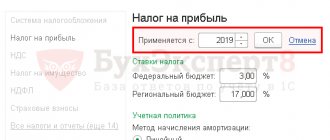

For general-regime organizations, entertainment costs are included in expenses in the amount of no more than 4% of labor costs in a given period. Representative expenses under the simplified tax system do not include income minus expenses in the list of expenses for simplifiers, since this list is closed. This means that these expenses are not taken into account and it is impossible to reduce the size of the tax base by them. However, despite this, representative costs must have an economic justification and be supported by documents.

You can verify your hospitality expenses through receipts, event programmes, expense reports and expense estimates. If entertainment expenses were paid non-cash, invoices and acts will serve as confirmation.

If entertainment expenses are incorrectly documented and do not have confirmation, the tax office may recognize them as personal and charge not only taxes, but also fines.

Accounting for receipt and disposal of fixed assets and the procedure for their inventory

D 08 - K 60 - reflects the costs of construction and installation work accepted from contractors;

D 19 - K 60 - VAT presented by the contractor for payment to the customer is reflected;

D 01 - K 08.3 - fixed assets put into operation.

When an organization carries out construction and installation work in an economic way, the following entries are made in accounting:

D 10 - K 60 - materials were purchased to carry out work on the construction of the facility;

D 19 - K 60 - VAT on purchased materials is reflected.

The costs for the construction of buildings, structures, installation and other capital construction costs minus VAT are reflected:

D 08 - K 07 - the costs of installing equipment are reflected;

D 08 - K 10 - costs of materials used are reflected;

D 08 - K 70 - wages to employees;

D 08 - K 69 - the amount of insurance contributions from employees' wages;

D 08 - K 19 - non-refundable VAT written off to increase the actual costs of construction and manufacturing;

D 08 - K 68 - VAT is charged on the volume of work performed;

D 60 - K 51 - funds were transferred;

D 68 - K 19 - VAT is reflected on materials purchased, work performed, services provided;

D 01 - K 08.3 - fixed assets were put into operation.

Acceptance of completed work on the completion and additional equipment of a facility, carried out in the order of capital investments, is formalized by an acceptance certificate for repaired, reconstructed and modernized facilities (form No. OS-3). The transfer of equipment for installation is formalized by an act of acceptance and transfer of equipment for installation (form No. OS-15).

Accounting for entertainment expenses

Representation expenses of a simplified company must be taken into account in accounting. In this case, a posting is generated: Debit 20, 44 and so on – Credit 71. For tax accounting purposes, in the “expenses” column, a note is made that expenses are not accepted.

A document such as advance reporting is used to confirm entertainment expenses. It can be found in the tab called “bank and cash desk”.

In the “advances” tab, the document on which the funds were issued must be indicated, and entertainment expenses themselves must be reflected in the “other” tab.

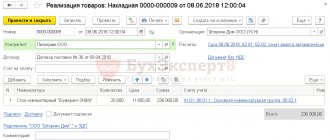

Debiting from current account

You can debit your current account from the same payment order. In it you need to set the status to “Paid” and click on the hyperlink “Enter a debit document from the current account.”

After clicking on the link, the completed document opens. The data is entered from the payment order. Therefore, if everything in the payment slip is correct, then you can simply write it off:

The document “Write-off from the current account”, unlike a payment order, generates transactions in 1C.

You can see the transactions by clicking the “Show transactions” button:

Everything was filled out correctly: funds were transferred from the organization’s current account to the supplier’s current account, which is reflected by posting Dt60.01 - Kt51. In the list of payment orders, a check mark appears in the first column opposite paid documents:

Other expenses not included

In addition to entertainment expenses, the tax base cannot be reduced by the following expenses:

- for marketing services;

- for disinfection;

- to connect water and electricity supplies;

- for various promotions for clients;

- for drinking water for company personnel;

- for various printed publications subscribed by the organization;

- to attract workers from other companies (engaged in other activities);

- for the arrangement of the company's office;

- for advertising;

- for staff pensions;

- VAT amounts;

- for certification of workplaces;

- to purchase property rights;

- customs duties when importing goods from abroad;

- penalty for violation of contract terms;

- registration costs.

Every accountant should be able to do at least three things:

- draw up a balance sheet;

- find the error;

- draw up an accounting statement.

It is the last point that will be discussed in this material. First, let’s find out what kind of paper this is. And where can I find a sample accounting certificate?

What kind of document is this

At its core, an accounting certificate is a primary accounting document, but at the same time it also serves as a register. In it, an authorized specialist records operations for which there is no full-fledged primary record:

- bug fix;

- debt write-off;

- determining the amount of reserve for doubtful debts;

- formation of the initial cost of a fixed asset, which consists of several operations;

- maintaining separate VAT accounting;

- and so on.

In some cases, a regular accounting certificate is required, and in some cases only a calculation certificate, in which the accountant, in addition to the entry itself, makes calculations. For example, an example of how to draw up an accounting statement to form the initial cost of a fixed asset looks like this:

In addition, there are other varieties of this important paper that are not primary. In particular, if it is necessary to compile information at the request of a government agency or court, in which to describe accounting data already reflected in the system by an accountant, for example, on debt, an accounting certificate is also drawn up. In court, for example, it can be used to confirm expenses incurred by a company or the amount of damage from someone else’s actions, as well as the validity of the stated adjustments. A sample accounting certificate of debt for the court can be downloaded at the end of the article.

It is important to remember only one thing: you cannot draw up this paper for transactions involving the capitalization or sale of material assets if third-party contractors were involved in the process. In this case, a different primary is used.

1C: Client-bank

Setting up Client Bank

To configure, launch Client Bank from the Payment Orders using the Send to Bank .

Click the Settings the Sending to Bank tab to the form for setting up exchanges with Client-Bank .

Specify your bank account and client-bank program.

To use Client Bank , it is necessary that the exchange settings with your bank are entered into 1C.

In the File upload to bank and File download from bank , indicate the name of the file and its location. This is necessary to automatically create or download files. By default the files are named 1c_to_kl and kl_to_1c . If this file is not found when downloading or uploading, the program will prompt you to specify it manually.

In the Default substitution details , set:

- Group for new counterparties - a group in the Counterparties directory in which new Counterparties . Here you can set any group, for example, Suppliers or Buyers . In our example, a group has been created in which all new counterparties will be saved, which will then need to be “disassembled” into buyers and suppliers.

The Income Item and Expense Item fields in bank statements are filled in automatically with preset settings in the Cash Flow Items directory using the Main Items . From the client bank settings, you can go to this directory using the link Cash flow items .

Below are the settings for uploading and downloading.

Unloading:

- indicate which documents will be uploaded to the client bank;

- what data is controlled during uploading: Correctness of the document number - checking for incorrect characters in the number;

- Security of exchange with the bank - so that after uploading, viruses do not change payment details.

Loading:

- Set the basic settings when downloading: Automatic creation of not found elements - counterparties that are not found during download will be automatically created in the Group folder for new counterparties .

- Before downloading, show the exchange form with the bank - if the checkbox is checked, the download will take place automatically. If not installed, you will be able to choose which statements to download and which not.

If you need to quickly see the picture of cash and quickly post bank statements, it is recommended to check the boxes for posting documents. But don’t forget to check all the data in your bank statements later, because... 1C may incorrectly determine something: a contract, account or other data.

How to download a bank statement in 1C 8.3

Loading an extract into 1C from Client Bank is performed from the Bank Statements by clicking the Load .

How to download a bank statement in 1C.

The Client-Bank window will be shown only if it is provided for by the settings (checkbox Show the “Exchange with bank” form before loading ).

Graphs that are highlighted in gray warn that this data is not in the database, and it will be loaded automatically. Pay special attention to the Agreement and check it with Payment Purpose . If they do not match, you need to go to the statement and correct it.

If there is no agreement with the counterparty, then it will be created automatically with the name Main agreement . If the counterparty has several contracts, then the contract for which the Main contract .

Check the boxes for all bank statements that need to be uploaded to 1C and click Upload .

How to load a bank in 1C.

Links to the created documents will be reflected in the Document .

Loading bank statements into 1C 8.3.

If extracts have already been downloaded previously, then links in the Document appear immediately when downloading the file. The previously downloaded data is verified using the payment document number indicated in the Number .

By clicking the Download Report you can generate a Report on downloaded documents .

How to download a payment slip for a bank from 1C

Launch Client Bank from the Payment Orders using the Send to Bank .

The Sending to Bank tab displays all payment documents whose Status is Prepared .

How to download a payment card from 1C.

Invalid payment orders are highlighted in red, for example, Payment order No. 1 dated December 27, 2018 is no longer valid. Go to the document by double-clicking on it in order to mark it for deletion or edit it. It is possible that our payment order has already been paid, but under some circumstances Status has not been adjusted.

In the Upload the boxes for all payment orders that need to be paid and click Upload .

If the settings provide control over the security of exchanges with the bank, then when you click the Upload a message will appear.

Do not close this window until you upload the data to the client bank. Next, perform a check using the Check .

After uploading, the Payment Order document status will change to Sent .

By clicking the Upload Report , you can generate a Report on uploaded payment documents .

We looked at how to optimize an accountant’s work with bank statements in 1C 8.3 Accounting, set up a Client Bank in 1C 8.3, upload a bank statement to 1C and upload a payment slip for the bank.

Test yourself! Take the test:

- Test No. 30. Analysis of subconto: Counterparties and Agreements

- Test No. 4. Incorrect agreement when settling with a counterparty: detecting and correcting the error using the Subconto Analysis report

Form and required details

Since this is a primary document, two important conditions must be met:

- The form and procedure for compilation must be prescribed in the accounting policies of the organization.

- Availability of the mandatory details provided for in Article 9 of the Federal Law of December 6, 2011 No. 402 on accounting.

If an organization can develop the form on its own or use a sample for filling out an accounting certificate (0504833), which was developed and approved by Order of the Ministry of Finance dated March 30, 2015 No. 52n for government institutions, then the requirements for the details are quite strict. The form must include:

- name of the organization;

- document number and date of its preparation;

- title of the document;

- the content of the reflected fact of economic life;

- units of measurement and method of reflection (monetary or natural);

- data from other primary documents (if necessary);

- position and full name the person who performed the operation;

- signature of the compiler.

Only if these requirements are met will the completed form be considered valid.

How information is transmitted

The process of opening a personal account for information constituting state secrets in the Federal Treasury and authorizing expenses under a state contract with state secrets is regulated by Government Decree No. 2153 of December 18, 2020. According to the document, the lead executor under a state contract with state secrets transmits information for opening a drug in several stages.

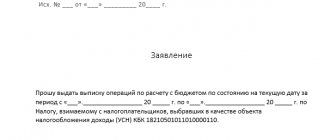

Stage 1. Preparation of documents:

- application for opening a drug store;

- sample signature cards (not required when opening the LS subsection);

- grounds for registering an account - an extract from the government contract.

Stage 2. Transfer of documents to the Federal Treasury by post (registered letter with acknowledgment of receipt) or in person. The employee who submits the documents encloses a permit to work with state secrets.

Stage 3. Waiting for test results. Document verification period: 2 working days (clause 6 of Government Decree No. 2153 of December 18, 2020). Deadline for sending notification of the results of the inspection: no later than the next business day after its completion.

Stage 4. Making changes to documents if there are comments.

Stage 5. Receiving notification of the opening of a drug account.

The territorial department of the department opens a personal account if a refusal to open it from the customer or the main executor is not received by the department within 3 working days (clause 10 of PP No. 2153 of December 18, 2020).

IMPORTANT!

A personal account for non-participants in the budget process, which is intended for settlements under government contracts with state secrets, is opened once - upon concluding the first such contract. For subsequent contracts, subsections of the personal account are opened.

Sample on how to draw up an accounting statement

There is nothing complicated in compiling this paper. Let's consider, for example, a sample accounting certificate about the correction of an error, or, as it is called, reversal. In it, the accountant must outline the essence of the transaction, as well as the circumstances under which the error occurred. It is also necessary to write entries with corrections and indicate how this affected taxes. If there have been changes in their calculation, you need to indicate which updated reports need to be submitted. The chief accountant certifies the accounting certificate with his signature.

Only on the basis of such paper can an accountant make corrections in the General Ledger of the organization, where no corrections are allowed.

Why do you need to prepare a certificate of the book value of fixed assets?

A certificate of the book value of fixed assets shows their value according to accounting data as of a particular date. It does not apply to mandatory forms of accounting reporting, but may be of interest to a certain circle of users.

Fixed assets belong to the category of capital investments of the organization. They have a lower degree of liquidity than, for example, working capital, and show the property and financial situation of the company.

For information on how to audit investments in non-current assets, read the article “Audit of investments in non-current assets (account 08)”.

A certificate of the book value of fixed assets can be used for internal analysis of the solvency of an enterprise, for management accounting purposes, and can also be provided for consideration by third-party users - investors, credit institutions, insurance companies and others. Fixed assets can act as collateral in commercial transactions.

For more information on what constitutes fixed assets, read our article “Non-current assets on the balance sheet”.

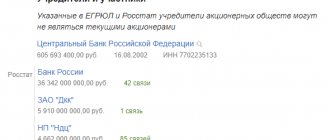

Providing statements of open current accounts of the organization

The list of situations when a legal entity needs to obtain documentary evidence of the existence and total number of open current accounts includes:

- preparation of a business plan;

- negotiations with business partners;

- participation in the tender;

- loan processing;

- judicial or prosecutorial request;

- liquidation or reorganization of the company.

In cases where it is necessary to obtain expanded information about account movements, the financial institution supplements the report with the following information:

- geographic location of transactions performed, indicating the addresses of companies and terminals;

- list of counterparties indicating their names;

- the amount of commission fees withheld by the bank.

You can receive an extended statement at a bank branch by paying a small commission, or for free in your personal account for an Internet banking user.

Where can I find a form for a certificate of book value?

The form of a certificate of the book value of fixed assets is not approved at the legislative level. This means that you can use any form of this document. Let us remind you that business entities have the right to develop forms of certain documents based on their needs and characteristics of their activities. Therefore, the enterprise can also approve the form and type of this document independently, securing it with the appropriate order.

Fixed assets in the certificate can be listed by name (if there are a small number of them) or divided into groups: non-residential buildings, machinery, inventory and equipment for production needs, and so on.

You can see an example of preparing such a certificate on our website. We offer 2 options for formatting this document.

A certificate of the book value of fixed assets is an optional document when submitting financial statements. It contains information about the cost of fixed assets that are listed on the organization’s balance sheet. Therefore, the certificate may be of interest to potential investors, banking and insurance organizations. A certificate of the book value of an enterprise's assets is filled out in any form due to the lack of a legally established form.

When necessary

In most cases, an accounting certificate about the availability of fixed assets also shows their residual value according to the balance sheet. She:

- helps business owners and its participants analyze the composition and condition of the company’s non-current assets;

- confirms the calculation of income tax;

- promotes insurance, as well as obtaining investments and loans.

Here we remind you about paragraph 49 Where required

Certificate of book value of property

It is hereby confirmed that, according to accounting data, the book value of property owned by LLC “_______________” on the right of ownership, as of “____” ______________ 20___ is __________________ (in words) rubles ___ kopecks.

Listing of property and its value (can be in tabular form):

A more specific example of an accounting certificate about the value of a fixed asset may look like this:

Limited Liability Company "Guru"

ACCOUNTING CERTIFICATE No. 18-OS

Moscow 03/31/2017

As of April 1, 2022, the residual (book) value of the building located at the address: Moscow, st. Ryabinovaya, 17, building 3, with a total area of 75.3 sq. m. m according to those. BTI passport No. 07-09-04444 dated September 10, 2005, accounted for as part of fixed assets (excluding revaluation), amounts to RUB 8,045,458.

Performed by: accountant____________Shirokova____________/E.A. Shirokova/

Chief accountant____________Pirogov____________/N.Yu. Pirogova/

If you find an error, please select a piece of text and press Ctrl+Enter.