Let's start with the fact that the obligation to pay taxes and contributions is considered fulfilled from the moment an order is presented to the bank to transfer funds to the appropriate Federal Treasury account. Of course, if there is a sufficient cash balance on the organization’s account from which money is transferred to the budget or extra-budgetary funds on the day of payment.

Read more recent materials:

How are penalties for non-payment of taxes or contributions reflected in accounting?

Collection of tax debts - according to new rules

If this obligation was not fulfilled in a timely manner, then in addition to the obligatory payments, the company will also have to fork out for penalties.

Penalties on taxes

Penalties are paid in addition to the tax amounts due for transfer to the budget. It does not matter that other measures have been applied to the taxpayer to ensure the fulfillment of the obligation to pay taxes, as well as measures of liability for violation of the legislation on taxes and fees.

In other words, in the event of untimely replenishment of the treasury, the fact of transferring taxes and fines for delays does not exempt from penalties.

As a rule, penalties are accrued for each calendar day of delay in tax payment, starting from the date recognized by law as the tax payment day.

Penalties for each day of delay are determined as a percentage of the unpaid amount of the mandatory payment. Moreover, the interest rate of penalties is taken equal to 1/300 of the Bank of Russia refinancing rate in force at that time. At the moment, this figure is 8 percent (instruction of the Bank of Russia dated December 23, 2011 No. 2758-U).

To calculate penalties (P), you should use the formula:

P = W x D x SR x 1/300

, Where

Z

– the amount of late paid tax;

D

– number of days of delay;

SR

– the Bank of Russia refinancing interest rate valid during the period of delay.

Example 1

Norma LLC did not pay land tax in the amount of 6,000 rubles by the deadline of February 1, 2012. The organization repaid the specified debt only on March 30 of the same year. The refinancing rate of the Bank of Russia from February 2 to March 30 (58 days) was 8 percent. Norma LLC calculated the amount of penalties in the amount of 92.8 rubles. (6000 rubles x 58 days x 8% x 1/300).

During the billing period, the discount rate may change, and more than once. The question arises: which of its values should be taken to determine penalties for late fulfillment of the obligation to pay tax in this case?

It should be borne in mind here: when during the period for which penalties are accrued, the refinancing rate of the Bank of Russia changed both upward and downward, all its values are applied for each period of their validity.

This is evidenced, for example, by resolutions of the FAS of the East Siberian District dated February 19, 2009 No. A19-9104/08-51-F02-493/ 2009, FAS Moscow District dated March 31, 2009 No. KA-A41/2507-09 . Let's look at what has been said with an example. Example 2

Akatsiya LLC did not pay the transport tax for 2011 in the amount of 10,000 rubles on time. The tax payment deadline is February 1, 2012. The organization paid off the tax debt in the following order: - February 15 - 4,000 rubles; — March 2 — 6000 rub. Thus, the amount of tax arrears was: - from February 2 to February 14 (13 days) - 10,000 rubles; — from February 15 to March 1 (17 days) — 6,000 rubles. The refinancing rate had the following values (conditionally): - from February 2 to February 10 (9 days) - 8%; — from February 11 to February 20 (10 days) — 8.25%; — from February 21 to February 29 (9 days) — 8.5%; — from March 1 to 2 (2 days) — 8.25%. Akatsiya LLC calculated the amount of penalties in the amount of 63.5 rubles. [(RUB 10,000 x 9 days x 8% x 1/300) + (RUB 10,000 x 4 days x 8.25% x 1/300) + (RUB 6,000 x 6 days x 8, 25% x 1/300) + (6000 rubles x 9 days x 8.5% x 1/300) + (6000 rubles x 2 days x 8.25% x 1/300)].

Penalties are transferred simultaneously with the payment of tax amounts or after payment of such amounts in full.

Let us note that penalties can be forcibly collected from the taxpayer’s funds in bank accounts, as well as from his other property.

In some cases, the accrual of “tax” penalties can be avoided. More specifically, there are only two such situations.

Firstly, when, by decision of the tax authority, the taxpayer’s property was seized.

Secondly, if, by a court decision, interim measures were taken in the form of suspension of transactions on the company’s bank accounts, seizure of funds or property.

In this case, penalties are not accrued for the entire period of validity of these circumstances.

Penalties on taxes: general information

Article No. 75 of the Tax Code of the Russian Federation regulates all issues related to penalties for tax collections: in what cases this penalty is calculated, in what amount and in what order - forced or voluntary. The law states that penalties are paid if the taxpayer does not make the tax payments required to him on time, that is, he is late in payment. It does not matter whether part of the amount or the entire tax collection was paid late.

The code of laws also explains that the accrual of penalties does not contradict and does not exclude other liability for violation of tax laws. In other words, even if a person is given an additional fine, the obligation to pay penalties accrued for each day of delay will still be assigned to the debtor.

When paying tax, a person must ensure that the money reaches the state treasury no later than the date indicated by the deadline for payment. From the very next day, penalties will begin to accrue.

Article 75. Penalty

Important point! When all due tax amounts are paid, the accrual of penalties stops. That is, the figure for the accrued penalty is fixed at the time the debt is repaid, and if the penalty has not been paid, then additional penalties are not charged.

Penalties are calculated not only for tax payments, but also for advance payments for taxes and fees. Thus, not only taxpayers, but also tax agents are required to pay penalties.

The tax office sends a request for payment of the debt and penalties to the debtor’s address. The letter indicates the total amount of the debt, the deadline by which the tax levy should have been paid, as well as the amount of the penalty on the day the demand was sent to the payer. The document also specifies other measures to collect tax debt if a person does not intend to pay it. It is necessary to respond to the received demand, that is, to deposit the amount of debt into the state treasury, within eight working days from the date of receipt of the letter.

Let us note that since 2016, a decision has come into force that the tax office has the right to send a letter informing about a citizen’s tax debt to his employer or other person paying income (pension, scholarship).

The letter from the tax office arrives in a branded envelope indicating all the contact details of the department.

Overdue tax advances

If an organization must make advance payments of tax during a tax period, then the obligation to make advance payments of tax is recognized as fulfilled in the same manner as established in relation to the tax as a whole for the period.

Thus, if advance tax payments are paid at a later date than those established by law, then penalties are charged on the amount of the debt on advances.

Let us remind you that advance payments are provided, in particular, for the following taxes.

Corporate income tax. At the end of each reporting period, firms usually calculate the amount of the advance payment based on the tax rate and profit calculated on an accrual basis from the beginning of the year to the end of the reporting period.

Organizational property tax. The amount of the advance payment for property tax is calculated based on the results of each reporting period in the amount of 1/4 of the product of the tax rate and the average value of property determined for the reporting period.

Transport tax. Organizations calculate the amount of advance tax payments at the end of each reporting period in the amount of 1/4 of the product of the corresponding tax base and tax rate. The legislation of a particular subject of the Russian Federation may cancel the obligation to make advance payments.

Land tax. The amounts of tax advances are calculated by those taxpayers for whom the reporting period is defined as a quarter. They determine these payments at the end of the 1st, 2nd and 3rd quarters of the current tax period as 1/4 of the tax rate as a percentage of the cadastral value of the land plot. The obligation to pay advance payments may be waived by local authorities.

If, at the end of the period, the amount of the calculated tax is less than the amount of advance payments payable during the specified period, then the “advance” penalties are subject to a commensurate reduction. This is stated in letters of the Ministry of Finance of Russia dated January 19, 2010 No. 03-03-06/1/9, dated March 18, 2008 No. 03-02-07/1-106, as well as in the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 26, 2007 No. 47.

Debt period

Until December 27, 2018, the debt period for calculating penalties was counted from the day following the tax payment deadline to the day preceding the payment of arrears to the budget (Letter of the Ministry of Finance of the Russian Federation dated July 5, 2016 N 03-02-07/39318). This rule has been preserved and is applied to this day for arrears accrued before December 27, 2018 (Letter of the Ministry of Finance of the Russian Federation dated January 17, 2019 N 03-02-07/1/1861).

From December 27, 2018, penalties on taxes and contributions administered in accordance with the Tax Code are calculated from the day following the established day for tax payment up and including the day of actual payment of the tax (clause 3 of Article 75 of the Tax Code of the Russian Federation). This rule applies to arrears arising from December 28, 2018.

For penalties for arrears in the Social Insurance Fund, the period of debt has long been determined from the day following the day of payment of insurance premiums until the day of payment of arrears inclusive (clause 3 of Article 26.11 of the Federal Law of July 24, 1998 N 125-FZ).

The old rule (the same as for arrears in the Social Insurance Fund) applies to arrears on contributions due for payment to extra-budgetary funds until 2022, i.e. during those periods when the administration of contributions has not yet transferred to the Federal Tax Service:

- interest rate – 1/300 of the refinancing rate;

- debt period – up to and including the day of payment of the arrears.

Penalties on insurance premiums

Just as in the case of taxes, penalties for late payments of contributions are paid in addition to the amounts of the contributions themselves and penalties.

Let us note that the Law of July 24, 2009 No. 212-FZ does not provide for advance payments for insurance premiums. During the billing period (that is, the calendar year), the payer pays insurance premiums in the form of monthly mandatory payments.

Attention

Filing an application for a deferment (installment plan) or an investment tax credit does not suspend the accrual of penalties.

Let us remind you that payments to extra-budgetary funds are due no later than the 15th day of the calendar month following the one for which the calculation is made. If the specified payment deadline falls on a weekend or non-working day, the end date of the payment period is considered to be the next working day following it.

Penalties for late payment of insurance premiums are accrued for each calendar day of delay in fulfilling the obligation to pay them. The account begins on the day following the due date for payment of insurance premiums.

Penalties for each day of delay are determined as a percentage of the unpaid amount of insurance premiums. In this case, just as when calculating penalties for late payment of taxes, the interest rate of penalties is taken equal to 1/300 of the refinancing rate of the Bank of Russia in force on those days.

To calculate penalties for insurance premiums, you should use the same formula as for calculating penalties for taxes.

Penalties are not charged on the amount of arrears that the payer of insurance premiums could not repay due to the following reasons: – by a court decision his transactions in the bank were suspended; - his property was seized.

Penalties are not accrued for the entire period while these circumstances exist.

It should be noted that there is another situation, not described in the legislation, in which penalties are not charged. This is exactly the case if the arrears arose as a result of the execution of written explanations on the application of legislation on insurance premiums. But only when such explanations were given to a specific policyholder or an indefinite number of persons by the body monitoring the payment of insurance premiums or another authorized government body (an authorized official of this body) within its competence. These circumstances are established in the presence of a corresponding document from this body, the meaning and content of which relates to the settlement (reporting) periods for which the arrears arose, regardless of the date of publication of such a document - for example, a letter from the Ministry of Health and Social Development, the Social Insurance Fund or the Pension Fund.

However, if the specified written explanations are based on incomplete or unreliable information provided by the payer of insurance premiums, then penalties are subject to accrual and payment.

Penalties are paid simultaneously with the transfer of insurance premiums or after payment of such amounts in full. Penalties can be forcibly collected from bank accounts, as well as from other property.

When are penalties not charged?

There are also several moments in the event of which penalties will not be charged. These include:

- An overpayment of the required tax, covering a payment that has not yet been made.

- Overpayment of the required tax, covering the amount of the penalty.

If the overpayment partially covers the resulting debt, penalties will be charged only on the difference, and not on the entire debt.

An overpayment is the amount of tax fees, as well as previously paid fines or other contributions that the payer transferred in excessive quantities or the tax authority collected excessively. In this case, the overpayment will be automatically counted instead of arrears or penalties. If a person knows that there is “extra” money in his account, he does not need to do anything - the tax authorities will recalculate the numbers themselves.

Let's look at an example. Ivan Sergeevich Semyonov owns a 2006 Honda Fit car, for which he pays about 900 rubles annually as transport tax. If in 2022 Semyonov pays two thousand rubles at once, he will not have to pay tax in 2022, accordingly, the amount of the penalty will not be accrued - the payment will go through automatically. If Semyonov paid one thousand rubles in 2022 instead of 900 rubles, and then missed the payment by three months, he will also not have to pay penalties. Why?

According to the calculation formula, penalties will be accrued as follows: (900 rubles x 8.25% x 1/300 x 16 days) + (900 rubles x 7.75% x 1/300 x 56 days) + (900 rubles x 7.5% x 1/300 x 19 days) and will amount to 21 rubles 26 kopecks, which is completely covered by the overpayment of 100 rubles.

Overdue contributions for injuries

The fact that the policyholder pays penalties when transferring the specified contributions at a later date than those established by law is stated in Article 22.1 of the Law of July 24, 1998 No. 125-FZ.

Penalties are accrued for each calendar day of delay in “accidental” contributions, starting from the day following the established day for payment of these contributions, and up to and including the day of their payment or collection.

Penalties are not accrued if the policyholder confirms that he could not repay the arrears due to the suspension of transactions on his bank accounts or the seizure of his property. Also, penalties are not accrued during the period of validity of the granted deferment or installment plan for the repayment of amounts owed on insurance premiums and other payments.

Penalties are determined as a percentage of the arrears, which recognizes the amount of insurance premiums not paid on time.

The interest rate of penalties is set at 1/300 of the Bank of Russia rate in effect at the time the arrears occurred. If the specified rate changes, the amount of penalties based on the new refinancing rate is determined from the day following the day of its change.

Penalties are paid simultaneously with the payment of insurance premiums, and if the policyholder has insufficient funds, after paying insurance premiums in full. Arrears and penalties may be collected by the FSS of Russia forcibly at the expense of funds and other property of the policyholder.

Innovations for 2022 regarding penalties for taxes

Since the beginning of 2022, the law regulating tax obligations has extended to insurance premiums (medical, pension, disability and maternity leave). Accordingly, penalties are also calculated for these types of contributions in case of late payment.

Penalties are calculated the same for both individuals and legal entities, but at different interest rates

Since the fall of 2022, according to the new rules, penalties began to be calculated for firms, companies and organizations - legal entities. For them, the interest rate of the penalty has changed.

Penalty interest rate

For individuals, including individual entrepreneurs, penalties are calculated at an interest rate equal to one three hundredth of the refinancing rate of the Central Bank of the country. For legal entities the interest rate is different.

Table 1. Interest rate for legal entities

| Overdue period | Penalty calculation formula |

| Firms that are late in payments by no more than thirty days inclusive will pay penalties at a rate of one three-hundredth of the refinancing rate of the Central Bank of the Russian Federation (as well as individuals). | Formula for calculating penalties for legal entities as a general rule |

| Firms that are overdue for tax payments by more than thirty calendar days will pay for the period of those same thirty days at the standard rate (1/300 of the refinancing rate of the Central Bank of the Russian Federation), and starting from the thirty-first day of debt - at a rate equal to one hundred and fiftieth (1 /150), that is, half as much. | Formula for calculating penalties for legal entities for the first 30 days of delay Formula for calculating penalties for legal entities starting from 31 days of delay |

Let's look at an example . is obliged to pay UTII in the amount of ten thousand rubles for the third quarter of the year no later than October 25, 2022. In fact, the money entered the state treasury only on November 30 of the same year. The refinancing rate during this period was 8.5 percent. Accordingly, “Belye Rosy” will have to pay a penalty in the amount of 113.3 rubles. How did this amount come about?

According to the 2022 innovations that we mentioned, for the first thirty days of delay the formula will be: 10,000 rubles debt x 8.5% x 1/300 x 30 days (from October 26 to November 24). The next period is calculated differently: 10,000 rubles of debt x 8.5% x 1/150 x 5 days (from November 25 to November 29).

Calculation of penalties: formula

As we indicated above, penalties are calculated as a percentage of the amount of tax not paid on time. The classic formula for calculations is as follows:

Amount of tax debt x Refinancing rate of the Central Bank of the Russian Federation for the period of delay x 1/300 x Number of days for which payments are overdue

The current value of the Central Bank key rate needs to be clarified for the period of existing debt

Important point! Since the beginning of 2016, the concept of “refinancing rate” has been abolished. The Central Bank approves the key rate, which corresponds to the abolished value. As of March 2022, the refinancing rate of the Central Bank of the Russian Federation is 7.5 percent. Taking this fact into account, penalties must be calculated separately for each period if the rate was adjusted at that time.

Next, you need to figure out how to calculate the number of days in which the payment was overdue. According to Article No. 75 of the country's tax code, the delay begins to be considered from the day following the due date for payment of the tax fee (the date when it was necessary to pay, but this did not happen) until the day preceding the actual payment. That is, the delay in basic tax payments in any case is considered from December 2 (as we remember, the deadline for depositing money is December 1 of the year following the tax period). For example, a person needs to pay taxes for 2022. He did not do this on time, but transferred the money on March 16, 2022. The number of days of delay in his case is thirteen. Accordingly, if the payment was late by only a day, the payer would not face a penalty.

Do not forget that penalties are also charged on advance tax payments that are not transferred on time. In this situation, the number of days of delay is calculated individually, depending on the schedule for making advances. This information is relevant only for legal entities.

You may be interested in information on how to record tax penalties. In the presented material we will tell you what transactions exist for accruing and depositing funds for debt of the required type.

Video - How to calculate tax penalties according to the new rules?

Reflection of penalties in accounting

For the purposes of calculating income tax, expenses in the form of penalties, fines and other sanctions transferred to the budget (to extra-budgetary funds) are taken into account when determining the tax base (clause 2 of Article 270 of the Tax Code of the Russian Federation).

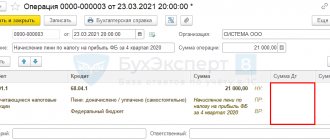

The accrual of penalties for late payment of taxes (advance payments thereon) in accounting looks like this: DEBIT 99 “Profits and losses” CREDIT 68 “Calculations for taxes and fees”

- penalties are accrued for late payment of taxes (advance payments).

In accounting, the accrual of penalties for late payment of insurance premiums is reflected as follows: DEBIT 99 “Profits and losses” CREDIT 69 “Calculations for social insurance and security”

- penalties were accrued for late payment of mandatory monthly payments. As we can see, the penalties to be paid do not affect either the amount of the financial result in accounting or the size of the tax base. Therefore, there are no differences between them in accordance with PBU 18/02.

M.V. Grebenarov, tax consultant

Tax accounting and reporting

The “Tax Accounting and Reporting” berator brings together and correctly systematizes complete and detailed information on how to organize and maintain tax accounting. Find out more >>

Fines for taxes, fees and charges

In most cases, fines are regulated by Article 122 of the Tax Code of the Russian Federation. It is valid for the following payments to the budget:

- VAT.

- Income tax.

- UTII.

- USN.

- Unified Agricultural Sciences.

- Excise tax

- Water, land, transport and property taxes.

- Contributions to the Pension Fund, Compulsory Medical Insurance Fund, Social Insurance Fund (in terms of disability and maternity).

- Trade fee.

Moreover, fines are imposed for non-payment of taxes, but not advance payments (clause 3 of Article 58 of the Tax Code). For them you will only have to pay penalties and, possibly, incur administrative penalties.

The penalty is usually 20% of the unpaid tax, fee or contribution. If the base is deliberately underestimated, the calculation is made incorrectly or is not made at all, then the taxpayer will have to part with 40%.

Penalties for personal income tax are calculated differently: 20% of the amount of tax that was unlawfully not withheld or not transferred, which the tax agent should have withheld and transferred. Moreover, he can be released from liability when three conditions specified in paragraph 2 of Article 123 of the Tax Code are simultaneously met:

- Report 6-NDFL was submitted on time.

- The calculation fully reflects the tax amount and there are no errors leading to its underestimation.

- The tax and penalties were transferred to the budget before the agent learned about the violation from the Federal Tax Service, or before an on-site personal income tax inspection was scheduled.

Individual entrepreneurs who pay for a patent, in case of delay, are not deprived of the right to use it, but are required to transfer the debt. If the tax office has not received payment on time, it will send a demand to the entrepreneur (clause 2.1 of Article 346.51). You will also have to pay off penalties, and penalties are calculated in the standard manner (Article 122).

Delay in payment of environmental fees is subject to administrative punishment under Article 8.41.1 of the Administrative Code: 5-7 thousand for the responsible person, for legal entities - triple the amount of the unpaid amount, and not less than 500 thousand, similarly for individual entrepreneurs, but the minimum limit is lower - 250 thousand rubles .

Finally, fines for contributions to “accident insurance” in the Social Insurance Fund are 20% or 40%, depending on the absence or presence of intent, as well as for other contributions, but this norm is regulated not by the Tax Code, but by Federal Law No. 125-FZ of July 24. 1998 in article 26.29.

Important! In 2022, some taxpayers have shifted the payment of taxes and contributions to new dates.

What is a penalty

In civil legislation there is no clear definition of the concept of “fine”, apart from what is mentioned in passing – a type of punishment in the form of a penalty. At the same time, a clearer concept can be obtained from tax legislation, where a separate article is already allocated in the Code.

According to the current norms of tax legislation, a penalty is the amount of a penalty that is charged to those payers who are late in paying a tax or fee or fine. This is a certain amount that is added to the amount of tax, fee, or fine. And the payer who missed the payment deadline is also obliged to pay this amount. Otherwise, its debt to the state budget will continue to grow.

Moreover, even if some other preventive or enforcement measures are applied to the payer aimed at collecting taxes, fees, and fines due to him, the penalty continues to be accrued. No one can cancel such a measure (should be understood as a penalty). The larger the amount of debt, the more penalties are charged on it.

Have you accrued penalties?

We will challenge it if it was illegal! Make an appointment with a lawyer.

+7

Payment of fines

Collection of penalties is possible forcibly when the payer voluntarily fails to pay the amount calculated to him. The main method is to withhold funds from personal bank accounts. That is, the tax authority, by making an appropriate decision, can oblige the bank to take certain actions, the purpose of which is to collect penalties from the payer.

The bank does not have the right to ignore the decisions of the tax authorities, therefore it withholds in favor of the state budget the funds necessary and sufficient to pay the penalty, if there are enough of them in the payer’s account to repay the debt. If not, notify the tax authority about the account balance during the working day.

Payment of penalties is the responsibility of the payer, and not his right. Thus, payers - individuals, in case of non-payment, may be subject to administrative or criminal prosecution for failure to fulfill their obligations. The tax authority has the right to file a corresponding statement of claim in court demanding the collection of penalties, as well as the imposition of a fine on the dishonest payer.

However, the individual is first sent in writing by personal delivery or transmission via mail (registered mail) a request for payment of existing taxes, fees (including insurance), penalties and fines. In case of non-compliance, the tax authority has the right to file an application with the court.

Payers - organizations or individual entrepreneurs - are also required to pay the penalties accrued to them.

If, after receiving a request for payment from the tax authority, this does not happen, the tax authority has the right to suspend transactions on bank accounts, and if this measure is insufficient, to apply to the judicial authorities with a statement of claim for recovery by seizure of property.

The greater the amount of penalty debt, the more or more expensive the property will be seized and then sold at market value to pay off the debt to the state budget.

There is a practice when the debtor-payer pays penalties when the legal proceedings have just begun. In this case, the court is obliged to take into account the payment in a fixed actual amount.

If this does not happen, then the decision indicates not only the deadline for the execution of the decision, but also the amount to pay the tax - in a fixed amount, and the amount of the penalty - in a percentage amount, according to the refinancing rate of the Central Bank.

Advance payments that the payer is required to make may also be subject to repayment obligations or late penalties. Thus, penalties for late payment begin to accrue from the moment when the tax is due to be paid, and not the advance payment for it. That is, the payer is conditionally given a deferment for payment without penalty, and in case of delay, penalties are already charged.

Author of the article

Method of calculation

When calculating, not the entire amount of the tax or fee that is prescribed to the payer is taken as a basis, but only the part that is overdue for payment. It is from its size that the size of the penalty is determined, as well as the final amount of the debt. A penalty is accrued every day, regardless of whether it is a weekday or a day off, from the moment the delay in payment of the tax or fee occurs. That is, if the payer was given ten days to pay the tax, and he came to pay on the fifteenth, then for 5 days of delay he is charged a penalty, which also must be paid.

The amount of the penalty is calculated separately from the amount of the tax or fee, but both amounts are added up when paid.

If the payer pays only one amount, ignoring the second, then the penalty continues to accumulate. There are cases in tax legislation when the debt reaches a certain amount, which allows the tax authorities to go to court to recover funds from the debtor to the state budget. Tax penalties are calculated in percentage format - a certain percentage is added to the tax amount every day, which is the penalty.

The amount of the penalty cannot be established and accrued when an organization, individual entrepreneur or individual does not have the funds to pay the principal debt due to the seizure of his property or the suspension of transactions on his bank accounts. Moreover, if such a preventive measure is already used, then, as a rule, the unscrupulous payer is also awarded a fine for unlawful actions; no penalties are provided for in this case.

The amount of the penalty is calculated as a percentage and is equal to 1/300 of the current refinancing rate by the Central Bank. Moreover, the data is taken into account for a specific day. The higher the Central Bank rate, the higher the penalty that will be charged for late payment of taxes, fees, and fines. The tax legislation does not provide for a fixed penalty for late payments of taxes, fees or fines, only a percentage expression.