A tax return is a written statement by the taxpayer about the objects of taxation, about income received and expenses incurred, about sources of income, about the tax base, tax benefits, about the calculated amount of tax and (or) about other data that serves as the basis for the calculation and payment of tax.

A tax return is submitted by each taxpayer for each tax payable by that taxpayer.

Based on the tax return and current tax rates, the tax authority exercises control over the amount of tax payable.

Types of tax returns

According to the types of taxes declared, the following types of declarations are distinguished:

- VAT declaration;

- Income tax return;

- Personal income tax declaration;

- Declaration of tax paid in connection with the application of the simplified taxation system;

- Declaration of tax on imputed income for certain types of activities (UTII);

- Declaration on the unified agricultural tax;

- Property tax declaration;

- Transport tax declaration;

- Land tax declaration;

- Declaration of mineral extraction tax (MET);

- Water tax declaration;

- Excise tax declaration, etc.

Document preparation and coding rules

The title page is filled out by the responsible persons of the taxpayer . The section that is intended to be filled out by an employee of the territorial office of the fiscal service is left blank. To make it easier to check the declaration, some of the information is encoded with special symbols.

So, if the form is submitted for the first time, “0” is entered in the cell under the name of the declaration; if the form has already been corrected once, then “1” is entered in the same cell, and “2” the second time.

The reporting period is then coded as follows:

- 1st quarter "21";

- 6 months "31";

- 9 months "33";

- annual for 2022 "34".

If a business entity calculates advance payments for income tax, then codes from 35 to 46 are entered in the cells. In this case, in the declaration for the 1st quarter, code 38 is entered in the same cells, and for 6 months - 39.

If a legal entity is liquidated or undergoes reorganization, then the number 50 is entered in the cell of the annual declaration.

The declaration is submitted even if the economic agent did not conduct business activities in the expired tax period. In this case, zero tax information is compiled. You can find out more about zero tax returns in our article.

The title page should also include the code of the territorial tax office . The name of the economic agent is written in the center, indicating its organizational and legal form of ownership (LLC, JSC, AOZT, individual entrepreneur).

The code of the main economic activity is entered below, based on OKVED 2. The new classifier of types of activities was approved by Rosstandart on January 31, 2014 by order No. 14-st.

BASIC

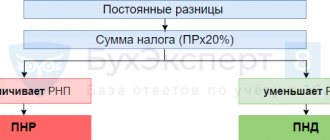

This abbreviation means the term “general taxation system”. Economic agents, not individual entrepreneurs, using such an accounting system, report on three types of taxes :

- Income tax at a rate of 20%.

- VAT at rates of 0,10,18%. Read more about VAT tax returns here.

- Property tax at a rate of 2.2%. You can find out about the property declaration here.

Individual entrepreneurs report to the territorial bodies of the Federal Tax Service on the following types of taxes:

- Personal income tax, rate 13% for residents of the Russian Federation.

- VAT, rates 0,10,18%.

- Property tax at a rate of 2%.

The declaration must be submitted 4 times a year, quarterly, no later than the 25th day of the month following the reporting quarter. Read about how to properly submit a declaration here.

ATTENTION : For individual entrepreneurs, the personal income tax declaration form 3-NDFL is submitted once a year following the reporting period, no later than April 30. At the same time, individual entrepreneurs submit the 4-NDFL reporting form.

- Read about how to prepare a tax return for individual entrepreneurs in this article, and you can learn about correctly filling out and submitting form 3-NDFL here.

UTII

This abbreviation means Unified Tax on Business. Filing a declaration is mandatory for individual entrepreneurs using this taxation system. This reporting form is submitted once a year.

In addition to financial indicators, this form of reporting includes::

- Amount of workers.

- The area of occupied territory that is used to conduct business.

- Number of seats for cafes, restaurants, cinemas, canteens, etc.

- Number of trade objects and vehicles.

The reporting period for such a declaration is a quarter. The deadline is the 20th of the month following the reporting period.

The submitted document consists of 3 sections:

- The calculated amount to be paid is the budget for all types of activities.

- The calculated amount to be paid is the budget for individual types of activities.

- The calculated amount payable to the budget for a specific tax period.

For more information about what this document is and how to fill it out, read our article.

Unified agricultural tax

Economic entities using the Unified Agricultural Tax taxation system submit once a year. Unified agricultural tax means unified agricultural tax. The deadline is April 1 based on the results of your activities over the past year. The last day for filing a return for 2016 is March 31, 2022.

In case of liquidation, a separate declaration under the Unified Agricultural Tax is submitted to the tax authorities by the 26th day of the month following the month in which the economic agent notified the Federal Tax Service of the termination of its business activities.

The submitted reporting form consists of 3 sections on 4 pages. All details of the economic entity are indicated on the title page of the document :

- Section 1 indicates the total amount of the calculated Unified Agricultural Tax, taking into account the advance payment.

- Section 2 provides a breakdown of the calculation including the loss, if any.

- Section 3 contains information about the property on the balance sheet of a legal entity.

PSN

The abbreviation PSN stands for patent taxation system. Entrepreneurs with the status of individuals conducting economic activities on the basis of an issued patent are exempted in accordance with Art. 346.52 of the Tax Code of the Russian Federation from the need to file a tax return.

simplified tax system

The abbreviation simplified taxation system means simplified taxation system . The declaration by economic agents using this form for reporting is submitted quarterly, before the 25th day of the month following the reporting period. This tax reporting form is submitted 3 times a year: April 25, July 25, October 25.

You can find out more about what the simplified tax system is here, and who has the right to submit such a declaration, read here.

Tax return forms

The forms and procedure for filling out forms of tax returns (calculations), as well as the formats and procedure for submitting tax returns (calculations) and documents attached to them in accordance with this Code in electronic form are approved by the federal executive body authorized for control and supervision in the field of taxes and fees, in agreement with the Ministry of Finance of the Russian Federation.

The federal executive body authorized for control and supervision in the field of taxes and fees does not have the right to include information in the tax return (calculation) form, and tax authorities do not have the right to require taxpayers (payers of fees, tax agents) to include information in the tax return (calculation) , not related to the calculation and (or) payment of taxes and fees, with the exception of:

- type of document: primary (corrective);

- name of the tax authority;

- location of the organization (its separate division) or place of residence of an individual;

- surname, name, patronymic of an individual or full name of the organization (its separate division);

- taxpayer contact telephone number;

- information to be included in the tax return.

Making changes to your tax return

If the taxpayer discovers in the tax return submitted by him to the tax authority that information is not reflected or is incompletely reflected, as well as errors leading to an underestimation of the amount of tax payable, the taxpayer is obliged to make the necessary changes to the tax return and submit an updated tax return to the tax authority.

If a taxpayer discovers inaccurate information in the tax return submitted to the tax authority, as well as errors that do not lead to an underestimation of the amount of tax payable, the taxpayer has the right to make the necessary changes to the tax return and submit an updated tax return to the tax authority in the manner established by this article .

In this case, an updated tax return submitted after the expiration of the established deadline for filing the return is not considered submitted in violation of the deadline.

If an updated tax return is submitted to the tax authority before the deadline for filing a tax return, it is considered submitted on the day the updated tax return is submitted.

If an updated tax return is submitted to the tax authority after the deadline for filing a tax return, but before the deadline for paying the tax, the taxpayer is released from liability if the updated tax return was submitted before the taxpayer learned that the tax authority had discovered the fact of non-reflection or incompleteness of information. in the tax return, as well as errors leading to an underestimation of the amount of tax payable, or the appointment of an on-site tax audit.

If an updated tax return is submitted to the tax authority after the deadline for filing a tax return and the deadline for paying the tax, the taxpayer is released from liability in the following cases:

1) submission of an updated tax return before the taxpayer learns that the tax authority has discovered non-reflection or incompleteness of information in the tax return, as well as errors leading to an understatement of the amount of tax payable, or about the appointment of an on-site tax audit for a given tax for a given period, provided that before submitting an updated tax return, he paid the missing amount of tax and the corresponding penalties;

2) submission of an updated tax return after an on-site tax audit for the corresponding tax period, the results of which did not reveal non-reflection or incompleteness of information in the tax return, as well as errors leading to an understatement of the amount of tax payable.

The updated tax return is submitted by the taxpayer to the tax authority at the place of registration.

The updated tax return (calculation) is submitted to the tax authority in the form that was in force during the tax period for which the corresponding changes are made.

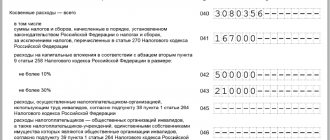

Deadlines for filing income tax reports in 2022

Article 230 in paragraph 2 of the Tax Code establishes the deadline for submitting final reports on income received. The completed document is submitted to the tax office 3 times: based on the results of work for 3, 6, and 9 months of economic activity. The deadline for submitting the document is until the last day of the month following the reporting quarter.

The final income tax return received from financial and economic activities for 2016 must be submitted by April 3, 2022.

Methods for filing tax returns

A tax return (calculation) can be submitted by a taxpayer (payer of a fee, tax agent) to the tax authority personally or through a representative, sent by mail with a list of attachments, transmitted electronically via telecommunication channels or through the taxpayer’s personal account.

When sending a tax return (calculation) by mail, the day of its submission is considered the date of sending the postal item with a description of the attachment.

When transmitting a tax return (calculation) via telecommunication channels or through the taxpayer’s personal account, the day of its submission is considered the date of its dispatch.