Place of data on dividends in the income statement

The profit declaration form used for reporting for 2022 has been updated (see Federal Tax Service order dated September 23, 2019 No. ММВ-7-3/ [email protected] as amended by Federal Tax Service order dated October 5, 2021 No. ED-7-3/ [email protected] ).

Comments from ConsultantPlus experts will help you fill it out. If you received dividends, this ready-made solution will help you reflect them in your income tax return. If you act as a tax agent and withhold income tax when paying dividends to a legal entity, this material will help you. Trial access to the legal system is free.

Organizations paying dividends fill out:

- sheet 03;

- subsection 1.3 section. 1 sheet 01.

Dividends paid to individuals are also reflected in personal income tax reporting.

Filling out sheet 03 is carried out exclusively by tax agents. If the company is not one, it may not include it in the declaration.

To learn about the cases in which a legal entity becomes a tax agent for profits, read the material “Who is a tax agent for profits taxes (responsibilities)?”

Structure of Sheet 03

The current form of the company income tax declaration is established by order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3/572. According to it, Sheet 03 of the income tax return in 2022 is intended to calculate the income tax that the company must withhold as a tax agent and source of payment. The same order established the rules for filling out the income and profit declaration (hereinafter referred to as the Procedure). Who should fill out Sheet 03 of the income tax return becomes clear from the three sections it includes:

| Structural part of Sheet 03 | What to reflect | What norms of the Tax Code of the Russian Federation should we follow? |

| Section A | Calculation of tax on dividends/income from equity participation in other organizations established in Russia | By equity participation:

|

| Section B | Calculation of tax on interest income on state and municipal securities | Article 281 Clause 5 of Article 286 Paragraph 4 of Article 287 Articles 328 and 329 |

| Section B | Register-decoding of dividend amounts (percent) | – |

As you can see, dividends to individuals are also reflected in Sheet 03 of the income tax return (in lines 020, 021, 022, 023, 024, 030, 040, 050, 051, 052, 053, 054, 060). That is, it shows not only the income addressed to the legal entity as a whole, but also the dividends that this company accrued to individuals and legal entities, and submits this report as a tax agent.

Procedure for filling out sheet 03

The procedure for filling out sheet 03 is contained in the same document that approved the declaration form.

The sheet consists of three sections devoted to:

- income in the form of dividends - section A;

- income on state and municipal securities (interest) - section B;

- decoding of dividend amounts - section B.

At the same time, the majority of organizations fill out only sections A and B, and do not complete section B.

Section A looks like this:

Fill it out for the period in which dividends were paid and for subsequent periods throughout the year. For example, when paying dividends in the 3rd quarter, section A must be included in the declaration for 9 months and a year.

In the section header you need to put:

- tax agent category code: 1 - if you are an issuer of securities on which you pay dividends, 2 - if not;

- type of dividends: interim or annual;

- tax period code and reporting year. For example, for a 2022 dividend paid in June 2022, the period code would be 34 and the reporting year would be 2022.

Next, fill in information about dividends - the total amount (lines 001 and 010) and by tax rates and categories of recipients (lines 020-070).

If you also received dividends, fill out lines 080 and 081, indicating the total amount of dividends and the amount by which the accrued dividends were reduced when calculating the tax, respectively.

In line 090 you need to indicate the difference between line 010 and line 081, in line 091 - the total tax base of dividends, from which the tax is calculated at a rate of 13%, in line 092 - the total tax base for dividends taxed at a rate of 0%.

The following is the income tax accrued on dividends: the total amount (line 100), on dividends paid in previous periods (line 110), and in the last quarter of the reporting year (line 120).

Section B of sheet 03 looks like this:

It is included in the declaration only for the quarter in which dividends were paid and is filled out for each participant. In the “Affiliation Attribute” field you need to put A, in the “type” field - 00, which means the primary calculation. When submitting clarifications, the serial number of the correction from 01 to 98 is entered here. Code 99 is used when canceling information.

After filling out sheet 03, information about dividends must be transferred to subsection 1.3 of section. 1 sheet 01.

It is also filled out only in the quarter when dividends were paid, and is not included in the declarations for subsequent periods.

In line 010 you need to put 1 (code 2 is used for income on state and municipal securities).

In line 01, indicate the tax payment deadline (the day following the day of dividend payment), and in line 040, the tax amount. If dividends were paid for several days, fill in the appropriate number of lines.

You can find out how to reflect the payment of dividends in the declaration for 2022 in ConsultantPlus by receiving free trial access to the K+ system.

Filling out a tax return by an organization paying dividends

In accordance with paragraph 3 of Art.

289 of the Tax Code of the Russian Federation, taxpayers (tax agents) submit tax returns (tax calculations) no later than 28 calendar days from the end of the corresponding reporting period. We would like to remind you that the reporting periods for corporate income tax are the first quarter, half a year and 9 months of the calendar year. Based on clause 4 of Art. 289 of the Tax Code of the Russian Federation, tax returns (tax calculations) based on the results of the tax period are submitted by taxpayers (tax agents) no later than March 28 of the year following the expired tax period. The tax period for income tax is a calendar year.

During 2016, the tax return was submitted to the tax authorities in the form approved by the order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3 / [email protected] “On approval of the tax return form for corporate income tax, the procedure for filling it out , as well as the format for submitting a tax return for corporate income tax in electronic form.” This order ceased to be valid due to the entry into force on December 28, 2016 of the order of the Federal Tax Service of Russia dated October 19, 2016 No. ММВ-7-3 / [email protected] “On approval of the tax return form for corporate income tax, its procedure filling out, as well as the format for submitting a tax return for corporate income tax in electronic form.” In other words, starting from the first reporting period of 2022, the tax return must be prepared and submitted to the tax authorities using a new form.

The tax calculation form on the amounts of income and withheld taxes paid to foreign organizations was approved by order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected] “Approval of the tax calculation form on the amounts of income and withheld taxes paid to foreign organizations, the procedure for filling it out , as well as the format for presenting tax calculations on the amounts of income paid to foreign organizations and taxes withheld in electronic form.”

Let's consider the procedure for filling out Section A “Calculation of tax on income in the form of dividends (income from equity participation in other organizations established on the territory of the Russian Federation)” of Sheet 03 of the declaration.

Please note that in accordance with clause 11.2.1 of Appendix No. 2 to Order No. ММВ-7-3/ [email protected] (hereinafter referred to as Appendix No. 2), Sheet 03 is filled out in relation to each decision on the distribution of profit remaining after taxation. In the case of an interim payment of dividends, code “1” is indicated in the “Type of dividends” detail; when dividends are paid based on the results of a financial year, code “2” is indicated. The “Tax (reporting) period” detail indicates the code of the period for which dividends are distributed. The codes defining the reporting (tax) period are given in Appendix No. 1 to the Procedure for filling out a tax return. The “Reporting year” requisite indicates the calendar year for the reporting (tax) periods of which dividends are paid. If payments are made under several decisions in the current period, then several Sheets 03 are filled out.

So, the organization submitting the tax calculation reflects on line 001 of Section, ALlist 03 of the declaration the total amount of dividends to be distributed by the Russian organization in favor of all recipients (indicator D1 in the tax calculation formula given in paragraph 5 of Article 275 of the Tax Code of the Russian Federation) (p 11.2.2 of Appendix No. 2).

Line 010 indicates the amount of dividends to be paid only to those shareholders (participants) in relation to whom the organization is a tax agent.

Lines 020, 021, 022, 023, 024, 030, 040, 050, 051, 052, 053, 054, 060 also indicate the amounts of dividends accrued to those organizations and individuals in relation to which the organization that submits the tax calculation is tax agent.

The indicator for line 010 is equal to the sum of the indicators for lines 020, 030, 040, 050 and 070.

Further along the lines of Section A of Sheet 03 of the declaration are reflected:

line 020 - the amount of dividends accrued to recipients of income - Russian organizations, as well as other persons, the accrual of dividends to which is indicated on line 024, the indicator of line 020 is equal to the sum of the indicators of lines 021, 022, 023, 024 (clause 11.2.3 of Appendix No. 2 ); line 021 - the amount of dividends subject to distribution to the Russian organizations specified in paragraphs. 1 clause 3 art. 284 of the Tax Code of the Russian Federation, i.e. dividends taxed at a rate of 0%; lines 022 and 023 - the amount of dividends subject to distribution to the Russian organizations specified in paragraphs. 2 p. 3 art. 284 of the Tax Code of the Russian Federation, i.e. dividends taxed at a rate of 13% (the indicators of lines 021–023 include, among other things, the amounts of dividends subject to distribution to organizations that have switched to a simplified taxation system, payment of a single tax on imputed income for certain types of activities, applying the taxation system for agricultural producers (unified agricultural tax); line 024 - dividends subject to distribution in favor of persons who are not tax payers, in particular dividends on shares owned by the Russian Federation, its constituent entities or municipalities, dividends on shares constituting property of mutual funds; line 030 - dividends accrued to recipients of income - individuals who are tax residents of the Russian Federation, upon payment of dividends to whom personal income tax is calculated, subject to withholding by the tax agent in accordance with Article 214 and paragraph 5 of Article 275 of the Tax Code of the Russian Federation. lines 040 and 050 - the amount of dividends accrued to recipients of income - foreign organizations and individuals who are not tax residents of the Russian Federation; lines 051 and 054 - the amount of dividends accrued to recipients of income - foreign organizations and individuals who are not tax residents of the Russian Federation, whose taxes are subject to withholding in accordance with international treaties of the Russian Federation at tax rates below the established paragraphs. 3 p. 3 art. 284 Tax Code of the Russian Federation; line 070 - amounts of dividends transferred to persons who are nominal holders of securities, without withholding tax; lines 080 and 081 - the amount of dividends received by the Russian organization itself from Russian and foreign organizations, minus the profit tax withheld from these amounts by the source of payment (tax agent); in this case, line 080 reflects the amount of dividends received by the tax agent himself in previous reporting (tax) periods, as well as from the beginning of the current tax period until the date of distribution of dividends between shareholders (participants) for the period specified in Section A of Sheet 03, and is also subject to reflecting amounts that were not previously taken into account when determining the tax base calculated in relation to income received by a Russian organization in the form of dividends; line 081 reflects the amount of dividends received by the Russian organization itself, with the exception of dividends specified in paragraphs. 1 clause 3 art. 284 of the Tax Code of the Russian Federation, the tax on which is calculated at a rate of 0% (the indicator of line 081 corresponds to indicator D2 in the tax calculation formula given in clause 5 of Article 275 of the Tax Code of the Russian Federation); line 090 - the total amount of dividends distributed in favor of all recipients, reduced by the value of the line 081 indicator: line 090 = line 001 - line 081, or line 090 = line 010 + line 070 - line 081; the indicator on line 090 corresponds to the difference between indicators D1 and D2: if the indicator is negative, then the obligation to pay tax does not arise and reimbursement from the budget is not made, and dashes are placed on lines 090–120; organizations filling out Section A of Sheet 03 of the declaration indicating code “2” for the “Category of tax agent” requisite, put dashes on lines 080 and 081, and the indicator of line 090 is determined based on the information provided by the Russian organization that pays income in the form of dividends ; line 091 - the amount of dividends, the profit tax on which is calculated for withholding by Russian organizations at the rates established by paragraphs. 2 p. 3 art. 284 Tax Code of the Russian Federation; the indicator is defined as the sum of data on the size of the tax bases for each specified taxpayer, calculated according to that given in paragraph 5 of Art. 275 of the Tax Code of the Russian Federation, the formula for calculating tax before applying the tax rate; line 092 - the amount of dividends, the profit tax on which is calculated to be withheld from Russian organizations at a rate of 0%; the indicator is defined as the sum of the given amounts of tax bases for each specified taxpayer, calculated as given in paragraph 5 of Art. 275 of the Tax Code of the Russian Federation, the formula for calculating tax before applying the tax rate; line 100 - the calculated amount of income tax, equal to the total amount of tax calculated for each taxpayer - a Russian organization at the rate specified in paragraphs. 2 p. 3 art. 284 Tax Code of the Russian Federation; line 110 - the amount of tax calculated on dividends paid to Russian organizations in previous reporting (tax) periods in relation to each decision on the distribution of income from equity participation; line 120 - the amount of tax accrued on dividends paid to Russian organizations in the last quarter (month) of the reporting (tax) period in relation to each decision on the distribution of income from equity participation.

When paying dividends partially (in several stages), the payment of tax is reflected in line 040 of subsection 1.3 of Section 1 of the declaration. In this case, the period is indicated by the taxpayer based on the date of payment of dividends in accordance with clause 4 of Art. 287 Tax Code of the Russian Federation.

How to fill out Appendix No. 2 to the income tax return

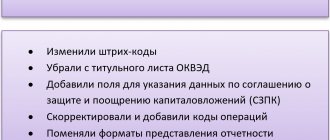

Appendix No. 2 was last used to reflect dividends paid to individuals from securities in the income tax return for 2022. In the 2022 declaration, Appendix No. 2 is intended for other purposes. Now it reflects information on income (expenses) received (incurred) during the execution of agreements on the protection and promotion of investments, as well as on the tax base and the amount of calculated corporate income tax.

Appendix No. 2 on dividends was also removed from joint stock companies. It was filled out only at the end of the year, separately for each individual recipient of dividends.

Income tax rate on dividends

Dividends are not expenses when calculating NP (Article 270 of the Tax Code of the Russian Federation). Dividends are paid from profits and when paid from their amounts, agents withhold taxes: personal income tax when paid to individuals and income tax when paid to companies.

Depending on the type of company, dividends in the income tax return are taxed at different tax rates. Thus, dividends received by domestic enterprises can be taxed at the rate:

- 13% - in the general case;

- 0% - if there is a share of the contribution in the management company of more than 50% and its ownership for at least 365 days on the day the decision on payment is made (clause 3 of Article 284 of the Tax Code of the Russian Federation).

A 15% NP is provided for dividends received by foreign companies from Russian legal entities.

Results

The composition of information about dividends in the income tax return depends on who the tax agent is, who receives the dividends and when they were paid (in the reporting period or earlier).

If dividends were paid this year, section A of sheet 03 must be included in the declaration. The remaining pages may be missing. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.