What is an advance payment

Before proceeding to a detailed analysis of the schemes for calculating advance payments, let us define this concept itself. An advance payment is a preliminary tax payment within the period provided for by the Tax Code of the Russian Federation. Late advance payment will result in the accrual of penalties.

Attention! It should be remembered that late payment of tax advances cannot serve as a basis for serious administrative sanctions, such as the imposition of fines, since such delay does not relate to violations of the Law on Taxes and Fees.

Obligation to pay advance payments

The law of the Russian Federation establishes that enterprises and organizations can pay advance payments both obligatory and voluntary. First, let's figure out who is required to make tax advances:

- first of all, these are newly registered companies whose revenue exceeds 5 million rubles per month or 15 million rubles in one quarter. It should be remembered that in this case they must make the first advance payment on taxes only after the end of the first quarter from the date of registration with the tax inspectorate ;

- enterprises whose net income from the sale of goods or provision of services over the previous year exceeded 15 million rubles on a quarterly basis.

The right to payment of monthly advances on income tax

The calculation and payment of advance payments is not always the responsibility of the organization. In some cases, the taxpayer may voluntarily switch to making advance payments based on the actual profit received. However, there are no legally established limits on the amount of income or any other parameters for such a transition. This can be done by promptly notifying the tax authority of your desire and only at the beginning of the new calendar year .

Who is required to make quarterly advances?

In addition to companies that have voluntarily expressed a desire to make advance payments of income tax quarterly, there are a number of categories of entrepreneurs and institutions that are required to do so (clause 3 of Article 286 of the Tax Code of the Russian Federation). Naturally, they no longer have to make a monthly advance payment. These include:

- companies with income for the previous 4 quarters of less than 60 million rubles. (or 15 million rubles quarterly);

- budgetary organizations;

- foreign companies that operate in Russia through a permanent representative office;

- members of simple partnerships (tax on income from participation);

- parties to production sharing agreements (income from the implementation of agreements is taxed);

- those who have acquired benefits from trust management income.

With each advance payment, the amount of annual income tax accrued for the year decreases accordingly.

...only once a quarter based on the results of the reporting period

There is a certain category of taxpayers who pay only quarterly advance payments based on the results of the reporting period, that is, for the first quarter, half a year, nine months.

At the same time, monthly advance payments to the budget are not made within the quarter. The list of taxpayers for whom such a procedure has been established for making advance payments of income tax during the tax period is contained in paragraph 3 of Art. 286 Tax Code of the Russian Federation . This:

- budgetary institutions (except for theaters, museums, libraries, concert organizations);

- autonomous institutions;

- foreign organizations operating in the Russian Federation through a permanent representative office;

- non-profit organizations that do not have income from the sale of goods (works, services);

- participants of simple (investment) partnerships in relation to the income they receive from participation in simple (investment) partnerships;

- investors of production sharing agreements in terms of income received from the implementation of these agreements;

- beneficiaries under trust management agreements.

In addition, other organizations (not listed in this list) must pay advances once a quarter if their income from sales, determined in accordance with Art. 249 of the Tax Code of the Russian Federation , for the previous four quarters did not exceed an average of 10 million rubles.

for every quarter. That is, the calculation takes into account the proceeds from the sale of goods (works, services) both of one’s own production and those previously acquired, and the proceeds from the sale of property rights (non-operating income is not taken into account). At the same time, the revenue indicator does not include the amounts of VAT and excise taxes charged to customers. According to the Ministry of Finance, in accordance with paragraph 3 of Art. 286 of the Tax Code of the Russian Federation, when determining the previous four quarters, it is necessary to take into account the consecutive four quarters preceding the period in which the deadline for submitting the corresponding tax return falls ( letters dated September 21, 2012 No. 03-03-06/1/493 , dated December 24, 2012 No. 03- 03-06/1/716 ).

For example, if sales revenues for the previous four quarters (II, III and IV quarters of 2013 and I quarter of 2014) exceeded an average of 10 million rubles. for each quarter, the taxpayer makes monthly advance payments starting from the 2nd quarter of 2014, reflected in the corporate income tax return for the 1st quarter of 2014.

According to para. 5 p. 1 art. 287 of the Tax Code of the Russian Federation, advance payments based on the results of the reporting period are counted against the payment of tax based on the results of the next reporting (tax) period.

Thus, the amount of the quarterly advance payment that the organization must pay to the budget based on the results of the corresponding reporting period ( QAP for additional payment ) is calculated as the difference between the amounts of quarterly advance payments calculated based on the results of the current reporting period

( KAP reporting ) and the previous reporting period ( KAP previous ):

KAP for additional payment = KAP reporting - KAP previous

Advance payments based on the results of the reporting period are made no later than the deadline established for filing tax returns for the corresponding reporting period ( paragraph 2, paragraph 1, article 287 of the Tax Code of the Russian Federation ).

Thus, during the year, organizations fill out tax returns once every three months, based on the actual profit received, and payment is made no later than April 28, July 28, October 28 of the current tax period.

Example 3

Over the previous four quarters, Strela LLC received income from sales, the amount of which did not exceed an average of 10 million rubles. for every quarter. In this regard, the organization makes quarterly advance payments. The tax rate is 20%, including to the federal budget - 2%, to the budget of a constituent entity of the Russian Federation - 18%.

Let us assume that the taxable base for income tax in 2013 was:

- for the first quarter – 100,000 rubles;

- for half a year – 120,000 rubles;

- for nine months - loss;

- per year – 150,000 rubles.

The following indicators will be reflected in tax returns:

| Indicators of sheet 02 of the declaration | Line code | I quarter | Half year | Nine month | Year |

| Tax base for tax calculation | 120 | 100 000 | 120 000 | – | 150 000 |

| Amount of calculated income tax | 180 | 20 000 | 24 000 | – | 30 000 |

| – to the federal budget | 190 | 2 000 | 2 400 | – | 3 000 |

| – to the budget of a constituent entity of the Russian Federation | 200 | 18 000 | 21 600 | – | 27 000 |

| Amount of accrued advance payments for the reporting (tax) period | 210 | – | 20 000* | 24 000* | – |

| – to the federal budget | 220 | – | 2 000 | 2 400 | – |

| – to the budget of a constituent entity of the Russian Federation | 230 | – | 18 000 | 21 600 | – |

| Amount of income tax to be paid additionally | |||||

| – to the federal budget | 270 | 2 000 | 400 | – | 3 000** |

| – to the budget of a constituent entity of the Russian Federation | 271 | 18 000 | 3 600 | – | 27 000** |

| The amount of income tax to be reduced | |||||

| – to the federal budget | 280 | – | – | 2 400 | – |

| – to the budget of a constituent entity of the Russian Federation | 281 | – | – | 21 600 | – |

The amounts of accrued advance payments for the corresponding reporting (tax) period, indicated on lines 210–230 of sheet 02 of the declaration, are transferred from lines 180–200 of the declaration for the previous reporting period.

**

At the end of nine months, the organization had an overpayment to the federal budget in the amount of 2,400 rubles, to the budget of a constituent entity of the Russian Federation - 21,600 rubles, which can be offset against the payment of income tax for the tax period (we talked about the rules for such offset earlier ). If the tax authority, based on the organization’s application, makes an offset, the tax obligations for the payment deadline of April 28, 2014 will be as follows:

to the federal budget - 600 rubles. (3,000 - 2,400);

to the budget of a constituent entity of the Russian Federation – 5,400 rubles. (27,000 - 21,600).

So, the Tax Code of the Russian Federation provides for three possible ways to make advance payments of income tax.

Taxpayers listed in paragraph 3 of Art. 286 of the Tax Code of the Russian Federation (including organizations with sales income not exceeding an average of 10 million rubles for each quarter over the previous four quarters) pay advance payments based on the results of the first quarter, half a year and nine months without paying monthly advance payments.

Other taxpayers can choose one of two ways to pay advances during the tax period:

- based on the results of the first quarter, half a year and nine months, plus monthly advance payments within each quarter;

- at the end of each month based on the actual profit received.

For your information,

from January 1, 2014, theaters, museums, libraries, concert organizations that are budgetary institutions do not calculate or pay advance payments ( clause 3 of Article 286 of the Tax Code of the Russian Federation ) and submit a tax return only after the expiration of the tax period ( clause 2 Article 289 of the Tax Code of the Russian Federation )

We calculate the amount of quarterly monthly advance payments

In this section we will look in more detail at how to correctly calculate the advance base. To do this, you should know and follow the basic principles of quarterly calculations in the current tax period:

- the amount of the calculated advance is determined on the basis of previously accrued advance amounts for previous quarters;

- in order to correctly calculate the advance payment, you need to take into account the current tax rates and the actual profit received;

- profit must be calculated from the beginning of the current tax period until the end of the last month, using a cumulative total.

And now, the same thing, but in a little more detail:

- for the 1st quarter, advance payments will be similar to the amount of the advance of the last quarter of the previous tax period;

- for the 2nd quarter, advance payments will be equal to one third of the advance payments paid for the first full quarter of the current tax period;

- for the 3rd quarter, advance payments are equal to one third of the difference between two advance payments: for six months and the advance for the first three months;

- for the 4th quarter, the advance will be equal to one third of the difference between the amounts of payments for 9 months and six months.

It happens that the calculated difference has negative values or a zero value - then there is no need to deduct advance payments.

Let's give an example of calculating quarterly advance payments.

Let's assume that the taxable profit of the enterprise for the 1st quarter of the year amounted to 12 million rubles. A quarterly advance at a rate of 20% will be equal to 2.4 million rubles. As we remember, the amount of the advance payment for the first quarter will be determined by the difference between the quarterly payment, that is, 2.4 million rubles. and previously made monthly payments. In this case, since there were no monthly payments, the entire amount will be presented for additional payment. Everything is clear here, let’s move on to the second quarter. In the 2nd quarter, the monthly advance is equal to 800 thousand rubles (2.4 million rubles divided by 3). Based on the results of half the year, the tax base is 30 million rubles. The quarterly advance will be equal to 6 million rubles. (i.e. 30 million rubles multiplied by 20%). Accordingly, you will need to pay an additional 1.2 million rubles for the 2nd quarter. (6 million rubles – 2.4 million rubles – 800 thousand rubles multiplied by 3) We figured it out, now we’re counting the next quarter. In the third quarter, the monthly advance will be 1.2 million rubles. (6 million rubles - 2.4 million rubles) For nine months, the taxable profit of the enterprise amounted to 41 million rubles. The quarterly advance will be 8.2 million rubles. (RUB 41 million multiplied by 20%). Thus, the company overpaid taxes by 1.4 million rubles. (8.2 million rubles – 6 million rubles – 1.2 million rubles multiplied by 3).

Attention! In accordance with the Tax Code of the Russian Federation, after calculations have been made, in case of monthly advance tax assessment, payment should be made no later than the 28th day of the month, and quarterly payments should be made no later than 28 days after the end of the reporting period.

If at the end of the year the organization is not in profit, but in loss, then the last quarterly advance payment (4th in account) is made zero (clause 8 of Article 274, paragraph 6 of clause 2 of Article 286 of the Tax Code of the Russian Federation).

Why transfer advances based on profit?

Despite the fact that the tax period for income tax is a calendar year, transferring tax to the budget in one amount at the end of the year is not allowed.

Before the payment deadline (based on the results of the reporting periods), advances are required to be paid, the amount of which is determined by one of the methods established in tax legislation. The purpose of such an advance payment is an even flow of funds into the budget. The procedure for calculating advances and paying them is established in Art. 286, 287 Tax Code of the Russian Federation. They describe the specifics of calculating advance payments for each of the permitted methods.

Advances paid during the year at the end of the year are counted towards the payment of income tax. Advance payments for the 1st quarter and income tax may be the same in size if the payer ceased activity before the end of the 1st quarter (or on the last day of this period).

What to take into account when calculating advances on profit for the 1st quarter, we will tell you further.

Monthly advance payments based on actual profits

As mentioned above, according to the Tax Code of the Russian Federation there is another method for calculating and paying advance taxes. It lies in the fact that any company has the right to pay tax advances based on actual profits.

NOTE! Monthly payments must be made in advance by those organizations that do not fall under the criteria for mandatory payment of quarterly tax contributions.

An enterprise can switch to this method of calculating and paying taxes at the beginning of each new year, but only with prior written notification to the tax office. In this case, the tax reporting and payment period for the organization will be every calendar month, and the amount of the tax advance will be calculated based on the tax rate and the actual profit received, calculated by increasing from the beginning of the year to the end of the last month. In this case, it is necessary to take into account previously accrued payments and the advance payment should also be transferred - no later than the 28th.

Important! This method of advance tax calculation has one significant drawback. Every time at the end of the tax period (and in this case it is one month), you need to fill out a tax return and submit it to the tax office without the slightest delay.

Quarterly additional payments to monthly advances (method No. 3): basic algorithm

This method is the most labor-intensive in terms of the volume of calculations and the number of issued payment orders for the transfer of advances. When using it, you are required to pay advances on profits based on the results of the 1st quarter, half a year and 9 months. In addition, monthly advances must be paid within each quarter.

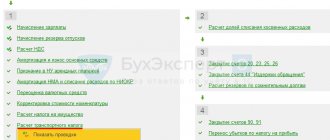

The basic rules for this method are shown in the figure:

Monthly earnings advances for 1Q 2022 are calculated based on 4Q 2022 data. If the calculated advance payment is negative or equal to zero, nothing needs to be transferred to the budget at the end of the current quarter (reporting period).

An example of calculating monthly advance payments for income tax payable in the 2nd quarter from K+ In the 1st quarter, Alpha LLC received a profit of RUB 3,750,000. and calculated the quarterly advance payment: 750,000 rubles. (RUB 3,750,000 x 20%). Accordingly, the monthly advance payment to Alpha LLC, payable in the second quarter, will be 250,000 rubles. (RUB 750,000 / 3). You can view examples for the II, III and IV quarters in full in K+. Trial access is free.

Features of calculating monthly advance payments

Each payment made reduces the calculated annual income tax amount. To determine the size of each payment, you should follow the following rules:

- for the first three months, payments are made in the same amount as accrued in the last quarter of the previous year;

- for the next 3 months you need to make a third of the payment transferred for the first quarter;

- The 3rd quarter is paid monthly in an amount that is one third of the difference from the amount of the advance payment for the first half of the year and the amount paid for the 1st quarter;

- for another 3 months you need to pay a third of the difference between advances for 9 months and for half a year.

IMPORTANT! Previous quarters are considered as such if they are sequentially counted 4 times backward from the current one (clause 3 of Article 286 of the Tax Code of the Russian Federation). It is the 4 previous quarters that are taken into account when determining the amount of monthly advance payments. It does not matter how they are located in the reporting year.

As the above information shows, tax advances must be calculated and paid in a strictly defined manner. At the same time, before choosing how often to make payments - quarterly or monthly, you need to analyze the company’s activities in terms of expenses and profits. Depending on the result, taking into account all possible restrictions, you can choose one of the two options proposed by law.

Section 1 Subsection 1.2 Advance payments for the third quarter

Section 1 of Subsection 1.2 of the declaration reflects monthly advance payments that must be paid in the third quarter.

The amount of advance payments for the third quarter was calculated on pages 300, 310 of Sheet 02. It is automatically distributed to Subsection 1.2 in the amount of 1/3 of the quarterly amount:

- pp. 120-140—from p. 300 “to the federal budget”;

- pp. 220-240—from p. 310 “to the budget of a constituent entity of the Russian Federation.”

For monthly advance payments within the reporting period, the payment deadline is set - no later than the 28th day of each month of this reporting period (paragraph 3, paragraph 1, article 287 of the Tax Code of the Russian Federation).

Based on this norm, in the third quarter it is necessary to pay the advance payments specified in Section 1 of Subsection 1.2:

- until July 28;

- until August 28;

- until September 28.

If the deadline for payment of advance payments falls on a weekend or holiday, then the deadline is postponed to the first working day following it (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

- Payment of income tax to the federal budget;

- Payment of income tax to the budget of a constituent entity of the Russian Federation.

In our example, payment of advance payments in the third quarter should be made:

- until July 28, 2022: to the federal budget - 18,000 rubles.

- to a subject of the Russian Federation - 102,000 rubles.

- to the federal budget - 18,000 rubles.

- to the federal budget - 18,000 rubles.

See also:

- Advance payments

- Transition to monthly payment of advance payments for income tax from January 1

- Calculation and payment of income tax and advance payments throughout the year

- Algorithm for calculating income tax and advance payments for the first quarter

- Algorithm for calculating income tax and advance payments for 9 months

- Algorithm for calculating income tax and advance payments for the year

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Algorithm for calculating income tax and advance payments for 9 months This article will be useful to those income tax payers who…

- Algorithm for calculating income tax and advance payments for the first quarter This article will be useful to those taxpayers who pay quarterly payments...

- Algorithm for calculating income tax and advance payments for the year...

- Function for comparing declarations when calculating advance payments for income tax...