New right

If an organization has several separate divisions on one municipal territory or its location with separate divisions together on this territory, from 2022 you can pay personal income tax and submit reports on it in one of 2 ways:

- at the location of one of these sections;

- at the location of the parent organization.

This is regulated by the new paragraph of paragraph 7 of Art. 226 of the Tax Code of the Russian Federation from January 1, 2020 (introduced by Law No. 325-FZ of September 29, 2019).

The tax agent himself chooses a separate office or head office (this is his right , not an obligation), taking into account the procedure established by clause 2 of Art. 230 Tax Code of the Russian Federation.

Let us note that until 2022, such tax agents paid personal income tax and submitted reports at the place of registration of both the parent organization and each separate division.

Responsibility for late payment of personal income tax

When transferring personal income tax to the budget, tax agents must comply with the deadlines established by Article 226 of the Tax Code of the Russian Federation. The provisions of Articles 227 and 228 of the Tax Code of the Russian Federation, according to which personal income tax can be paid at the end of the year, do not apply to tax agents. This procedure is confirmed by Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 5, 2011 No. 1051/11.

The tax inspectorate may collect from the tax agent a fine in the amount of 20 percent of the personal income tax amount subject to withholding and (or) transfer to the budget:

- if, within the established period, the tax agent did not withhold (not fully withhold) the tax from funds paid to the counterparty;

- if, within the established period, the tax agent has not transferred (not fully transferred) the withheld amount of tax to the budget.

This follows from the provisions of Article 123 of the Tax Code of the Russian Federation and is confirmed by letter of the Ministry of Finance of Russia dated March 19, 2013 No. 03-02-07/1/8500.

The application of penalties does not relieve the tax agent from the obligation to transfer the withheld amount of tax to the budget (clause 5 of Article 108 of the Tax Code of the Russian Federation). Moreover, the tax inspectorate can recover these amounts in an indisputable manner (clause 1 of article 46, clause 1 of article 47 of the Tax Code of the Russian Federation).

If personal income tax is transferred to the budget later than the established deadlines, then in addition to penalties, the inspectorate may charge the organization a penalty (Article 75 of the Tax Code of the Russian Federation). Penalties will be accrued for the organization as a whole, taking into account the date of receipt of income by each employee and the actual terms of withholding personal income tax by the tax agent (clause 2 of the letter of the Federal Tax Service of Russia dated December 29, 2012 No. AS-4-2/22690).

A fine under Article 123 of the Tax Code of the Russian Federation can be avoided if the organization proves that it did not have the opportunity to withhold personal income tax from an employee (clause 21 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57). At the same time, the tax agent is not obliged to transfer to the budget the amount of unwithheld personal income tax at his own expense (clause 9 of Article 226 of the Tax Code of the Russian Federation). If it is impossible to withhold personal income tax, then the organization is obliged to notify the tax office within a month about the unwithheld amount of tax (subclause 2, clause 3, article 24 and clause 5, article 226 of the Tax Code of the Russian Federation).

Important : if an organization did not withhold tax when paying income, it cannot be charged a penalty for late transfer of personal income tax to the budget. This was stated in the letter of the Federal Tax Service of Russia dated August 4, 2015 No. ED-4-2/13600. The position of the tax service is based on the fact that the tax agent should not pay tax at his own expense. And if personal income tax is not withheld, the debtor to the budget is the employee who received the income, and not the tax agent. For objectivity, we note that in paragraph 2 of Resolution No. 57 of July 30, 2013, the Plenum of the Supreme Arbitration Court of the Russian Federation allowed for the possibility of collecting penalties in cases where the tax agent was supposed to withhold tax, but in fact did not do so. According to the Supreme Arbitration Court of the Russian Federation, in such situations, penalties can be accrued from the moment when the tax had to be withheld until the deadline for payment must be fulfilled by the taxpayer himself.

If failure to withhold (incomplete withholding) and (or) non-transfer (incomplete transfer) of tax to the budget is revealed as a result of an audit, the organization (its employees) may be subject not only to tax liability, but also to administrative, and in some cases, criminal liability (Art. 123 of the Tax Code of the Russian Federation, Article 15.11 of the Code of Administrative Offenses of the Russian Federation, Article 199.1 of the Criminal Code of the Russian Federation).

The tax inspectorate cannot fine a tax agent under Article 122 of the Tax Code of the Russian Federation. Only taxpayers can be held liable under this article. It is they who are entrusted with the obligation to pay legally established taxes (subclause 1, clause 1, article 23 of the Tax Code of the Russian Federation). The responsibilities of tax agents are to correctly and timely calculate the amount of tax, withhold it from the income of the counterparty (taxpayer) and transfer it to the budget (clause 3 of Article 24 of the Tax Code of the Russian Federation). For failure to fulfill these obligations, they may be held liable under Article 123 of the Tax Code of the Russian Federation. Any other classification of violations committed by a tax agent is unlawful (Article 106 of the Tax Code of the Russian Federation).

Submission deadline

As a general rule, the company must notify the Federal Tax Service of its choice no later than January 1 (clause 2 of Article 230 of the Tax Code of the Russian Federation).

Taking into account the New Year holidays from January 1 to 8, this document had to be sent to the inspection no later than January 9 .

KEEP IN MIND

cannot be changed during the year . Exceptions:

- the number of sections has changed;

- There are other changes that affect the procedure for submitting information about the income of individuals and personal income tax amounts.

However, due to the rather late approval of the notification form in 2022, the Federal Tax Service issued a special clarification. According to it, tax agent organizations planning to apply the new procedure for transferring personal income tax and submitting reports from 2022 can submit to the inspectorate a notification about the choice of a tax authority until January 31, 2022 (Friday).

If the tax agent plans to submit a notification after the transfer of personal income tax, then in order to avoid arrears and overpayments, these tax amounts should be transferred from January 1, 2022 to the payment details of the selected separate division .

At the same time, the tax agent has the right to submit an application for clarification of the payment if it is necessary to adjust certain details (payer’s checkpoint, tax identification number, checkpoint and name of the payee).

We submit personal income tax reports.

No later than April 1, organizations must report income. To which inspection should Form No. 2-NDFL be sent if the company has a separate division - at the location of the parent company or division?

The Letter of the Ministry of Finance of the Russian Federation dated December 3, 2008 No. 03-04-07-01/244 states that an organization has the right to choose which tax authority to submit information in Form No. 2-NDFL for employees of separate divisions.

The right of choice is exercised by divisions that pay wages to their employees and transfer personal income tax from the current account of their division.

Where to report on 2-NDFL if a separate division is not allocated to a separate balance sheet and does not have a current account?

Such companies are also given the right to choose. An organization, performing the functions of a tax agent, has the right to submit information in Form N 2-NDFL on the income of individuals and the amounts of accrued and withheld tax for employees of a separate division to the tax authority at the place of tax registration of the parent organization or at the place of tax registration of a separate division . Officials agree on this issue. The Ministry of Finance explained this situation in a letter dated August 28, 2009 N 03-04-06-01/224. The Federal Tax Service, in turn, in a letter dated April 10, 2009 N 20-15/3/ [email protected]

Which form to use

For this purpose, the form for notification of the selection of a tax authority, the procedure for filling it out and the electronic format for submission were approved by Order of the Federal Tax Service of Russia dated December 6, 2019 No. ММВ-7-11/622.

According to the order, the new form of notification of the selection of a tax authority for a separate division comes into force on January 1, 2020. Her KND is 1150097.

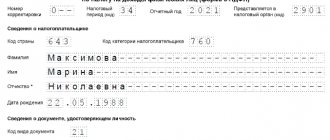

The notification form consists of 2 sheets - a standard title page and a sheet with a list of the organization/its divisions entered by the checkpoint and the corresponding Federal Tax Service codes.

Further, you can use the direct link for free notifications 2022:

NOTICE ABOUT CHOICE OF TAX AUTHORITY 2020

How to fill out a notification

In general, the rules are no different from filling out other tax forms. This can be done both on paper and electronically. The same applies to sending it to the Federal Tax Service.

So, in the absence of any indicator, a dash is placed in all familiar places in the corresponding field. The same applies to the situation when, to indicate any indicator, it is not necessary to fill out all the information.

| Notification field | How to fill out |

| Checkpoint of an organization/separate unit | The checkpoint of the parent organization or the selected separate branch, through which the calculated and withheld tax amounts will be transferred, as well as 2-NDFL certificates and 6-NDFL calculations will be submitted |

| OKTMO code | Code of the municipality on the territory of which the organization or the selected separation is located, as well as separate divisions for which the tax will be transferred, presentation of 2-NDFL and 6-NDFL. If the OKTMO code has 8 characters, the empty spaces on the right are not filled. |

| Reason for presenting notification (code) | “1” – if you submit a notification in connection with a decision to switch to paying tax to the regional budget at the location of the organization or selected division “2” – if you submit a notification in connection with a change in the number of units “3” – if you submit a notification in connection with the refusal to switch to paying tax to the regional budget at the location of the organization or selected division “4” – if you submit a notification in connection with other changes affecting the procedure for submitting 2-NDFL and 6-NDFL |

| (indicate other changes that affect the procedure for submitting certificates in form 2-NDFL and calculations in form 6-NDFL) | Indicates changes that affect the presentation of these reports. Fill in if the number “4” is indicated in the “Reason for notification (code)” field. |

In the last section of the notification, checkpoints are provided for the organization and all separate divisions located on the territory of one municipality, in respect of which the organization or its chosen separate division will pay personal income tax and report.

Please note: the number of fields “Checkpoint of organization/separate subdivision” and “Tax authority code” must correspond to the number of separate subdivisions located on the territory of the same municipality with the organization or selected subdivision.

How to distribute personal income tax if an employee worked in different departments of the company in one month.

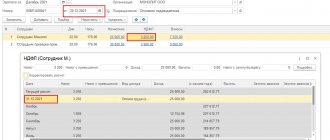

Employee Ivanov A.S. has a salary of 45,000 rubles. There are a total of 21 working days in September 2013. Since there were no other payments in September, Ivanov’s daily earnings amount to 2,142.86 rubles. (RUB 45,000: 21 days).

From September 1 to September 15 (10 working days), the employee worked at the head office located in Moscow. During this time, he was credited with 21,428.60 rubles. (RUB 2,142.86 × 10 days). Personal income tax amounted to 2,786 rubles. (RUB 21,428.60 × 13%).

And from September 16 to September 30 (11 working days) - in a separate unit located in Chelyabinsk. During this time, he was credited with 23,571.46 rubles. (RUB 2,142.86 × 11 days). Personal income tax amounted to 3064 rubles. (RUB 23,571.46 × 13%).

The same should be done if the employee combines his main job at the head office with part-time work at a branch of the same organization (letter of the Ministry of Finance of Russia dated April 14, 2011 No. 03-04-06/3-89).

Where to pay personal income tax if an employee on a business trip works in another department?

If an employee travels to other departments on a business trip, personal income tax is transferred to the main place of work. This is due to the fact that he is not paid a salary in other departments. A similar situation is discussed in the letter of the Ministry of Finance of Russia dated August 8, 2012 No. 03-04-06/3-223.

Where should personal income tax be paid if an employee was transferred to another unit in the middle of the month?

If an employee is transferred to work in another division, the corresponding amounts of personal income tax will need to be paid at the location of this division. Moreover, if the division is registered in the middle of the month, personal income tax for this month will also need to be paid separately: in proportion to the share of income accrued to the employee during work in this division (letter of the Federal Tax Service of Russia for Moscow dated December 26, 2007 No. 28- 11/124267).

The employee worked in several separate departments and then took leave during this period.

If an employee worked in several departments and goes on vacation, personal income tax on his income, including vacation payments, must be transferred to the budget at the location of the department in which he was granted vacation (letter of the Ministry of Finance of Russia dated August 17, 2012 No. 03-04 -06/8-250).

How to issue a payment order to pay personal income tax for a separate division.

When transferring tax, the head office must indicate the following data in the payment order for each separate division:

- details of the Federal Treasury and the tax inspectorate of the region in which the separate division is located and registered for tax purposes;

- checkpoint assigned to the unit;

- OKTMO code of the municipality to whose budget personal income tax is transferred.

More detailed information can be found in the letters: Ministry of Finance of Russia dated 07/03/2009 N 03-04-06-01/153, Federal Tax Service of Russia for Moscow dated 07/01/2010 N 20-15/3/068888, dated 05/20/2010 N 20-15/3/ [email protected]

The company mistakenly transferred personal income tax to the Federal Tax Service of the parent organization, but should have transferred it to the Federal Tax Service of a separate division, will the company be fined?

According to the tax authorities, if an error is made in the details, the obligation to transfer tax cannot be considered fulfilled. The tax agent should once again transfer the personal income tax using the correct details, pay the penalty, and then claim the erroneously transferred tax amount. This is where difficulties arise for the tax agent.

Thus, in one case, an LLC mistakenly transferred personal income tax to the location of a separate division. The Federal Tax Service refused to refund the tax due to the fact that the refund can only be made after an on-site tax audit.

However, the arbitration court found that, according to paragraph 6 of Art. 78 of the Tax Code of the Russian Federation, the amount of overpaid tax is subject to refund upon a written application from the taxpayer within one month from the date the tax authority receives such an application. Refunds are made only after the amount of overpaid tax is offset against the arrears (debt).

It does not follow from this provision that an on-site tax audit is necessary for a refund. Nevertheless, the Federal Tax Service brought the case to the cassation court, which confirmed that the tax authorities had come up with conditions for a refund. In addition, the court confirmed the legality of collecting penalties from the Federal Tax Service for the delay in tax refund (Resolution of the Federal Antimonopoly Service ZSO dated January 20, 2011 N A67-3340/2010).

It should be noted that the Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 645/05 of August 23, 2005, noted that the Tax Code of the Russian Federation does not provide for liability for improper performance by a tax agent of its duties, in particular for violation of the transfer procedure withheld by personal income tax. If personal income tax was withheld and transferred on time and in full, but with incorrect details in the payment order, then the tax inspectorate has no grounds for bringing the tax agent to tax liability in the form of a fine in the amount of 20% of the unpaid amount under Art. 123 Tax Code of the Russian Federation.

Now tax authorities and Federal Treasury authorities have the opportunity to independently redistribute between budgets the amount of tax credited to the appropriate accounts.

And if so, then paying personal income tax at the place of registration of a legal entity instead of paying tax at the location of a separate division cannot entail the accrual of penalties in accordance with clause 1 of Art. 75 of the Tax Code of the Russian Federation, since a penalty is recognized as an amount of money that a tax agent must pay in the event of payment of due amounts of taxes later than the deadlines established by the legislation on taxes and fees.

Since the money was transferred on time, and the tax office did not exercise its right to clarify the payment, there are no grounds for collecting personal income tax and penalties.

Tax authorities often refer to subparagraph. 4 p. 4 art. 45 of the Tax Code of the Russian Federation and the Procedure for accounting by the Federal Treasury of revenues to the budget system of the Russian Federation... approved. By Order of the Ministry of Finance of Russia dated December 16, 2004 N 116n. By virtue of this Procedure, the Federal Treasury authorities cannot independently redistribute received funds between the budgets of the constituent entities of the Russian Federation.

The Presidium of the Supreme Arbitration Court of the Russian Federation put an end to this controversial issue. In the Resolution dated July 23, 2013, the court indicated that the fulfillment of the obligation to pay tax does not depend on the correctness of the OKATO indication in the payment documents and this violation of the tax payment procedure cannot lead to the accrual of penalties. If the Federal Treasury account is correctly indicated, personal income tax in any case goes to the budget system of the Russian Federation. Tax authorities and Federal Treasury authorities have the opportunity to independently redistribute the corresponding amount of tax between budgets.

After this, the Federal Tax Service issued a letter dated August 2, 2013 N BS-4-11/14009, which states that: since the enterprise withheld personal income tax and transferred it in a timely manner and in full, the inspectorate had no grounds for attracting him to tax liability under Article 123 of the Code.