City land has the best tax increases.

Charles Warner

Taxation is inextricably linked with all sectors of life and economic activity of citizens and legal entities. Several times a year, huge companies and individual citizens are forced to calculate the amount of their mandatory payments to the state. As you know, the recent trend has been very disappointing: more and more taxes are being introduced, and taxation rules are becoming more and more complex.

However, in this article we will talk about a case where the exact opposite situation occurred.

Transport tax and movable property tax

It should be noted that this article deals specifically with the movable property tax, which should not be confused with the transport tax.

These mandatory payments are not correlated in any way. Transport tax exists separately; its objects include, for example, cars, motorcycles, buses and other vehicles specified in part one of Article 358 of the Tax Code.

In turn, the tax on movable property has never existed independently. Simply, movable property was included in the property tax of organizations, that is, the object of property tax until 2022 was not only real estate, but also movable objects.

What property taxes do individuals pay?

We remind you

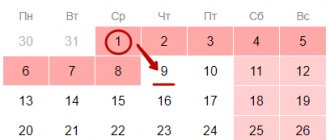

We remind all owners of cars, apartments, and garden plots that December 1 is the deadline for payment of property taxes by individuals. Citizens pay property taxes such as transport, land, and personal property taxes. Read more about paying these taxes in our article.

***

Movable property subject to transport tax

Individuals pay transport tax in relation to vehicles registered on them, in particular cars, motorcycles, snowmobiles, snowmobiles, motor boats, boats, jet skis (Part 1 of Article 357, Article 358 of the Tax Code of the Russian Federation).

There are currently no plans to abolish the transport tax. Issues regarding the introduction of transport tax on the territory of the constituent entities of the Russian Federation, the establishment of the tax rate, as well as the establishment of tax benefits for certain categories of taxpayers are within the competence of the legislative (representative) bodies of the constituent entities of the Russian Federation (Clause 3 of Article 12, Article 356 of the Tax Code of the Russian Federation).

Previously, we told you how to properly register a car.

Real estate subject to property tax

Property tax for individuals is levied on real estate owned by citizens on the territory of the Russian Federation, in particular residential buildings, apartments, rooms, garages, parking spaces, unfinished construction projects, other buildings, structures and premises (Articles 400, 401 of the Tax Code) RF).

Land plots are not subject to property tax for individuals.

Real estate subject to land tax

Land tax is levied on land plots that belong to individuals on the right of ownership, the right of permanent (perpetual) use or the right of lifelong inheritable possession (clause 1 of Article 388, clause 1 of Article 389 of the Tax Code of the Russian Federation).

Calculation and payment of property taxes

Calculation of property taxes for individuals is carried out by tax authorities based on information received from registration authorities. To pay taxes, an individual is sent a tax notice indicating the amounts of the relevant taxes and the data on the basis of which they were calculated.

The tax is paid for no more than three calendar years preceding the year the tax notice was sent (clause 4 of article 85, clause 1 of article 360, clause 1 of article 362, clause 3 of article 363, clause 1 of article 393 , paragraph 3 of Article 396, paragraph 4 of Article 397, article 405, paragraphs 1, 2 of Article 408, paragraphs 2, 4 of Article 409 of the Tax Code of the Russian Federation).

Note! If the total amount of taxes calculated by the tax authority is less than 100 rubles, the tax authority does not send a tax notice to the taxpayer. An exception is the case when, after the expiration of the calendar year, the tax authority loses the right to send a tax notice due to the fact that three calendar years preceding the calendar year of sending the tax notice have expired (Clause 4 of Article 52 of the Tax Code of the Russian Federation; Letter of the Federal Tax Service of Russia dated June 17, 2021 N BS-4-21/ [email protected] ).

The taxpayer may not pay property tax or pay it in a smaller amount if he has the right to a benefit (clause 1 of Article 56, clause 361.1, clause 5 of Article 391, clause 7 of clause 1 of Article 395, clause 10 of Art. 396, Article 407 of the Tax Code of the Russian Federation).

Rates and benefits for transport tax are established by regional laws (clause 3 of article 12, clause 3 of article 14, article 356 of the Tax Code of the Russian Federation).

| Reference. KBK for transport tax When paying transport tax by individuals, indicate KBK 182 1 0600 110 (Appendix No. 2 to Order of the Ministry of Finance of Russia dated 06/08/2020 N 99n; Order of the Federal Tax Service of Russia dated 12/29/2016 N ММВ-7-1 / [email protected] ). |

Rates and benefits for land tax are established by regulations of representative bodies of municipalities, and in Moscow, St. Petersburg and Sevastopol - by the laws of these cities (clause 4 of article 12, clause 1 of article 15, clause 2 of article 387 Tax Code of the Russian Federation).

| Reference. KBK for land tax (using the example of Moscow) The BCC for land tax depends on the location of the taxable object. When paying land tax in Moscow, individuals indicate KBK 182 1 0600 110 (Appendix No. 4 to Order of the Ministry of Finance of Russia dated 06/08/2020 No. 99n; Order No. ММВ-7-1/ [email protected] ). |

Rates and benefits for property tax for individuals are also established by regulations of representative bodies of municipalities, and in Moscow, St. Petersburg and Sevastopol - by the laws of these cities (clause 4 of article 12, clause 2 of article 15, Clause 2 of Article 399 of the Tax Code of the Russian Federation).

| Reference. BCC for personal property tax (using the example of Moscow) The BCC for personal property tax depends on the location of the taxable object. When paying property tax in Moscow, individuals indicate KBK 182 1 06 01010 03 1000 110 (Appendix No. 4 to Order of the Ministry of Finance of Russia dated 06/08/2020 No. 99n; Order No. ММВ-7-1/ [email protected] ). |

For all property taxes, a single payment deadline has been established - no later than December 1 of the year following the expired calendar year. In this case, the obligation to pay tax arises no earlier than the date of receipt of the tax notice (clause 4 of article 57, clause 1 of article 363, clause 1 of article 397, clause 1 of article 409 of the Tax Code of the Russian Federation).

Note. You can voluntarily transfer a single tax payment towards the upcoming payment of property taxes, as well as personal income tax payable on the basis of a notification (clause 1 of article 45.1, clause 6 of article 228 of the Tax Code of the Russian Federation).

Notification to the tax authority about taxable property

If you have taxable property for which you have never received a tax notice, paid tax, or benefited from an exemption, you must report it to the tax authority of your choice.

Such a message, accompanied by copies of title documents for real estate, documents on state registration of a vehicle, is submitted by December 31 of the year following the previous one. The message must be sent in relation to each taxable object once (clause 2.1 of Article 23 of the Tax Code of the Russian Federation).

The message can be submitted directly to the tax authority, through the MFC, sent by registered mail, and also transmitted electronically through the taxpayer’s personal account or the “Contact the Federal Tax Service of Russia” service on the official website of the Federal Tax Service of Russia (clause 2.1, article 7. 23 Tax Code of the Russian Federation; Information from the Federal Tax Service of Russia).

For failure to submit or untimely submission of this message to the tax authority, you may be held accountable. The fine is 20% of the unpaid tax amount (clause 3 of Article 129.1 of the Tax Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated March 27, 2017 N 03-02-07/2/17737).

Electronic journal The ABC of Law

In the ABC of Law" SPS ConsultantPlus, current answers to everyday questions are presented, the procedure is prescribed with links to legislation.

History and essence of the problem

It must be said that taxation of movable property has long been a “hot” topic, which was almost constantly the subject of discussion in business circles, in the legal community and, of course, at the state level. The main issue has always been the prospect of abolishing this tax.

The reason is that this tax was highly profitable, a source of very significant amounts for the regional budgets of Russia, but at the same time it had a negative impact on business development and disincentivized investment processes.

The first step in favor of easing the tax burden of organizations was the decision to exempt taxpayers from paying tax on movable property, which was registered as a fixed asset on January 1, 2013.

However, it was envisaged that as early as 2022, regions will have the right to independently decide on full or partial exemption from paying the tax in question. Including the regions, according to the idea, could decide on the absence of any benefits for organizations. Thus, there was a threat that after receiving this right, regional authorities would introduce full tax rates. Thus began a new stage in the discussion of this topic: business asked the authorities to “freeze” the regions’ right to tax refunds, and the regions, in turn, did not agree to such a solution to the issue and insisted on the need to continue paying the movable property tax. As a compromise, the following solution was found: from January 1, 2022, regions still have the right to provide benefits to organizations, but the marginal tax rate on movable property is changing - from 2.2% to 1.1%.

Who paid tax before?

Until 2022, only companies in some regions of the country paid the movable property tax. The exceptions were payers of special tax regimes represented by UTII and the simplified tax system. Simplified people did not even pay property taxes if their properties were not included in special cadastral lists.

A fee of 1.1 percent of the value or size of movable property was paid. But now organizations are completely exempt from this type of fee. This significantly reduced the tax burden on enterprises.

Which regions were taxed?

In which regions was the fee paid?

Only in some regions of the country this type of tax was paid. It was the regional authorities who determined the terms and rules for transferring funds. Additionally, companies were established at the local level that could count on benefits or other types of concessions when paying this fee.

Until 2022, the levy on movable property was in effect in the Republic of Adygea and Altai, as well as in the Amur, Kursk, Oryol, Moscow, Smolensk, Tomsk, Sakhalin, Omsk, Novosibirsk, Kemerovo and Tambov regions.

Companies had to independently contact the Federal Tax Service branches to obtain information about the need to pay this type of fee. Tax service employees additionally reported what tax rate applies, when exactly funds need to be transferred, as well as which enterprises have the right to apply for benefits.

Changing the approach to movable property tax

Last year, that is, in 2022, the above events took an interesting turn. 25 constituent entities of Russia either did not introduce a tax at all, or decided on benefits only in relation to certain categories of movable property. That is, instead of obtaining the intended compromise solution, it only turned out to create an imbalance in the tax burden of organizations across the country.

Thus, in the middle of last year, the authorities were forced to admit that taxation of movable property is still too burdensome. As a result, a law was prepared and adopted to exclude movable objects from taxation.

It should be noted that all those changes that were adopted by the law discussed above, that is, Law No. 302-FZ, affect exclusively the procedure for taxation of legal entities, which means the abolition of the tax on movable property does not apply to the tax on property of individuals, the object of which is still both real estate and movable property.

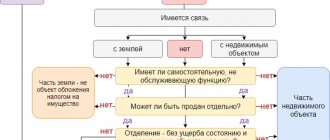

Decision of the Supreme Court of the Russian Federation

The Supreme Court of the Russian Federation analyzed court decisions in case No. A32-56709/2019, in which the Federal Tax Service assessed a property tax to a company in relation to a distribution and transformer substation (power installation), located in a room on the ground floor of a building serving a hotel, and refused to grant an exemption from it taxation (determination of the Judicial Collegium for Economic Disputes dated May 17, 2021 No. 308-ES20-23222).

According to tax authorities, the company unlawfully classified the power plant as movable property and applied the benefit (exemption) established by clause 21 of Art. 381 Tax Code of the Russian Federation. The cost of the power plant must be included in the corporate property tax base, since this object should be considered as real estate - part of the energy center building intended to serve the hotel.

However, the Supreme Court of the Russian Federation recognized the legality of the inspectorate’s inclusion of the cost of the power plant in the tax base for calculating the property tax of organizations.

He concluded that the company legally accepted the power plant for accounting as a separate inventory item and did not include the cost of this object in the corporate property tax base, considering it movable property. That is, equipment. And a strong connection with the earth is not the most important criterion here.

The reasoning of the RF Armed Forces is as follows:

- The very criteria of the Civil Code of the Russian Federation of a strong connection between a thing and the land, the impossibility of dividing a thing in kind without destroying, damaging the thing or changing its purpose, as well as combining things for general use into a complex thing do not allow us to unambiguously resolve the issue of taxpayers’ right to benefits. The fact is that they do not allow one to differentiate between investments in the renovation of production equipment and the creation of non-capital structures from investments in the creation (improvement) of real estate - buildings and capital structures;

- in both cases, the acquired assets do not have a strong connection with the land before completion of installation, and after the start of operation, they can form a complex thing with the real estate object, the division of which without destruction or damage becomes impossible or economically unfeasible;

- The presence (absence) of information about an object of fixed assets in the Unified State Register cannot be used as an unconditional criterion for assessing the legality of applying the benefit.

As a result, the Supreme Court of the Russian Federation came to the conclusion that it is necessary to use the criteria established in accounting for recognizing taxpayer property (movable and immovable) as relevant fixed assets.

The basis for the classification of fixed assets in accounting:

- All-Russian Classifier of Fixed Assets (OKOF) OK 013-2014 (SNS 2008), put into effect on 01/01/2017 by order of Rosstandart dated 12/12/2014 No. 2018-st;

- previously valid OKOF OK 013-94 (approved by Resolution of the State Standard of Russia dated December 26, 1994 No. 359).

According to these classifiers, equipment does not belong to buildings and structures and forms an independent group of fixed assets. An exception is cases directly provided for by OKOF, when individual objects are recognized as an integral part of buildings and are included in their composition (for example, communications inside buildings necessary for their operation; equipment for built-in boiler plants, water, gas and heat supply devices, as well as sewerage devices) .

Accordingly, the exclusion from the object of taxation is applicable to machinery and equipment that acts as movable property during their acquisition. They are rightfully registered as separate inventory objects , and not as components of capital structures and buildings.

Changing the tax obligation of citizens

However, for citizens, the first of January this year became significant. With regard to individuals, Law No. 334-FZ of August 3, 2018 introduced a number of quite serious amendments. First of all, now the tax on all types of property is levied depending on its cadastral value. This rule is now in effect in all regions of the country.

Second amendment: abolition of the reduction factor of 0.8 for the fourth year of application of calculation based on cadastral value. It is important to note that this amendment is effective from 2022, that is, from the calculation and payment of tax for 2022.

The third, one of the most important innovations, is that a limit has been introduced on tax growth. Now the increase in its size compared to the previous year should be no more than 10%.

These and other important changes, such as expanding the list of benefits, must be carefully studied by every taxpayer.

Our practice

Sometimes it can be quite difficult to calculate the tax consequences of property transactions. In this situation, the best solution would be to consult with a tax lawyer who will help you choose the best option.

The Krainev and Partners team consists of specialists of various profiles and high qualifications, which allows us not only to offer clients support for turnkey transactions and litigation, but also to advise our clients on tax issues.

You can sign up for a consultation by sending a brief description of your question by email