For one reason or another (due to an error, intentionally, due to a subsequent possible lack of funds in the current account), companies transfer personal income tax in a larger amount than they withheld from the employee. However, according to the regulatory authorities, it is impossible to reduce current personal income tax payments by the amount of such an overpayment.

In practice, a common situation is when, having transferred an excess amount of personal income tax (for example, due to a counting error), the company transfers a smaller amount in the next period, that is, it independently offsets the overpaid amount of personal income tax.

If this rule works for “ordinary” taxes, then the situation is different with regard to personal income tax. Many tax agents are faced with the fact that the tax office ignores overpayments and charges penalties and fines on the unpaid amount of personal income tax.

In order to understand the reason for additional personal income tax assessments in such a situation, let us turn to the definition of a tax agent.

Tax agent concept

The concept of tax agents is given in Article 24 of the Tax Code of the Russian Federation.

Tax agents are persons who are entrusted with the responsibility for calculating, withholding from an individual and transferring taxes to the budget system of the Russian Federation. The functions of a tax agent include the correctness and timeliness of calculation and withholding of taxes from funds paid to taxpayers, as well as transfer to the appropriate accounts of the Federal Treasury. In terms of personal income tax, the fulfillment of the duty of a tax agent is to withhold the accrued amount of tax directly from the income of an individual upon their actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation). Failure to fulfill the duties of a tax agent entails the accrual of penalties and fines (Article 75, Article 123 of the Tax Code of the Russian Federation). When calculating personal income tax, the main role is played by the date of actual receipt of income. It is the date of actual receipt of income that determines the moment of deduction and transfer of personal income tax.

Transfer of tax from your own funds

In accordance with Art. 24 of the Tax Code of the Russian Federation, tax agents are persons who are entrusted with the duties of calculating, withholding from the taxpayer and transferring taxes to the budget system of the Russian Federation. Tax agents transfer withheld taxes in the manner prescribed by the Tax Code of the Russian Federation for the payment of taxes by a taxpayer. Clause 3 of Art. 226 of the Tax Code of the Russian Federation establishes that personal income tax amounts are calculated by tax agents on an accrual basis from the beginning of the tax period based on the results of each month in relation to all income taxed at a rate of 13% accrued to the taxpayer for a given period, with the offset of the tax amount withheld in previous months of the current tax period.

Tax agents are required to withhold the accrued amount of personal income tax directly from the taxpayer’s income upon actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation). The tax agent withholds the accrued amount of tax from the taxpayer at the expense of any funds paid by the tax agent to the taxpayer upon actual payment of these funds to the taxpayer or on his behalf to third parties.

By virtue of clause 6 of Art. 226 of the Tax Code of the Russian Federation, tax agents are required to transfer the amounts of calculated and withheld personal income tax no later than the day of actual receipt of cash from the bank for the payment of income , as well as the day of transfer of income from the accounts of tax agents in the bank to the accounts of the taxpayer or, on his behalf, to the accounts of third parties in banks .

The date of actual receipt of income is defined as the day of payment of income, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties, when income is received in cash (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). And when receiving income in the form of wages, the date of actual receipt by the taxpayer of such income is recognized as the last day of the month for which he was accrued income for work duties performed .

Further, the norms of the Tax Code of the Russian Federation (clause 9 of Article 226 of the Tax Code of the Russian Federation) warn: payment of personal income tax at the expense of tax agents is not allowed .

And here the tax authorities report that since the company transferred the amount of personal income tax earlier than paying wages to employees, then it (de jure) transferred the amount of tax from its own funds, which is prohibited by law. This means that the amount paid is not recognized as a tax transfer; accordingly, the company faces arrears, fines and penalties!

That's it!

Date of actual receipt of income

Each type of income has its own date of actual receipt.

For example, when receiving income in cash, the date of income is defined as the day the income is paid, including the transfer of income to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (clause 1 of Article 223 of the Tax Code of the Russian Federation). When receiving income in the form of wages, the date of actual receipt of income is the last day of the month for which the employee was accrued income (clause 2 of Article 223 of the Tax Code of the Russian Federation). That is, income in the form of wages arises for the employee only on the last day of the month (Letters of the Ministry of Finance of the Russian Federation dated October 27, 2015 No. 03-04-07/61550, dated July 22, 2015 No. 03-04-06/42063).

The accrued amount of personal income tax on temporary disability benefits and vacation payments must be transferred no later than the last day of the month in which they were paid (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Tax agents are required to withhold the calculated amount of personal income tax directly from the employee’s income upon actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation).

In practice, many different situations arise when it is not clear at what point an employee’s income arises and, accordingly, the tax agent’s obligation to calculate, withhold and transfer the amount of personal income tax.

Explanations of the date of personal income tax withholding in difficult situations are discussed in Letter of the Ministry of Finance of the Russian Federation dated July 25, 2016 No. 03-04-06/43479.

In the Letter, representatives of the financial department took into account the position given in the Ruling of the RF Armed Forces dated May 11, 2016 No. 309-KG16-1804. EXAMPLE No. 1.

Salaries to company employees are paid twice a month:

- advance payment - on the last day of the current month;

- final payment is due on the 15th of the next month.

Believing that the amount of personal income tax was not withheld from the advance payment, the company paid personal income tax only at the time of final settlement with employees, that is, on the 15th of the next month.

During the audit, tax inspectors recognized the company’s actions as unlawful, assessed penalties and fined the tax agent on the basis of Article 123 of the Tax Code of the Russian Federation.

The tax agent argued that when paying wages twice a month, the obligation to withhold and transfer personal income tax to the budget arises only once during the final calculation of the employee’s income based on the results of each month for which income was accrued to him.

However, senior judges did not find the tax agent's argument convincing. Since income (advance) to employees was paid on the last day of the month, the tax agent had an obligation to calculate and withhold personal income tax amounts in accordance with clause 2 of Article 223 of the Tax Code of the Russian Federation.

That is, in this example, the employer was obliged to withhold personal income tax both on the date of the advance payment and on the date of payment of the second part of the salary to the employee.

When will wages be paid for December 2022? When to withhold and pay personal income tax?

Every year in December, accountants are faced with the problem of when to pay the December salary and how to correctly reflect this in the 6-NDFL report. In our article today, we will look at the nuances of paying December wages and what you need to pay attention to when filling out reports, using the example of registration in the programs 1C: Enterprise Accounting 3.0 and 1C: Salaries and Personnel Management 3.1.

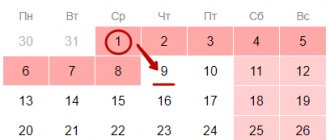

First, let's deal with the theoretical part of the question. If wages are to be paid during the New Year holidays (from January 1 to January 9, 2022), then their payment is legal on the last working day, that is, December 30, 2022 . If the salary payment deadline does not fall within this period or the payment is planned earlier than December 30, then it is better for the employer to establish a rule about postponing the salary payment date in local documents, since there is a risk of bringing the organization to administrative liability under Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, that is, violation of labor legislation. According to the Ministry of Finance, it is impossible to withhold personal income tax until the month has ended; therefore, sanctions are possible for failure to withhold personal income tax for the period from December 15 to the date of payment, since personal income tax will be recognized as paid from one’s own funds (Letter dated March 13, 2018 No. 03-04- 06/15182). Insurance premiums should also be calculated on the last working day. And if there is more than half a month left before the next payment (advance), an interim payment should be made. If wages for December are paid on December 30, then personal income tax must be withheld from it on the same day, and it must be transferred to the budget no later than January 10, 2022.

Thus, it is more expedient to pay wages only on December 30, in this case the organization will avoid the risk of disputes with regulatory authorities.

With regards to personal income tax, tax payment is made no later than the working day following the day of withholding (clause 6 of article 226 of the Tax Code of the Russian Federation). In this case, it is necessary to take into account the provisions of paragraph 7 of Art. 6.1 of the Tax Code of the Russian Federation on postponing tax payment deadlines that fell on non-working days, weekends and holidays to the next working day. Therefore, the last day for paying personal income tax on December wages to the budget is January 10, 2022. The wording “no later” means that personal income tax can be transferred earlier, that is, on the day of withholding - December 30, 2022.

Regarding the procedure for filling out reports, we remind you that from the first quarter of 2022, a new form of calculation 6-NDFL has been in effect, which includes as Appendix 1 a certificate of income and tax amounts of an individual (certificate 2-NDFL), it is generated only in the annual report.

Next, let's look at the reflection of wages for December in the 1C: Enterprise Accounting 3.0 program. In the first example, it is assumed that the payment will be made on December 30, 2021.

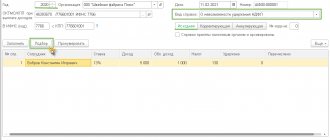

On December 30, 2022, standard payroll is carried out (section “Salaries and Personnel” - “All Accruals”), which reflects the calculation of personal income tax as of December 31, 2021.

Next, we create a statement for the payment of salaries for December 2022 dated December 30, 2021. If you check the personal income tax withholding, you can see that the date of receipt of income and tax withholding is 12/31/2021.

To check the timing of personal income tax transfers in the program, you can go to the “Document Movement” section of the statement and look at the “personal income tax to be transferred” register. Looking at the “Last payment deadline” column, we will see that this is the date after the end of the holidays - 01/10/2022.

It turns out that the program provides that we must transfer the tax by January 10, 2022.

In the second example, we will understand that the payment is initially intended to be January 10, 2022. Our salary accrual also remains from December 30, but when creating the payout sheet, we indicate the date as 01/10/2022. If we click on “Tax” in the statement, we can see that the date of receipt of income has not been changed - the last day of the month is December 31. All that will differ from the first example is the deadline for tax payment; it will move to 01/11/2022.

Now let's move on to the 1C program: Salaries and personnel management ed. 3.1. First, we fill out the document “Accrual of salaries and contributions” as of December 30, 2021. Then we process the payment of wages according to the statement, in which we indicate the date - 12/30/2021. In the statement we also see that the date of receipt of income is the last day of the month (December 31, 2022).

We fill out the 6-NDFL report. Please note that the date of generation of the report (indicated on the title page) is greater than the date of the December salary payment sheet. Salaries always appear in the 6-NDFL report on the accrual date; accordingly, regardless of whether the payment was in December or January, the December salary amounts will be reflected in the 2021 annual report.

The first section of the report reflects the tax transferred, and it is reflected with the date 01/10/2022 (if the statement is dated 12/30/2021) or 01/11/2022 (if the statement is dated 01/10/2022).

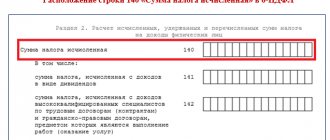

In section 2 on lines 110, 112 you can check the reflection of accrued wages. On lines 140, 160 the tax is calculated and withheld. In this article, we looked at how to correctly calculate and pay December wages and reflect these transactions in 1C: Enterprise Accounting ed. 3.0 and 1C: Salaries and personnel management 3.1. If you have any difficulties working with the program, please contact the 1C Expert Support Center. Our experts will quickly and easily resolve your issue. Work in 1C programs with pleasure! To contact us, call +7 (499) 956-21-70 or write to

Transfer of personal income tax in a larger volume

Often, companies mistakenly or deliberately transfer personal income tax to the budget in a larger amount than is actually withheld from an individual. In this case, the purpose of payment indicates “Income tax for individuals”. Such actions often lead to tax disputes with tax authorities. And if previously the tax inspectorate could see the amount of personal income tax paid and accrued only after submitting a report on form 2-NDFL, which is submitted once a year, now tax officials see the payment of personal income tax quarterly using 6-NDFL certificates. How dangerous is “advance” personal income tax? How do tax authorities qualify such company actions?

Position of regulatory authorities

For a number of years, regulatory authorities believed that the listed “advance” personal income tax should be paid again (Letters of the Federal Tax Service of the Russian Federation dated September 29, 2014 No. BS-4-11 / [email protected] , dated July 25, 2014 No. BS-4 -11/14507, Ministry of Finance of the Russian Federation dated September 16, 2014 No. 03-04-06/46268, dated September 1, 2014 No. 03-04-06/43711). The letter of the Federal Tax Service of the Russian Federation dated May 5, 2016 No. SA-4-9/81160 was no exception in this sense. The reason is that the amount of personal income tax withheld from the income of an individual is transferred to the budget, but personal income tax cannot be transferred at the expense of one’s own funds (clause 9 of Article 226 of the Tax Code of the Russian Federation).

Therefore, the amount paid ahead of time is not considered tax and, in order to fulfill the duties of a tax agent, personal income tax must be paid again (for example, when paying wages - no later than the day following the day of payment of income - clause 6 of Article 226 of the Tax Code of the Russian Federation). If this is not done, then with a high degree of probability, tax authorities will charge additional penalties and a fine in the amount of 20% of the unpaid amount of personal income tax (Article 123 of the Tax Code of the Russian Federation). The amount of tax transferred in excess (before the established deadline) cannot be offset, but can only be returned on the basis of an application submitted to the tax office.

Arbitration practice

Let us analyze court decisions regarding the legality of offsetting overpayments of personal income tax that arose in connection with the transfer of tax in a larger volume.

It should be noted that today, judicial practice is in favor of the tax agent, despite the fact that regulatory authorities consistently refuse to allow companies to offset the excessively transferred tax against debt repayment.

The basis for the refusal is that payment of tax at the expense of tax agents is not allowed (clause 9 of Article 226 of the Tax Code of the Russian Federation).

EXAMPLE No. 2.

For 2 years, the company transferred payments to the budget with the purpose of “Individual Income Tax” in a larger volume than was withheld from the individual, and therefore, an overpayment of personal income tax arose.

Subsequently, when paying income to an individual, the company withheld the calculated amount of personal income tax from his income, but did not transfer it to the budget, assuming the right to offset the overpaid tax. However, during the audit, the tax authorities considered the company’s actions to be a tax offense under Article 123 of the Tax Code of the Russian Federation, which was reflected in the failure to transfer personal income tax amounts within the prescribed period, and the amounts paid in advance were qualified as tax paid at the expense of the tax agent’s own funds.

The courts of two instances supported the arguments of the tax inspectorate regarding the violation of the deadlines for transferring personal income tax to the budget.

The cassation court overturned the decisions of previous courts based on the following arguments.

As a general rule, the obligation to pay tax must be fulfilled within the period established by the legislation on taxes and fees (paragraph 2, paragraph 1, article 45 of the Tax Code of the Russian Federation). The taxpayer has the right to fulfill the obligation to pay tax ahead of schedule. At the same time, the rule on early payment of tax also applies to tax agents (clause 8 of Article 45 and clause 2 of Article 24 of the Tax Code of the Russian Federation).

The cassation judges analyzed the rules for tax offset established by Article 78 of the Tax Code of the Russian Federation. The offset of the amounts of overpaid federal taxes and fees, regional and local taxes is carried out for the corresponding types of taxes and fees, as well as for penalties accrued on the corresponding taxes and fees.

The rules established by Article 78 of the Tax Code of the Russian Federation also apply to the offset or return of amounts of overpaid advance payments, fees, penalties and fines and apply to tax agents (Clause 14 of Article 78 of the Tax Code of the Russian Federation).

Thus, based on the analysis of the above rules, the tax agent has the right to offset the amount of overpaid taxes, which are federal, against upcoming payments, as well as repayment of arrears on personal income tax.

In this situation, the company transferred personal income tax in advance, as a tax agent, and subsequently, when paying income to the taxpayer, always withheld the calculated personal income tax from the taxpayer’s income.

As the court noted, payment of personal income tax at the expense of a tax agent will take place when personal income tax is paid by the tax agent not “for the taxpayer,” but “instead of the taxpayer,” that is, when paying income, personal income tax is calculated and transferred to the budget, but is not withheld by the tax agent from the income taxpayer.

And therefore, the early transfer by the personal income tax company of the offense established by Art. 123 of the Tax Code of the Russian Federation, does not form.

In addition, due to the legal position of the Constitutional Court of the Russian Federation, set out in the ruling dated 02/08/2007 No. 381-0-P, all guarantees of property rights apply to overpaid taxes.

In this tax dispute, the cassation court made an important conclusion for tax agents: under such conditions, the refusal to recognize personal income tax paid by the tax agent ahead of schedule creates artificial grounds for bringing the tax agent to tax liability, and the offset of these amounts as tax and recording by the tax authority the absence of arrears is an obstacle to bringing to tax liability (Resolution of the Moscow District Administration of July 28, 2016 No. A40-128534/2014).

In the Decisions of the Autonomous Okrug of the Yamalo-Nenets Autonomous Okrug dated May 25, 2016 No. A81-978/2016, the Autonomous Authority of the Kamchatka Territory dated June 15, 2015 No. A24-244/2015, and the Resolutions of the Autonomous District of the Volga-Vyatka District dated February 19, 2016 No. A38 -6347/2012, West Siberian District dated October 26, 2015 No. A27-1682/2015, East Siberian District dated June 10, 2015 No. A58-4233/20144, Ural District dated May 26, 2015 No. F09- 2467/15 and dated 02/06/2015 No. Ф09-10188/14, the tax inspector’s argument that the amount of personal income tax excessively transferred by the tax agent is not an overpaid tax payment was also rejected, since payment of tax at the expense of the tax agent is not allowed ( Clause 9 of Article 226 of the Tax Code of the Russian Federation).

It should be noted that in the database of arbitration cases there are court decisions that support the position of the tax authorities. For example, in the Resolution of the Arbitration Court of the North-Western District dated June 19, 2015 No. A56-41307/2014, the court agreed with the tax inspectorate’s arguments regarding holding a tax agent liable under Article 123 of the Tax Code of the Russian Federation due to the transfer of personal income tax to the budget before the payment of income to an individual face.

If a company has overpaid personal income tax, it should contact the tax office with an application for a tax refund. After all, according to the regulatory authorities, this amount cannot be offset against future personal income tax payments, but can only be returned. To do this, you must submit an application in free form (Letters of the Ministry of Finance of the Russian Federation dated November 12, 2014 No. 03-04-06/57158 and the Federal Tax Service of the Russian Federation dated July 4, 2011 No. ED-4-3/10764).

However, when returning the overpaid personal income tax to the current account, tax agents may also face difficulties.

If tax registers are not provided (in particular, cards for accounts 68 and 70), the tax inspectorate has the right to refuse a tax refund and the courts support the inspection. EXAMPLE No. 3.

The company mistakenly transferred personal income tax to the budget and applied to the tax office for a refund.

In the statement, the company noted that the specified amount of tax was not withheld from individuals. Only a copy of the payment order was attached to the refund application.

The tax office refused to refund the tax amount to the company, indicating that these documents were not enough. Without tax registers (cards were requested for accounts 68 “Calculations for taxes and fees” and 70 “Settlements with personnel for wages”) it is impossible to determine the amount of overpayment of tax.

When deciding in favor of the tax inspectorate, the judges proceeded from the following:

- the fact of filing an application for the return to the current account of the amount erroneously transferred to the budget does not indicate the existence of grounds for the return of this amount automatically; - the tax agent must document that personal income tax is transferred to the budget in excess of the amount of tax actually withheld from the income of individuals, is not related to the performance of the duty of a tax agent, and is transferred erroneously from one’s own funds;

- in order for the tax authority to be able to determine the nature of the amount paid by the applicant, the company had to submit supporting documents (tax registers, account cards 68 “Calculations for taxes and fees”, 70 “Settlements with personnel for wages”), since in the absence of an analytical accounting for account 70, it is not possible to draw a conclusion about the presence of an overpayment (non-payment) of personal income tax, as well as to qualify what caused the overpayment (non-payment) of personal income tax: at the expense of the tax agent’s own funds or due to incorrect calculation of personal income tax for the taxpayer;

- the list of payment orders for payment of personal income tax in itself does not allow determining the presence of overpayment (non-payment) of personal income tax; in payment orders the amount of payment for the specified period is indicated without breakdown by specific individuals; The register of information on the income of individuals is reference general information.

And since the company did not provide evidence to confirm the overpayment of tax and did not attach a corresponding document indicating an erroneously excessive payment, the courts came to the conclusion that the tax authority had no grounds for returning the amount of money (Resolution of the AS of the West Siberian District dated October 30, 2015 No. A67-8760/2014).

Court verdict: in what cases can personal income tax be paid before wages are paid?

The Arbitration Court of the Central District, in Resolution No. A54-8727/2018 dated October 29, 2019, recognized that tax officials illegally fined a tax agent who transferred personal income tax for employees before the actual payment of their salaries.

Subject of dispute

: a tax agent was fined for untimely transfer of withheld personal income tax to the budget. During the audit, the Federal Tax Service found that personal income tax from payments to employees was transferred to the budget before the actual payment of wages. That is, the tax was paid from the funds of the tax agent himself, which is directly prohibited by law. The decision of the Federal Tax Service was challenged in court.

What were they arguing about?

: 5,188 rubles.

Who did win

: tax agent.

The cassation court declared the decision of the tax inspectorate illegal and violating the rights of the tax agent. By law, tax agents are required to withhold the accrued amount of personal income tax directly from the taxpayer’s income upon actual payment (Clause 4 of Article 226 of the Tax Code of the Russian Federation).

The obligation to pay personal income tax is considered fulfilled by the employee from the day the tax amounts are withheld by the tax agent. After calculating and withholding personal income tax, the tax agent is obliged to transfer this amount to the appropriate budget. Failure of a tax agent to fulfill the obligation to timely transfer personal income tax entails the accrual of penalties and prosecution under Art. 123 Tax Code of the Russian Federation.

In themselves, the actions of transferring personal income tax to the budget before the established deadline do not lead to the occurrence of arrears for personal income tax, and the corresponding actions of the tax agent do not form an event and the elements of a tax offense established by Art. 123 Tax Code of the Russian Federation.

Payment of personal income tax at the expense of tax agents is indeed not allowed (clause 9 of Article 226 of the Tax Code of the Russian Federation). At the same time, payment of personal income tax at the expense of a tax agent will take place when personal income tax is paid by the tax agent not “for the taxpayer,” but “instead of the taxpayer.” That is, in cases where, when paying salaries, personal income tax is calculated and transferred to the budget, but is not withheld by the tax agent from the employees’ income.

Evidence of the transfer of tax at the expense of the Federal Tax Service's own funds was not presented in the case materials.

By transferring personal income tax in advance, the tax agent always withheld the calculated personal income tax from the income of his employees. In this regard, in fact, the costs of paying personal income tax have always been borne by the employees themselves. At the end of the tax period, there was no personal income tax debt for either the employees or the employer.

Accordingly, the court concluded, the tax inspectorate had no grounds to hold the tax agent liable under Art. 123 Tax Code of the Russian Federation.