Balance sheet as a way to reflect obligations

Funds and resources, taking part in supporting activities, are constantly changing.

To ensure the most efficient operation of a business entity, you need to know what the funds (assets) of the enterprise consist of, and from what resources (liabilities) it is formed, what is the purpose of their existence. Balancing is a way of grouping the assets and liabilities of an enterprise or institution for a certain date in monetary value, drawing up a table where the left (active) part must necessarily be equal to the (right) passive, where, as in nature, when it “decreases” in one place, it is necessary “ arrives" in another. The balance sheet form is approved by the accounting regulations.

A balance sheet item is a record that reflects either the enterprise’s funds or their sources. The source for filling in the lines are the corresponding entries in the accounting accounts. Items in the balance sheet are formed into sections based on the principle of purpose, urgency and turnover.

The balance sheet is a kind of “snapshot” of a business entity, so a real display of assets and liabilities allows you to evaluate the “health” of the enterprise and the method of “treatment” if necessary. The necessary answer to the main question about debt - to whom we owe, how much, what we are obliged to pay, whose funds we use - is presented in the liability side of the balance sheet.

Formation of line 1550 balance

Current liabilities of the enterprise that cannot be reflected on “target” lines and have a duration of less than 365 days are recorded in line 1550 of the balance sheet.

These include:

- Obligations of the developer for targeted funds, if the contract expiration date is less than 365 days;

- Funds for current expenses, secured by the charter of the enterprise;

- Deposited payments to staff;

- Amounts of value added tax deducted upon prepayment and which must be paid to the budget upon receipt of goods or services.

There is a clarification in Accounting Rules 4/99 (clause 11) - an entry on line 1550 is made only when it is established that they are insignificant, that is, they will not radically affect the financial assessment of the enterprise, but must be shown for accounting accuracy.

The balance on line 1550 consists of the credit balances on accounts and subaccounts 76 and 86 as of the reporting date.

It is not worth displaying in the balance sheet the amounts of value added tax deducted when paying an advance (prepayment) and due for restoration. These amounts are balanced with advances (prepayments) indicated as part of accounts receivable (letter of the Ministry of Finance of Russia dated January 9, 2013 No. 07-02-18/01). As a result, prepayments paid are reflected without tax. This will result in a reduction in the balance amount by the amount of the applicable VAT.

Accounting for other obligations at the enterprise

To account for other obligations at enterprises and institutions, account 76 “Settlements with various debtors and creditors” is opened. It summarizes information on insurance settlements, claims of various types, amounts of employee wages deposited for various claims based on court decisions, executive orders and other orders.

Sub-accounts must be opened for this account for details:

- 76-1 - displays insurance amounts;

- 76-2 - shows amounts for claims of various types;

- 76-4 - displays the debt on deposited amounts.

They show accrued, but not paid on time, amounts of employee wages. As a rule, such a situation arises due to the non-appearance of recipients. The statute of limitations under Russian law is three years. After this period, the deposited liability must be transferred to account 91, where income from various non-operating transactions is taken into account.

Most of the entries in account 76 are significant for accounting and are recorded on other lines of the balance sheet.

When displayed in the balance sheet, it is impossible to balance the amounts of entries for assets and liabilities (debit and credit balances of account 76) (clause 34 of PBU 4/99).

Line 1550 “Other liabilities” is equal to the credit balance on account 86 (relative to other short-term liabilities) and the amount of the same balance on account 76 (other short-term liabilities).

On balance line 1550, targeted funds can be reflected as information about the amounts intended for targeted financing that are received by the developer if there are less than 365 days left before the transfer of the object.

To do this, a balance transfer is formed from account 86 “Target funds and targeted financing.” If the liability period is more than a year, this amount is recorded on line 1450 of the balance sheet.

The amounts of balances of target financing received in foreign currency are not subject to repeated adjustment or recalculation for expression in the financial statements. They are shown at the rate that was valid on the date of their acceptance onto the balance sheet.

Structure of liabilities in the balance sheet

Liabilities have the same classification structure as assets: current liabilities and non-current liabilities. They are reflected in the balance sheet in order of increasing due date for their payment.

Current responsibility

Current liabilities are those that must be paid within 12 months or the operating cycle if its duration is more than one year. Their occurrence is usually associated with the use of current assets (English Current Assets), the creation of another current liability or the provision of any services.

Typically this section of the balance sheet includes the following items.

- Debt to banks

. Represents the amount of short-term debt owed to banks, for example, under a bank line of credit. - Accounts payable

. This is the amount of debt owed to suppliers of products and services that were provided on credit, but the payment period for which has not yet arrived. - Salaries, rent, taxes and utilities payable

. This reflects the amounts that the company must pay to its employees, landlords, government, etc. - Accrued liabilities (accrued expenses)

. These liabilities arise because expenses are incurred in a period prior to the period in which they are paid. This item covers a wide variety of expenses, for example, advances received from clients, dividends payable, arrears of accrued wages, etc. - Bills payable (short-term loans)

. These are the amounts that the company is obliged to pay to the creditor, which usually also includes the payment of interest. - Deferred income (customer prepayments)

. These are payments received from customers for goods and services that the company has not yet provided or has not yet begun to incur any costs associated with providing them. - Dividends payable

. It arises in a situation where a company has already announced dividends, but has not yet paid them to its owners. - The current portion of long-term debt

. This item reflects the portion of long-term debt that falls due in the next 12 months. In theory, any associated premiums or discounts should also be classified as current liabilities. - Current portion of finance lease obligations

. This is part of the long-term finance lease payments that are due over the next year.

long term duties

Long-term liabilities are those that must be repaid later than 12 months or after the operating cycle, if it is longer than one year. They should be reflected as the present value of future payments.

The most common examples of long-term liabilities are.

- Bills payable (long-term loans).

This is the amount that the company is required to pay the lender, which usually includes interest. - Long-term debt (bonds payable).

This is long-term debt minus the current portion. - Deferred tax liabilities.

They arise as a result of discrepancies between accounting and tax accounting standards in the case when the amount of tax payable in accounting exceeds the amount of tax payable in tax accounting. In other words, it is the amount of tax that the company will have to pay in the future. - Employee pension plan.

This is the company's obligation to pay pension benefits to its retired and active employees. Payments from this fund begin upon the employee's retirement. This item reflects the additional amount the company must contribute to its current pension fund to meet its future pension obligations. - Long-term finance lease obligations.

How to show long-term liabilities on the balance sheet

To reflect the value of long-term liabilities in the organization's balance sheet, it is necessary to use information on the credit balance of certain accounts as of the reporting date.

Let us present an algorithm for calculating indicators of long-term liability items in the balance sheet (Order of the Ministry of Finance dated October 31, 2000 No. 94n). Please note that, for example, “K67” means the credit balance of account 67 as of the reporting date.

| Indicator name | Code | Which accounting accounts data is used? | Algorithm for calculating the indicator |

| Borrowed funds | 1410 | 67 “Calculations for long-term loans and borrowings” | K67 (in terms of debt with a maturity date of more than 12 months at the reporting date) |

| Deferred tax liabilities | 1420 | 77 “Deferred tax liabilities” | K77 |

| Estimated liabilities | 1430 | 96 “Reserves for future expenses” | K96 (in terms of estimated liabilities with a maturity period of more than 12 months after the reporting date) |

| Other obligations | 1450 | 60 “Settlements with suppliers and contractors”, 62 “Settlements with buyers and customers”, 68 “Settlements for taxes and fees”, 69 “Settlements for social insurance and security”, 76 “Settlements with various debtors and creditors”, 86 “Target financing" | K60 + K62 + K68 + K69 + K76 + K86 (all in terms of long-term debt) |

We remind you that VAT accrued for payment on advances received reduces in the balance sheet the accounts payable from which it was calculated (letter of the Ministry of Finance dated 01/09/2013 No. 07-02-18/01). This means, for example, that an advance received on the reporting date in the amount of 118,000 rubles (including 18% VAT) will be reflected in the balance sheet liability in the amount of 100,000 rubles (118,000 - 118,000 *18/118). Similarly, VAT on an advance issued is not reflected in the liability side, but reduces the amount of receivables in the asset balance sheet.

Long-term obligations are obligations with a maturity period of more than a year.

Long-term liabilities include debt obligations, deferred tax liabilities, and estimated liabilities of the organization.

When assessing the financial condition of an enterprise, long-term liabilities are usually divided into two groups:

- part of long-term accounts payable that will be repaid more than 12 months after the reporting date;

- part of long-term accounts payable that will be repaid before the expiration of the next 12 months after the reporting date.

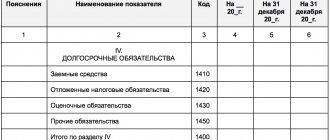

Long-term liabilities and balance sheet

In the form of the Balance Sheet, approved by Order of the Ministry of Finance of Russia dated July 2, 2010 N 66n, section. IV looks like this.

| Explanations | Indicator name | Code | On ____ 20__ | As of December 31, 20__ | As of December 31, 20__ |

| 1 | 2 | 3 | 4 | 5 | 6 |

| IV. LONG TERM DUTIES | |||||

| Borrowed funds | 1410 | ||||

| Deferred tax liabilities | 1420 | ||||

| Estimated liabilities | 1430 | ||||

| Other obligations | 1450 | ||||

| Total for Section IV | 1400 |

This section displays information about the organization's long-term liabilities. Long-term liabilities are those whose maturity exceeds 12 months after the reporting date.

The procedure for generating indicators according to the lines of section IV of the balance sheet liabilities

The organization’s liabilities (essentially its borrowed capital) are presented in two liability sections of the balance sheet, depending on their maturity date:

- in Sect. IV “Long-term liabilities” – liabilities whose maturity is more than 12 months after the reporting date;

- in Sect. V “Short-term liabilities” – obligations that must be repaid within the next year.

Section IV of the balance sheet consists of five lines.

This section should reflect information about the organization's obligations, the maturity of which is more than 12 months after the reporting date.

The lines of Section IV, for example, should reflect the amount of a loan or loan raised for a long period of more than a year, the amount of deferred tax and valuation liabilities of the company, as well as the amount of other long-term liabilities.

Let's consider the order of filling out these lines.

Line 1410 “Borrowed funds”:

Line 1410 must reflect data on all long-term loans and borrowings received by the organization for a period of more than 12 months.

At the same time, this line reflects the amount of loans received both in cash and in kind, bank loans, and the company’s obligations under issued financial bills.

To fill out line 1410, take the credit balance of account 67 “Calculations for long-term loans and borrowings.”

Moreover, this should be done only in that part of the debt for which the repayment period exceeds 12 months after the reporting date.

Line 1420 “Deferred tax liabilities”:

Line 1420 is filled out by companies applying PBU 18/02.

To fill out line 1420, take the credit balance of account 77 “Deferred tax liabilities.”

If an organization offsets deferred tax assets and deferred tax liabilities and presents them on a collapsed basis (balanced), it is necessary to fill out page 1420 only if the credit balance of account 77 “Deferred tax liabilities” turns out to be greater than the debit balance of account 09 “Deferred tax assets” (by the amount differences between them).

Line 1430 “Estimated liabilities”:

Line 1430 shows the amount of reserves created in accordance with PBU 8/2010.

For example, this line should reflect the amount of the reserve for warranty repairs.

In this case, this line should indicate only data on long-term estimated liabilities for a period of more than 12 months.

Line 1430 reflects the credit balance of account 96 “Reserves for future expenses” (in terms of obligations with a maturity period of more than 12 months) not written off as of December 31 of the reporting year.

Line 1450 “Other obligations”:

Line 1450 should contain information about other long-term liabilities that were not reflected in the above lines of Section IV.

So, for example, on line 1450 you can indicate data on accounts payable to suppliers and contractors with a repayment period of more than 12 months.

This may be the credit balance of the following accounts:

- 60 “Settlements with suppliers and contractors” in terms of long-term accounts payable for installments or deferred payment provided by suppliers and contractors, if it is more than 12 months;

- 62 “Settlements with buyers and customers” - in terms of debt to buyers and customers, the repayment period of which exceeds 12 months (arising as a result of receipt of advances and prepayments for the upcoming supply of products, goods, performance of work, provision of services, including debt on commercial loans) ;

- 68 “Calculations for taxes and fees” - in terms of long-term debt for taxes and fees (for example, when providing an organization with an investment tax credit, deferment or installment plan for the payment of federal taxes and fees);

- 69 “Calculations for social insurance and security” - in terms of long-term debt on insurance contributions (for example, when restructuring debt to extra-budgetary funds);

- 76 “Settlements with various debtors and creditors” - regarding other long-term accounts payable and obligations;

- 86 “Targeted financing” – in terms of obligations the fulfillment period of which exceeds 12 months after the reporting date. Data on targeted financing is reflected here (account credit 86 “Targeted financing”) (for example, when developer organizations receive targeted financing from investors, which generates the developer’s obligation to investors to transfer the constructed facility to them).

The total amount on lines 1410 - 1450 is reflected on line 1400 “Total for Section IV” of the balance sheet liabilities, which characterizes the total amount of long-term borrowed capital (liabilities) of the organization.

Line 1550 “Other obligations”

On line 1550

other liabilities of the organization are reflected, the repayment period of which does not exceed 12 months:

[Credit balance on account 76 “Settlements with various debtors and creditors”] (in terms of other short-term liabilities)

Plus

[Credit balance on account 86 “Targeted financing”] (in terms of other short-term liabilities)

Other current liabilities may include:

· targeted financing received by developer organizations from investors and generating an obligation to transfer the constructed facility to them within 12 months after the reporting date;

· VAT amounts accepted for deduction when transferring an advance (prepayment) and subject to restoration for payment to the budget upon actual receipt of goods, works, services or upon return of the transferred advance;

· special purpose funds to finance current expenses.

BALANCE SHEET (Order of the Ministry of Finance dated July 2, 2010 N 66n)

| ASSETS |

| Intangible assets |

| Research and development results |

| Intangible search assets |

| Material prospecting assets |

| Fixed assets |

| Profitable investments in material assets |

| Financial investments |

| Deferred tax assets |

| Other noncurrent assets |

| Total for Section I |

| Reserves |

| Value added tax on purchased assets |

| Accounts receivable |

| Financial investments (excluding cash equivalents) |

| Cash and cash equivalents |

| Other current assets |

| Total for Section II |

| BALANCE |

| PASSIVE |

| Authorized capital (share capital, authorized capital, contributions of partners) |

| Own shares purchased from shareholders |

| Revaluation of non-current assets |

| Additional capital (without revaluation) |

| Reserve capital |

| Retained earnings (uncovered loss) |

| Total for Section III |

| Borrowed funds |

| Deferred tax liabilities |

| Estimated liabilities |

| Other obligations |

| Total for Section IV |

| Borrowed funds |

| Accounts payable |

| revenue of the future periods |

| Estimated liabilities |

| Other obligations |

| Total for Section V |

| BALANCE |

On line 1550

other liabilities of the organization are reflected, the repayment period of which does not exceed 12 months:

[Credit balance on account 76 “Settlements with various debtors and creditors”] (in terms of other short-term liabilities)

Plus

[Credit balance on account 86 “Targeted financing”] (in terms of other short-term liabilities)

Other current liabilities may include:

· targeted financing received by developer organizations from investors and generating an obligation to transfer the constructed facility to them within 12 months after the reporting date;

· VAT amounts accepted for deduction when transferring an advance (prepayment) and subject to restoration for payment to the budget upon actual receipt of goods, works, services or upon return of the transferred advance;

· special purpose funds to finance current expenses.

BALANCE SHEET (Order of the Ministry of Finance dated July 2, 2010 N 66n)

| ASSETS |

| Intangible assets |

| Research and development results |

| Intangible search assets |

| Material prospecting assets |

| Fixed assets |

| Profitable investments in material assets |

| Financial investments |

| Deferred tax assets |

| Other noncurrent assets |

| Total for Section I |

| Reserves |

| Value added tax on purchased assets |

| Accounts receivable |

| Financial investments (excluding cash equivalents) |

| Cash and cash equivalents |

| Other current assets |

| Total for Section II |

| BALANCE |

| PASSIVE |

| Authorized capital (share capital, authorized capital, contributions of partners) |

| Own shares purchased from shareholders |

| Revaluation of non-current assets |

| Additional capital (without revaluation) |

| Reserve capital |

| Retained earnings (uncovered loss) |

| Total for Section III |

| Borrowed funds |

| Deferred tax liabilities |

| Estimated liabilities |

| Other obligations |

| Total for Section IV |

| Borrowed funds |

| Accounts payable |

| revenue of the future periods |

| Estimated liabilities |

| Other obligations |

| Total for Section V |

| BALANCE |