Deduction for previous years in 3-NDFL

Calculation of the balance of property deduction from the previous year

How to find out if a deduction has been received previously

Example and sample of filling out 3-NDFL with deduction for previous years

Results

It is profitable to immediately receive the money you have been paying for 3 years, because a large amount will come. How to return taxes paid for several years when buying an apartment?

If you have questions or need help, please call Free Federal Legal Advice.

- The call throughout Russia is free 8 800 350-94-43

Deduction for previous years in the 3-NDFL declaration: what to write

The Tax Code in Chapter 23, devoted to income tax, provides citizens, under certain conditions, with the opportunity to return previously paid tax or not pay it in the future. This opportunity is called the right to deduction. Deductions are given in Articles 218 - 221 of the Tax Code of the Russian Federation.

What is a deduction? This is an amount that is deducted from the tax base when calculating personal income tax. Reducing your basis reduces your tax, and the difference between the tax before and after the deduction is applied is what you get.

Important!

The Tax Code of the Russian Federation provides maximum amounts of compensation, but if your expenses are less than these amounts, then you can only return within the limits of actual expenses.

Example 1

Olga Gavrilova is a full-time student at the university and paid 40,000 rubles for the first year of study. She pays personal income tax because she works as an assistant accountant on the evening shift.

According to Article 219 of the Tax Code of the Russian Federation, the maximum deduction for expenses on one’s studies is 120,000 rubles, but Gavrilova’s actual expenses are less - only 40,000, which means that her tax base will be reduced by 40,000.

The second limitation is the tax base itself. If it is less than the deduction, then the refund will be calculated based on the base.

Example 2

Olga Gavrilova pays 150,000 rubles for her studies. Her income for the calendar year amounted to 100,000 rubles, since her husband actually pays for her education.

The first limit is actual expenses and the maximum amount. Gavrilova’s actual expenses are 150,000, and the maximum compensation under Article 219 is 120,000 rubles. Therefore, the maximum compensation value is taken for calculation.

The second limit is the base. Gavrilova’s base is less than the maximum deductible amount, therefore, the base is taken for calculation. Those. The smallest value is always taken. As a result, 100,000 rubles will be deducted from the base, and the base will become zero. This difference is the amount for calculating compensation.

In this case, the method of receiving compensation depends on the will of the payer:

In the first case, there is a refund of the tax amounts paid, and in the second - receiving wages without charging 13%. The return can cover the past 3 years - if the right to it also arose 3 years ago or earlier. If the right arose earlier, then you can still only return it for the last 3 years; all previous years “burn out.”

So, what is a deduction for previous years in 3-NDFL - this is a refund of the tax paid for these years, subject to the conditions of Chapter 23 of the Tax Code of the Russian Federation. To return for 3 years at once, you must submit 3 separate declarations with separate income certificates (for each year), checks, etc. Documents that have not changed can be attached only to one report, for example, contracts, licenses, etc.

Important!

For each year, you must fill out the form that was in effect at that time.

and 3-NDFL for tax deductions and declaration of income for different periods can be found at the link .

How to calculate deductions for previous years in the 3-NDFL declaration - based on 2-NDFL certificates. You need to contact the accountant at your place of work and request certificates for each year. These certificates contain the most important information - how much income tax was paid for you by your employer when calculating your salary. The certificate will contain separate amounts by month and a total for the entire year.

Next, you need to calculate the expenses to be reimbursed, for example, for study, for 3 years. Please note what date is indicated on the receipt; if you paid for the entire course in September 2015, then these expenses are not included in the compensation, but if the transaction was made in 2016, starting from January 1, then you can reimburse the expenses. Compare expenses with the limits under the Tax Code of the Russian Federation and the base.

Example 3

Olga Gavrilova pays 90,000 rubles a year for her higher education. She works as a real estate agent and earns 600,000 rubles a year, of which she pays personal income tax - 78,000 rubles. In her fifth year, she decided to receive a social benefit for her studies.

Despite the fact that the expenses took place over the past 4 years, Gavrilova cannot reimburse them for the first year. For the remaining courses she will return 78,000 rubles. Total: 78,000 + 78,000 + 78,000 = 234,000 rubles. She will be able to compensate for the fifth year only next year.

If you have questions or need help, please call Free Federal Legal Advice.

In the video about the balance of the deduction

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

The balance of the property tax deduction transferred from the previous year: how to calculate

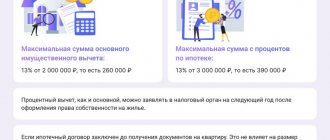

The largest income tax deduction for citizens is property: 260,000 for housing and up to 390,000 for mortgage interest. Therefore, the return of these amounts is often extended over several years, especially for those individuals who pay much less personal income tax per year than they could potentially return, i.e., their property deduction is greater than their income for the year.

According to Article 220, such a refund is provided to each citizen once in a lifetime and in full - the remainder will be carried forward until final exhaustion, even if the transfer drags on for decades. If you do not receive a full refund from one item, you can receive the balance at any time in the future for another.

Example 4

Olga Gavrilova earns 500,000 rubles a year and pays 65,000 rubles in tax. She bought an apartment in 2016 for 2,500,000 rubles and wants to apply for a refund in 2019 for 3 years.

For 2016, Gavrilova will return the same amount as she paid to the budget: 65,000 rubles. Balance carried over to 2022: 2,000,000 (maximum deduction) - 500,000 (used portion) = 1,500,000 rubles.

For 2022, the return will be the same: 65,000 rubles. Balance: 1,500,000 - 500,000 = 1,000,000 rubles.

For 2022, an amount of 65,000 will be returned, and the balance is equal to: 1,000,000 - 500,000 = 500,000 rubles. Thus, if her salary remains the same in 2019, then she will fully return the amounts due when she applies for a refund of the 2019 personal income tax in 2020. In total, Gavrilova will receive income tax refunds for 4 years.

Example 5

Olga Gavrilova earns 500,000 rubles a year and pays 65,000 rubles in personal income tax. She bought a room in 2016 for 1,000,000 rubles and wants to apply for compensation in 2019.

For 2016, Gavrilova will be returned 65,000 rubles. Carrying balance: 1,000,000 (actual expenses are taken, since they are less than the maximum deduction) - 500,000 rubles.

She will pay back the same amount again in 2022. Balance: 500,000 - 500,000 = 0, therefore she has exhausted her deduction for this room and cannot return any more.

However, throughout her life she has the right to receive another 1,000,000 deduction (after all, the maximum is 2,000,000) if she acquires any more real estate.

If the balance of the property tax deduction is less than the tax base, then the money will be returned within the limits of the balance.

Example 6

Olga Gavrilova earns 500,000 rubles a year and pays 65,000 rubles in personal income tax. She bought a share in the apartment for 1,700,000 rubles 5 years ago and wants to exercise the right to reimbursement of expenses.

For 2016 she will receive 65,000. Balance: 1,700,000 - 500,000 = 1,200,000.

For 2022, she will be compensated in the amount of another 65,000. Balance: 1,200,000 - 500,000 = 700,000 rubles.

She will return another 65,000 in 2022. Remaining: 700,000 - 500,000 = 200,000.

for 2022, she will be able to return only 26,000, since her balance is less than the amount earned for the year. She earned 500,000 and paid 65,000, but only had a deduction of 200,000. Therefore, the return would be: 200,000 × 13% = 26,000.

The balance of the property tax deduction for interest payments is transferred in the same way. But interest is refunded:

- after full compensation of basic expenses - the cost of the apartment;

- as interest is repaid - you have repaid the interest for the year, which means that next year you can reimburse it by providing a certificate from the bank.

Example 7

Olga Gavrilova earns 500,000 rubles a year and pays 65,000 in tax. She bought the house with mortgage funds. The cost of the house is 3,000,000 rubles. Interest expenses in total are 4,000,000. She managed to file declarations in December 2022.

For 2015, she will return 65,000, and the balance for basic expenses will be: 2,000,000 (the maximum deduction is taken, since actual expenses are greater than the maximum) - 500,000 = 1,500,000.

For 2016, she will also receive 65,000, i.e. in the 3-NDFL declaration, the amount transferred from the previous year is as follows. Balance for next year: 1,500,000 - 500,000 = 1,000,000.

For 2022, 65,000 will be transferred to her. The balance: 1,000,000 - 500,000.

In 2019, she will submit an application and a certificate of employment again. She will be refunded 65,000 for 2022. There is no balance, the deduction for housing expenses has been completely exhausted.

Now she can return the interest starting in 2022, or already in 2020 she can receive compensation at her place of work - personal income tax will not be withheld from her salary for 6 years (3,000,000 / 500,000 = 6 years). 3,000,000 is the maximum interest deduction; the maximum is taken, since actual expenses are higher.

Transfer to next year

The balance is automatically carried over to the next year. But you can only get it if you have a taxable base and have purchased real estate.

You can submit a declaration for the purchase of real estate in any year, even if the real estate was purchased in 2022, then the deduction can be received even in 2022, but taking into account if the citizen pays income tax this year.

Exceptions are provided for pensioners who receive a deduction for the previous 3 years before retirement, provided that these years they worked under an employment contract or made a profit.

How to find out if a taxpayer has previously received a deduction

A property deduction is given once in a lifetime to every citizen if he had expenses for the purchase, construction or repair of housing. Whether a citizen received a tax deduction when purchasing an apartment is indicated in the AIS-Tax database, so there is no point in applying for a refund a second time - you will receive a refusal.

The Federal Tax Service stores information not only about the use of the right to reimbursement, but also about the balances if you have not returned the maximum, so in no way will it be possible to reimburse expenses twice or more. But if you register ownership of another person - for example, a spouse, then he can receive a refund according to the annual personal income tax paid.

Important! You can receive a deduction for housing registered in the name of your minor child, but it will be taken into account as the use of your one-time right, while a child over 18 years of age can receive independent compensation.

Multiple rights to deduction

In current legislative acts one can often find the concepts of one-time and multiple-time deduction rights. It is often not easy for a person uninformed in matters of legislation and taxation to understand these concepts. We will try to explain everything in simple, accessible language.

Let's imagine that you bought an apartment worth 870,330 rubles. (amount less than 2 million). The transaction and ownership rights were completed before 01/01/14. By submitting the necessary documents, you will receive a tax refund of RUB 113,143. (RUB 870,330 * 13%). Next year (after 01/01/14) you bought half of the house at a price of 1,040,502 rubles. Since the first transaction was completed before 01/01/14, you cannot receive a deduction when purchasing part of the house. This rule applies in accordance with the one-time right to deduction. That is, despite the fact that after the first transaction there was a deduction balance of 1,129,670 rubles. (RUB 2,000,000 – RUB 870,330), you cannot receive a refund.

As for the right to multiple use of the deduction, it arises if the first transaction was completed before 01/01/14. For clarity, let's change the above example. Let's say you bought an apartment after 01/01/14 (cost 870,330 rubles). As in the first case, you received a refund of 113,143 rubles. But, unlike the first example, having bought half a house for 1,040,502 rubles, you can also apply for a deduction and receive a refund of 135,265 rubles. (RUB 1,040,502 * 13%). Thus, based on the results of two transactions, the amount of the used deduction will be 1,910,832 rubles. (870,330 rubles + 1,040,502 rubles) out of a possible 2 million rubles. This means that, having purchased any type of residential real estate for the third time, you have the right to apply for a deduction for the remaining amount of 89,198 rubles. (RUB 2,000,000 – RUB 1,910,832) and receive a refund of RUB 11,592. (RUB 89,198 * 13%).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

How to fill out 3-NDFL with deductions for previous years in 2022: example and sample

To demonstrate the procedure and rules for filling out the declaration, initial data is required.

Example 8

Olga Gavrilova bought an apartment for 2,800,000 rubles. Her salary in 2015 was 600,000 rubles. In 2016, she earned 540,000 rubles. In 2022, her income is 800,000 rubles. And in 2018 she earned 700,000 rubles. Gavrilova has already received a deduction for 2015 and now wants to continue reimbursement of expenses. Let's look at an example of filling out the 3-NDFL declaration.

It is convenient to start filling out the declaration from the end.

Example of filling out for 2016 :

- Sheet D1 - here enter information about your apartment: address, amount of expenses (if they are more than 2,000,000 rubles, then you need to enter 2,000,000, since this is the maximum reimbursable expenses), date of registration of rights, year of commencement of the deduction. For the first time, columns “balance of property tax deduction” 170 and 160 are not filled in. Please note that in column 230 you need to indicate the balance carried over to the new year. According to our example: 2,000,000 (maximum deduction) - 600,000 (used part = income for the year) = 1,400,000 rubles.

- Sheet A. Filled out using certificate 2-NDFL. If you have only one place of work, then filling out the page is not difficult - rewrite the results from the certificate. If you do not work in an organization, but under GPC agreements, then use such an agreement to indicate the source details.

- Section 2. It is necessary to enter data from previous sheets. Follow the hints in brackets below the columns.

- Section 1. The result is written here. Select code “2” - refund from the budget. KBK - it is important to indicate the correct budget classification code. For reimbursement transactions, the code specified in the sample applies.

Your OKTMO is a territorial sign; if you do not know it, then use the “Address and payment details of the inspection” service on the Federal Tax Service website. - Title page - rely on the passport. Do not put a date if you are not going to submit the form to the Federal Tax Service on the same day.

You can download this sample from here .

To fill out 3-NDFL for 2016, click here.

Example of filling out for 2017 :

- Sheet D1 - be sure to save this sheet from the last report (make 2 copies, otherwise you may not remember what your balance was, what part of the compensation you used). In line 160 you need to indicate the same balance from the previous declaration that you indicated in line 230. And in line 230 of this declaration write the new balance: old balance - annual income. Gavrilova only has 60,000 left for compensation, i.e. she will return only 7,800 for 2022, and this will exhaust her right.

- Sheet A is filled out as standard.

- Section 2 - calculate the amount to be refunded. This sheet reflects the results of the 2 previous pages.

- Section 1 - standard filling.

- Cover page - copy all the information from the previous cover page, except for the year - here it is already 2022. This form does not indicate an address.

Download this form here .

To fill out the declaration for 2022, click here.

Example of filling out for 2018 :

Appendix 7 - in the new form the sheets are called differently. In Appendix 7 at the top, fill in the fields about the object itself.

And then indicate the portion used, your income for the year, and the balance carried over to the new year. Gavrilova only transferred 60,000 rubles, which means that in 2022 she will receive 7,800 rubles back.

Appendix 1 - former sheet A. Filling out has become shorter.

Section 2 - results of previous pages.

Section 1 - result.

The title page is almost the same as in the previous version.

you can follow the link .

to fill out your 2022 return here.

Receipt procedure

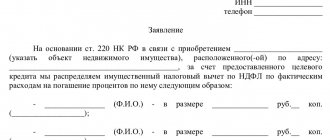

You must contact the tax office and apply for a deduction. It can be issued on paper or electronically in advance.

The applicant must indicate his income, as well as provide information confirming the fact of purchasing real estate or obtaining a mortgage loan.

A tax deduction from an employer when purchasing an apartment is one of the options for refunding funds. How to file a waiver of a tax deduction in favor of a spouse? A sample application is here.

How to calculate the standard child tax credit? Details in this article.

Required documents

To receive the remainder of the property tax deduction, you must provide:

- certificate 2-NDFL;

- declaration 3-NDFL;

- certificate of payment of interest, as well as payment documents;

- title documents for real estate;

- deed of transfer of real estate.

Here is a sample of a 2-NDFL certificate,

sample application for tax deduction,

sample declaration 3-NDFL.

A citizen can contact the Federal Tax Service in person or through a representative. If the applicant acts through an intermediary, then the tax office will need to bring a notarized power of attorney.

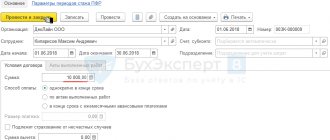

Filling example

Taxpayers are offered 3 options for filling out form 3-NDFL:

- on the declaration form;

- through the official Federal Tax Service “Declaration” program (you can download the application on the Tax Inspectorate website);

- through the taxpayer’s personal account on the tax service website.

The program makes it easy to create a report. It is required to answer the questions proposed to the applicant; as a result, the sheets of the 3-NDFL document will be generated automatically.

Filling out a declaration using the program

The principle of working with the application is answers to questions on the basis of which specific declaration sheets are formed. In our case, it is necessary to provide detailed information about the acquired property and income for previous years, so that the program generates Appendix 7 of the document. Please note that sections with personal data and information about the employer are required.

Let's assume that in 2022 an apartment was purchased for 1,900,000 rubles. At the same time, a citizen’s salary subject to income tax is 480 thousand rubles per year.

- In the program, open the menu “Income received in the Russian Federation”.

- We choose a rate of 13%.

We choose a rate of 13 percent

- Click on the green plus sign under the rate and enter information about the employer.

- Below, click another plus sign and fill in information about income (the code is indicated in certificate 2-NDFL).

Filling in information about income

- Earnings are paid for each month, the total amount is calculated automatically.

- Under the total amount, you need to indicate the part of the salary that was withheld (you can find the exact figure in paragraph 5 of the 2-NDFL certificate).

Amount withheld

- Then go to the deductions tab and fill in information about the property

- From the available options, choose “property”.

Choosing a property deduction

- Click the green plus sign to add a property.

- In the window that opens, carefully enter the following information: method of acquiring the property;

- taxpayer identification (owner, etc.);

- cadastral number of the object;

- date of registration of ownership;

- cost of the object;

- if the applicant is a pensioner, you need to tick the appropriate box.

Object information

- After filling in the data, the total price of the object will be displayed below, and under it the field “Deduction for previous years.”

- In this field we enter the refund amount received previously. In our case, these are 2 previous reporting years - 2022 and 2022. The calculation is carried out according to the algorithm we discussed above. We multiply the income of 480 thousand rubles by two and get an amount of 960 thousand. We enter it in the required field.

- Then click the “Save” button. All necessary sheets are generated automatically.

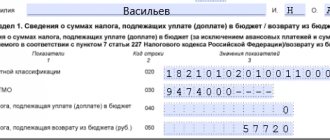

- This is what Appendix 7 will look like with data on deductions for the previous, current and subsequent periods.

Example application 7

- Please note that clause 2.1 indicates previously taken into account deductions, clause 2.6 indicates the amount of the benefit for the reporting period, and clause 2.8 indicates the unused balance that carries over to the next tax period.

If the declaration is filled out without using a program, then the same data is entered manually into the corresponding sheets of the document.

Receiving a deduction for several years at once

A citizen has the right to receive a refund for the purchase of real estate at any time. The only restrictions:

- maximum amount (no more than 2 million rubles);

- availability of official earnings subject to personal income tax;

- recorded income (only earnings for the last three years are taken into account).

The filing deadline of April 30 applies only to those citizens who declare their income and are required to pay tax. Those wishing to receive a property deduction can contact the Federal Tax Service throughout the year following the purchase of real estate.

When receiving a return for several years at once, the information is reflected not in a single declaration, but separately - for each reporting period. Thus, the number of reporting documents must correspond to the number of years for which the return is issued.

About taxes and relations with the state in simple language

Site search

Subscribe to our VKontakte group!

latest comments

- Tatyana on I have already submitted a declaration, what documents should I provide next year?

- Administrator "Simple taxes" to the entry Documents for obtaining a property deduction

- Vasily on Documents for obtaining a property deduction

Join our group on Odnoklassniki!

The last notes

- Loan agreement between an individual and a legal entity 06/28/2017

- How can you distribute the deduction for interest paid between spouses 06/06/2017

- Payment for tuition by the other spouse 05/13/2017

- Tax deduction under an equity participation agreement 03/14/2017

- Payment for treatment by the other spouse 02/11/2017

Contacts

Social media

Terms of use of the site

On the “Simple Taxes” website, the user has the opportunity to read articles written by an experienced expert, ask a question on the topic of the site and receive an answer from an expert. The expert’s answer represents his private opinion on a given issue, based on the analysis and interpretation of the norms of the current legislation of the Russian Federation and law enforcement acts, is of an informational nature, and is not binding for the user. The expert and the site administration are under no circumstances liable for any losses, including actual damages and lost profits, penalties and/or claims of third parties related to the use of answers to the questions asked.