Step-by-step instruction

On June 29, the Organization sold a Nissan Teana car to the buyer Simbirsoft LLC at a price of RUB 240,000. (including VAT 20%). On the same day, the Nissan Teana car was deregistered with the traffic police.

Depreciation in accounting and for profit tax purposes was calculated using the straight-line method. The depreciation bonus for sold fixed assets was applied in the amount of 30%.

The residual value of the fixed asset (BU = 440,000 rubles, NU = 308,000 rubles) exceeded sales revenue.

The parties to the transaction are not interdependent persons.

Sales are made before the expiration of 5 years from the date of commissioning of the vehicle.

Its remaining useful life is 11 months.

On July 2, payment was received from the buyer to the bank account in the amount of RUB 240,000.

Let's look at step-by-step instructions for creating an example. PDF

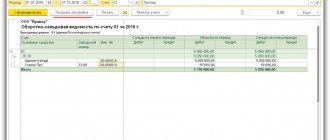

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| OS implementation | |||||||

| June 29 | 62.01 | 91.01 | 240 000 | 240 000 | 200 000 | Revenue from OS sales | OS transfer |

| 26 | 02.01 | 40 000 | 28 000 | 28 000 | Calculation of depreciation for the last month | ||

| 02.01 | 01.09 | 560 000 | 392 000 | 392 000 | Write-off of accumulated depreciation | ||

| 01.09 | 01.01 | 1 000 000 | 700 000 | 700 000 | Write-off of the initial cost of the OS | ||

| 91.02 | 01.09 | 440 000 | 308 000 | 308 000 | Write-off of residual value of fixed assets | ||

| 91.02 | 68.02 | 40 000 | VAT accrual on revenue | ||||

| Issuance of SF for shipment to the buyer | |||||||

| June 29 | — | — | 240 000 | Issuing SF for shipment | Invoice issued for sales | ||

| — | — | 40 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Deregistration of a car | |||||||

| June 29 | — | — | — | Removing a car from registration with the traffic police | Register of information Registration of vehicles - Deregistration | ||

| Reflection in the tax accounting amount of the loss from the sale of fixed assets | |||||||

| June 29 | 97.21 | 91.09 | — | 108 000 | 108 000 | Transfer of the amount of loss from the sale of fixed assets to the remaining private investment fund (NU) | Manual entry - Operation |

| Receipt of payment from the buyer | |||||||

| July 02 | 51 | 62.01 | 240 000 | 240 000 | Receipt of payment from the buyer | Receipt to the bank account - Payment from the buyer | |

| Accounting for the monthly amount of loss as part of indirect expenses for NU | |||||||

| July 31 | 91.02 | 97.21 | — | 9 818,18 | 9 818,18 | Accounting for the monthly amount of loss as part of indirect expenses (IO) | Closing the month - Write-off of deferred expenses |

For the beginning of the example, see the publications:

- Purchasing a car

- Acceptance for accounting of fixed assets with bonus depreciation

OS implementation

Regulatory regulation

Sales are recognized as the transfer of ownership of goods (including fixed assets) on a reimbursable basis (Article 39 of the Tax Code of the Russian Federation). At the same time, organizations must take into account the income and expenses associated with acquisitions and sales.

Income:

- In the accounting system, revenue from the sale of fixed assets is classified as other income and is reflected in the credit of account 91.01 “Other income” (clause 31 of PBU 6/01, clause 7 of PBU 9/99, chart of accounts 1C). Income is recognized at the moment of transfer of ownership of the fixed asset (clause 12 of PBU 9/99).

- In NU, income is the proceeds from the sale of fixed assets without VAT (clause 1 of Article 248 of the Tax Code of the Russian Federation). The date of receipt of income using the accrual method is the date of transfer of ownership of the asset (clause 1, article 39 of the Tax Code of the Russian Federation, clause 3 of article 271 of the Tax Code of the Russian Federation).

Expenses:

- In accounting, this is the residual value of the fixed asset and the costs associated with its implementation (dismantling, transportation, evaluation, etc.) (clause 5, clause 9 of PBU 10/99). Expenses in the accounting system are reflected in the debit of account 91.02 “Other expenses” (clause 31 of PBU 6/01, clause 11 of PBU 10/99, chart of accounts 1C).

- In NU, the amount of expenses that reduce sales income, just as in accounting accounting, includes the residual value of the fixed asset and expenses associated with its sale (Article 249 of the Tax Code of the Russian Federation, paragraph 1, clause 1, Article 268 of the Tax Code of the Russian Federation).

If the sale of fixed assets is carried out, in respect of which a depreciation bonus was previously applied, then the bonus must be restored if:

- the object is sold to a person who is interdependent with the taxpayer earlier than after 5 years from the date of commissioning.

VAT

Sales of fixed assets are subject to value added tax on the date of shipment (transfer) of fixed assets (clause 3 of article 38 of the Tax Code of the Russian Federation, clause 1 of article 39 of the Tax Code of the Russian Federation, subclause 1 of clause 1 of article 146 of the Tax Code of the Russian Federation, article 147 of the Tax Code RF).

The date of shipment of the OS is recognized (clause 1, clause 1, clause 16, article 167 of the Tax Code of the Russian Federation):

- date of drawing up the transfer and acceptance certificate (for example, OS-1) - for movable property;

- the date of transfer to the buyer according to the transfer and acceptance certificate, regardless of the date of state registration of the transfer of ownership - for real estate.

Features of calculating the tax base and the applied VAT rate depend on how input VAT was taken into account when purchasing fixed assets:

- VAT was not included in the cost of fixed assets (clause 1 of Article 154 of the Tax Code of the Russian Federation): tax base - the contractual cost of the sold fixed assets;

- VAT rate is 20%.

- tax base - profit from the sale of fixed assets, representing the difference between the contractual value of the sold fixed assets and its residual value;

When selling fixed assets, it is not necessary to restore the VAT accepted for deduction upon purchase, even if the fixed assets were sold at a loss (clause 3 of Article 170 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated January 15, 2015 N 03-07-11/422).

The amount of accrued VAT is reflected in Dt 91.02 “Other expenses” in correspondence with Kt 68.02 “Value added tax”.

Accounting in 1C

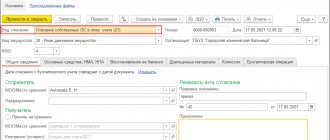

The sale of fixed assets is documented in the document Transfer of fixed assets in the section fixed assets and intangible assets - Disposal of fixed assets - Transfer of fixed assets.

The header of the document states:

- OS event - description of the OS transfer event. In our example - Sale , which has an OS event type - Transfer ;

- Agreement - a document according to which settlements are made with the buyer, Type of agreement - With the buyer .

In our example, settlements under the agreement are carried out in rubles PDF. As a result of selecting such an agreement, the following subaccounts for settlements with the buyer are automatically established the Transfer of Assets

- Settlement account - 62.01 “Settlements with buyers and customers”;

- Advances account - 62.02 “Calculations for advances received.”

If necessary, accounts for settlements with the buyer can be corrected in the document manually or configured for the automatic insertion of other accounts for settlements with the counterparty.

On the Fixed Assets , the following is indicated:

- Fixed asset - implemented by the OS, selected from the Fixed Assets directory;

- Income account - 91.01 “Other income”;

- Subconto - an analytical item for accounting for other income and expenses, selected from the directory Other income and expenses, Type of article - Sales of fixed assets ;

- VAT account - 91.02 “Other expenses”;

- Expense account - 91.02 “Other expenses”. For analytical accounting, the same Subconto as for other income.

Postings according to the document

The document generates transactions:

- Dt 62.01 Kt 91.01 - revenue from the sale of fixed assets;

- Dt 91.02 Kt 01.09 - write-off of residual value;

- Dt 91.02 Kt 68.02 - accrual of VAT on the sale of fixed assets;

- Dt Kt 02.01 - depreciation calculation for the month of disposal of fixed assets;

- Dt 02.01 Kt 01.09 - write-off of accumulated depreciation to determine the residual value;

- Dt 01.09 Kt 01.01 - write-off of the original cost to determine the residual value;

Control

Calculation of monthly depreciation amount:

Calculation of financial results:

Documenting

The organization must approve the forms of primary documents, incl. OS implementation document and an inventory card form for OS accounting. In 1C, the OS Acceptance and Transfer Certificate (OS-1) and the OS Inventory Card (OS-6) are used.

The form can be printed by clicking the Print button - Certificate of acceptance of the transfer of OS (OS-1) of the document Transfer of OS . PDF

Based on this act, a record of disposal is made in the inventory card of the sold fixed assets, which is attached to the act of acceptance and transfer of fixed assets (clause 81 of the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n).

the OS Inventory Card (OS-6) button in Fixed Assets directory . PDF

Income tax return

Starting from the half-year declaration, the loss from the sale of fixed assets will be reflected in Appendix 3 to Sheet 02: PDF

- line 010 - number of retired fixed assets;

- line 020 - number of retired fixed assets with a loss;

- line 030 - revenue from the sale of fixed assets;

- line 040 - residual value of fixed assets;

- line 060 - loss from the sale of fixed assets.

Accounting

Accounting for real estate objects that are the property of an organization is determined by PBU 6/01 “Accounting for fixed assets” (hereinafter referred to as PBU 6/01) and Methodological guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 N 91n (hereinafter referred to as Methodological Guidelines). instructions No. 91n).

It should be noted that neither PBU 6/01 nor Methodological Instructions N 91n provide for the procedure for reflecting transactions for the division of fixed assets.

In this regard, we consider it necessary to note the following.

The cost of an item of fixed assets is subject to write-off from accounting in the event of its disposal, in particular due to sale or partial liquidation during reconstruction work (clause 29 of PBU 6/01, clause 76 of Methodological Instructions N 91n). At the same time, from the first day of the month following the month of disposal of the fixed asset item, the accrual of depreciation charges for this object stops (clause 22 of PBU 6/01, clause 62 of Methodological Instructions N 91n).

As we have already noted, the fact of registration of new real estate objects that arose after the division of a single non-residential premises does not entail the termination of ownership of this property (letters of the Ministry of Finance of Russia dated November 29, 2011 N 03-05-06-03/91, dated November 9, 2007 N 03-05-06-03/87, dated 05/24/2007 N 03-05-06-03/26). However, when dividing a property, new premises are registered under independent cadastral numbers, which, in essence, means the disposal of the original property and the emergence of four new properties, for which the organization has received new title documents.

The list of reasons for disposal of fixed assets is not closed.

In our opinion, in relation to the situation under consideration, the reflection in the accounting of transactions on the disposal of real estate, as the primary object of accounting, and the acceptance of new premises as fixed assets for accounting, may be as follows:

First option

Debit 01, (new fixed asset) Credit 01, (old fixed asset item)

— the initial cost of a new property has been formed - Premises 1; Debit 02, (old fixed asset) Credit 02, (new fixed asset) - the amount of accrued depreciation related to the new fixed asset - Premises 1 is transferred. Similar entries should be reflected when reflecting the acceptance of Premises 2, 3, 4 for accounting.

In this case, the initial cost of the fixed asset and the amount of depreciation accrued on it is distributed by the organization among new accounting objects depending on the allocated objects, i.e. either in proportion to the total area (if the cost of each square meter is approximately the same), or based on other criteria established by the organization.

However, there is another option for reflecting the section of a fixed asset item in accounting.

The second option

It is based on the assumption that new real estate objects are registered under independent cadastral numbers, which, in essence, means the disposal of the original real estate object and the emergence of two new ones, for which the organization has received new title documents. The Ministry of Finance of Russia also refers to this (letters dated November 29, 2011 N 03-05-06-03/91, dated November 9, 2007 N 03-05-06-03/87, dated May 24, 2007 N 03-05-06- 03/26).

In this case, income and expenses from writing off fixed assets from accounting are reflected in accounting in the reporting period to which they relate and are subject to credit to the profit and loss account as other income and expenses (clause 31 of PBU 6/01, p. 86 Guidelines No. 91n).

With this accounting option, the following accounting entries are made:

Debit 01, subaccount “Retirement of fixed assets” Credit 01, subaccount “Own fixed assets” - the original cost of the old fixed asset item is written off; Debit 02 Credit 01, subaccount “Disposal of fixed assets” - the amount of accumulated depreciation on the old fixed asset is written off; Debit 91, subaccount “Other expenses”, Credit 01, subaccount “Disposal of fixed assets” - the residual value of the old fixed asset item is written off.

And at the same time: Debit 08 Credit 91, subaccount “Other income” - reflects the emergence of a new property - Premises 1; Debit 01, subaccount “Own fixed assets” Credit 08 - Premises 1 is included in the fixed assets.

Similar entries should be reflected when reflecting the acceptance of new real estate objects for accounting (Premises 2, 3, 4).

Due to the fact that the regulatory legal acts on accounting do not define the procedure for reflecting operations on the division of fixed assets, we recommend that the chosen accounting option be fixed in the accounting policy of the organization.

At the same time, taking into account that the form of the primary accounting document intended for dividing the inventory number of an object of fixed assets is not approved by regulatory legal acts, we recommend that in the accounting policy of the organization either approve Form N OS-4 as used when registering these transactions, or independently develop and approve your form. Let us recall that the obligation to use unified forms of primary documents in accounting, with the exception of those established by authorized bodies in accordance with and on the basis of federal laws (for example, cash documents), was abolished as of January 1, 2013 (see information from the Ministry of Finance of Russia dated December 4, 2012 N PZ-10/2012, Article 9 of Law N 402-FZ). From this date, each organization develops and approves forms of primary accounting documents independently. Also, the forms of primary documents of federal executive authorities that organizations used previously can be approved as primary ones.

Please note that the business transaction in question must be based on an order from the manager (or his authorized person), which determines the purpose and procedure for carrying out this operation.

Issuance of SF for shipment to the buyer

The organization is obliged to issue an invoice within 5 calendar days from the date of shipment and register it in the sales book (clause 3 of article 168 of the Tax Code of the Russian Federation).

You can issue an invoice to the buyer by clicking the Issue an invoice on the document Transfer of fixed assets . PDF

Invoice data is automatically filled in based on the document Transfer of Assets .

- Operation type code : “Sale of goods, works and services and operations equivalent to it.”

Documenting

You can print the completed invoice form by clicking the Print from the document Invoice issued or the document Transfer of Assets . PDF

Sales Book report can be generated from the Reports – VAT – Sales Book section. PDF

VAT declaration

The amount of accrued VAT is reflected in the VAT return:

In Section 3 p. 010 “Implementation (transfer on the territory of the Russian Federation...)”: PDF

- amount of sales revenue, excluding VAT;

- the amount of accrued VAT;

In Section 9 “Information from the sales book”:

- invoice issued. Operation type code "".

VAT

The objects of VAT taxation are transactions involving the sale of goods (work, services) on the territory of the Russian Federation (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation). According to paragraph 1 of Art. 39 of the Tax Code of the Russian Federation, sales are recognized as the transfer on a paid (or in some cases gratuitous) basis of ownership of goods, the results of work performed by one person for another person, and the provision of services for a fee by one person to another person. Thus, in the situation under consideration, the object of taxation does not arise.

Cases in which amounts of VAT previously accepted for deduction by the taxpayer on fixed assets are subject to restoration are defined in clause 3 of Art. 170 Tax Code of the Russian Federation. The specified paragraph does not provide for the case of division (or other transformation) of a real estate property.

The texts of the documents mentioned in the experts’ response can be found in the GARANT legal reference system.

Deregistration of a car

When selling a vehicle, it is necessary to deregister the vehicle with the traffic police. From the moment of deregistration, the collection of transport tax stops.

If the vehicle is deregistered during the year, then the advance payment for transport tax is calculated taking into account the ownership coefficient (clause 3 of Article 362 of the Tax Code of the Russian Federation).

Deregistration of a vehicle with the State Traffic Safety Inspectorate is completed in the register of information Registration of vehicles, type of operation Deregistration in the section Directories - Taxes - Transport tax.

The register indicates:

- Fixed asset - a vehicle that is deregistered;

- Date - the date of its deregistration with the traffic police.

Property tax

In accordance with paragraph 1 of Art. 375 of the Tax Code of the Russian Federation, the tax base for property tax is defined as the average annual value of property recognized as an object of taxation, taken into account at its residual value, formed in accordance with the established accounting procedure approved in the accounting policy of the organization.

Thus, if for accounting purposes the organization applies the procedure recommended above, in this case the tax base for property tax will not be distorted compared to the period before the date of division of the fixed asset item.

Reflection in the tax accounting amount of the loss from the sale of fixed assets

If the residual value of an asset, taking into account the costs associated with its sale, exceeds the proceeds from its sale, then the difference between these values is recognized as a loss.

The loss from the sale of fixed assets under NU cannot be fully taken into account at the time of sale of the fixed assets. It is included in indirect (other) expenses in equal shares over the remaining useful life of the asset, defined as the difference between the established useful life of the asset and the actual life of its operation until the moment of sale (clause 3 of Article 268 of the Tax Code of the Russian Federation).

The loss under the accounting system is fully taken into account at the time of sale (clause 31 of PBU 6/01).

Determining the amount of loss

The amount of loss subject to equal write-off in tax accounting can be determined using the report Register of information on financial results from the sale of fixed assets and intangible assets in the section Reports - Income tax - Tax accounting registers - Register of reporting data generation - Financial results from the sale of fixed assets and intangible assets.

Reflection in the tax accounting amount of the loss from the sale of fixed assets

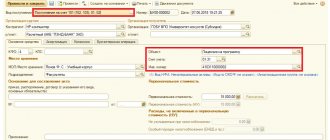

There is no standard document for reflecting in NU the operation of accounting for the amount of loss from the sale of fixed assets in 1C.

Therefore, we propose to reflect the loss from the sale of fixed assets according to NU by posting Dt 97.21 Kt 91.09:

- in the debit of account 97.21 - the transfer of losses to the future is reflected to automatically include the loss in other expenses in equal shares over the remaining useful life of the fixed assets;

- on the credit of account 91.09 - the loss is excluded from the expenses of the current period in NU.

This operation is reflected using the document Transaction entered manually, the operation type Operation in the section Operations – Accounting – Transactions entered manually.

The document states:

- Date - date of implementation of the OS;

- The amount is not indicated, because in accounting, the loss was recognized at a time when the document Transfer of Assets .

The reference book Deferred Expenses specifies the parameters for recognizing losses from the sale of fixed assets in the National Institution:

- Type for NU - Losses from the sale of depreciable property ;

- Amount - 108,000 , i.e. amount of loss according to NU;

The amount in the Deferred Expenses is indicated for reference only. To calculate the monthly loss amount, the amount indicated in account 97.21 is used, i.e. Amount NU Dt document Transaction entered manually .

- Recognition of expenses - By month ;

- The write-off period from to is the period during which the loss will be taken into account in other expenses for NL. Set starting from the month following the implementation, ending with the last month of the OS SPI.

Control

Income tax

For tax accounting purposes, depreciable property (fixed assets) is property with a useful life of more than 12 months and an original cost of more than 40,000 rubles, which is owned by the taxpayer, used to generate income and the cost of which is repaid by calculating depreciation (clause 1 Article 256, paragraph 1 of Article 257 of the Tax Code of the Russian Federation).

Features of organizing and maintaining tax accounting for transactions with depreciable property are defined in Art. 322 and 323 of the Tax Code of the Russian Federation. The taxpayer determines profit (loss) from the disposal of depreciable property on the basis of analytical accounting for each item as of the date of recognition of income (expense). Analytical accounting must contain, in particular, information about the initial and residual value of property disposed of in the reporting (tax) period, the amount of accrued depreciation, and the dates of acquisition and disposal of property.

At the same time, Ch. 25 of the Tax Code of the Russian Federation does not provide for options for reflecting transactions when fixed assets arise as a result of the division of depreciable property owned by the taxpayer. In fact, the division of a building in the situation under consideration is difficult to recognize as its reconstruction, modernization, technical re-equipment and others that affect the change in the initial cost of an existing depreciable property (clause 2 of Article 257 of the Tax Code of the Russian Federation). In this case, several independent objects of fixed assets arise, for each of which analytical accounting must be carried out.

In our opinion, since in the situation under consideration the disposal of a fixed asset is not associated with its sale, expenses, including amounts of depreciation underaccrued in accordance with the established useful life, are included in non-operating expenses (clause 8, clause 1, article 265 of the Tax Code of the Russian Federation).

In turn, the cost of new premises taken into account as depreciable property is included in the non-operating income of the taxpayer on the basis of clause 8 of Art. 250 Tax Code of the Russian Federation. The assessment of income in this case is carried out on the basis of market prices, determined taking into account the provisions of Art. 105.3 of the Tax Code of the Russian Federation, but not lower than the residual value of depreciable property, determined in accordance with Chapter. 25 Tax Code of the Russian Federation. In this case, information on prices must be confirmed by the taxpayer with documents, which in the situation under consideration does not present any difficulties.

Let us recall that by virtue of paragraph 1 of Art. 257 of the Tax Code of the Russian Federation, the residual value of fixed assets (put into operation after the entry into force of Chapter 25 of the Tax Code of the Russian Federation) is defined as the difference between their original cost and the amount of depreciation accrued during the period of operation.

According to the Russian Ministry of Finance, set out in letter No. 03-03-06/1/632 dated October 6, 2011, for tax accounting purposes, the value of premises for which ownership rights have been registered in exchange for ownership of the entire building is determined based on the original cost of the building and the share the area of the new premises minus the amounts of accrued depreciation on the building, calculated in proportion to the area of the newly formed premises. At the same time, the useful life of each new premises remains unchanged and corresponds to the previously established service life of the building.

Taking into account the above, in tax accounting the organization disposes of real estate as an object of depreciable property, and four new objects of depreciable property arise. At the same time, these operations will not have an impact on the overall financial result of the taxpayer’s activities, since the amounts of non-operating expenses and non-operating income generally coincide.

Receipt of payment from the buyer

At the time of sale of the fixed assets, the buyer’s receivables were reflected in accordance with Dt 62.01 “Settlements with buyers and customers.” When payment is received from the buyer, the receivables are repaid and the posting Dt Kt 62.01 (chart of accounts 1C) is generated.

Receipt of payment from the buyer is documented with the document Receipt to the current account; transaction type Payment from the buyer based on the document Transfer of fixed assets by clicking the Create button based on - Receipt to the current account.

Document Receipt to current account transaction type Payment from buyer can be:

- enter through the section Bank and cash desk – Bank – Bank statements – Receipt button;

- download from the Client-Bank program or directly from the bank if the 1C:DirectBank service is connected.

The document states:

- from - date of payment by the buyer, according to the bank statement;

- According to document No. from - the number and date of the buyer’s payment order, according to the bank statement.

- Payer - the buyer who transferred the payment;

- Amount - payment amount in rubles, according to the bank statement;

- Agreement - a document according to which settlements are made with the buyer, Type of agreement - With the buyer .

- An income item is a cash flow item. In our example, fixed assets are sold, so the Income Item is indicated with the Type of Movement - Proceeds from the sale of non-current assets (except for financial investments) .

Selecting the Income Item in the payment document from the buyer is necessary to automatically fill out the Cash Flow Statement.

Postings according to the document

Document we generate transactions:

- Dt Kt 62.01 – receipt of payment from the buyer.

Accounting for the monthly amount of loss as part of indirect expenses for NU

Every month until the loss is written off in full, in the procedure menu Closing the month is a routine operation Write-off of deferred expenses .

Postings according to the document

The document generates transactions:

- Dt 91.02 Kt 97.21 - recognition in the current month of the monthly amount of loss under NU.

Control

The calculation of the portion of the amount of loss in the taxable income included monthly in other expenses is determined by dividing the entire amount of the unaccounted loss in the taxable income by the remaining useful life.

Income tax return

Starting from the half-year declaration, the monthly amount of the loss written off is reflected as part of indirect (other) expenses: PDF

- Sheet 02 Appendix No. 2 page 100 “Amount of loss from the sale of depreciable property.”

Test yourself! Take a test on this topic using the link >>