What is the difference between vacation pay and sick pay in terms of personal income tax?

Form 6-NDFL, along with regular payments subject to personal income tax, includes vacation pay and sick pay. Unlike wages paid every half month (Article 136 of the Labor Code of the Russian Federation), they are calculated:

- vacation pay - when taking a vacation with payment no later than 3 calendar days before its start (Article 136 of the Labor Code of the Russian Federation);

ATTENTION! In order not to make a mistake with the date of payment of vacation pay and not to incur a fine from the labor inspectorate and interest for late payments to employees, read our publication “If vacation is from Monday, you cannot issue vacation pay on Friday.”

- sick leave - within 10 calendar days after receiving the relevant document from the employee and is paid along with the next salary (Clause 1, Article 15 of the Law of the Russian Federation “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 No. 255- Federal Law").

IMPORTANT! Starting from 2022, the employer pays only the first 3 days of sick leave and some benefits. The remaining payments are made directly by the FSS.

If there are differences in the timing of accruals and payments for vacation and sick leave, there are the same rules for determining:

- the date of recognition of income as received for the purposes of calculating personal income tax - it corresponds to the date of payment of income (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation);

- deadline for paying personal income tax - this is the last date of the month in which payments were made (clause 6 of article 226 of the Tax Code of the Russian Federation).

Regarding the last period, vacation pay and sick leave differ from all other income, personal income tax on which must be paid no later than the first working day following the day of payment (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Because of this feature, in 6-NDFL, vacation and sick leave in most cases will be shown separately from other payments.

About the features of accounting for salary advances in 6-NDFL, read the article “How to correctly reflect an advance in the 6-NDFL form (nuances)?” .

Important details of vacation pay

When the start and end of the vacation fall within one month or one reporting period, problems with reflecting the corresponding amounts in Calculation 6-NDFL, as a rule, do not arise.

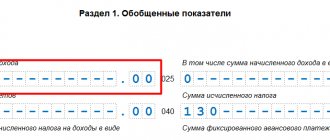

Let us remind you that section 1 of Calculation 6-NDFL “Generalized indicators” is filled out for the organization as a whole on an accrual basis. Section 2 “Dates and amounts of income actually received and withheld personal income tax” reflects the indicators for the reporting period. Now we list the rules for reflecting vacation pay in Calculation 6-NDFL.

Rule 1 . Income in the form of vacation pay is considered received on the day of their payment (Article 223 of the Tax Code of the Russian Federation) and is reflected on page 100 of Section 2.

Rule 2. Personal income tax is withheld on the day the money is paid to employees (Article 226 of the Tax Code of the Russian Federation) and is reflected on page 110 of Section 2. Thus, the same date is entered in lines 100 and 110.

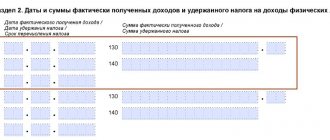

Rule 3. Vacation pay along with personal income tax is reflected on line 130, personal income tax withheld from vacation pay is reflected on line 140.

Rule 4 . The deadline for paying personal income tax to the budget (Article 226 of the Tax Code of the Russian Federation) is the last day of the month in which the money is paid, the amount is reflected on page 120 of Section 2.

Rule 5. In Calculation 6-NDFL, paid vacation pay is shown, not accrued. However, there is an important exception to this rule. If vacation pay is paid in the last month of the quarter, and the last day of this month falls on a weekend, then the deadline for transferring the tax is the next period (clause 6 of Article 226 of the Tax Code of the Russian Federation). Since the payment of vacation pay has taken place, this fact is recorded in section 1 of the Calculation. Section 2 of the Calculation for the next period reflects the deadline for transferring personal income tax to the budget (line 120) (letter of the Federal Tax Service of Russia dated 04/05/2017 No. BS-4-11/6420).

Reflection in 6-NDFL of vacation pay paid separately and together with salary

From reporting for 2022, Form 6-NDFL was updated by order of the Federal Tax Service dated September 28, 2021 No. ED-7-11/ [email protected]

Use sample 6-NDFL 2021, compiled by ConsultantPlus experts, and check whether you filled out everything correctly. This can be done for free by getting trial online access to the system.

How to reflect vacation pay in 6-NDFL? In most cases, situations regarding personal income tax on vacation pay come down to 2 options:

- vacation pay is paid separately from salary as it accrues - then they are shown in separate lines of section 1 of form 6-NDFL for two reasons: there is a specific deadline for paying income and a special deadline for paying personal income tax on it;

- vacation pay is paid along with the salary (for example, during a vacation followed by dismissal) - in this case, they still need to be shown in separate lines of section 1 of form 6-NDFL, since with a single deadline for paying income, the deadline established for paying personal income tax will be different from it, which is indicated in line 021.

At the border of periods, the deadline for paying personal income tax on vacation pay, subject to the general procedure for transferring it to the next working day if it falls on a weekend (Clause 7, Article 6.1 of the Tax Code of the Russian Federation), may move to the quarter following the reporting period. But from 2022, this does not matter for filling out the first section of 6-NDFL. It indicates all personal income tax amounts that were withheld in the last 3 months of the reporting period. Even if the payment deadline moves to the next quarter, the tax is reflected in the period in which it was withheld.

If you have access to ConsultantPlus, check whether you have correctly reflected vacation pay in 6-NDFL. If you don't have access, get a free trial of online legal access.

Form 6-NDFL

Quarterly personal income tax reporting in Form 6-NDFL has been established for tax agents since 2016 by Federal Law No. 113-FZ dated May 2, 2015.

In calculations using Form 6-NDFL, the tax agent provides general information on all individuals who received income from him. These are the amounts of paid income, provided tax deductions, calculated and withheld personal income tax and the timing of its transfer to the budget (clause 1 of Article 80 of the Tax Code of the Russian Federation).

The calculation consists of sections, each of which must be completed:

Title page;

Section 1 “Generalized indicators”;

Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

Form No. 6-NDFL must be submitted:

- for the first quarter – no later than April 30;

- for half a year - no later than July 31;

- for nine months - no later than October 31;

- for the year - no later than April 1 of the year following the reporting year.

The date of submission of the calculation is considered:

- the date of its actual submission - when submitted personally or by a representative of a tax agent to the tax authority;

- the date of its sending by mail with a description of the attachment - when sent by mail;

- the date of its dispatch, recorded in the confirmation of the date of dispatch in electronic form via telecommunication channels of the electronic document management operator.

How to show carryover vacation pay and their recalculation?

How to reflect vacation pay that transfers to another month or quarter in form 6-NDFL? This is done according to the general rules:

- accrual of income in the form of vacation pay and related tax, regardless of which period they relate to, in accordance with the actual date of these accruals and the payment deadline established for them will fall into the general figures of section 2 of form 6-NDFL;

- payment of vacation pay will be shown in section 1 of form 6-NDFL for the period of personal income tax withholding, with details by tax payment deadline.

For an example of filling out 6-NDFL for carryover vacation pay, see ConsultantPlus. Trial access to the system is free.

The need to recalculate vacation pay after submitting reports with data on it may arise in 2 situations:

- An error was made when calculating vacation, and incorrect data was included in the report. In this case, you must submit an updated 6-NDFL report with the correct information in it.

- The recalculation has statutory reasons and is legally carried out later than the initial calculation of vacation pay (for example, when recalled from vacation, upon dismissal, when vacation is postponed due to untimely payment of vacation pay). In such a situation, data on it can be included in the corresponding lines of the report for the period in which the recalculation was made (letter of the Federal Tax Service dated May 24, 2016 No. BS-4-11/9248, Federal Tax Service for Moscow dated March 12, 2018 No. 20-15/049940 ).

See also “Clarification 6-NDFL: when not needed when recalculating vacation.”

How to reflect study leave in 6-NDFL was explained by N. N. Taktarov, 3rd class adviser to the State Civil Service of the Russian Federation. To do it right, get a trial online and study the official's opinion for free.

Payments under GPA in 6-NDFL

Remunerations under civil contracts must be included in the calculation of 6-NDFL starting from the reporting period in which they were paid to the individual, since the day of actual receipt of such income is the date of their payment.

Please note that the date of signing the act for work performed or services provided does not matter.

In Sect. 1 of the 6-NDFL calculation, you need to reflect the amount of tax withheld from payments under civil contracts, if the deadline for its transfer falls on the last three months of the reporting period:

- in field 020, include in the total tax withheld for the last three months of the reporting period the amount of personal income tax withheld from remuneration under civil contracts;

- in field 021 indicate the first working day following the day of payment of remuneration;

- in field 022 reflect the amount of withheld personal income tax, the transfer deadline for which falls on the date specified in field 021.

If remuneration is paid to an individual in parts, then each of them is reflected in a separate block of fields 021, 022. This is due to the fact that the timing of the transfer of personal income tax on each part of the remuneration paid is different.

In Sect. 2 calculations of 6-NDFL, remuneration under a civil contract and the corresponding tax must be reflected on an accrual basis, starting from the report for the period in which the payment was made until the end of the reporting year as follows:

- in field 100 – indicate the rate at which the tax on remuneration under the contract is calculated (for example, 13);

- in field 110 - the total amount of income for all individuals since the beginning of the year, which are taxed at this rate, including remuneration under a civil contract;

- in field 113 – taxed at the rate reflected in field 100, the total amount of income for all individuals from the beginning of the year under civil contracts, the subject of which is the performance of work (rendering services);

- in field 120 - the total number of individuals who received payments reflected in field 110;

- in field 130 - the total amount of tax deductions for personal income tax provided for payments from field 110, including deductions for remuneration under a civil contract;

- in field 140 - the amount of personal income tax calculated on all income indicated in field 110 (including deductions), including tax calculated on remuneration under a civil contract;

- in field 160 - the total amount of personal income tax withheld since the beginning of the year, including the tax withheld from remuneration under a civil contract.

If remuneration under a civil contract is paid on the last day of the reporting period, the deadline for paying personal income tax on it will expire in the next reporting period. In this case, the remuneration should be reflected in section. 2 calculations of 6-NDFL for the period in which it was paid, without reflection in section. 1 of this calculation. In Sect. 1 payment of remuneration will be reflected in the calculation for the next reporting period.

Example of filling out 6-NDFL with vacation pay

The specificity of reflecting vacation pay in 6-NDFL is due to 3 dates:

- Accruals of income from vacation pay and the corresponding amount of tax - in this regard, vacation pay is no different from other income, and they fall into section 2 of form 6-NDFL on a general basis (i.e., when the income is recognized for the purposes of calculating tax on it ).

Important! According to the latest clarifications from the Federal Tax Service, wages (like any income) should not be included in 6-NDFL if it has not yet been paid on the date of submission of the calculation. Therefore, it is better to report after the employer’s deadline for paying wages for the last month of the reporting period. Otherwise, clarification will be required.

- Vacation pay payments - tax is entered into section 1 of form 6-NDFL according to the date of personal income tax withholding.

- The deadline for paying the tax - it contains the significant difference between vacation (sick leave) and other income, which, without changing the procedure for filling out form 6-NDFL, leads to the existence of a special moment for entering data on vacation (sick leave) into this report.

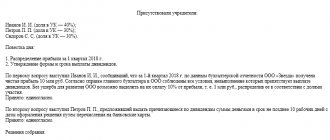

Example

Let's say there are the following initial indicators:

| Month of 2022 | Number of employees | Accrued | Deductions | Tax calculated | Paid | Payment date | ||

| Salary | Vacation pay | Salary | Vacation pay | |||||

| October | 8 | 240 000 | — | 4 000 | 30 680 | 109 320 | — | 08.10.2021 |

| 100 000 | — | 25.10.2021 | ||||||

| November | 8 | 216 342 | 27 314 | 4 000 | 31 155 | 109 320 | — | 10.11.2021 |

| 23 763 | 20.11.2021 | |||||||

| 100 000 | — | 25.11.2021 | ||||||

| December | 8 | 227 143 | 25 476 | 4 000 | 32 320 | 88 738 | — | 10.12.2021 |

| — | 22 164 | 17.12.2021 | ||||||

| 100 000 | — | 24.12.2021 | ||||||

| Total: | 683 485 | 52 790 | 12 000 | 94 155 | 607 378 | 45 927 | ||

| Total: | 736 275 | 12 000 | 94 155 | 653 305 | ||||

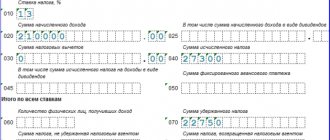

In section 1 of form 6-NDFL, taking into account the fact that salary payments made before the end of each month are advances and personal income tax on them must be paid within the deadlines established for the final payment (letter of the Ministry of Finance dated 02/13/2019 No. 03-04-06/ 8932, dated July 13, 2017 No. 03-04-05/44802), these data will be reflected as follows:

- Page 021 - 10/11/2021;

- Page 022 - 30 680;

- Page 021 - 11/11/2021;

- Page 022 - 30 680;

- Page 021 - 11/30/2021;

- Page 022 - 3 551;

- Page 021 - 12/13/2021;

- Page 022 - 27 604;

- Page 021 - 01/10/2022;

- Page 022 - 3 312.

Don't forget to check the generated report. To learn how to do this, read the publication “How to check 6-NDFL for errors?” .

Dates of receipt of income and withholding of personal income tax

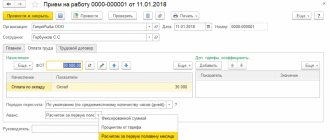

Unlike salary, the day of actual receipt of income for which is considered the last day of the month, the day of receipt of income for vacation pay (including compensation for unused vacation upon dismissal) and sick leave is considered the date on which they were transferred to the employee’s bank account, or paid in cash (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation).

The employer must pay vacation pay to the employee 3 working days before the vacation. As for sick leave benefits, the employer accrues them on the basis of sick leave within a 10-day period, paying them on the next “payday” day.

“Vacation pay” and “sick leave” personal income tax, as well as tax on other income, must be withheld on the day of their payment, and transferred to the budget no later than the last date of the month of payment to the employee, taking into account the transfer to the next working day if it coincides with weekends and holidays (p 6 Article 226 of the Tax Code of the Russian Federation). Let us remind you that for tax withheld from salary and compensation for vacation, the transfer deadline is the next day after payment of income.

These features of reflecting dates, common for sick leave and vacation pay, must be taken into account when filling out section 2 of the 6-NDFL calculation.

Results

Reflection of vacation pay in form 6-NDFL has its own characteristics associated with the establishment of a special deadline for paying tax on them. At the same time, the existing procedure for filling out the form does not fundamentally change.

Sources:

- Labor Code of the Russian Federation

- Tax Code of the Russian Federation

- Federal Law of December 29, 2006 No. 255-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Let's sum it up

- In certain cases, the employee has the right to vacation, which is in addition to the mandatory 28-day period of annual rest. His days that were unused at the time of dismissal are subject to payment, as for the main vacation.

- Days of additional leave are also allowed to be replaced by monetary compensation without dismissal, if the employee is not one of the persons in respect of whom there is a ban on such an operation.

- The rules for determining the dates characterizing both types of compensation are the same. And this gives the right to show compensation paid upon dismissal in section 2 of form 6-NDFL together with the salary paid on the last day of work.

- Compensation without dismissal is usually reflected in a separate set of lines 100-140, since it is issued either separately or with those frequently made payments (salary, vacation pay, sick leave), for which the date of receipt of income or the day of expiration of tax payment is determined in a manner different from used for compensation without dismissal.