Introductory information

Since 2016, the amounts of personal income tax withheld from the income of individuals have been required to be reported to the Federal Tax Service on a quarterly basis. For these purposes, form the calculation form 6-NDFL, approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. MMV-7-11/450.

In the calculation of 6-NDFL, you should show all income for the payment of which an organization or individual entrepreneur is recognized as tax agents. These are salaries, remunerations under civil contracts and other income. In particular, bonuses paid must be reflected in 6-NDFL.

The paid bonuses when filling out should first be reflected in section 2 of 6-NDFL, and then summarize the indicators in section 1. Let us explain how to correctly fill out 6-NDFL when paying bonuses.

We reflect the bonuses in section 2

In Section 2 6-NDFL, you need to show the dates of receipt and withholding of tax, the deadline set for transferring tax to the budget, as well as the amount of income actually received and withheld personal income tax. The income of individuals should be grouped according to the lines of section 2:

- by dates when they were actually paid

- according to the timing when the personal income tax amounts withheld from these incomes must be transferred to the budget.

Each such grouping is reflected in a separate block:

For each line of the specified block, filling rules are defined, in particular:

- line 100 “Date of actual receipt of income” - is filled out taking into account the provisions of Article 223 of the Tax Code of the Russian Federation;

- line 110 “Date of tax withholding” - taking into account the provisions of paragraph 4 of Article 226 and paragraph 7 of Article 226.1 of the Tax Code of the Russian Federation;

- line 120 “Tax payment deadline” - taking into account the provisions of paragraph 6 of Article 226 and paragraph 9 of Article 226.1 of the Tax Code of the Russian Federation.

However, in relation to bonus payments, the lines of Section 2 should be completed taking into account certain features. Let's explain them.

So, the date of actual receipt of income in the form of wages is considered to be the last day of the month for which the employee was accrued income for work duties performed (clause 2 of Article 223 of the Tax Code of the Russian Federation). That is, for example, even if an employee received a salary for August in September, the date of receipt of income is still considered to be August 31 (the last day of this month). This is provided for in paragraph 2 of Article 223 of the Tax Code of the Russian Federation. Therefore, in relation to wages, this date is transferred to line 100 “Date of actual receipt of income.” But with regard to bonus payments, the approach is different. The Letter of the Federal Tax Service dated 06/08/16 No. BS-4-11/10169 explains that when transferring personal income tax from the premium amount, one must be guided by paragraph 1 of Article 223 of the Tax Code of the Russian Federation. It provides that the date of actual receipt of income is considered to be the day the income is paid, and not the last day of the month.

Paragraph 2 of Article 223 of the Tax Code of the Russian Federation states that the date of receipt of earnings is the last day of the month. However, do not take this point into account when paying bonuses.

In addition, paragraph 4 of Article 226 of the Tax Code of the Russian Federation obliges tax agents to withhold the accrued amount of personal income tax upon actual payment of income. And the tax should be transferred to the budget no later than the day following the day of payment of income (clause 6 of Article 226 of the Tax Code of the Russian Federation). Therefore, personal income tax must be withheld when the bonus is actually issued to the employee. There is no need to wait for the end of the month (letter of the Ministry of Finance of Russia dated March 27, 2015 No. 03-04-07/17028).

If we summarize all of the above without confusing wording from the Tax Code of the Russian Federation, then in Section 2 of 6-NDFL, reflect the payment of bonuses in a separate block:

- on line 100 – the date of payment of the premium;

- on line 110 - the same date as on line 100;

- on line 120 – the next day after the one indicated on line 110;

- on line 130 - the amount of the premium;

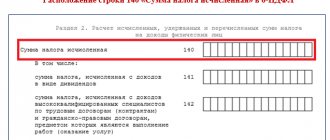

- on line 140 - the amount of personal income tax.

One-time bonus in the middle of the month

Let's give an example of how the reflection of the bonus in 6-NDFL should look like in real life. Let’s assume that Alpha LLC paid an employee a one-time holiday bonus of 15,000 on August 15, 2016. On the same day, the accountant needs to withhold tax from the bonus in the amount of 1,950 rubles (15,000 × 13%). No later than the next day (August 16), the tax should be transferred to the budget. Under such conditions, show the one-time bonus in 6-NDFL for 9 months of 2016 as follows:

Bonus paid along with salary

But what to do if the bonus is paid along with the salary? How to show it in section 2 of the 6-NDFL calculation? In such a situation, the bonus in section 2 also needs to be highlighted as a separate block.

Let’s assume that Progress LLC paid the salary and bonus for July on August 5, 2016. The total payment amount is 65,000 rubles. For salary, the date of receipt of income will be July 31, and for bonuses - August 5. The amount of the award is 10,000 rubles. The amount of tax on the premium was 1,300 rubles (10,000 × 13%). The accountant needs to reflect the paid bonus in 6-NDFL for 9 months of 2016 in a separate block of section 2:

Show your salary in the amount of 55,000 rubles (65,000 – 10,000) in a separate block. You should not “mix” bonus and salary together (in one block).

Conclusion: one-time bonuses are shown in 6-NDFL on the date when the bonus was issued. Salaries, but not bonuses, are dated to the last day of the month.

Grouping awards into one block

The above procedure for reflecting bonuses in lines 100, 110, 120, 130 and 140 of Section 2 applies to all types of incentive bonuses. In the specified way, in the calculation of 6-NDFL, you show monthly, quarterly and annual bonuses: highlight them separately from the salary and mark the day of payment as the date of actual receipt of income (clause 1 of Article 223 of the Tax Code of the Russian Federation). In the same way, show bonuses in kind (subclause 2, clause 1, article 223 of the Tax Code of the Russian Federation).

Please note that all awards in section 2 can be grouped together (in one block) if they have the same date of actual receipt of income. That is, if, for example, on October 5, 2016, employees were paid both a monthly bonus for September and a quarterly bonus for the 3rd quarter, then both of these payments can be combined in one block of section 2.

Also see “Terms for payment of bonuses under the new wage law: what has changed.”

If the monthly bonus is wages

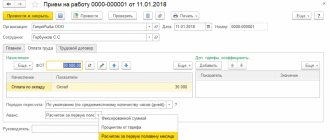

Some employers are willing to pay employees monthly bonuses or bonuses regardless of performance. And in employment contracts you can find similar wording: “The employee is paid a monthly bonus in the amount of 12,000 rubles.”

In this case, the employer is obliged to give the employee a bonus or bonus every month, regardless of the results of work. And such a payment is already a payment for labor, and not an incentive payment. And for income in the form of wages, the date of actual receipt of income is the last day of the month for which wages were accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). Therefore, monthly bonuses, which are remuneration, do not need to be separately allocated in section 2.

Let us assume that Stella LLC, under the terms of the employment contract, is obliged to pay the employee a salary of 30,000 rubles and a bonus of 15,000 rubles every month. The total monthly salary is 45,000 rubles (30,000 + 15,000). This amount should not be divided into salary and bonus in section 2:

But be careful: this rule does not apply to quarterly and annual bonuses. Always write them separately in section 2, since they have nothing to do with the monthly salary.

Drawing up 6-NDFL when paying a one-time bonus

New form 6-NDFL from 2022

Let's consider the procedure for displaying the deadline for paying tax on bonuses not related to the performance of work duties in the new 6-NDFL report.

| Line number | Operation | Operation time | Link to the Tax Code of the Russian Federation |

| 020 | The total amount of personal income tax that was withheld during the last 3 months of the reporting period | Pay day | Clause 3 Art. 226 |

| 021 | Tax payment deadline | Business day following the payment day | Clauses 6, 7, Art. 6.1, clause 6 of Art. 226 Tax Code of the Russian Federation |

| 022 | Amount of personal income tax payable | Business day following the payment day | Clauses 6, 7, Art. 6.1, clause 6 of Art. 226 Tax Code of the Russian Federation |

| 110 and 112 | Prize amount | On the day of payment | Clause 3 Art. 226 |

| 140 | Calculation of personal income tax | On the day of payment | Clause 3 Art. 226 |

| 160 | Withholding personal income tax | On the day of payment | Clause 4 art. 226 |

You can see a sample of filling out 6-NDFL for 2022 using the new form in ConsultantPlus. If you do not already have access to this legal system, trial access is available for free.

Previous form 6-NDFL (until 2022)

And below are the line codes for reflecting a one-time bonus in the old form 6-NDFL (from the Federal Tax Service order dated 10/14/2015 No. ММВ-7-11 / [email protected] ).

| Line number | Operation | Operation time | Link to the Tax Code of the Russian Federation |

| 020 | Income accrual | On the day of payment | In accordance with the date of calculation of personal income tax |

| 040 | Calculation of personal income tax | On the day of payment | Clause 3 Art. 226 |

| 100 | Date of actual receipt of income | On the day of payment | Subp. 1 clause 1 art. 223 |

| 070, 110 | Withholding personal income tax | On the day of payment | Clause 4 art. 226 |

| 120 | Transfer of personal income tax | No later than the day following the day of payment of income to the employee | Clause 6 Art. 226 |

When calculating the bonus, you need to show it in a separate block of cells 100–140 in section 2.

We reflect the awards in section 1

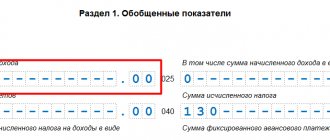

Section 1 6-NDFL shows the total amount of accrued income, deductions, as well as the total amount of accrued and withheld tax.

Section 1 must be filled out with a cumulative total for the first quarter, six months, nine months and a year (letter of the Federal Tax Service of Russia dated February 18, 2016 No. BS-3-11/650). In section 1, include income (deductions, tax amounts) for transactions performed during the reporting period. For example, in section 1 of the calculation for 9 months of 2016, indicators for the period from January 1 to September 30 inclusive should be reflected. So, in particular, in section 1 you need to show:

- on line 020 - all employee income on an accrual basis from the beginning of the year.

- on line 040 - the amount of calculated tax on an accrual basis from the beginning of the year.

Let us assume that in the period from January 1 to September 30, 2016, employees were paid wages in the amount of 985,000 rubles. This amount already includes bonuses paid for 9 months in the amount of 140,000 rubles. The entire amount of earnings, including bonuses, must be shown on line 020. And the tax calculated from this entire amount is transferred to line 040 of the calculation for 9 months of 2016. The tax amount is 128,050 rubles (985,000 × 13%).

Simply put, reflect bonuses in section 1 in the total amount of income and calculated tax. There is no longer any need to highlight bonuses separately in this section.

Annual and quarterly bonuses: a special approach

The letter of the Federal Tax Service dated January 24, 2017 No. BS-4-11/1139 contains very important clarifications from tax authorities on the issue of reflecting bonuses in the calculation of 6-NDFL. The meaning of these clarifications is that the method of determining the date of actual receipt of income in the form of a bonus for performing job duties depends on the results of the period for which the employee was awarded a bonus (based on the results of the month, quarter or year).

For example, in the case of payment of bonuses for a month, the date of actual receipt of income should be considered the last day of the month for which the employee was accrued bonuses. For example, when paying a bonus based on the results of December 2016, the date of receipt of bonus income is December 31, 2016. If the bonus is paid based on the results of work for a quarter or year, then it should be based on the date of the bonus order.

Let’s assume that the bonus based on the results of work in 2016, based on the employer’s order dated January 17, 2017, is paid on February 6, 2017. In such a situation, the annual bonus should be reflected in 6-NDFL for the first quarter of 2022 as follows:

Section 1:

- on lines 020, 040, 070 - the corresponding total indicators;

- on line 060 – the number of individuals who received income.

Section 2:

- on line 100 “Date of actual receipt of income” – 01/31/2017;

- on line 110 “Tax withholding date” – 02/06/2017;

- on line 120 “Tax payment deadline” – 02/07/2017;

- on lines 130 “Amount of income actually received” and 140 “Amount of tax withheld” - the corresponding total indicators.

The position on bonuses has changed!

The date of income is the day on which such bonus was paid. Therefore, include production annual, semi-annual and quarterly bonuses in the personal income tax tax base of the month in which they were paid (subclause 1, clause 1, article 223 of the Tax Code of the Russian Federation). This is stated in letters of the Ministry of Finance of Russia dated September 29, 2022 No. 03-04-07/63400, Federal Tax Service of Russia dated October 5, 2022 No. GD-4-11/20102.

Previously, employees of the Federal Tax Service of Russia explained that the date of income should be considered the last day of the month to which the order to pay the bonus was dated (letter dated January 24, 2022 No. BS-4-11/1139).

How to ultimately take into account “bonus” income: explanations from the Ministry of Finance

Clarity was brought to this issue by letter of the Ministry of Finance of the Russian Federation dated September 29, 2017 No. 03-04-07/63400. Depending on the type of incentive payment, the financial department determined the date of receipt of income as follows:

- For monthly bonuses - the last day of the billing month.

- For quarterly, annual and one-time bonuses for production results - the date of payment.

The Ministry of Finance does not separately explain the procedure for recognizing income on one-time non-production bonuses. These include, for example, payments for anniversaries. But income from such types of incentives was always recognized on the date of payment and did not cause disagreements between regulatory authorities (letter of the Federal Tax Service of the Russian Federation dated August 11, 2017 No. GD-4-11 / [email protected] ).

Let's consider how to reflect the premium in 6-NDFL, taking into account current clarifications from tax authorities and the Ministry of Finance.

Bonuses reflected along with salary: what to do

It is worth recognizing that the situation with the reflection of bonuses in 6-NDFL is quite confusing. Therefore, we do not exclude that some accountants could make a mistake and show the bonuses paid along with the salary. That is, do not separate bonuses into a separate block in section 2, but group bonuses together with salary and indicate the date of receipt of income - the last day of the month.

In such a situation, it makes sense to clarify the calculation of 6-NDFL, since an incorrect date for receiving income in the form of a premium entails an incorrect date for the tax payment line (line 120 in section 2). If tax officials find an inaccuracy in section 2, the tax agent will be fined 500 rubles for false information (Article 126.1 of the Tax Code of the Russian Federation). This fine can be avoided if you manage to detect the inaccuracy and submit an updated calculation before the inspectors find the error. Moreover, submitting clarification will help avoid confusion in accounting.

If you decide to clarify premiums in the calculation of 6-NDFL, then indicate in the corrective calculation the indicators from the original report, but already corrected.