Definition of Accounting Entries

An accounting entry is a method of recording business transactions in different accounts. The amounts are equal. Every business entity undergoes several payments and trade transactions every day, including:

- settlements with suppliers;

- payment of taxes;

- transfer of funds for the purchase of devices;

- ensuring the transportation of goods.

Accounting records can also be called a tool for recording income and expenses. Financial activities are reflected using double entry:

- Debit contains information about income from various sources;

- The Credit includes information about expenses, including wages and settlements with counterparties.

Credit and debit accounts are interconnected. They are presented in a single table, which is also known as a correspondent account.

All values in the statements must match the information in the primary documents. In other words, transactions that are reflected in the journals are necessarily confirmed by appropriate documentation.

Double entry method

The concepts of correspondence of accounts and accounting entries are based on the principle of double entry. The essence of this principle is to record each business transaction twice: as a debit to one account and a credit to another. With non-automated accounting, there were two methods of accounting - memorial and journal-order. Currently, accounting programs allow you to reflect transactions in any convenient form.

From the double entry method, it logically follows that the property of business transactions is to change simultaneously the indicators of both sides of the balance sheet. Most often, typical households. operations produce movements on the “opposite” sides of the balance sheet.

Posting classification

There are two types of accounting records:

- simple, which reflect two accounts (debit and credit);

- complex - include more than two accounts.

Postings are used depending on the trading operation.

Postings are also divided according to the nature of the information reflected - into real, conditional and clarifying. Real ones are used to reflect business transactions, for example, the calculation and payment of wages. Conditionals arise as a result of accounting methodology. But in reality this operation was not performed. Used to transfer or clarify indicators.

There can be several examples:

- closing the sales account and determining the financial result;

- production costs include management costs. The latter are accounted for in the “General business expenses” account, while no business facts occur.

Clarifying entries involve maintaining corrective records, as well as records for writing off the calculation difference in the production process accounts. They, in turn, are divided into two categories:

- additional ones, which increase the amount of turnover on the account; regular ink is used when drawing up;

- reversal – when calculating the totals, the red amount is subtracted and drawn up in red ink.

Example of postings on account 10

The Alpha organization bought 270 sheets of iron from Omega. The cost of materials was 255,690 rubles. (VAT 18% - 39,004 rubles). Subsequently, 125 sheets were released into production at average cost, another 3 were damaged and written off as scrap (write-off at actual cost within the limits of natural loss norms).

Cost formula:

Average cost = ((Cost of remaining materials at the beginning of the month + Cost of materials received for the month) / (Number of materials at the beginning of the month + Number of materials received)) x number of units released into production

Average cost in our example = (216686/270) x 125 = 100318

Let's reflect this cost in our example:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 60.01 | 51 | Paid for materials | 255 690 | Bank statement |

| 10.01 | 60.01 | Receipt of materials to the warehouse from the supplier | 216 686 | Request-invoice |

| 19.03 | 60.01 | VAT included | 39 004 | Packing list |

| 68.02 | 19.03 | VAT is accepted for deduction | 39 004 | Invoice |

| 20.01 | 10.01 | Posting: materials released from warehouse to production | 100 318 | Request-invoice |

| 94 | 10.01 | Writing off the cost of damaged sheets | 2408 | Write-off act |

| 20.01 | 94 | The cost of damaged sheets is written off as production costs | 2408 | Accounting information |

Examples of accounting entries

An example of correspondence between two accounts: wages were paid to employees from the cash register in the amount of 500,000 rubles. The operation is reflected by the following posting: On the debit of the account - 70 “Settlements with personnel for wages”, on the Credit - 50 “Cash” - 500,000 rubles.

If transactions affect more than two offsetting accounts, they can be presented in two ways. One account can be debited and several accounts credited. In this case, the total amount credited does not differ from the amount of the debited account.

Example:

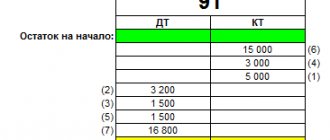

The company's account was credited with revenue in the amount of 100 thousand rubles and the amount from the sale of equipment - 50 thousand rubles:

Debit of account 51 “Current accounts” - 150 thousand rubles;

Credit to account 90 “Sales” - 100 thousand rubles;

Credit to account 91 “Other income and expenses”, in this case the subaccount “Other income” is used - 50 thousand rubles.

Complex wiring can be presented in the form of two simple ones:

For debit - 51 “Current accounts”, for Credit - 90 “Sales” - 100 thousand rubles;

Debit 51 “Settlement accounts” Credit 91 “Other income and expenses (subaccount “Other income”)” - in the amount of 50 thousand rubles.

Let's consider another option, when several accounts are debited and one is credited at the same time. In this case, the debit amount is equal to the credit amount.

As an example:

Materials were received from the counterparty in the amount of 50 thousand rubles, as well as equipment for installation in the amount of 50 thousand rubles. A complex accounting entry is reflected as follows:

Debit account 10 “Materials” - 10 thousand rubles;

Debit of account 07 “Equipment for installation” - 50 thousand rubles;

Credit to account 60 “Settlements with suppliers and contractors” - 60 thousand rubles.

Complex wiring can also be presented in the form of two simple ones:

For Debit - 10 “Materials”, for Credit account 60 “Settlements with suppliers and contractors” - 10 thousand rubles;

Debit account 07 “Equipment for installation” Credit account 60 “Settlements with suppliers and contractors” - 50 thousand rubles.

Complex postings significantly reduce the number of accounts, and this allows you to reduce the time for performing analytical and accounting functions.

Table of transactions for business transactions in accounting

There are a great variety of wiring. In this case, a business transaction can be reflected in 1 entry (simple entries) or several (complex entries).

For example, goods were received with VAT in the amount of 50,000 rubles. This fact must be reflected in 2 entries:

- goods and materials arrived at the warehouse: Dt 41 Kt 60 - 41,666.67 rubles;

- Input VAT is allocated: Dt 19 Kt 60 - RUB 8,333.33.

Find typical accounting entries for VAT accounting here.

Let's look at the basic entries in accounting.

Accounting for fixed assets and intangible assets:

| Operation | Dt | CT |

| OS arrived | 08 | 60 (71, 75, 76) |

| OS put into operation | 01 | 08 |

| Depreciation of fixed assets | 20 (23, 25, 26, 44) | 02 |

| Received intangible assets | 08 | 60 (71, 75, 76) |

| Intangible assets accepted for accounting | 04 | 08 |

| Depreciation of intangible assets | 20 (23, 25, 26, 44) | 05 |

ATTENTION! From 2022, the new FSB 6/2020 “Fixed Assets” and FSB 26/2020 “Capital Investments” are mandatory. The provisions of these standards can be applied earlier by prescribing such a decision in the accounting policies of the enterprise.

ConsultantPlus experts explained step by step how to disclose information in reporting when applying FAS 6/2020 “Fixed Assets” and FAS 26/2020 “Capital Investments”. Get free demo access to K+ and go to the ready-made solution to find out all the details of this procedure.

Read more about fixed asset accounting in the article “Accounting for fixed assets - accounting entries” .

Inventory accounting:

| Operation | Dt | CT |

| Materials received | 10 | 60 (75, 76) |

| Production waste accepted | 10 | 20 (23, 29) |

| Materials written off as expenses | 20 (23, 25, 26, 44) | 10 |

| Materials sold | 90 (91) | 10 |

| Animals purchased | 11 | 60 (75, 76) |

| Transfer of young animals to the main herd | 08 | 11 |

| Animal slaughter costs | 20 (23, 29) | 11 |

For detailed entries for materials accounting, see the article “Accounting entries for materials accounting .

Cost accounting:

| Operation | Dt | CT |

| Depreciation accrued | 20 (23, 25, 26, 44) | 02 (05) |

| Materials have entered production | 20 (23, 29) | 10 |

| General business and general production expenses are distributed to the main products (on accounts 25 and 26, expenses are collected as a whole, and at the end of the month they are distributed among the products produced) | 20 | 23 (25, 26) |

| Own semi-finished products entered production | 20 | 21 |

| Works (services) performed by third-party companies | 20 (23, 25, 26, 44) | 60 (76) |

| Taxes and contributions accrued | 20 (23, 25, 26, 44) | 68 (69) |

| Salaries accrued to employees | 20 (23, 25, 26, 44) | 70 |

| Manufactured products released | 21 (43) | 20 |

| Trading expenses written off to cost | 90 | 44 |

Examples of cost accounting entries can be found in this article.

Accounting for goods and finished products:

| Operation | Dt | CT |

| Items for sale have arrived | 41 | 60 (71, 75) |

| Trade margin reflected | 41 | 42 |

| Manufactured products have arrived | 43 (21) | 20 (23, 29) |

| Sales of goods and materials | 90 | 41 (21, 43) |

| Shortage of inventory items taken into account | 73 (94) | 41 (21, 43) |

The algorithm for accounting for goods is reflected in the article “Postings Dt 41 and Kt 41, 60 (nuances)” .

Cash accounting (hereinafter referred to as DS):

| Operation | Dt | CT |

| DS received from buyers | 50 (51) | 62 |

| Revenue | 50 | 90 |

| Return of accountable funds | 50 (51) | 71 |

| A contribution has been received to the management company | 50 (51) | 75 |

| Payment to the supplier | 60 (76) | 50 (51) |

| Issue on record | 71 | 50 (51) |

| Salary payment | 70 | 50 (51) |

| Transfer of taxes and contributions | 68 (69) | 51 |

More detailed information can be found in the section “Bank, cash desk” .

Accounting for settlements:

| Operation | Dt | CT |

| Receipt of goods and materials | 10 (41) | 60 |

| Receipt of services | 20 (23, 25, 26, 44) | 60 (76) |

| Payment to the supplier | 60 (76) | 50 (51) |

| Receipt of DS from the buyer (or debtor) | 50 (51) | 62 (76) |

| Sales to the buyer | 62 | 90 |

| Taxes (contributions) accrued | 20 (25, 26, 44, 90, 91, 99) | 68 (69) |

| Salary accrued | 20 (23, 25, 26, 44) | 70 |

| Taxes (contributions) paid | 68 (69) | 50 (51) |

| Salary paid | 70 | 50 (51) |

| Received credit (loan) | 50 (51) | 66 (67) |

| Loan repayment (interest) | 66 (67) | 50 (51) |

| Interest accrued on the loan | 20 (25, 26, 44) | 66 (67) |

| Money issued against advance report | 71 | 50 (51) |

| Advance report reflected | 07 (08, 10, 20, 25, 26, 41, 44) | 71 |

| A loan was issued to an employee | 73 | 50 (51) |

| The shortage is attributed to the person at fault | 73 | 94 |

| Repayment of a loan by an employee | 50 (51) | 73 |

| Compensation for shortage of goods | 41 | 73 |

| AC accrued | 75 | 80 |

| Dividend payment | 75 | 50 (51) |

| Introduced by the Criminal Code | 08 (10, 11, 41, 50, 51) | 75 |

For the procedure for accounting for mutual settlements with suppliers and customers, see the articles:

- “Account 60 in accounting (nuances)”;

- “Account 62 in accounting (nuances)”;

- “Keeping records of accounts receivable and payable.”

Capital Accounting:

| Operation | Dt | CT |

| AC accrued | 75 | 80 |

| Buying shares | 81 | 50 (51) |

| Replenishment of reserve capital | 84 (75) | 82 |

| Covering losses using reserve capital | 82 | 84 |

| Increase in share price | 75 | 83 |

| Decrease in the cost of fixed assets due to revaluation | 83 | 01 |

| Distribution of additional capital between owners | 83 | 75 |

| Special-purpose financing | 50 (51) | 86 |

For the main entries for capital accounting, see the article “Procedure for accounting for an organization’s own capital (nuances)” .

Financial results:

| Operation | Dt | CT |

| Cost of sold inventories | 90 | 10 (21, 41, 43) |

| Revenue | 50 (51, 57) | 90 |

| Implementation | 62 | 90 |

| VAT charged on sales | 90 | 68 |

| Expenses written off | 90 | 20 (44) |

| Positive financial sales result | 90 | 99 |

| Negative sales result (loss) | 99 | 90 |

| Write-off of materials donated free of charge | 91 | 10 |

| Bank services | 91 | 51 |

| Write-off of shortage | 91 | 94 |

| Excess materials have been identified | 01 (10, 21, 41, 43) | 91 |

| OS implementation | 91 | 01 |

| Interest accrued (state duty, legal expenses) receivable by court decision | 76 | 91 |

| A shortage of supplies and DS has been identified | 94 | 10 (11, 21, 41, 43, 50) |

| The amount of the shortfall is attributed to the perpetrators | 73 | 94 |

| Accrual of reserve for future expenses | 20 (23, 25, 26, 44, 91) | 96 |

| Deferring costs | 97 | 10 (21, 41, 43, 60, 76) |

| Future expenses are written off as current expenses | 20 (23, 25, 26, 44) | 97 |

| Accrued deferred income from leasing activities | 98 | 90 |

| Receipt of money as deferred income | 50 (51) | 98 |

| Losses due to emergency situations (hereinafter referred to as emergencies) | 99 | 07 (08, 10, 11, 20, 21, 41, 43) |

| Profit tax accrued | 99 | 68 |

| Determination of financial results | 99 (90, 91) | 99 (90, 91) |

| Uncovered losses identified | 84 | 99 |

| The profit received is attributed to distribution | 99 | 84 |

We talked about the entries for accounting for retained earnings on account 84 here.

Who keeps the accounting records?

Accounting records are required to be used by all business entities - both large companies and individual entrepreneurs using a simplified taxation system. Some organizations are subject to annual audits, so it is very important for them to keep their accounting records in order. These include the following categories:

- joint stock communities;

- insurance companies;

- financial and credit groups;

- securities companies;

- non-state pension funds.

What is a balance sheet

A way of grouping the financial indicators of a business's assets and liabilities to show its financial condition as of a specific date is called a balance sheet.

The balance sheet, as the main source of information for analyzing the financial and economic activities of an enterprise, has two parts - assets and liabilities:

- An asset includes property; cash; accounts receivable.

- A liability is the totality of all obligations of an enterprise and the sources of its funds.

Depending on the legal form of the organization, balance sheets can have different types. For internal purposes, an organization can adopt its own forms for reflecting information. For reporting to government bodies - for example, to the Federal Tax Service - it is mandatory to use legally approved reporting forms and data transfer formats.

Who is responsible for mistakes

Serious recordkeeping violations may result in the following sanctions:

- tax;

- administrative;

- payment of fines.

Responsibility for errors lies with the chief accountant, as well as the head of the company. If an error is identified in the papers, it is necessary to correct them immediately, as the sanctions can be serious.

The chief accountant is responsible for the damage caused to the direct employer. He acts as a financially responsible person. The procedure for its collection is specified in the employment contract with the employee.

If this information is not reflected in the contract, only penalties can be applied to the accountant, the amount of which does not exceed his monthly salary.

Financial liability is regulated by federal laws and the labor code. An employment contract cannot contradict the laws. It is prohibited to collect an amount greater than that specified in the code.

The manager is also the financially responsible person. All damages that may be recovered from him are indicated in the Labor Code (Article 277). Similar conditions apply to the probationary period.

Every day, companies conduct several transactions. Significant transactions also include transfers between accounts, so all actions must be reflected in the computer database. Some organizations continue to keep records in paper journals.

Postings make it possible to track how, what and in what amount were transferred between correspondent accounts. Using this information, you can get an idea of income and expenses, as well as the company's activities as a whole. Some enterprises carry out mandatory audits of their accounting records. It is necessary to make sure that all postings do not diverge from the primary documentation. This will avoid the application of sanctions.

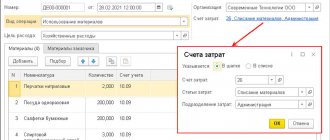

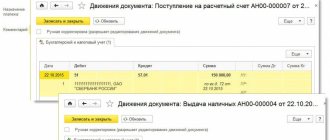

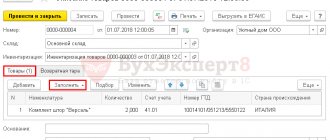

1C: Accounting 8

“1C: Accounting 8” is the most popular accounting program that can take accounting automation to a whole new level. A convenient product and services connected to it will allow you to effectively solve the problems of the accounting department of any business!

- Support of different tax systems, maintaining accounting and tax records, submitting reports;

- Inventory accounting, batch accounting, settlements with counterparties, extracting primary documents;

- Payroll calculation, accounting of cash transactions;

- Integration with other 1C programs and websites;

- Working with electronic certificates of incapacity for work (ELS).

Try 30 days free Order

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Simple and complex accounting entries - how to make them

Wiring can be simple or complex. This will depend on the actual operation they reflect:

- One simple transaction reflects one business transaction. For example, goods arrived at the organization’s warehouse without VAT being allocated in the primary documents. The accountant will make one entry for this operation: Dt 41 Kt 60.

- Complex posting is when two accounting records are used for one business transaction. For example, a supplier made a shipment to an economic entity with the allocation of value added tax in the invoice and, accordingly, in the invoice. When an accountant receives all the necessary documents for one operation, he will need two accounting entries at once: Dt 41 Kt 60 and Dt 19 Kt 60.

It must be remembered that almost all transactions reflecting business transactions are formed on the basis of supporting documents. These may be documents from suppliers, bank statements, shipping documents, payroll statements, accounting statements, etc.

The above list does not exhaust the entire scope of primary documents used in accounting, and can be expanded depending on the characteristics of the accounting carried out in each specific organization.

You will find a complete list of primary documents in the Directory from ConsultantPlus. Get free trial access to the system and proceed to the list.