Types and conditions for providing financial assistance

Current legislation does not prohibit an employer from providing financial assistance to its employees (hereinafter referred to as financial assistance). In paragraphs 2.2.2.1 section 2 GOST R 52495-2005, approved. Prospect of the Federal Agency for Technical Regulation and Metrology dated December 30, 2005 No. 532-st, contains a definition of material assistance (hereinafter referred to as financial assistance) as a socio-economic service consisting of providing clients with funds, food, sanitation products, etc. .

Financial assistance is one-time in nature and is paid at the request of the employee based on the order of the manager. It can be related, for example:

- with the birth of a child;

- with the death of an employee or a member of his family;

- with treatment;

- with damage caused by a natural disaster;

- with retirement due to disability or age.

Such payments are not included in wages, as they are not of an incentive or compensatory nature. They are aimed at supporting an employee in a difficult life situation.

Form 6-NDFL

All persons who are recognized as tax agents (Article 226, 226.1 of the Tax Code), starting from 01/01/2016, are required to submit quarterly Form 6-NDFL to the tax authorities at the place of registration (Federal Tax Order No. ММВ-7-11/ [email protected] ).

The calculation is compiled on an accrual basis, with the 1st section being formed on an accrual basis, and the 2nd section reflects only the information that corresponds to the quarter of the period for which the information is submitted.

The calculation form consists of:

- Title page.

- Section 1 “Generalized indicators”.

- Section 2 “Dates and amounts of income actually received and withheld personal income tax.”

Features of accounting for material assistance in personal income tax

The possibility of issuing financial assistance must be taken into account in the regulations and documents of the organization: regulations on remuneration, collective agreement and (or) in the employment contract with the employee.

In personal income tax, financial assistance is considered as an economic benefit, which forms an object of taxation (Articles 208, 209, 210 of the Tax Code of the Russian Federation). But its social status allows it to exempt from taxation either certain types of financial assistance (Article 217 of the Tax Code of the Russian Federation), or certain amounts within the limit. For example:

- with the birth of a child - exempt from tax, but not more than 50,000 rubles. per child;

- with the death of an employee or a member of his family - exempt from tax;

- with damage caused by a natural disaster - exempt from tax;

- with retirement due to disability or age - exempt from tax, but not more than 4,000 rubles;

- on other grounds - exempt from tax, but not more than 4,000 rubles.

Financial assistance is subject to taxation

Material assistance specified in the list of Appendix 2 of the Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11 / [email protected] may not be subject to personal income tax, but is reflected in 6-personal income tax. This happens because for these types of financial assistance there is a tax-free limit for the year, and personal income tax will have to be withheld from all payments above.

This applies to the following types of financial assistance:

- one-time assistance to an employee at the birth or adoption of a child up to 50,000 rubles;

- financial assistance to WWII participants, their widows, prisoners of war and prisoners up to 10,000 rubles, if assistance was provided not from the budget of the Russian Federation or a foreign state, but from other persons;

- financial assistance in the amount of 4,000 rubles per year provided to employees and former employees who resigned due to retirement due to disability or age (for vacation, for a wedding, for treatment, upon retirement.

Other types of financial assistance should be reflected in the declaration.

Let's look at a few examples.

IP Khrumov has 3 employees. Salaries are received twice a month: advance payment on the 25th and final payment on the 10th of each month. There are no tax deductions for children. For January - June, an individual entrepreneur paid his employees wages in the amount of 630 thousand rubles.

Example 1

On the occasion of Ivanov’s retirement, on June 22, 2022, financial assistance was awarded in the amount of 10,000 rubles. Payments by the employer upon retirement of an employee are not subject to personal income tax if the amount of payments does not exceed 4,000 rubles.

In section 1, financial assistance will be reflected as follows:

- In line 020 we write the amount of personal income tax withheld for the last three months - 82,680 rubles, this also includes the tax on financial assistance - 780 rubles (10,000 - 4,000) × 13%;

- In line 021 we indicate the date on which the withheld tax must be transferred to the budget. For financial assistance, the working day following payment is June 23, 2021;

- In line 022 we indicate the amount of personal income tax transferred on the date from line 021 - 780 rubles.

Additionally, in the first section, lines 021 and 022 will be filled in for each payment from April to June - advance payment and calculation at the end of the month.

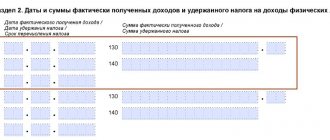

In the second section of 6-NDFL, financial assistance for the six months will also be reflected

- in line 110 we indicate the amount of income accrued to individuals since the beginning of the year - 640,000 rubles = 630,000 rubles salary + 10,000 rubles financial assistance. We duplicate this amount in line 112, since all income was from employment contracts;

- in line 120 we write the number of income recipients - 3 people;

- in line 130 we indicate the amount of deduction from financial assistance - 4,000 rubles;

- in line 140 we indicate the total amount of calculated tax - 82,680 rubles = (630,000 + 10,000 - 4,000) × 13%;

- in line 160 we enter the amount of tax withheld - 82,680 rubles.

Example 2

An individual entrepreneur paid an employee 55 thousand rubles on June 5 on the occasion of the birth of a child on June 1. The payment amount not exceeding 50 thousand rubles is not subject to personal income tax.

For clarity, let’s imagine that there were no other payments during the reporting period.

Section 1 is filled out like this:

- In line 020 we write the amount of personal income tax withheld for the last three months, including tax on the taxable part of financial assistance - 650 rubles (55,000 rubles - 50,000 rubles) × 13%;

- In line 021 we indicate the date on which personal income tax from financial assistance must be transferred - 06/06/2021;

- In line 022 we indicate the amount of personal income tax transferred on the date from line 021 - 650 rubles.

In section 2, financial assistance must be shown in the total amount of accrued income, and in line 130 the non-taxable amount must be entered - 50,000 rubles. In general, filling will be similar to example 1:

- in line 110 - 55,000 rubles;

- in line 120 - 1 person;

- in line 130 - 50,000 rubles;

- in line 140 - 650 rubles = (55,000 - 50,000) × 13%;

- in line 160 we write down the amount of tax withheld - 650 rubles.

If the payment in connection with maternity were 50 thousand rubles or less, then there would be no need to withhold tax, since the amount of the payment does not exceed 50 thousand rubles.

The Federal Tax Service allows financial assistance for the birth of a child up to 50,000 rubles inclusive not to be shown in 6-NDFL (letter dated December 15, 2016 No. BS-4-11/ [email protected] ). If you nevertheless reflected it, it must also be indicated in the certificate of income and tax amounts of the individual at the end of the year.

Example 3

From May 14 to 27 Sidorov A.A. goes on annual leave. According to the collective agreement, each employee is entitled to financial assistance in the amount of 4,000 rubles. It is not subject to personal income tax, since it does not exceed 4,000 rubles. But if during the year the assistance turns out to be more, personal income tax will have to be calculated and withheld in the standard manner from the entire excess amount.

- For the year, the amount of income was 420,000 rubles = 35,000 rubles × 12 months.

- The average daily earnings amounted to 1,194.54 rubles = 420,000 / 12 months / 29.3.

- The amount of vacation pay was 16,723.56 rubles = 1,194.54 × 14 days.

- One-time assistance for vacation 4,000 rubles.

When filling out the first section, lines 021 and 022 are filled out separately, for vacation pay, separately for financial assistance, separately for wages, if all payments were made on different dates.

- in line 020 we write the total amount of personal income tax withheld over the last three months - 56,774.06 rubles = (420,000 + 16,723.56 + 4,000 - 4,000) × 13%.

For vacation pay:

- In line 021 - 05/31/2021 (personal income tax on vacation pay is paid no later than the last day of the month in which the vacation pay was received);

- In line 022 - 2,174.06 rubles (16,723.56 rubles × 13%).

For financial assistance, lines are not required to be filled out, since in this case personal income tax is not paid on it. However, if we paid tax on it, line 021 would indicate the date following the day of payment of financial assistance for vacation. Additionally, lines 021 and 022 for salary must be completed.

Section 2 will include the following data:

- In lines 110 and 112 we write 440,723.56 rubles = 420,000 + 16,723.56 + 4,000.

- In line 130 - 4,000 rubles.

- In lines 140 and 160 - 56,774.06 rubles = (420,000 + 16,723.56 + 4,000 - 4,000) × 13%.

How to reflect financial assistance in 6-NDFL

In cases where the amount of financial assistance is not subject to taxation, the tax agent has the right not to reflect it in the calculation of 6-NDFL. And in payments that have a limit, you need to indicate the entire amount of financial assistance and the tax deduction attributable to it.

The date of receipt of income in the form of financial assistance is the day of payment of money, or the day of transfer of income in kind (clause 1 of Article 223 of the Tax Code of the Russian Federation).

Since such payment is usually made during the inter-payment period, on the basis of a separate payment document, financial assistance in 6-NDFL (Section 2) is reflected in separate lines 100, 110 and 120.

Reflection of financial assistance for vacation in the report

Often, enterprises have established a procedure for combining annual financial assistance to an employee with vacation pay. This is determined by the organization’s internal regulations governing labor and remuneration issues. When financial assistance is issued simultaneously with vacation pay, then in the 6-NDFL report:

- days of issue, withholding, personal income tax rates will be the same;

- Dates for paying taxes to the budget will vary.

The date of receipt of income for two types will be the day the funds are issued to the employee. The same day will become the date of personal income tax withholding. As for the date of transfer of income tax, they may vary by type of income. For personal income tax on the amount of vacation pay, the date of transfer of personal income tax will be the last day of the month, and for financial assistance - the day following its issuance. Therefore, in the 6-NDFL report, you need to fill out lines 100-140 in the second section separately for each payment period.

Reflection of material assistance in 6-NDFL: example of filling

Let’s assume that on July 21, 2017, due to the difficult financial situation of the employee, he was accrued and paid financial assistance in the amount of 5,000 rubles, of which 4,000 rubles are not taxable. (clause 28) Art. 217 of the Tax Code of the Russian Federation, deduction code 2760 “Financial assistance provided by employers to their employees” acc. from the Federal Tax Service of the Russian Federation dated September 10, 2015 No. ММВ-7-11/ [email protected] ). In the 6-NDFL report, financial assistance, 4,000 rubles must be indicated in the tax deduction amount field.

Step 1. In Form 6-NDFL (if there is no other data for the reporting period), in column 020, indicate the amount of financial assistance.

Step 2. In field 030, enter the limit value.

Step 3. In field 100, indicate the date when the financial aid was issued. In field 110 - when the tax is withheld (cannot be earlier than the previous number). In field 120 - the date of tax transfer. In the example, January 25 is Friday, so the tax is transferred on Monday, January 28.

The final form 6-NDFL will look like this.

Financial assistance in 6-NDFL until 2022

As for the 6-NDFL form until 2022, the principle of reflecting financial assistance in it was similar. You can see line-by-line filling in the examples below.

Example 1

Manager Safiullin R. had a daughter 2 weeks ago, and the company administration decided to pay him a one-time allowance of 20,000 rubles.

Page 100 - date of payment;

Page 110 and 120 - “00.00.0000” (letter of the Federal Tax Service dated 08/09/2016 N ГД-3-11/ [email protected] );

Page 130 - amount of financial assistance;

Page 140 - "0".

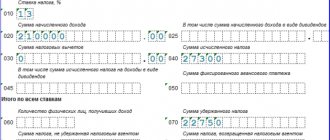

Example 2

Blacksmith Stepanov T., a classmate of manager R. Safiullin working in another city, received a one-time “children’s” payment during the same period of time. Its value was 65,000 rubles.

But only 63,050 rubles were transferred to his salary card. — affected by the withholding of personal income tax from the amount exceeding the non-taxable threshold (50,000 rubles).

Personal income tax = 1,950 rubles. ((65,000 – 50,000) × 13%).

The following data will be entered in 6-NDFL:

- lines 020 and 130 (accrued assistance) - 65,000 rubles;

- line 030 (non-taxable threshold) - 50,000 rubles;

- lines 040 and 070 (calculated and withheld tax) - 1,950 rubles.

How does the presence of the “blacksmith” profession in the staffing table affect the company’s costs, see the article “What refers to harmful working conditions (nuances)?” .

Example 3

Fitter A.S. Voronchikhin, who recently left the company with the wording “of his own free will,” asked his former employer to support him financially (to pay for medicines for a close relative). He was given 3,500 rubles.

When filling out 6-NDFL, this payment was not taken into account based on the following considerations:

- type of income - financial assistance;

- the amount does not exceed the limits provided for in paragraph 28 of Art. 217 of the Tax Code of the Russian Federation (4,000 rubles per year).

This approach turned out to be wrong. The company’s specialists did not pay attention to the fact that assistance was provided to a person who resigned not because of retirement or disability, but of his own free will. Under Art. 217 of the Tax Code of the Russian Federation, it is impossible to calculate this income. It must be reflected in 6-NDFL, and also the personal income tax must be calculated from its full amount: 3,500 rubles. × 13% = 455 rub.

What is due to an employee who decides to leave the company is described in the article “The procedure for calculating and paying severance pay upon dismissal .