What documents are considered cash registers?

Cash transactions are formalized using cash documents, among which the following are required for use in 2022:

- cash receipt order (KO-1),

- expense cash order (KO-2),

- cash book (KO-4),

- payroll statement (T-49),

- payroll (T-53).

These documents can be maintained both on paper and on electronic media.

From the list above, only cash receipts and debit orders are directly classified as cash documents (clause 4.1 of Bank of Russia Directive No. 3210-U dated March 11, 2014). Other documents are not cash documents by law, but are still used when processing cash transactions.

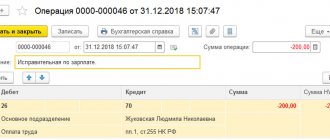

Corrections in cash documents

Strict reporting forms do not allow corrections. There should be no blots. The use of correctors is prohibited. Actions if there is an error:

- PKO/RKO . The cashier must cross out the damaged order and draw up another one. The crossed out form is attached to the cash register report for the day.

- Cash book . Eliminates erasers and correction fluids. The inscription with an error must be carefully crossed out, and a reliable number or text must be indicated above it. A note “Corrected” is made in the empty field next to it. Then the date of edit is put, the signature of the responsible persons with transcripts. Similar actions must be done with all copies.

How long to store cash documents in 2020

The storage periods for cash documents are specified in the list, approved. Order of the Ministry of Culture of Russia No. 558 dated August 25, 2010, and depend on the type of document. Information on shelf life is presented in the table:

| Document's name | Shelf life | From what date should the deadline be counted? | Base |

| Payroll T-49, payroll T-53, used for calculating and paying salaries, stipends, etc. |

| From January 1 of the year following the year in which the document was generated | clause 412 of the list, approved. Order No. 558 |

| 5 years Note: tax legislation establishes a shorter storage period for primary documents than accounting legislation - 4 years (subclause 8, paragraph 1, article 23 of the Tax Code of the Russian Federation) therefore we take the longest period - 5 years (according to Law dated December 6, 2011 No. 402-FZ) | From January 1 of the year following the reporting year | paragraph 362 of the list, approved. by order of the Ministry of Culture dated August 25, 2010 No. 558, clause 1 of Art. 29 of the Law of December 6, 2011 No. 402-FZ “On Accounting” |

Example

The cash book is stitched, sealed and signed by the manager on December 31, 2022. The shelf life of the book begins on January 1, 2020 and ends on December 31, 2025.

Storage periods for accounting and tax documents

For most accounting documents, the retention period is 5 years. This period is established in Article 29 of the Accounting Law No. 402-FZ.

The storage periods for most personnel, banking documents and documents on the assessment of fixed assets, intangible assets, etc. are established by order of the Federal Archive of December 20, 2022 No. 236.

The main storage periods for tax documents can be found in the Tax Code. Documents necessary for the calculation and payment of taxes and contributions, including documents confirming income and expenses, payment (withholding) of taxes, must be kept for five years after the end of the tax period in which the document was used.

Federal Law No. 6-FZ dated February 17, 2021 amended Article 23 of the Tax Code of the Russian Federation.

The tax law has increased the storage period for primary documents from four years to five years.

The storage periods for VAT accounting documents are established in accordance with subparagraph 8 of paragraph 1 of Article 23, subparagraph 5 of paragraph 3 of Article 24 of the Tax Code of the Russian Federation; documents that formed the basis for calculating the tax base and paying taxes must be stored for 5 years. by Government Decree of December 26, 2011 No. 1137 and is included in the order of the Federal Archive No. 236.

So that you don’t waste time searching for the right answer, we have collected all the shelf life in a single table.

Document storage periods in 2022

| Document | Shelf life | Base |

| ACCOUNTING DOCUMENTS | ||

| Primary accounting documents | 5 years If there are disputes or disagreements, documents must be kept until a decision is made on the case | P. 277 of the List, approved. By Order of the Federal Archive of December 20, 2019 No. 236 Art. 29 of Law No. 402-FZ |

| Cash documents and books | ||

| Bank documents | ||

| Checkbook stubs | ||

| Orders, timesheets, bank notices and requests for funds transfers | ||

| Expense reports | ||

| Correspondence with the bank | ||

| Cash receipt and strict reporting form | 6 months from the date of issue on paper | Clause 8 art. 4.7 of the Law of May 22, 2003 No. 54-FZ |

| Cashier-operator's book and other documents confirming cash settlements with customers | 5 years | Part 1 art. 29 of the Law of December 6, 2011 No. 402-FZ |

| Accounting policy documents | 5 years | P. 267 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Accounting statements: balance sheet, financial results statement, report on the intended use of funds, appendices thereto | Annual - constantly Intermediate - 5 years | P. 268 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| CALCULATION AND PAYMENT OF TAXES AND CONTRIBUTIONS | ||

| Tax returns and calculations, except for the DAM | 5 years | P. 310, 311 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Certificates on the fulfillment of the obligation to pay taxes, fees, contributions, penalties and fines, the status of settlements with the budget | 5 years | P. 305, 312, 313 of the List, approved. By Order of the Federal Archive of December 20, 2019 No. 236, Clause 8, Art. 23 Tax Code of the Russian Federation |

| Documents required for calculating taxes and documents confirming expenses | 5 years | Clause 8 art. 23 Tax Code of the Russian Federation Art. 29 of Law No. 402-FZ |

| Documents confirming the amount of loss incurred | The entire period for which the tax is reduced | |

| Notifications, demands, decisions, resolutions, objections, complaints. | 5 years | |

| Documents used in preparing a complaint based on the results of an on-site or desk inspection | 10 years | |

| Electronic documents with UKEP, certificates of keys for verifying electronic signatures with which documents are endorsed. | 5 years | |

| Calculations for insurance premiums (annual and quarterly): | ||

| if the paperwork is completed before the end of 2002 | 5 years (75 years - if there are no personal accounts or payroll records) | P. 308 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| if the paperwork was completed after January 1, 2003 | 5 years (50 years - if there are no personal accounts or payroll records) | |

| Cards for individual accounting of payments and accrued insurance premiums | 6 years | P. 309 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Invoices | 5 years | P. 317 of the List, approved. By Order of the Federal Archive of December 20, 2019 No. 236 Government Decree of 2612.2011 No. 1137 |

| Sales purchase books and additional sheets for them | 4 years since last entry | Government Decree No. 1137 dated 2612.2011 |

| Documents for applying tax benefits provided for regional investment projects | 6 years | Clause 3 art. 89.2 Tax Code of the Russian Federation |

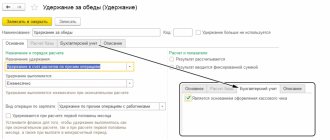

| SALARY DOCUMENTS | ||

| Regulations on remuneration and bonuses for employees | 5 years | P. 294 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Cards for individual accounting of payments, rewards and insurance premiums | 6 years | P. 309 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Registers of information on the income of individuals | 5 years | P. 313 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Personal accounts of employees: for documents for which: | ||

| Office work completed by the end of 2002 | 75 years old | P. 296 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| The paperwork was completed after January 1, 2003 | 50 years | |

| Pay slips, payslips for the issuance of wages, benefits, fees, financial assistance and other payments | For 6 years, if the employer maintains personal accounts for employees. If he doesn’t lead, then 50 (75) years. | P. 295 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Writs of execution | 5 years | P. 299 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Time sheets | 5 years | P. 402 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Applications, lists of employees, certificates, extracts from protocols, conclusions, correspondence and other documents on the payment of benefits, bonuses, revision of wages, payment of sick leave and issuance of financial aid | 5 years | P. 401, 405, 406 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Documents confirming the calculation and payment of contributions | 6 years | Subp. 6 clause 3.4 art. 23 Tax Code of the Russian Federation |

| Documents for payment of benefits: certificates of incapacity for work, applications, contracts for medical and sanatorium-resort services for employees | 5 years | P. 618, 633 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Expense vouchers for sanatorium and resort vouchers | 5 years | Item 636 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| HR DOCUMENTS | ||

| Orders and instructions on the main activities: taking office, on assigning the duties of chief accountant to the head, on early resignation, on the appointment of responsible persons | Constantly | P. 434 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Internal labor regulations | 1 year | P. 381 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Regulations or instructions for the processing of personal data | Constantly | P. 440 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Consent to the processing of personal data | 3 years after consent expires or after revocation | P. 441 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Vacation schedule Documents on disciplinary sanctions | 3 years | P. 453 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Documents on disciplinary sanctions | 3 years | P. 383 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Applications regarding the need for foreigners | 1 year | P. 377 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Documents on the status and measures to improve working conditions and safety | 5 years | P. 409 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Books, registration logs, databases of industrial accidents, accident records | 45 years | P. 424 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Orders and instructions on administrative and economic issues | 5 years | P. 434 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Orders for sending on a business trip | 5 years | P. 434 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Orders on the provision of annual leave, additional paid and educational leave | 5 years | P. 300, 434 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Agreements on financial liability of the financially responsible person. Lists of responsible persons and sample signatures | 5 years | P. 279, 281, 282 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Documents (reports, acts, lists, schedules, correspondence) of periodic medical examinations | 3 years | Item 635 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Employment contracts and additional agreements thereto | If the paperwork was completed before January 1, 2003, then they must be stored for 75 years, if after - 50 years | P. 435 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| All orders for personnel: on hiring, transfer, relocation, combination, part-time work, dismissal, remuneration, certification, advanced training, assignment of ranks and titles, promotion, awards, parental leave, leave without pay A also: memos, certificates, statements to orders regarding personnel. | P. 434 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 | |

| All original personal documents: work books, diplomas, certificates, certificates, certificates not required by employees upon dismissal | P. 449 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 | |

| Civil contracts with individuals and acts on them | Clause 301 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 | |

| Personal files and personal cards of employees | P. 444, 445 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 | |

| Orders to change personal and biographical data | P. 434 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 | |

| Notifications, warnings to employees | 3 years | P. 436 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Employee applications for the issuance of work-related documents and their copies | 1 year | P. 451 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Magazines, books of record of labor safety briefings (introductory and on-the-job) | 45 years | P. 423 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Documents related to work in harmful and dangerous working conditions - time sheets and business trip orders | 50 (75) years | P. 410, 411, 414 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| FIXED ASSETS | ||

| Documents on revaluation of fixed assets and depreciation | 5 years after disposal of fixed assets or intangible assets | P. 323 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Documents on write-off of fixed assets | 5 years after disposal of fixed assets or intangible assets. | P. 323 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Acts of acceptance and transfer of real estate to the new copyright holder, i.e. when transferring from balance sheet to balance sheet | 5 years after disposal of property | P. 325 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| simplified tax system | ||

| Books of accounting of income and expenses for the simplified tax system | 5 years | P. 318 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| EXPERT ANALYTICAL DOCUMENTS | ||

| Reports and conclusions of expert and analytical activities of the Accounts Chamber, regional and local control and accounting bodies | 10 years | P. 142 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| FINANCIAL AND ECONOMIC ACTIVITY PLAN | ||

| The financial and economic activity plan must be kept for as long as the budget estimate | ||

| at the place of approval | 5 years | P. 243 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| at the place of development | constantly | |

| Reports on the implementation of FCD plans | ||

| annual | constantly | P. 272 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| quarterly | 5 years | |

| period | 1 year | |

| Reports on the implementation of grant and subsidy agreements | 5 years | P. 262 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| CONTRACTS AND AGREEMENTS | ||

| Lease agreements, free use of: real estate; movable property | Upon expiration of the contract, after termination of obligations: 10 years and 5 years | P. 94 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Agreement of gift (donation) of property | Before the liquidation of the organization | P. 90 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Leasing agreement | 5 years after expiration of the contract or redemption of the property. If there is a disagreement, the agreement must be kept until a decision is made on the case. | P. 96 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Real estate pledge documents | 10 years from the date of expiration of the contract. In case of a dispute, documents are kept until a decision is made on the case. | P. 98 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Real estate exchange agreement; movable property | Before the liquidation of the organization; 5 years upon expiration of the contract or upon fulfillment of obligations | P. 99 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Agency agreement: for real estate; on movable property | 15 years; 10 years | Clause 101 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

| Credit or loan agreement with the condition of pledging property | 10 years | P. 261 of the List, approved. By Order of Rosarkhiv dated December 20, 2019 No. 236 |

If different regulations specify different retention periods for the same type of document, use the longer period as your guide.

PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT

Complete information about accounting rules and taxes for an accountant. Only a specific algorithm of actions, practical examples and expert advice. Nothing extra. Always up-to-date information.

Connect berator

Storage periods for cash receipts and fiscal storage in 2022

With the introduction of online cash registers, the seller does not need to save paper receipts, however, he is obliged to store the FN (fiscal drive) for 5 years from the moment its use is completed (Clause 2 of Article 5 of the Law of May 22, 2003 No. 54-FZ “On use of cash register equipment...").

Due to the fact that all information about purchases is recorded on the drive, the need to maintain and store the cashier-operator’s book has disappeared.

The situation is completely different when an organization acts not as a seller, but as a buyer - purchasing something for its needs and receiving a payment receipt issued by the supplier’s online cash register. In this case, the buyer keeps the check as the primary document confirming the transaction for 5 years after the end of the reporting year.

Paper checks fade quickly, so to fulfill the duty of storing them you can:

- ask the seller to send the check electronically (for this you need to provide an email address, phone number, read the QR code);

- Immediately make a copy of the check and file it with the original.

The data specified in the receipt or BSO must be readable for at least 6 months after the business transaction (Clause 8, Article 4.7 of Law No. 54-FZ).

What is their storage period?

The order of safety of cash registers is regulated by both accounting and tax legislation. In Art. 23 of the Tax Code of the Russian Federation explains the storage period for cash documents for cash transactions: organizations are required to retain documentation with accounting and tax information for 5 years. At the request of tax authorities, income and expense registers are kept for the same amount of time.

Determines the period for which cash register documents are stored in the organization, and 402-FZ. In Art. 29 of the Accounting Law establishes a minimum period of preservation of primary accounting registers. It is 5 years after the end of the reporting year, which coincides with the requirements of the Tax Code of the Russian Federation.

The company independently organizes storage and provides the conditions required for the safety of documentation. If necessary, the company creates an archive and transfers all registers of previous years there (clause 2 of Article 13 125-FZ of October 22, 2004).

If a company conducts an audit of the cash register, a special audit act is drawn up. 402-FZ does not have a separate provision regarding how long the audit report of the main cash register is kept and how to store it. But the accounting law clearly defines the storage period for cash documents. All registers related to cash discipline are kept by the company for 5 years.

Confirms the minimum storage period for the cash book in the organization (and other cash register documents) and the order of the Federal Archive No. 236. Clause 277 of the order No. 236 provides the storage period for bank registers and cash register documents, counterfoils of cash check books, orders, time sheets and other forms.

In accordance with paragraph 277 of list No. 236, the storage period for a cash receipt order is 5 years. RKO, cash book, cashier's journals and checks are stored for a similar period.

What are the consequences of violating the storage period for cash documents?

If you get rid of a cash document confirming a business transaction ahead of schedule, tax authorities may deduct the corresponding expenses during audits. The result is additional taxes, penalties and fines.

In addition, for the absence of primary documents, inspectors can fine the taxpayer 10,000 rubles. (for primary violation) or 30,000 rubles. (if repeated) - in accordance with Art. 120 Tax Code of the Russian Federation.

There is also an administrative penalty for officials for violating the terms of storage of documents:

- fine under art. 15.11 Code of Administrative Offenses in the amount of 5,000-10,000 rubles. (for a primary offense), 10,000-20,000 rubles. or disqualification for a period of one to two years (for repeated violation);

- fine under art. 13.20 Code of Administrative Offenses in the amount of 300-500 rubles.

How to destroy expired documents

If cash documents have expired, they must be destroyed. It is necessary not only to get rid of documents, but also to arrange it correctly. For this purpose, an act “On the allocation for destruction of documents that are not subject to storage” is drawn up. It is signed by an expert commission, the composition of which must be approved by the head of the organization.

Form for document destruction act

If there are a lot of documents to be destroyed, you do not need to indicate a complete list, but only their type. For example: advance reports for ____ year.

There are two ways to get rid of documents:

- on your own (if the volume of papers is small);

- with the help of a hired organization.

If you destroy papers yourself, you can use a shredder - it's quick and convenient.

Let's sum it up

- The shelf life of most cash primary documents is 5 years, counted from January 1 of the year following the reporting year. Salary statements are stored for 5 years (if there are personal accounts), 75 (50) years (if there are no personal accounts).

- Owners of online cash registers are required to store not the punched checks themselves, but a fiscal drive in which all information about sales is recorded.

- Tax and administrative liability is provided for violation of the terms of storage of documents.

Receipt for acquiring - is it necessary or not?

Discussions about whether a fiscal receipt is needed for online payment and whether there is a need to save it have been going on since the beginning of the 2000s.

In 2003, Law No. 54-FZ was adopted, which defined the use of cash registers when paying for goods or services with a bank card or cash. But this law did not take into account the main thing: technologies are constantly updated, in particular, the possibility of online payment appeared not so long ago. Until 2016, under this law, a fiscal receipt was not required when directly transferring funds to a company’s account. However, in 2016, Federal Law No. 290 was issued, which states in black and white that a receipt is required for any payment method, including when it comes to paying out winnings from lottery tickets and receiving paid content (games, books, software etc.)

Therefore, at present, checks are definitely needed for acquiring. However, not all of them need to be stored for many years.