Despite the significant change in international tax rules, the foreign element has not completely disappeared. Therefore, the issues of obtaining financing from foreign companies, including parent companies, do not lose their relevance.

There are several ways to obtain financing from a foreign company. In order to decide on the choice of one or another option or a combination of them, you need to answer the following questions:

- for what purposes are funds needed - short-term covering the cash gap or financing the construction of a new warehouse. Or maybe even non-commercial status projects;

- How long does it take to raise funds? Is their volume accurately determined? Thus, with debt financing, framework agreements are possible (specific amounts are issued by the participant as needed). With capital financing, such freedom is limited by a more complex registration procedure;

— in which jurisdiction is the foreign country located and what tax conditions are provided for by the Double Taxation Agreement (hereinafter referred to as the Agreement), as well as the tax law of this state.

Let's look at each method in more detail.

Capital contribution

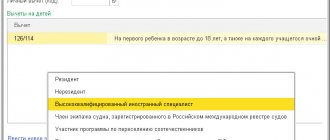

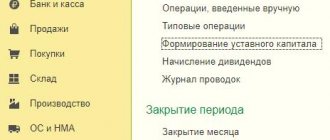

A contribution to the authorized capital is permissible if the foreign company has a share in the authorized capital of the Russian recipient of investments. A contribution to the authorized capital, in contrast to debt financing, is a non-repayable investment of funds for the participant. More precisely, the “return” in this case is indirect - in the form of dividends after the company receives a profit.

When paying dividends, tax is always withheld at source . The amount of tax depends on the existence of the Agreement and its terms.

In the absence of a tax treaty, the usual rate of 15% applies. That is, a Russian company must calculate, withhold and transfer to the budget of the Russian Federation 15% of the total amount of dividends paid to a foreign participant.

This rule is most often adjusted by the norms of bilateral agreements on the avoidance of double taxation. Since 2022, the terms of agreements with a number of popular states (Cyprus, Malta, Luxembourg) have been revised, and from 2022 the Agreement with the Netherlands will most likely cease to apply. The standard withholding tax rate is now 15%. The reduced 5% rate is retained only in relation to certain foreign organizations, for example, public companies whose shares are traded on the stock exchange.

Perhaps, a contribution to the authorized capital is the most labor-intensive way to invest funds in terms of registration .

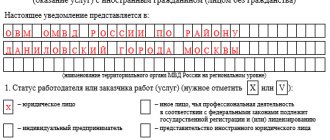

To invest funds in the authorized capital of an already established company, it is necessary to carry out a procedure for increasing the authorized capital of a Russian company, this means:

- in an LLC, make and notarize a decision to increase the authorized capital (in other words, the decision must be made in the presence of a notary). If the director of a foreign company is a foreigner and does not plan a visit to Russia, then he must issue a power of attorney to a Russian individual with the right to vote at the general meeting of participants of the Russian subsidiary;

- for a joint stock company - to register an additional issue of shares, which also entails time and financial costs;

- make changes to the charter and the Unified State Register of Legal Entities.

A contribution to the authorized capital as a method of financing from a foreign company will be justified if:

- funds are intended for the implementation of an investment project with vague payback prospects;

- the Russian company plans to build or reconstruct real estate over a long period of time;

- the financial situation of the Russian company or the potential tax risks present do not allow the choice of debt financing, and in the future there is a desire to distribute dividends to a foreign company with payment of tax at a reduced rate;

- the sale of the Russian company to third parties is not excluded. In this case, large investments in the authorized capital will help reduce taxation of income from the sale of shares/shares.

Contribution to property

Cash contributions to the property of a Russian subsidiary without increasing the authorized capital are a “faster” method of financing compared to a contribution to the authorized capital. To do this, a foreign participant only needs to make a decision (organize a general meeting of participants) and transfer funds.

A cash contribution to property received from a foreign company participant is not subject to income tax for a Russian company (as well as when receiving it from a Russian participant).

Let us recall that tax exemption for contributions to property is possible on two grounds, depending on the share of participation of a foreign company in a Russian one:

- gratuitous transfer of funds on the basis of paragraphs. 11 clause 1 art. 251 of the Tax Code of the Russian Federation, if the share of participation of a foreign company in a Russian company is at least 50%. The peculiarity of this norm is that it is applicable to all organizations, regardless of their legal form;

- contribution to property on the basis of clause 3.7. Art. 251 of the Tax Code of the Russian Federation - allows any participant to make a contribution, regardless of the share of participation, without incurring income tax on the recipient. However, the recipient of funds can only be a business company (LLC, JSC) and partnership.

With this method of financing, a “return” on investment is possible:

- by paying dividends with withholding tax at source in Russia;

- by returning to the foreign parent company previously made cash contributions to the property on the basis of clause 11.1, clause 1 of Article 251 of the Tax Code of the Russian Federation. There are no restrictions regarding the foreign residence of a company that is a member of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of the Russian Federation dated October 3, 2019 N 03-08-05/75878). It is important to remember that the rule only applies strictly within the amount of a previously made deposit in cash.

Interest-free foreign currency loans from a foreign founder

The arbitrators supported the tax authorities, recognizing their decision as legal.

| The fact of using a foreign currency loan received from a foreign founder for a long time, in the absence of opportunities and intentions to repay it, allowed tax inspectors to prove that the transaction was fictitious and that there was in fact no obligation. From which it follows that the Russian organization had no right to convert into rubles the amount of foreign currency receipts from the founder on the reporting dates. |

What if the debt is forgiven?

Suppose a Russian taxpayer received a foreign currency loan from the founder, used it for a number of years, and then, due to the impossibility of repayment, the debt was forgiven. Is a taxpayer who, at each reporting date, reflected negative exchange rate differences in tax accounting as part of non-operating expenses, required to recalculate after forgiveness?

In order to understand this issue, we will give another example from arbitration practice - the Resolution of the Fifth Arbitration Court of Appeal dated December 1, 2016 in case No. A51-7826/2016

(By determination of the AS Far Eastern Military District dated March 16, 2017 No. F03-642/2017), the cassation appeal proceedings were terminated), in which a case similar to the previous one was considered.

The Russian organization also received loans in foreign currency from the sole founder (a foreign company), also used borrowed funds in its activities for a number of years, and also at the reporting date reflected in non-operating expenses a negative exchange rate difference arising as a result of the increase in the ruble exchange rate against the dollar.

The only significant difference was that when the tax inspectorate came with an audit, the foreign founder forgave the debt to the Russian “daughter”.

In this case, as in the previous one, the Federal Tax Service reclassified the loan agreement as an investment agreement and, as a result, removed exchange rate differences from tax expenses.

Arguments of the Federal Tax Service.

The economic essence of the exchange rate difference is to increase or decrease the value of the debt obligation in national currency while the value of the obligation in the loan currency remains unchanged.

The exchange rate difference is a non-operating expense associated with a debt obligation; it fixes the difference between the value of an asset at the time of its acquisition and the value of the same asset at the time of its return (or in a certain period of time). In the situation under consideration, the taxpayer did not incur costs associated with servicing and repaying the debt obligation. Therefore, exchange rate differences on terminated debt obligations represent expenses that were not actually incurred by the company, and therefore do not comply with the requirements of Art.

252 Tax Code of the Russian Federation .

Arbitrators' arguments.

The arbitrators in this situation supported the taxpayer, noting the following.

Exchange differences form a type of non-operating income and expenses that are not directly related to either the main obligation or the gratuitous transfer of property rights.

The specifics of reflecting exchange rate differences for tax purposes are such that neither expenses with a negative difference, nor income with a positive difference are actually incurred expenses (income received), however, due to the legal regulation indicated above, they must be taken into account for tax purposes.

At the same time, the norms of Ch. 25 Tax Code of the Russian Federation

do not make the recognition of income and expenses in the form of exchange differences when revaluing a foreign exchange liability dependent on whether the amount of the specified

main obligation

in the taxpayer’s expenses or income.

The arbitrators separately emphasized that the tax authority, objecting to the accounting for tax purposes of negative

exchange rate differences on forgiven debt obligations, but at the same time sees no legal obstacles to taking into account

positive

exchange rate differences on the same category of debt obligations as income.

As a result, the judges rejected the Federal Tax Service's argument that there was no economic justification for the disputed costs in the form of a negative exchange rate difference that arose during the revaluation of debt obligations, which were subsequently forgiven.

At the same time, the justification given by the Russian organization for the need to forgive the debt was taken into account, namely: the decision to terminate (forgive) borrowed obligations was made by the participant in accordance with the provisions of the company’s constituent documents; this decision was subject to exceptional and urgent measures taken to prevent the risk of a decline in net asset value.

The judges concluded that the subsequent termination of the loan obligation in relation to the taxpayer cannot serve as a basis for recalculating the income tax base.

Earlier, a similar opinion was expressed by the financial department.

| Income (expenses) in the form of a positive (negative) exchange rate difference are subject to accounting as part of non-operating income (expenses) in the tax periods in which they arose, and are not subject to recalculation in connection with the forgiveness of a debt in foreign currency by the founder in later tax periods (Letter of the Ministry of Finance of Russia dated November 3, 2015 No. 03-03-06/63375 ). |

When a forgiven debt is not income

To conclude the topic, we will consider what tax consequences will arise for a Russian organization to which the founder has forgiven the loan. First of all, she may be interested in the question of whether she is generating non-operating income in the form of the amount of forgiven debt?

As follows from paragraph 8 of Art. 250 Tax Code of the Russian Federation

, an organization that accepts property (including cash) free of charge will have non-operating income (except for the cases specified in

Article 251 of the Tax Code of the Russian Federation

).

In subparagraph 11 of paragraph 1 of Art. 251 Tax Code of the Russian Federation

, in particular, it states that when determining the tax base, income in the form of property received by a Russian organization free of charge is not taken into account:

– from an organization, if the authorized capital of the receiving (transferring) party consists of more than 50% of the contribution of the transferring (receiving) organization; – from an individual, if the authorized capital of the receiving party consists of more than 50% of the contribution of this individual.

Moreover, if the organization transferring the property is a foreign company, then the specified income is not taken into account when determining the tax base only if the state of permanent location of the transferring organization is not included in the list of offshore zones.

The rules set out in paragraphs. 11 clause 1 art. 251 Tax Code of the Russian Federation

, can be extended to cases of debt forgiveness (including those arising under a loan agreement).

This conclusion follows from letters of the Ministry of Finance of Russia dated October 19, 2011 No. 03-03-06/1/678

,

dated October 11, 2011 No. 03-03-06/1/652

,

dated October 21, 2010 No. 03-03-06/1/ 656

. They state that funds received by a Russian organization under a loan agreement from an organization or individual, if the obligation under the loan agreement was subsequently terminated by forgiveness of the debt, will not constitute income for income tax purposes (subject to compliance with the requirements for participation in authorized capital).

According to clause 3.4 clause 1 art. 251 Tax Code of the Russian Federation

property transferred by participants to the company in order to increase net assets, including through the formation of additional capital, is also not taken into account in income for tax purposes.

As the Ministry of Finance explained in Letter No. 03-03-06/1/71620 dated December 8, 2015

, this rule also applies to cases of an increase in the company’s net assets with a simultaneous decrease or

termination of its obligations

to the relevant participants, if such an increase in net assets was, in particular , a consequence of the will of a participant in the company.

Note.

Funds received from the founder free of charge (including as a result of debt forgiveness under a loan agreement) are not taken into account as income if one of the conditions is met:

– the founder owns more than 50% of the share in the authorized capital and is not an offshore company ( clause 11, clause 1, article 251 of the Tax Code of the Russian Federation

);

– funds were received to increase net assets ( clause 3.4, clause 1, article 251 of the Tax Code of the Russian Federation

). In this case, the size of the founder’s share in the authorized capital does not matter.

* * *

So, if an organization delays repaying a foreign currency loan from the founder, then tax authorities can re-qualify the loan agreement as an investment agreement and exclude negative exchange rate differences from non-operating expenses. If a loan, which the taxpayer had no intention of repaying, is forgiven, exchange rate differences can be taken into account when calculating the taxable base.

Of course, it is difficult to draw far-reaching conclusions based on two examples. And yet we believe that in a situation similar to that described in the second resolution, the taxpayer has a greater chance of defending his case.

Ermoshina E. L., expert of the information and reference system “Ayudar Info”