Regardless of the field of activity, any business is associated with costs. The entrepreneur pays some of them at once, while others endure constantly. In general, such expenses can be spent both on material factors of production (for example, the purchase of equipment) and on the use of these funds (various services, wages to employees). In any case, these expenses must be taken into account and recorded in monthly reports. In the article we will define fixed and variable production costs and explain what they are in economics using real examples.

Essence of the term

Any business involves the consumption of various types of resources - these are temporary (human), materials, raw materials, as well as electricity, water and other utilities. Separately, it is also worth noting the depreciation of machinery and production equipment. After going through the entire cycle and turnover, in a good situation, the business should pay off. That is, the revenue received by the company covers the costs incurred during production. This is what determines the two basic rules of a successful enterprise:

- Continuity of activity - one cycle is replaced by another. Either smoothly with gradual replacement of stages, or abruptly. For example, according to the principle: the batch is sold - the revenue is received - we proceed to a new order.

- Receiving income. It is not always possible for an entrepreneur to gain profit from the first turn; it is usually a protracted process. As a rule, monthly costs should be recouped immediately, and the initial one (purchase of equipment) should be recouped over time. But the result and natural goal is to receive revenue that will not only cover the costs, but will also be significantly higher than them.

Let's give a definition: fixed and variable costs of an enterprise are the cost, monetary equivalent for various types of resources in the course of activity.

Economics suggests that at the business level, costs depend on and are based on two parameters:

- Resources are finite and not limitless. Their supply may cease or for other reasons become impossible. This applies not only to material things, for example, raw materials that are out of stock, but also to intangible things – time, labor, technology.

- Alternative uses of the same resource. Assuming that one steel is suitable for making a car body, then most likely it is not used for smelting sewing needles. In other words, if raw materials are used in one direction, they will not be used in another. And purchasing an alternative is not always possible.

But manufacturers are trying their best to minimize costs, which means they are looking for other suppliers, creating a certain resource “safety cushion”, and also considering alternative markets and finding more inexpensive options.

Calculation of variable production costs

How to calculate variable costs? Very simple. To find their total amount for the period, you need to add up all the costs that are defined as variables.

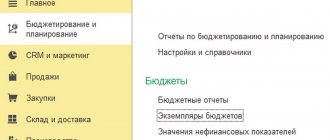

It is convenient to use accounting data from the accounting accounts discussed above for this purpose. It should be taken into account that in accounting there is no division into fixed and variable costs, but the existing direct costing method allows them to be divided in this way, according to which fixed costs can be written off as a decrease in the financial result at a time. These are the costs accounted for in accounts 26 and 44. If all other costs are considered variable (and this is sufficiently justified for account 25), then the calculation of variable costs is significantly simplified.

In the cost sharing situations we discussed above in small and large organizations, it will look like this:

- Small enterprises that use only two accounts (20 and 26) to collect costs will take into account as variables the amount of costs that during the period under review will be written off from account 20 (if the company provides services) to the debit of account 90 or from account 20 to the debit of account 43 (if we are talking about finished products). In the first case, for the period corresponding to the reporting period, this amount can be taken from line 2120 of the financial results report. In the second, variable costs will fall into the same line of Form 2 if the volumes of products produced and sold during the period coincide.

For information on the procedure for entering data into the lines of the financial results report, read the article “Filling out Form 2 of the balance sheet (sample)”

- Trade organizations that use only one account 44 to account for costs will highlight among them those that are defined as variable (costs of packaging goods, interest and rewards paid for sales, with charges on them), and, adding their sum with the cost of goods sold (which will be equal to the volume of debit from account 41 to the debit of account 90), they will receive the total amount of variable costs for the period under review. It will not be possible to take this data directly from the accounting records.

- Large organizations that use all existing accounts (20, 23, 25, 26, 44) to account for costs and have decided to classify expenses collected on account 25 as variable, variable costs for the period will be determined as the cost of finished products written off from account 20 to the debit of account 43, or as the cost of services written off from account 20 to the debit of account 90. If the organization does not carry out trading activities and does not need to divide the costs collected on account 44, then for the reporting period the volume of variable costs for services can also be taken from line 2120 of the financial results report. Data on finished products will fall into this line if the volumes of produced and sold products coincide for the period under review.

Thus, the use of the direct costing method significantly simplifies the calculation of the amount of variable costs. If this method is not used, then the variable cost formula will look like this:

PI = ∑ З,

where: PI - variable costs;

Z - costs incurred in connection with the direct creation of sold goods (works, services) and taken into account in their cost. They must be summed up, but the expenses included in the cost price when distributing account 26 must be excluded from them.

What are the features: what costs are fixed and variable?

When a manufacturer has costs, they directly affect the entire cost of the production process, and therefore the cost of the final product (service). It is based on this that this classification is made.

Uninterruptible ones are those that practically do not depend on anything. They are not affected by how big the batch is this month and how big next month. The price tag for them is usually fixed. Payment is made monthly or quarterly, annually - depending on the specific type. And such expenses must be paid in any situation, even if the company has temporarily ceased its activities for some reason.

Fixed costs include:

- Any loans, borrowings and other financial obligations that need to be paid.

- Equipment depreciation. Some believe that the wear and tear of equipment directly depends on the amount of use. But there is such property that is depreciated regardless of actions. For example, a building gradually collapses, cars become obsolete and lose market value, etc.

- Costs for rented space.

- Payment of interest on the company's bonds.

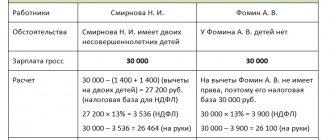

- Most of the employees' salaries. There are people who work seasonally or on a percentage basis, and others who work on a salary basis. These are accounting, lawyers, advertising department and many other positions. Even if there are no orders, the workshops are idle, they need to be paid monthly.

Variable costs, in one way or another, directly depend on the amount of work done (number of goods produced, services provided), as well as on the amount of expenditure on resources. The assortment also influences them. Here's what they can be:

- Supply of raw materials.

- Wages of those employees who receive salaries and bonuses depending on production volumes.

- Transportation of goods means either the cost of fuel together with maintenance of the vehicle fleet, or hiring the services of a transport company.

- Receipts for electricity and other utility resources used in production (water for cooling parts, for example).

- Maintenance and repair of technical equipment, equipment, tools and other things necessary for work.

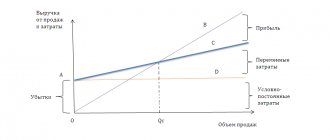

If you imagine the totality of these expenses as a graph, it will look like this:

That is, costs are expected to increase depending on production. Accordingly, incomes also grow.

An interesting feature is that both a firm's fixed and variable costs (this is from the examples above) are variable in the long term. That is, such a strict distinction can only be made for a few months, or at most years (short-term forecasts). And on a scale of one or more decades, all costs are variable.

What are the costs of the enterprise?

Costs (expenses) incurred by a legal entity for the purposes of management accounting are divided into 2 large groups:

- Constants that ensure the operation of the entire enterprise as a whole, but are not directly related to the main production process. They do not depend on production volumes and occur even if production is temporarily not functioning. These include, for example, the costs of maintaining the management apparatus, taxes, rent, organizing sales, advertising, information and consulting services, communication services, and personnel training.

- Variables that make up the actual cost of production (direct costs of production). Their volume directly depends on the volume of production and changes with it.

The classification of costs as fixed or variable costs of an enterprise is quite conditional. They are determined by many factors and in reality reveal more complex dependencies, including on production volumes.

The determination of their sizes, and, consequently, the reliability of economic calculations and the reliability of the conclusions that are drawn on their basis depend on the correctness of dividing costs into these 2 groups.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Kinds

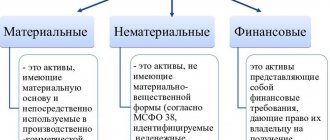

When classifying all material losses at an enterprise, in economics it is customary to first of all subdivide them into:

- Economic. These are real payments, the actual loss of funds from circulation. You can look at receipts, invoices, calculate with maximum accuracy, and make a report.

- Alternative. Essentially, these are missed opportunities. That is, what could have been obtained if a different solution had been chosen. The calculation is made as an assessment of the potential funds that could be obtained if other resources and technologies were used.

Economic ones, in turn, are divided into:

- Internal. They are also called implicit. They are distinguished like this. A manufacturer, for example, has its own equipment, say a vehicle. He puts it into circulation and uses it with minimal maintenance and fuel costs. But implicit expenses can be considered the amount that would presumably be accrued if the transport were not her own, but hired.

- External. They are explicit, accounting ones. These are the material resources that we talked about above, which are spent on acquiring resources of one order or another.

External costs, in turn, are divided into two main categories. Sometimes the classification is presented like this:

Let us give brief definitions and give examples.

How to define the concept of fixed costs (what are these costs, what are they for)

In short, this is what is spent regardless of production volumes. They have to be paid, even if the workshop is idle, the workers are on strike, and the nearest power plant that supplies your office has cut off power for a day.

Graphically, this expense item will look like a straight line:

Many business consultants insist on turning fixed costs into variable ones. How to do this - instead of a full-time accountant, use the services of an outsourcing company, for example.

Example

Let's assume that a businessman took out a loan from a bank. He undertakes to pay N thousand rubles monthly. And even if product turnover has dropped significantly, the monthly payment remains the same. A way to make this expense item more “convenient” and dependent on production is to consider investment options instead of a loan. Then the investor will invest money in the development of the business and receive a percentage of the income. And if there is no profit, then you don’t need to pay anything.

Variable costs: what are they?

They have a direct dependence (they can either increase or decrease) on production volumes. That is, in order to increase the production of a product, it is necessary to use more raw materials.

It is interesting that at the beginning of a business there is usually a direct relationship - the number of products produced literally dictates the amount of costs. Then this proportion becomes softer (for the manufacturer) because he learns to save and use resources more profitably.

Example

It is interesting to consider this relationship in connection with the current trend towards the introduction of labeling for many product categories. Now it is already actively used to regulate the turnover of alcoholic beverages, tobacco, and medicines. The more cigarette packs a company produces, the more marking codes need to be ordered.

If we consider the issue of labeling goods from a cost point of view, then the constant costs will be those that will be spent at a time on the purchase of equipment (scanners, online cash registers) and software. How to save in this case - contact. We will help you choose an option to solve the problems of your individual enterprise.

General, average (unit) costs

The total costs for a period, consisting of fixed and variable costs, are called total costs. Accordingly, the total costs of each of the groups that form this sum are called total fixed and total variable costs.

For each of these amounts, you can determine the average (or unit) costs, which are calculated as the quotient of dividing the total amount of the corresponding costs by the number of products produced during the period under consideration. Average (or unit) costs represent the costs per unit of production.

You can calculate similar indicators broken down by product type. This will make it possible to set an appropriate price for it, and if it turns out to be significantly higher than the market price, then make a decision to discontinue production or ways to reduce costs (production or management).

An example of calculating fixed and variable costs in the table

A small and relatively new textile production received a government order - up to 5,000 units of goods (for example, medical gowns). Working primarily on this project, the company has the following costs:

| What are the funds used for? | What type of consumption is it? | Amount in rubles |

| Renting premises | Post-e | 50 thousand |

| Depreciation of equipment per year | Post-e | 48 thousand |

| Interest on the loan (not the payments themselves) | Post-e | 84 thousand annually |

| Payment of utilities | Per-e | 18.5 thousand |

| Raw materials for sewing - fabric and accessories | Per-e | 200 thousand |

| Seamstress salaries | Per-e | 360 thousand monthly |

| Salaries of administrators and other staff units | Post-e | 135 thousand |

| Purchase of sewing machines and other equipment | Post-e | 500 thousand |

Based on these data, we will conduct further calculations.

Costs

6.1. Nature of costs

The life experience of each of us suggests that there are no benefits without losses, and no results without costs. The production of goods and services necessarily involves costs, which represent the expenditure of resources. How to measure the value of resources spent in production, and therefore costs? Economic theory gives two significantly different answers to this question. Namely, there are two concepts of costs:

- accounting costs.

- costs of lost opportunities (opportunity costs).

Moreover, paradoxically, both answers are correct and have deep economic meaning.

6.1.1. Accounting costs

The essence and structure of accounting costs

The value of the resources used in production can first of all be expressed by the price at which the company purchased them on the market. In this case, costs appear as the sum of payments that the company made to suppliers and its own employees. All payments must be recorded in accounting documents. This method of estimating costs is called accounting, and the costs estimated with its help are called accounting costs.

To better understand what exactly accounting costs include, we list their main items.

- material costs

- payment for raw materials, materials, fuel, energy, purchased components and semi-finished products. - labor costs

- wages of employees, as well as other payments provided for in employment contracts. - deductions for social needs

- deductions according to the norms established by law to the social insurance fund, the Pension Fund of the Russian Federation, the employment promotion fund, etc. - depreciation

- deductions according to the standards established by law, reflecting the wear and tear of equipment, buildings, etc. - other costs

- commission payments to the bank for cash and banking services; interest on loans, lease payments; payment for work and services provided by other companies; taxes and fees included by law in production costs.

Thus, the logic of the accounting approach to estimating resource costs is to answer the question: how much did the firm pay to produce this good? This is a retrospective assessment based on careful accounting of the firm's transactions.

Amount of accounting costs

The concept of accounting costs is very important and useful. Resource costs here receive a clear, unambiguous and objective monetary measurement. Knowing the exact amount of accounting costs is key to determining whether a firm is profitable or unprofitable. To do this, it is enough to compare accounting costs with the amount of company income (also taken into account by accounting). The economic meaning of such accounting analysis is extremely important: only enterprises that are profitable in the long term are able to maintain their place in the market, while long-term losses lead to inevitable bankruptcy.

The accounting calculation methodology is standardized and therefore suitable for an objective assessment of the state of affairs of a company, as well as for comparing the state of affairs at different enterprises. In Russia, in particular, the mandatory accounting standard for all firms is established by law and is carefully monitored by tax, banking and other authorities. Since a planned economy is very different from a market economy, accounting in our country has historically differed from that adopted in other countries. However, in recent years, the main trend in the development of accounting in Russia has been to bring its rules closer to international standards.

It is the balance sheet of an enterprise that is studied by everyone who is interested in obtaining the most important information about it: investors, before investing money in this enterprise; stockbrokers deciding whether to buy his shares; shareholders, checking whether a sufficient amount of dividends was paid to them; tax authorities - when determining the tax base of an enterprise.

Limitations of the accounting method

At the same time, the level of accounting costs does not always allow us to accurately judge the state of affairs in the company. Let us remember that only in a competitive market can price perform an information function. Therefore, accurate measurement of costs is only possible when all resources expended are valued at their market price.

This doesn't always happen. For example, in a socialist economy, prices were set centrally. The presence of planned unprofitable enterprises, state support for unprofitable production, and ignorance of inflationary processes turned the state price system into a pavilion of distorting mirrors. In addition, the costs of enterprise resources were planned not according to actual sizes, but according to established standards. At the same time, outdated spending standards were often used that did not correspond to the modern level of technical progress.

Of course, now the situation has changed. During the course of reforms, market pricing mechanisms began to dominate in the Russian economy. Already in 1996, the share of products for which prices and tariffs were regulated at the federal and regional levels amounted to only 15–16% of the total cost of goods and services produced. Enterprises became independent economic entities.

However, even in modern Russia, the actual prices for purchasing resources may not be market prices. Elements of the administrative mechanism and other market imperfections continue to play a large role in our economy. For example, the assessment of capital resource costs adopted by the accounting method is based on legally (i.e., subjectively, by the will of people) established depreciation rates. The amount of these deductions does not necessarily reflect actual wear and tear on the equipment. Finally, let’s remember one of the most common fraud schemes in modern Russia: buying resources from “friendly” companies at inflated prices or selling products to them at reduced prices. As a result of these frauds, money is easily transferred to the accounts of “friendly” companies. So, actual prices for purchasing resources are not always the best guide in measuring costs.

Explicit and implicit costs

The second disadvantage of the accounting method is that it includes the costs only of those resources that the company acquires from outside (raw materials, materials, labor, etc.). They are called explicit (external) costs. Explicit costs are reflected in cash payments from the firm's accounts to resource suppliers.

However, some resources may already be owned by the enterprise. Therefore, they do not need to be purchased anywhere, which means that the corresponding costs are not reflected in accounting documents, although they exist in reality. The costs of these resources form implicit (internal) costs.

For example, the owner of a pharmacy kiosk at a metro station, who himself works as a salesperson, will not enter into an employment contract with himself, which specifies the amount of wages. But this does not mean that he does not expend effort and time, which have a certain value, and therefore are also costs.

There is a paradoxical rule of practice from an accounting point of view: “... some of your highest upcoming expenses are related to things that you have already bought and paid for ...”, i.e. which are your property.

The company's own resources are usually the entrepreneurial abilities of its owners (if the latter themselves manage the business), land and capital of the entrepreneur or shareholders. These resources play a significant role in a market economy. And it is they who remain outside the scope of the accounting concept of costs!

Calculation: what are fixed costs in the given example

In the economic literature, this indicator is written with the letters FC (we have already used this abbreviation above when drawing up the graph). Let's apply it now:

FC = 50*12 + 48 + 84 + 500 = 1,232 thousand per year.

Let us derive the average value depending on the number of units of production:

AFC = 1,232,000 / 5,000 = 246.4 rubles goes for 1 robe.

Now let’s calculate the variable costs (cost of materials, salaries of workshop workers, electricity):

VC = 200 + 360 + 18.5*12 = 782 thousand per year.

Average value (AVC) = 783,000 / 5,000 = 156.4 rubles per 1 USD

TC is the total cost, calculated by addition. As a result, we receive 20,140 thousand per year or 402 rubles 80 kopecks for one robe.

Conclusions based on calculations

If you invest this value in the cost price and add 20-30%, then the enterprise’s income can be called stable. Note that this example does not take into account defects (this is the minimum value) and transportation, that is, it is assumed that delivery and shipment are at the expense of the receiving party.

How to figure out why costs change over time

So far, in this case, fixed costs are higher than variable ones. This is explained by the fact that the business is new, while there is a loan, and also there is still a small turnover. With the release of an increased number of orders, the reverse process will occur - VC will become higher than FC.

To keep track of variables, you need:

- regularly make fresh calculations;

- look for alternative ways of development;

- adjust economic regulation measures.

Only a comprehensive analysis will help determine the real reasons for the decline or increase in costs.

Returnable and sunk costs

Costs are grouped depending on whether the money invested will be returned back or not.

Return costs

It is assumed that this group of costs will come back sooner or later. For example, this is a large part of production costs. After all, first the company invests money in production, then sells the finished product, thereby returning the costs incurred and making a profit. Examples of such costs: costs of raw materials, wages, and so on.

Sunk costs

The company bears these costs, but will never be able to return them. That is, they do not participate in the creation of profit. For example:

- costs of creating and registering a company;

- insurance costs;

- expenses for banking services and so on;

- expenses for failed research projects.

Analysis and planning

Regardless of the size of your business, it is necessary to plan - for a month, a year or a longer period. This is necessary to:

- rational use of resources;

- make a short-term profit forecast, and on the basis of this make decisions on modernization, expansion of production, etc.;

- find ways to save money to reduce costs and increase competitiveness.

What needs to be done for this? First of all, carry out an analysis - take inventory of all expense items, organize them, analyze the need and possibility of introducing changes.

Remember that the quality of the product (if you save on materials) or its popularity (reducing advertising, for example) may depend on which categories you adjust.

Classification

Costs can be private or public. They will be private if this indicator relates to a specific company. Social costs are an indicator that applies to the entire society. The following basic forms of enterprise costs are also distinguished:

- Permanent . Expenses within one production cycle. They can be calculated for each of the production cycles, the length of which is determined by the enterprise independently.

- Variables _ Full costs transferred to the finished product.

- Are common . Costs within one production stage.

In order to find out the overall indicator, you need to add up the constant and variable indicators.

Depending on the type of product, its complexity, the type and nature of the organization of production, enterprises use the following basic methods of accounting and calculating the actual cost of products, such as standard, distribution and custom. Methods for calculating the cost of products make it possible to study the process of formation of the cost of specific types of products, compare actual costs with planned ones, compare production costs for a specific type of product with the costs of competitors' products, justify prices for products, and make decisions on the manufacture of profitable types of products. Learn more about calculation methods

What is included in variable expenses

The most significant are:

- Cost of materials, raw materials.

- Communal payments.

- Transportation.

- Salaries of hired workers.

- Product labeling.

- Energy resources.

Crisis measures

One of the common ways to minimize costs during a turning point (economic decline, falling purchasing power, emergence of competitors) is to reduce staff. But before resorting to this extreme method, it is worth checking other options. For example, you can change the supplier, find an investor, or transfer part of the staff to a salary based on a percentage of sales.

Production and non-production costs

Costs are grouped depending on whether they are involved in the production process or not.

Production costs

These are costs associated with production. These include almost all variable and direct costs:

- for raw materials and supplies;

- for repairs of production sites;

- employees' wages;

- utility costs and so on.

Non-production costs

These are expenses that are not directly related to production, but without them the company cannot exist. For example:

- salaries of administrative and management personnel;

- office rental;

- utility costs in the office;

- renovation of an office building;

- buying furniture;

- payment for banking, accounting and auditing services.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions