Companies that carefully analyze partners most often work in areas such as finance, IT, logistics and transport, business services, FMCG.

There is a whole set of data on partners who are checked most often. This is mainly information about registration, owners, and reporting. Less than 1% of companies are interested in messages that appear about their counterparties in the media, enforcement proceedings, information about licenses and trademarks.

Contour.Focus API research data

No matter how much businesses would like to avoid the monotonous analysis of information on partners, it remains an important part of their activities. According to a joint survey by Promsvyazbank, Opora Rossii and Magram Market Research, about 27% of businessmen encountered dishonest behavior from counterparties in 2022. Basically, these are delays in payment under contracts, delivery of low-quality products, and sometimes poaching customers.

Why do you need to check your counterparty?

The Tax Code obliges taxpayers to document the validity of expenses and deductions (Article 54.1, Article 172, Article 252 of the Tax Code of the Russian Federation).

In most cases, such documents come from counterparties. Therefore, when choosing a business partner, it is necessary to evaluate not only the terms of the planned transaction and its commercial attractiveness, but also the business reputation and solvency of the potential counterparty, as well as the risk of non-fulfillment of its obligations both under the contract and to the budget. In turn, the Federal Tax Service Inspectorate, when carrying out control measures, has the right to question the legality and validity of reducing the tax liability (determination of the Judicial Collegium for Economic Disputes of the Supreme Court of the Russian Federation dated July 20, 2020 No. 306-ES19-27836). Determine the likelihood of an on-site tax audit and receive recommendations on the tax burden

In order to successfully resist the claims of the tax authorities, verification of the counterparty is required before signing the contract. In particular, you need to make sure that the party to the contract is a real organization that can be contacted without problems; it has the resources necessary to fulfill its obligations (production capacity, equipment, personnel) and relevant experience. At the same time, judicial practice proceeds from the fact that the depth of checks depends on the significance of the transaction: the larger the contract, the more carefully it is necessary to study the counterparty (determination of the Judicial Collegium for Economic Disputes of the Armed Forces of the Russian Federation dated May 14, 2020 No. 307-ES19-27597).

Thus, before concluding a one-time small transaction, it is enough to make sure that the counterparty is registered in the Unified State Register of Legal Entities and can be contacted at the address specified in the register, and an authorized person acts on his behalf.

Receive a fresh extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs with the signature of the Federal Tax Service Send an application

The exception is situations when the terms of the planned contract deviate significantly from the market level, or their services are offered by a company or individual entrepreneur that does not have experience in executing similar transactions. In these cases, it makes sense to further find out whether the potential counterparty has the necessary resources, debts to the budget and other business partners, study its business reputation, etc. The same thorough checks should be carried out when purchasing real estate or other high-value assets, or before entering into long-term contracts.

Checklist for checking a counterparty

Any taxpayer can use the recommendations of the Federal Tax Service as a guide for action. The department shares them in its letters.

So, for example, in the Letter of the Federal Tax Service of Russia dated July 13, 2017 No. ED-4-2 / [email protected] you can find the following control questions about the integrity of counterparties, which tax authorities use when checking:

- Do you personally know the head of the counterparty organization, under what circumstances, when did you meet?

- What relationships (friendships, business) unite you?

- What work (services) did the counterparty organization perform for you, what goods did it supply?

- Has this organization previously provided similar services for you, performed work, or supplied goods?

- What actions did you take to establish the business reputation of the counterparty organization?

Methods of checking an organization for reliability

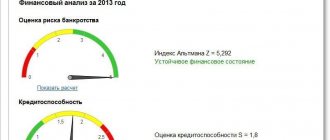

Today, there are several verification mechanisms available. The easiest way is to use paid services that aggregate all publicly available data. Comprehensive information about a potential counterparty will be provided quickly, in an accessible and visual form. At the same time, some of these services will also conduct an initial analysis of the collected information; They will tell you what points you need to pay attention to and give a preliminary assessment of the safety of the transaction.

You can find out how much taxes the counterparty paid and check its financial condition in the “Kontur.Focus” service. Connect to the service

An alternative option involves independently collecting information using free databases of government agencies and other open sources. In particular, information about the counterparty can be found on the websites of the Federal Tax Service, Rosreestr, arbitration courts, bailiffs, etc. It would also be a good idea to use regular search engines to assess the business activity of your future partner.

Finally, there is another way to check. It involves obtaining all the necessary information directly from the counterparty or persons related to him. This option is usually used in addition to the first or second. From the company with which you plan to cooperate, you can request a copy of the charter, information about the manager’s passport details, information from tax returns, as well as real reviews (recommendations) of people who have dealt with it.

Contour.Focus: opportunities for checking the counterparty

Based on the number of sources described, we can conclude that finding a counterparty and checking its reliability is an extremely difficult job. But this work can literally be minimized to one click using a service such as Contour.Focus.

Why the service is convenient:

- The search for a company or individual entrepreneur is carried out by name, address, full name, tax identification number and other parameters. The relevance and reliability of information is guaranteed through access to official government open sources.

- In addition to the latest extracts from the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs, the user receives data from the Card Index of the Supreme Arbitration Court, the Federal Bailiff Service, the Federal Treasury State Contract Database, the Unified Federal Register of Bankruptcy Information, and the Rosstat Organizations Accounting Database.

- The company card, in addition to all other necessary information, includes a selection of links with mentions of the company on the Internet, which allows you to speed up the process of collecting facts by aggregating information from the media, from forums with reviews, from the website of the company itself and the websites of its partners, suppliers and clients, from the issuer's information disclosure page, from news resources.

- The service user can put 1000 companies under surveillance. Upon learning of changes in data, Contour.Focus will notify the user about them by email.

- The service is able to analyze organizations according to criteria preset by the user.

Learn more about all the capabilities of the Contour.Focus service.

How to check a counterparty: step-by-step instructions

If a special paid service is used for verification, then to obtain an analytical certificate for the counterparty, it is enough to enter its data into the appropriate program. In other cases, to find out information about the counterparty, you should follow a certain algorithm.

Step one: checking the counterparty on the Federal Tax Service website

Self-checking should begin by visiting the official website of the Federal Tax Service, where the electronic service “Business risks: check yourself and your counterparty” is posted. With its help, you can generate an extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs. To do this, you need to enter the TIN or OGRN (OGRNIP) of the taxpayer being audited. Or indicate the name of the organization (full name of the individual) and select the region. The extract you receive will ensure that your business partner is a current taxpayer and that liquidation, exclusion from the register, or bankruptcy proceedings have not been initiated against him.

Additionally, from the extract you can find out information about the head of the organization and its address. This information should be compared with that provided by the counterparty itself. In addition, you need to pay attention to the OKVED codes indicated in the extract. Such information will make it possible to verify that the business partner indicated during registration a code corresponding to the type of activity that he undertakes to carry out under the terms of the agreement.

IMPORTANT

If an extract from the Unified State Register of Legal Entities displays information about the unreliability of information about the address, manager or participants of the counterparty, then it is better to refrain from concluding an agreement with him.

Check the counterparty for the accuracy of information in the Unified State Register of Legal Entities and signs of a shell company

Next, on the Federal Tax Service website, you need to check whether your partner has tax debts. To do this, you need to enter his TIN into the service “Information on legal entities that have arrears in paying taxes and/or have not submitted tax reports for more than a year.” The amount of debt itself can be viewed in the “Open Data” section on the Federal Tax Service website. But it is impossible to obtain information from this section by simply indicating the TIN or OGRN of the counterparty. To find out information about tax debt, you need to find and download the corresponding file on the page https://www.nalog.ru/opendata/7707329152-debtam/.

ATTENTION

It is quite difficult to find information about a specific counterparty in Open Data.

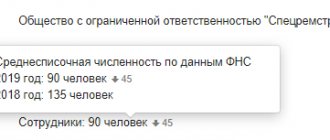

The Federal Tax Service website contains hyperlinks to archives containing files with data for all taxpayers at once. Accordingly, in order to find the organization being checked, you will have to open dozens, if not hundreds of files one by one, and study their contents. It is much more convenient to obtain information from registers, including about the tax debt of the counterparty, using special services. Thus, Kontur.Focus users just need to enter the name or TIN of the counterparty in the search bar. The service will collect important information from the Federal Tax Service databases and other sources in one window and generate an express report (for more details, see “Information on tax regimes applied by taxpayers has been published” and “Information on the average number of employees for 2019 has been published”). Connect to the "Contour.Focus" service to choose only reliable counterparties Submit an application

Next, on the Federal Tax Service website you need to use the “Transparent Business” service. The verification is carried out using the INN, OGRN, and the name (full name) of the counterparty. Using the service, you can find out information about the manager and founders of a business partner regarding their participation in various “mass” organizations, possible disqualification or deprivation of the right to hold positions (participate in the management of organizations). It is also possible to check whether the counterparty’s address is a mass registration address. Separately, it should be clarified whether the director stated that he has no relation to the relevant organization (https://service.nalog.ru/svl.do).

Check the counterparty for bankruptcy

After this, it makes sense to go to the https://bo.nalog.ru section, where you can get data on the organization’s accounting records (by TIN, OGRN, address or name).

Another service on the Federal Tax Service website allows you to find out whether the counterparty’s account is blocked. On the page https://service.nalog.ru/bi.do you need to select the option “Request for current decisions on suspension”, then enter the TIN of the counterparty and the BIC of the bank in which the account being verified is opened. For more information about this service, see “Blocking a tax account in 2022: how to check it on the Federal Tax Service website and what to do.”

In addition, the official website of the Federal Tax Service allows you to check the following data about the counterparty (information is contained in the file archives):

- whether it applies special tax regimes (https://www.nalog.ru/opendata/7707329152-snr/ and https://npd.nalog.ru/check-status/);

- how much taxes I paid (https://www.nalog.ru/opendata/7707329152-paytax/);

- whether he was brought to tax liability (https://www.nalog.ru/opendata/7707329152-taxoffence/);

- what is the number of employees (https://www.nalog.ru/opendata/7707329152-sshr2019/).

IMPORTANT

Information published on the website of the Federal Tax Service is not issued upon request (clause 1.1 of Article 102 of the Tax Code of the Russian Federation), letter of the Federal Tax Service dated March 25, 2020 No. BS-19-11 / [email protected] ).

If an organization sends a letter to the inspectorate with a request to provide information about the number of employees of the counterparty, its tax regime, taxes paid, violations committed and other data, it will be refused. You will have to collect this information yourself by studying the Federal Tax Service databases. Or, as mentioned above, it can be obtained in a few clicks in a special service. Find out about the taxes paid by the counterparty and the violations committed by him Start an audit

Step two: checking the counterparty by TIN or OGRN

The next stage is to search for data about the counterparty by its TIN, OGRN or name in the databases of government agencies. You can use the following sites for this:

- https://kad.arbitr.ru (data on the counterparty’s litigation);

- https://rosreestr.ru/site/eservices/ (data on real estate owned by the counterparty);

- www.zakupki.gov.ru (data on purchases in which the business partner took part).

Receive notifications about government procurement for small and medium-sized businesses Set up newsletter

IMPORTANT

It would also be a good idea to “punch” the TIN and OGRN of the counterparty through search engines in order to study customer reviews and other information available on the Internet.

Step three: verification of enforcement proceedings

The service on the website of the Bailiff Service (www.fssprus.ru) does not provide information on TIN or OGRN. This data bank works exclusively with the name of an organization or data about an individual. To search, go to the “Services” section and then to the “Bank of Enforcement Proceedings”. Then enter information about the counterparty and region.

ATTENTION

The detected debt data will not indicate the TIN or OGRN. Therefore, this information should be used with caution. The fact is that in one region there may be several organizations with the same name (resolution of the Arbitration Court of the Moscow District dated April 15, 2020 No. F05-4553/2020). Accordingly, it is better to double-check the information about debt found on the bailiffs’ website using other sources. In particular, in the data bank of arbitration cases (https://kad.arbitr.ru) or on the website of the court of general jurisdiction that made the decision

Step four: collecting information on the Internet

The “correspondence” stage of verification ends with the analysis of information from the Internet. First of all, you should study the business partner’s website. The information posted there must be verified with the data obtained in the previous steps. It is also necessary to make sure that it corresponds to the information that the counterparty himself provided about himself.

After this, information about the business partner is requested through search engines by his company name, address, full name of the manager, etc. The information obtained will form an image of the business reputation of the counterparty.

Step five: request information from the counterparty

The next step is the “face-to-face” verification stage. Copies of documents confirming the powers of the officials who will sign the agreement are requested directly from the counterparty. This could be a charter, order, power of attorney, etc. You should also request identification documents of these individuals.

IMPORTANT

This information must be current as of the date of signing the contract, invoice or source document.

Therefore, in long-term relationships, you should periodically update information about powers of attorney, orders and passport information. Exchange UPD and invoices with counterparties through the EDI operator Incoming free

Also, documents are directly requested from the counterparty for the right to carry out certain types of activities (licenses, SRO approvals, etc.), and information about the availability of resources necessary for the execution of a specific contract (personnel, transport, warehouses, etc.). It would not be amiss to ask for copies of the lease agreement or documents confirming ownership of the premises at the location of the counterparty.

The information received from the partner is verified with the data that was received at the “correspondence” stage. If discrepancies are identified, you need to request clarification from the counterparty.

The verification is completed with measures to ensure that the counterparty's officials are located at its registered address and are available for contact at the specified telephone numbers and email address. Also, at the “face-to-face” stage, you can directly contact other organizations and individual entrepreneurs who have already dealt with the counterparty and ask them for recommendations.

Internet sources for finding additional information about the counterparty

Registers of unscrupulous suppliers

Such a register is available on the FAS website. Also, if necessary, you can study the Register of Unscrupulous Suppliers in the Unified Procurement Information System.

File of arbitration cases

The file cabinet contains millions of cases. To get information about a case, you need to fill in any fields in the search filter and click the “Find” button. If you do not know the case number, then look for information using other parameters.

The card includes brief information about the case, information about the participants in the case, the chronology of the consideration of the case in each of the instances, and the final judicial acts adopted in them.

Data Bank of Enforcement Proceedings

The service provides information about the existence of enforcement proceedings, its subject and the amount payable in relation to any individual or legal entity.

Working with the bank is based on simple steps: choosing a search by individuals or legal entities, indicating the region, last name and first name, or the name of the enterprise.

Unified Federal Register of legally significant information on the facts of the activities of legal entities, individual entrepreneurs and other economic entities

The resource allows you to familiarize yourself with information about the activities of economic entities. To check a legal entity, enter the name of the enterprise, code (TIN, OGRN) and address in the search form. The search for individual entrepreneurs is carried out using the full name and code (TIN, OGRNIP).

License registers

If your company plans to enter into a transaction with a counterparty as part of a licensed activity, then it would be wise to check in advance whether it has the necessary license. Such information is contained on the websites of licensing authorities.

For example, the Register of licenses is on the website of Rosprirodnadzor. Roskomnadzor on its official website publishes the Register of licenses in the field of communications, the Register of operators occupying a significant position in the public communications network, etc.

Checking against the list of invalid Russian passports

Since the service of the Main Directorate for Migration Issues of the Ministry of Internal Affairs of Russia is updated with information about invalid passports on a daily basis, the information in it is always up-to-date.

When should companies use this online tool? For example, to check the head of a company with which a deal is to be concluded. After all, many limit themselves to requesting a copy of the order to assume a position or an extract from the Unified State Register of Legal Entities, which indicates the name and position of the person. But checking your passport will never be superfluous.

In addition, pay attention to the term of office of the counterparty’s representative - has it expired? The period is specified in the organization's charter or power of attorney. The charter can also reveal another important criterion for assessing the counterparty - limiting the authority of the manager to conclude transactions whose amount exceeds a certain value.

Government contracts

The facts of repeated conclusion of government contracts are an undoubted advantage of the counterparty. They may indicate its reliability, especially if all obligations were fulfilled on time.

Unified register of inspections

On the website of the Prosecutor General's Office you can find information about scheduled and unscheduled inspections of both legal entities and individual entrepreneurs. The search is carried out according to the approved annual consolidated plan for conducting scheduled inspections and the results of unscheduled inspections.

Membership in the Chamber of Commerce and Industry of the Russian Federation

Enter the OGRN or INN into the search form on the website of the RF CCI - and you will find out whether the legal entity or individual entrepreneur is a member of the chamber. If a company or entrepreneur is there, it means that economic activity is being carried out.

Yandex.Maps and Google Maps

If to check a counterparty you need a panorama of the building in which the legal entity is registered, use Yandex or Google maps.

Contractor's website

The company's official website can tell you a lot about it. This is a very useful tool for identifying important information about a business partner. As a rule, the company’s clients are always indicated on it. You can contact them and find out their opinion about the counterparty. It is possible that negative comments will come up in conversation. Or it will generally turn out that someone else’s logo on the counterparty’s website was published for status purposes, but in fact no partnership relations exist between the companies.

Internet search

Enter the name of the company and the full name of its director into a search engine and see in what context they are mentioned.

Consequences of account blocking

Freezing an account by decision of the tax service has two restrictions:

- applies only to a certain amount of funds (i.e. partial blocking);

- complete cessation of account transactions.

The first situation is typical for a blockage caused by tax non-payments. With it, using the account is permissible, but with maintaining a certain balance of funds on it. It is allowed to use this balance to make payments with a priority corresponding to tax transfers, or with a higher order (Clause 1, Article 76 of the Tax Code of the Russian Federation).

However, whatever the option for limiting the use of the account, the presence of a block by decision of the Federal Tax Service entails the impossibility of opening an account anywhere else (clause 12 of Article 76 of the Tax Code of the Russian Federation).

Blocking under Law No. 115-FZ always leads to a complete ban on transactions on accounts and also does not allow the possibility of opening a new current account (clause 5.2 of Article 7 of Law No. 115-FZ).

Regardless of which document (Tax Code of the Russian Federation or Law No. 115-FZ) the account is frozen, this process takes place very quickly:

- The tax authority notifies the bank of the decision made electronically (clause 4 of Article 76 of the Tax Code of the Russian Federation), and the bank is obliged to take the necessary actions on the day it receives it (clause 7 of Article 76 of the Tax Code of the Russian Federation). The perpetrator of such actions is provided with information during the working day following the day the decision is made (Clause 4 of Article 76 of the Tax Code of the Russian Federation).

- The bank monitors information on the grounds for blocking according to Law No. 115-FZ independently. But he must also respond within one working day (subclause 6, clause 1, article 7, clause 5, article 7.5 of law No. 115-FZ). In this case, the client is not required to be informed.

Thus, the person whose current account is blocked will be the last to know about the blocking.

Read about when blocking an account should be considered illegal.

Offline verification of the counterparty, identification of suspicious signs

Armed with all sorts of free online verification tools, don't forget about offline investigation.

Check the following details:

The actual location of the company at the address indicated in the documents

Verifying the actual location is especially important in cases where you are negotiating, for example, with a manufacturing company whose activities require warehouses and production facilities. Unscrupulous counterparties may indicate non-existent addresses.

Meet the Guide

When discussing the terms of cooperation and concluding deals, it is important to get to know the company’s management personally.

Evidence that the company is ready to fulfill the terms of the transaction

This can only be understood during negotiations, observing the behavior of management. You should be wary if the counterparty is in a hurry and wants to quickly agree on payment, while luring in with low prices and unrealistic conditions.

Timing for resumption of inspections

In accordance with the resolution of the Government of the Russian Federation, the Federal Service for Economic Supervision published an official notice on the restoration of the standard procedure for the implementation of control procedures. Previously, due to epidemiological restrictions, this practice was temporarily suspended, but starting from 2022, conducting on-site events, monitoring the accrual and payment of mandatory fees, as well as assessing ongoing commercial transactions between interdependent entities are carried out in full. In addition, the deferment of control over the installation of cash terminals and compliance with the regulations for conducting cash transactions was not extended - these measures are also being implemented by the department from January 1.

SEA BANK (JSC) projects for salary transfer can be convenient and interesting for any enterprises and organizations, regardless of the number of employees working in them.

What is a registered address

When created, an organization is registered at any address, which is considered its location and is indicated in the Unified State Register of Legal Entities.

According to paragraph 2 of Art. 54 of the Tax Code of the Russian Federation, the location of a legal entity is determined at the level of the locality. However, under the terms of clause 3 of Art. 54 of the Tax Code of the Russian Federation, the organization will be responsible for 2 things:

- failure to receive messages sent to the address specified in the Unified State Register of Legal Entities;

- absence of a representative of a legal entity at this address.

Thus, the real (postal) address is indicated in the Unified State Register of Legal Entities. Correspondence sent to a specific legal entity should be accepted at this address, and at least some representative of this legal entity, or better yet, the management of the organization should be present.

Information in the Unified State Register of Legal Entities comes from the constituent documents. Accordingly, they must indicate the address that will appear in the Unified State Register of Legal Entities. The legislation does not require confirmation of the organization’s relationship to this address during registration, but it establishes administrative (Article 14.25 of the Code of Administrative Offenses of the Russian Federation) and criminal (Article 171 of the Criminal Code of the Russian Federation) liability of applicants for providing knowingly false information.

Read about the measures taken to increase the reliability of the Unified State Register of Legal Entities in the article “There will be less false information in the Unified State Register of Legal Entities”

When drawing up a constituent agreement, the legal entity being created can indicate as an address:

- Address of the property that will be included in the company’s management company as a contribution.

- The address of the rented premises in which the entire company or part of it will be located.

- Address of the place of residence or other property of the founder, if in the region of registration the tax authorities are loyal to the indication of such addresses.

- An address that is only relevant for registration. This is the so-called legal address at which the organization is not actually located. As a rule, a lease agreement is also concluded for it, which can be presented to the Federal Tax Service when registering a company.

Mass registration addresses are those addresses where more than 10 companies are registered. In this case, the address will not necessarily be fictitious or “rubber”. Under one address, for example, there are:

- business centers specially created to accommodate the offices of small firms;

- territories of industrial enterprises that rent out part of their premises and areas.

The following are fictitious addresses:

- registration of many companies, most of which cannot actually be contacted;

- non-existent;

- relating to unfinished or destroyed buildings;

- belonging to “closed” institutions;

- in respect of which it is known that the owner is prohibited from registering.

The Federal Tax Service Inspectorate usually has information about such addresses.

What happens when account operations are suspended

The PC freezing procedure involves several successive stages:

- Consideration by the controlling agency of the existing grounds and issuance of an appropriate order within the framework of the procedural regulations.

- Sending a notification to the bank that services the company or individual, suspending restrictions on the account.

- Sending a copy to the taxpayer, with receipt of confirmation of information in the form of a signature.

- Fulfillment by the bank of the presented requirement and subsequent transfer to the tax service of information about the amount of funds remaining at the disposal of the company or individual.

The decision to block a current account based on the results of an inspection by the Federal Tax Service can be made by the immediate head of the body, as well as his deputy. The standard template for drawing up resolutions is approved by the provisions enshrined within the framework of the order published on July 14, 2015 N ММВ-7-8/284, while an electronic form is sent to the credit institution.

There are a number of operations that can be carried out on the account if there are blocks by the Federal Tax Service. This list includes:

- Calculations for wages and severance pay.

- Payment of existing child support obligations.

- Repayment of insurance premiums and imposed fines for non-payment of taxes.

- Compensation for damage to health.

You can clarify information about the reasons for blocking your Federal Tax Service account, the duration of the ban and the amount of debt, as well as check the tax information about existing debts online. Moreover, even a resolution on suspension is not a basis for a ban on the transfer of mandatory fees, as well as the implementation of priority transactions, the procedure for the execution of which is regulated by the norms of the Civil Code.

Finding a company by TIN is better than litigation

With a high-quality check of your counterparty, you will also be able to avoid additional taxes and problems in collecting debts on time. After all, not lending is not an option for modern business, including individual entrepreneurs. Because with this approach it is simply impossible to exist and develop normally in the market. And concluding transactions on your own terms is an opportunity only for those who sell truly necessary or unique goods. But not everyone wants to do the work first, and only then receive payment, which is not guaranteed. Therefore, remember that the initial audit of the company will take much less effort and time than later legal proceedings. Everything will be fine with checking companies for reliability using TIN on the nalog.io website!

Corporate history

On the tax.ru website, checking a counterparty by TIN for free also means finding out its corporate history. The publication of the Russian Tax Service “Bulletin of State Registration” helps in this. You can find it at the following link:

https://www.vestnik-gosreg.ru/publ/vgr/

Here you can find various communications from companies that they are required by law to post publicly. First of all, these are the facts of decision making:

- about closure;

- reorganization;

- reduction of authorized capital;

- purchase of LLC 20% of the authorized capital of another company, etc.