From 2022, paper sick leave certificates will no longer be issued in medical institutions; they will be replaced by electronic certificates of incapacity for work (ELN). The payment procedure will also change. Currently, the Ministry of Labor’s pilot project “direct payments” is operating throughout the country. In accordance with it, benefits to employees of organizations are paid not by the employer, but by the bodies of the Social Insurance Fund directly. From 2022, direct payments will become proactive: the Social Insurance Fund will pay benefits without a request.

Let's talk about how the procedure for opening and paying sick leave will change in 2022.

Who will be paid for sick leave?

Payment of benefits for temporary disability in accordance with Federal Law No. 255-FZ of December 29, 2006 “On compulsory insurance in case of temporary disability and in connection with maternity” is granted to employees who are unable to perform their job duties due to a number of reasons:

- employee illness or injury, including medical termination of pregnancy and in vitro fertilization (IVF) procedure;

- caring for a sick family member;

- quarantine of an employee or a child under 7 years of age attending a preschool educational organization, or another family member recognized by law as incompetent;

- implementation of prosthetics in an inpatient specialized medical institution;

- rehabilitation in sanatorium-resort institutions on the territory of the Russian Federation after inpatient treatment.

In other words, if a person is working, he can count on being provided with sick leave.

Reasons for receiving benefits on sick leave form 182n

- The benefit may be paid due to temporary disability, for example, illness, in which case the following documents must be collected:

- Certificate of incapacity for work.

- A certificate with information about the level of income, from which the amount of payments will be calculated in the future.

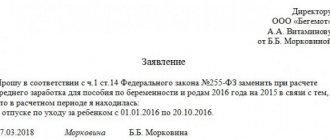

- Application for changing years in the billing period (provided if necessary).

- The benefit, which is paid due to pregnancy and childbirth, to receive it must be provided:

- A piece of paper confirming incapacity for work.

- A certificate of income, from which the amount of payments will then be calculated.

- An application for changing years in the billing period (the same as in the first case, is provided if necessary.

- Another case when you can receive sick leave payments is when an employee becomes temporarily disabled after an accident at work or due to an occupational disease. Then he needs:

- A sheet confirming the disability and its cause (can be issued on paper or electronic media).

- A certificate containing information about income in the pay period from the previous employer (provided if necessary or upon request).

- Application for changing years in the billing period (also provided if necessary).

- A report on the accident/situation that resulted in an employee being injured at work (you can provide copies of materials in which the incident is investigated).

What determines the size of the sick leave payment?

In accordance with the law (Article 7 of the Federal Law of December 29, 2006 No. 255-FZ), the amount of the benefit is calculated individually.

In case of illness, quarantine or injury of an employee, undergoing sanatorium-resort rehabilitation after undergoing inpatient treatment, prosthetics in a specialized hospital, payment of temporary disability benefits depends on the length of service:

| Seniority | Amount of benefit payment (part of the employee’s earnings) |

| 8 years or more | 100% of average earnings |

| from 5 to 8 years | 80% of average earnings |

| up to 5 years | 60% of average earnings |

If the employee himself is in a hospital or is caring for a child, in addition to the employee’s length of service, the maximum amount of benefit payment depends on the life circumstances in which the disabled employee finds himself:

| Life circumstance | Amount of benefit payment (part of the employee’s earnings) |

| Illness or injury of an employee that occurs within 30 calendar days after termination of work under an employment contract | 60% of average earnings |

| Hospital stay due to work injury | 100% of average earnings regardless of length of service |

| Caring for a sick child in a hospital setting | Depending on insurance experience |

| An employee with less than 6 months of insurance coverage | Does not exceed the minimum wage (taking into account the regional coefficient) for a full calendar month |

| Temporary disability that began before the downtime period and continues during the downtime period | In the amount of wages assigned for the period of downtime, but not higher than the amount of temporary disability benefits that the employee would receive according to the general rules. |

How to calculate the amount of payment for sick leave?

To calculate temporary disability benefits, you must have an idea of:

- average daily earnings of the employee;

- duration of temporary disability.

To calculate the average daily earnings, all the employee’s income from which payments were made to the Social Insurance Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund are taken.

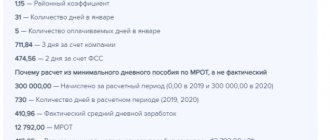

Thus, the formula for calculating average daily earnings will be as follows:

SDZ = 3p2 / 730

SDZ – average daily earnings

3p2 – earnings for 2 years

After calculating the average daily earnings, you can begin calculating temporary disability benefits:

PVN = SDZ * KD

PVN – temporary disability benefit

SDZ – average daily earnings

KD - number of days of illness

Example:

Ivanova I.I. provided a certificate of temporary incapacity for work, which indicated the period of incapacity for work from 04/01/2022 to 04/10/2022 (10 days). The total work experience is 14 years.

To calculate temporary disability benefits, the employee’s earnings for 2022 and 2022 will be considered.

Earnings of Ivanova I.I. for 2022 amounted to 384,000 rubles, for 2018 – 396,000 rubles.

Average daily earnings (384,000 + 396,000) / 730 = 1,068.49 rubles.

The amount of temporary disability benefits is 1068.49 * 10 = 10684.9 rubles.

What is it for?

The certificate provides information on earnings for 2 years of a person’s work (or for the last months, if he worked for the company for less time).

The indicators reflected in the certificate are needed to pay the individual benefits provided by law. Such a form is issued by management on the last working day, when the employee is expelled, or later, upon receipt of a corresponding request. At the same time, management does not have the right to refuse such a document. In case of such a refusal, the employee has the right to file a complaint with the labor inspectorate (TI).

When joining a new enterprise, the employee is required to submit the document to the accounting department for:

- Calculation of benefits according to the ballot.

- Calculation of benefits for labor and child support.

( Video : “Certificate of income for maternity and sick leave. Certificate 182n. For the last two years”)

When is the certificate prepared?

The management of the company is obliged to hand over certificate 182n to the departing employee on the final working day along with other documents.

If an employed person was not at work, then he has the right to submit a written request to receive such a certificate at any time. At the same time, the law provides that part-time workers who have been working in various institutions for less than 2 years have the right to issue a ballot only at one institution. In the request, the employee must reflect a request for the issuance of a certificate for calculating benefits according to the ballot in the new institution. He can send such a request either in person, or by sending a representative, or via mail, with notification of delivery of the correspondence.

Such a certificate must be issued within 3 days after receiving the request. This requirement is enshrined at the legislative level. Therefore, if this legal norm is violated, a former employee of the company can file a complaint with the TI or the court.

Minimum amount of sick leave payments

The amount of temporary disability benefits depends on the employee’s length of service and earnings, but cannot be lower than the minimum wage. According to Art. 133 of the Labor Code of the Russian Federation, the minimum wage from 01/01/2022 is 11,280 rubles.

Average daily earnings cannot be less than average daily earnings in accordance with the minimum wage:

| Work experience of the employee | % of average earnings | Minimum average daily earnings (RUB) |

| Up to 5 years | 60 | 225,60 |

| 5-8 years | 80 | 300,80 |

| More than 8 years | 100 | 376,00 |

If the employee’s employment is part-time, the average daily earnings may be less than this.

To assign what payments and measures of financial assistance you need a certificate in form 182n

A certificate in form 182n is needed so that the employer, based on the average salary, can calculate the amount of benefits for illness, pregnancy, childbirth and child care.

In principle, these are the main factors that can “trigger” or “trigger” the beginning of material support in the form of payments. And these are the most objective factors of an employee’s temporary disability. In this sense, the state protected and supported employees.

But for each reason for receiving payments, you need to provide individually different documents; below we will talk in more detail about each of them.

Maximum amount of sick leave payments

The maximum amount of temporary disability benefits depends on the employee’s income limit, on which insurance premiums are calculated.

Thus, the maximum amount of employee income for which insurance premiums were calculated was:

- in 2022 – 755,000 rubles;

- in 2022 – 815,000 rubles.

Thus, when calculating the average daily earnings in 2017, the amount cannot exceed: (755,000 + 815,000) / 730 = 2,150.68 rubles, but depending on the employee’s length of service, the average daily earnings will be as follows:

| Work experience of the employee | % of average earnings | Maximum average daily earnings (RUB) |

| Up to 5 years | 60 | 1290,41 |

| 5-8 years | 80 | 1720,54 |

| More than 8 years | 100 | 2150,68 |

How to prepare a certificate for sick leave?

After the employee provides a certificate of temporary disability, he needs to pay the benefits due and receive compensation from the Social Insurance Fund.

According to clause 67 of the order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011 No. 624n “On approval of the Procedure for issuing certificates of incapacity for work,” the calculation of benefits for temporary disability, pregnancy and childbirth is carried out by the policyholder on a separate sheet and attached to the certificate of incapacity for work.

The legislation of the Russian Federation does not approve the form of the calculation certificate, but one should take into account the fact that the certificate is a primary document, the completion of which is subject to Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, where the mandatory details of the primary accounting document are:

1) name of the document;

2) date of preparation of the document;

3) the name of the economic entity that compiled the document;

4) the content of the fact of economic life;

5) the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

6) the name of the position of the person (persons) who completed the transaction, operation and the person(s) responsible for its execution, or the name of the position of the person(s) responsible for the execution of the accomplished event;

7) signatures of persons indicating their surnames and initials or other details necessary to identify these persons.

In addition to the specified information, the calculation certificate must indicate:

- registration number in the Social Insurance Fund;

- subordination code;

- date of calculation;

- details of the certificate of temporary incapacity for work;

- amount of temporary disability benefits.

Stages of document flow between the employee, the policyholder and the Social Insurance Fund

Temporary disability benefit

- The medical organization places the electronic health information in the Sotsstrakh information system.

- The FSS sends a request to the Pension Fund regarding the employment of the insured employee.

- In one calendar day, the Pension Fund issues information about the fact of employment in a specific company, as well as the TIN and KPP of the policyholder.

- The Social Insurance Fund notifies the employer that its employee is on sick leave.

- When sick leave is closed, the FSS turns to the employer for the information necessary to calculate the benefit.

- The employer provides information within three working days.

- The Social Insurance Fund pays the benefit and informs the employee about it through his personal account on the State Services and the employer.

The Social Insurance Fund may request information from the employer about:

- length of service;

- salary;

- regional coefficient;

- rate if the employee works part-time;

- periods of suspension from work without pay;

- periods of absence from work.

In this case, the employer pays for the first three days of temporary disability of the employee.

Maternity benefit

- The medical organization places a closed electronic health insurance document in the Sotsstrakh information system.

- The Social Insurance Fund requests data for calculation from the employer.

- An employee applies for maternity leave.

- After this, the employer sends a register with data for calculation to the Social Insurance Fund.

Maternity benefits are fully paid by the Social Insurance Fund.

One-time benefit for the birth of a child

- The FSS learns about the birth of a child from the unified state register of the civil registry office. Neither the employee nor the employer is required to report this.

- The FSS checks information about parents’ employment through the Pension Fund, and through the unified state social security information system - about the assignment or non-appointment of benefits. If the benefit has already been assigned, the procedure will end there. If not assigned, the FSS will continue to request the necessary information.

- The Social Insurance Fund may require the employer to clarify the regional coefficient. This information must be provided within two business days from the date of receipt of the request.

Monthly child care allowance

For this type of benefit, the application procedure will remain. The employee will have to simultaneously submit an application to the employer for granting benefits and for child care leave for up to three years. The employer has three working days to send the “Information for the assignment of benefits” form to the territorial body of the Social Insurance Fund.

If an employee loses the right to a monthly benefit, the employer is obliged to notify the Social Insurance Fund within three working days.

Sample certificate of calculation for sick leave

Appendix to the sheet

temporary disability

№ 987654321

Calculation of temporary disability benefits

No. 10 dated April 05, 2022

Insured LLC "ABV", registration number 74185293, subordination code 002356

Insured person Ivanov Ivan Ivanovich, personnel number 7890

TIN 963852741, SNILS 014-785-236 90, insurance experience 5 years 3 months

Benefit percentage – 60%

Period of incapacity for work – from 04/01/2022 to 04/10/2022

Number of days of incapacity for work – 10 days

Information on wages from January 1, 2022 to December 31, 2018

| Year | Amounts paid for the year (RUB) | Maximum permissible base value (rub.) | Amounts for calculating benefits (RUB) |

| 2017 | 384000 | 755000 | 384000 |

| 2018 | 406000 | 815000 | 406000 |

Chief accountant Petrova Petrova P.P.

11.04.2022

If an employee is on sick leave for a long time, a statement of calculation is drawn up for each certificate of temporary incapacity for work. In this case, payment is made in installments.

How to obtain certificate 182n in 2022?

Entering earnings indicators into form 182n is carried out on a standard form, by entering information manually (in dark paste).

Alternatively, you can fill out the certificate on your computer after downloading the form. The completed form must be signed by the director of the enterprise and the head. an accountant and certified by a seal (if any). Individual entrepreneurs are exempt by law from the mandatory certification of documents with stamp attributes (if such a norm is not reflected in the internal regulations of the individual entrepreneur).

A mandatory condition is the affixing of personal signatures of responsible persons, without the use of facsimile signatures.

The form is issued in one copy, however, if necessary, management can provide an unlimited number of copies.

( Video : “Filling out the Certificate of Earnings and Excluded Periods”)

Structure of help 182n

The structure of form 182n includes 4 sections:

1) The first section displays data about the company that issued the form. It is noted here:

- Name of the institution.

- The name of the insurance service where the company is registered.

- Registration number of the institution, code, INN/KPP.

- Address and contact phone number.

2) In the second, data about the person to whom the certificate is presented is displayed, where it is noted:

- FULL NAME. employee.

- Passport details (series, number, by whom and when issued).

- Place of residence.

- SNILS.

- Periods when the employee was unable to work and received benefits.

3) The third section is used to record salary indicators for 2 years, from which insurance payments were transferred to the Social Insurance Fund and the Pension Fund.

4) The fourth part displays periods when insurance payments were not transferred (for example, periods of incapacity for work). These are the so-called excluded periods. Each period is filled in on a separate line, displaying:

- Start and end dates.

- Numbers of days, displayed in numbers and words.

- Reasons (illness, maternity leave, supporting a newborn).

- The days of the excluded period are calculated for each year and for the reporting time.

Cross-throughs are not allowed when issuing a certificate. The validity of the form is confirmed by the signature of officials (chief and chief accountant).

Questions and answers

- Is the invoice certificate a mandatory document?

Answer: This document is mandatory for processing temporary disability benefits. A correctly executed certificate allows you to make payments in full and avoid problems with inspectors.

- Our employee has been on sick leave for 4 months. Is it possible to duplicate the calculation certificate with each temporary disability certificate?

Answer: It will not be possible to duplicate the calculation certificate, because... Each certificate is attached to a specific certificate of temporary incapacity for work.