How are one-time maternity benefits calculated, can a husband receive them? How are they calculated if you were fired during pregnancy? When are they due to be paid?

Maternity benefits must be paid before childbirth in any case

One-time maternity payments, namely maternity benefits, are accrued after 30 weeks of pregnancy only to a pregnant woman. My husband can't get them. If a woman was laid off due to reorganization during pregnancy, then the benefits are assigned to the social security authorities within 10 days from the date of receipt of the documents. Art. 15 Federal Law No. 255-FZ.

If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call by phone for any region.

When is maternity benefit paid?

Maternity benefits are accrued in one payment no later than 3 calendar days before the start of the vacation. If a woman applies for it after 6 months from the end of the vacation, then the payment will not be assigned. Child care benefits are paid for 1.5 years.

Maternity benefits or maternity benefits (Maternity benefits) are payment for sick leave due to pregnancy. Sick leave is divided into prenatal and postpartum periods and for the normal course of pregnancy each of them is 70 days. The total duration is 140 days.

There are situations when maternity leave increases:

- in case of complications and multiple pregnancies detected before birth - the first period is 84 days, the second - 110 days;

- for complications and multiple pregnancies detected during childbirth - periods of 70 and 124 days, respectively;

- if pregnancy with 1 child proceeded with complications, then the postpartum period is 86 days, the prenatal period is 70 days.

Read: Maternity leave

Some cases where BIR benefits are assigned to nulliparous women include their adoption of children under 3 months of age:

- 1 child - based on 70 days from the date of birth;

- 2 or more - based on 110 days from the moment of their birth.

The BiR allowance is paid for leave lasting from 140 to 194 days for pregnant women, and from 70 to 110 days for women who are adoptive parents.

Payments are assigned after a woman goes on BIR leave at 30 weeks of pregnancy.

Federal Law No. 81-FZ of May 19, 1995 “On state benefits for citizens with children” (hereinafter referred to as No. 81-FZ) identifies categories of benefit recipients:

- working;

- dismissed during the liquidation of organizations within 12 months from the date they were declared unemployed;

- students;

- military personnel;

- women who are adoptive parents.

Procedure for applying for maternity benefits

- Get sick leave. The benefit is paid on the basis of sick leave for pregnancy and childbirth. It can be obtained from a gynecologist who is observing a pregnant woman in consultation. That is, in the clinic where the expectant mother registered. A sick leave certificate is issued at the 30th week of pregnancy. 140 days are allotted for pregnancy and childbirth. This is a significant period, so the size of the benefit is impressive.

- Give your sick leave to your accountant or HR officer. It is recommended to do this as early as possible. Therefore, check in advance who at your work deals with maternity issues. You can hand over the sick leave in person or ask a relative. It all depends on the requirements of a particular employer.

- Find out the period for payment of benefits. This is an optional item. But it will clearly let the employer know that you are aware of your rights and are in control of the issue of transferring money.

Please note that the timing of maternity payments for pregnant women and young mothers cannot be vague. They are clearly established in legislation. If they start convincing you otherwise, refer to Order No. 1012n of the Ministry of Social Development of Russia dated December 23, 2009.

The timing of receiving benefits depends on when the employee submits her sick leave. She can do this both immediately and after childbirth. A certificate of incapacity for work can be submitted within six months after the birth of the child.

How to apply for maternity leave for working people

Maternity payments to working pregnant women are paid from the Social Insurance Fund through the employer. In the regions participating in the pilot project of direct social payments, the money is transferred to the recipient by the Social Insurance Fund. But the documents are still handed over to the employer.

To receive benefits under the BIR, a pregnant employee performs the following steps:

- Registers with a antenatal clinic or other medical organization.

- Receives a certificate of registration indicating the duration of pregnancy.

- At the 29th week of pregnancy, she receives a certificate of incapacity for work, which is issued from the 30th week of pregnancy.

- Submits a package of documents to the employer:

- a certificate of income for the last 2 years of work, if you were employed during this period by other employers;

- statement;

- bank account details (if the money is paid directly by the FSS);

- a certificate from a medical organization (for military personnel instead of a sick leave certificate).

If a pregnant employee works or has worked part-time in the last 2 years, then each employer pays her benefits.

If a woman feels well and wants to work after 30 weeks of pregnancy, then the following rule must be taken into account. You cannot receive B&R benefits and wages at the same time. The employer will calculate wages for the period worked, and maternity benefits - from the moment you go on maternity leave based on the remaining days.

The sick leave was issued for 140 days, but the employee worked for another month. This means that her maternity leave will be paid for 110 days, and she will receive a salary for 30 days of work. A benefit for a woman is when the current salary is higher than the average monthly income for the previous 2 years.

The next rule is that if a woman has the right to both child care benefits for up to 1.5 years and maternity pay, then she can receive one or the other. The employee decides what payment to leave herself, based on the accrued amounts.

Accrual and payment of maternity benefits

The benefit is calculated using the formula:

SRS/KD × CBD,

Where SRS is income for the 2 calendar years preceding the year of maternity leave,

CD - number of calendar days of the billing period,

CBD - number of sick days.

The amount of payment is limited to the maximum value of the base for calculating insurance contributions to the Social Insurance Fund for each billing year. For 2019, the calculation period is 2022 and 2022. The limits set for them are 755,000 rubles and 815,000 rubles, respectively. If the employee’s annual income is greater than these amounts, then the maximum amount is taken for calculation.

The number of calendar days in 2017-2018 is 731. The periods when the employee:

- was on maternity leave, maternity leave or sick leave;

- did not work due to the fault of the employer or for reasons independent of both parties;

- received additional days of rest to care for a disabled child;

- was released from work with or without pay.

Substituting the limit values into the formula, we obtain the calculation of the maximum allowable benefit values, where KBL takes the value 140, 156 and 194 days:

(815000+755000) / 731 × 140 = 1,570,000 / 731 × 140 = 300,684 rubles

1473000 / 731 × 156 = 335,048 rubles

1,473,000 / 731 × 194 = 416,662 rubles.

The legislation provides for situations when, when calculating maternity benefits, a woman can replace the calculation period with two calendar years in which the income was higher. For example, when a woman was on previous maternity leave or parental leave for up to 1.5 years.

According to Article 11 of Law No. 255-FZ, B&R benefits are paid at 100% of average earnings. But if the total work experience is less than 6 months, the calculation is not based on average earnings, but on the minimum wage, increased by the regional coefficient.

In 2022, the minimum wage is 11,280 rubles.

Calculation formula:

11,280 × 24 / CD × CBd,

Let's find the minimum payment values for different periods of maternity leave:

11,280 × 24 / 731 × 140 = 51,848 rubles.

11,280 × 24 / 731 × 156 = RUB 57,773.35

11,280 × 24 / 731 × 194 = 71,846.34 rubles.

These amounts will be accrued to the employee if her average monthly income is below the minimum wage.

The amount of maternity leave for female military personnel is set in the amount of monetary allowance.

The employer is obliged to accrue benefits within 10 calendar days from the date of receipt of the documents and application.

Payment of maternity benefits occurs on the next day established by the organization for receiving wages. This norm is spelled out in Article 15 of Law No. 255-FZ dated December 29, 2006 and Article 18 of Order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1012n.

Employer's refusal to pay maternity benefits

The employer’s refusal to accrue and pay benefits under the BiR is a violation that is prosecuted under Article 5.27 of the Code of Administrative Offenses of the Russian Federation. An employee who has been denied payment proceeds as follows:

- Submits documents for calculating maternity benefits to the Social Insurance Fund and declares a violation on the part of the employer.

- Writes a complaint to the Labor Inspectorate.

- Draws up an application to the Prosecutor's Office to inspect the organization.

Maternity payments to unemployed people

The amount of maternity benefit for non-working women depends on their status:

- for full-time students - the amount of the scholarship;

- for those dismissed during reorganization or who ceased private practice or activity as an individual entrepreneur during the last year - 628.47 rubles per month.

If maternity leave occurred when the woman was registered as unemployed at the Employment Center, then the benefit is accrued in the minimum amount calculated according to the minimum wage. Receiving unemployment benefits and maternity benefits at the same time is unacceptable.

Unemployed women entitled to receive benefits submit documents to the social protection authorities at their place of location or residence.

List of documents:

- statement;

- certificate of incapacity for work;

- work book or extract with marks from the last place of work;

- a certificate from the Employment Service confirming registration as unemployed;

- a certificate from the social security authorities at the place of residence about the non-assignment of benefits, if the documents are submitted to the social security authority at the location;

- Bank details for receiving funds.

Female students submit documents to their educational institution:

- statement;

- a certificate from a medical organization instead of a certificate of incapacity for work;

Maternity benefits are accrued within 10 calendar days from the date of application. And payment is made until the 26th day of the month following the month of submission of documents. The period for applying for maternity leave is no more than 6 months from the end of maternity leave (sick leave).

Payment of maternity benefits by the employer

Only women have the right to receive maternity benefits provided by the employer. It cannot be received by her husband or other relative. Benefits are provided to all pregnant and postpartum women at their place of employment. If a girl quits or changes companies, she can receive benefits at any permanent job where she has been employed within the last two years.

Note! If a girl continues to work during pregnancy, she cannot receive benefits. In this case, the payment period is shifted. In such a situation, maternity leave is assigned from the moment the application and sick leave are submitted.

To apply for benefits, the employer must submit an application for maternity leave and a certificate of incapacity for work. But that is not all. If a woman has changed her job over the past two years, she will also need a salary certificate in form 182n from her previous organization.

Deadlines for transferring benefits

The benefit payment period is 10 calendar days. They count from the moment the employee submits all the necessary documents. According to the law, the head of the organization is obliged to transfer funds during this period. The entire amount is paid in one lump sum. That is, for the entire period of maternity leave. In the future, the Social Insurance Fund will compensate the employer for the amount paid.

New benefit payment rules

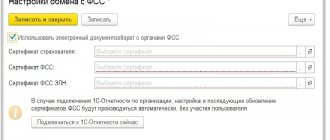

The Social Insurance Fund is conducting an experiment that operates in some regions. It involves a different scheme for paying maternity benefits. Maternity benefits are calculated and transferred not by the employer, but by the Social Insurance Fund. In the regions participating in the new social insurance project “Direct Payments”, receiving a cash payment involves the following scheme:

- the woman submits all documents to the employer. This applies to sick leave, salary certificates (if necessary) and applications for maternity leave. However, it is filled out for social insurance;

- the employer submits the documents to the Social Insurance Fund. The organization where the woman works must do this within 5 days;

- The FSS is considering the application. Making a decision on granting benefits takes 10 calendar days;

- The FSS transfers benefits. A woman can receive the money due until the 26th of the month following the application. The payment is transferred to a bank account, the details of which must be indicated in the application for maternity leave. Money can also be sent by postal order.

The Tver, Tambov, Samara and Rostov regions, Khabarovsk Territory and other regions are taking part in the “Direct Payments” pilot project. The full list can be found on the FSS website.

Need to remember

- Maternity benefits or maternity benefits are paid to a woman before the onset of childbirth.

- To receive payment, you must obtain a certificate of incapacity for work for the entire period of maternity leave, which begins from the 30th week of pregnancy.

- The duration of maternity leave depends on the woman’s condition and the number of fetuses: from 140 to 194 days.

- Women who are adoptive parents are entitled to maternity benefits if the child was less than 3 months old at the time of adoption. Vacation duration is from 70 to 110 days.

- Maternity benefits are calculated based on average monthly earnings, but cannot exceed the maximum amount of the insurance base.

- If the service is less than 6 months and the income is below the minimum wage, the benefit is calculated on the basis of the minimum wage. These are the minimum payment amounts.

- Unemployed people receive benefits from social security authorities if they were fired during the reorganization of the enterprise.

- Full-time students receive benefits at the place of study.

- Only a pregnant woman or an adoptive mother can receive maternity leave.

Emergency hotline for the population : we provide free consultations to pensioners, parents and beneficiaries of any category from legal experts over the phone.

All sick leave will become electronic

Currently, an employee can receive from a doctor both a paper and electronic certificate of incapacity for work. In any case, the benefit will be accrued (see “The procedure for issuing sick leave is changing: what should the employer do”).

From January 2022, as a general rule, only electronic sick leave certificates will remain in use. Such a bulletin must be generated by a medical organization, signed with an enhanced qualified electronic signature and posted in the FSS information system. The employee, if desired, will be able to obtain an extract from the specified document from doctors.

It is electronic ballots that will serve as the basis for the assignment and payment of benefits (new edition of Part 6 of Article 13 of Law No. 255-FZ):

- due to illness and caring for a sick family member;

- on pregnancy and childbirth (BiR).

Work with electronic sick leave with a “complicated” salary with bonuses and coefficients