How direct payments work

Previously, Social Insurance and employers used the offset principle: the company transferred benefits to the employee, and sent insurance contributions to the Social Insurance Fund minus the benefit amounts.

Now employers transfer social insurance contributions in full. The task is to send the employee’s application and accompanying documents to receive benefits to the Social Insurance Fund, and the Fund, after verification, transfers the money to the employee. The algorithm for calculating benefits remains the same.

This procedure was introduced so that citizens receive benefits on time and in full, even if the employer is experiencing financial difficulties. The employer’s benefit is that money does not need to be withdrawn from circulation to pay benefits. The accountant also has less work: the benefit is calculated and transferred by the local branch of the Social Insurance Fund, this saves time and simplifies reporting.

What should an employee and employer do when applying for benefits starting in 2022?

to his employer in 2022 . He also gives him an application for payment, if necessary.

It is the employer’s responsibility promptly submit to the Social Insurance Fund at the place of its registration the documents received from the employee. As a general rule, documents (register) must be sent no later than 5 calendar days from the date of their receipt.

They must be sent by registered mail with a description of the attachment or by TKS. However, if the employer has an average number of employees for the year preceding the year the employee applied for benefits exceeds 25 people , he must submit a register of information to the Fund in the form of an electronic document. For employers with 25 employees or less, sending documents to the Social Insurance Fund electronically is a right , not an obligation.

What payments does the employer make in 2022?

Individual entrepreneurs and legal entities continue to pay employees at their own expense the following payments:

- sick leave for the first three days of illness;

- funeral benefits;

- additional days off required to care for disabled children.

There is a way to receive compensation from the Social Insurance Fund for funeral benefits and payment for additional days off. To do this, the employer submits an application for compensation and supporting documents to the Fund. The period for consideration of the package by the Social Insurance Fund is 10 working days, the period for transfer if the decision is positive is another 2 working days.

How can an employer determine the personal income tax of an employee who received temporary disability benefits?

The transfer of benefit funds directly to employees is not reflected in the software used in personnel records when calculating wages, which introduces ambiguities in the determination of personal income tax.

At the moment, the territorial bodies of the Federal Social Insurance Fund of the Russian Federation do not provide for the issuance of certificates of income in the form of temporary disability benefits to the employer by the territorial bodies of the Federal Social Insurance Fund of the Russian Federation.

A citizen can receive a certificate of income received in the form of benefits in person by submitting a written application to the territorial body of the Federal Social Insurance Fund of the Russian Federation at the place of registration of the employer as an insurer. The application can be submitted by both the employee and his representative, whose powers are established by law.

The method of submitting an application may be different: you can personally contact the territorial body of the FSS, you can send the application by mail, you can send the application electronically using the personal account of the insured person: https://lk.fss.ru or through the government services portal: https: //www.gosuslugi.ru

Considering that the payment is made not by the employer, but by another tax agent, the organization calculates and withholds tax upon actual payment of benefits for the first three days of temporary disability (clause 1, clause 1, article 223, clauses 1, , 4, article 226 Tax Code of the Russian Federation, clause 8 of the Regulations on the payment of benefits for VNIM in 2022), and the tax will be withheld from the remaining amount of the benefit by the Federal Social Insurance Fund of the Russian Federation. The Federal Insurance Fund of the Russian Federation also withholds personal income tax when paying benefits for sick leave in case of injury at work (clauses 1, 4, article 226 of the Tax Code of the Russian Federation, clause 7, Regulations on payments for accident insurance in 2022).

Benefit payments are not included in the calculation of average earnings. The procedure for calculating average earnings to pay benefits is described in detail in the “Ready Solution: How to Calculate Average Earnings to Pay Benefits.”

What does an employee need to do to receive sick leave payments from the Social Insurance Fund?

The employee, as usual, submits a sick leave certificate to the employer within six months from the date of closure or provides the employee's personal health insurance number. Sometimes you need certificates from other places of work and bank details for crediting funds. If an employee missed the six-month deadline for submitting the slip to the employer for a good reason, he can still receive his benefit from the Social Insurance Fund on his own if he sends an application there.

If the sheet is handed over to the employer on time, he is obliged to pay benefits for the first three days of incapacity for work within 10 calendar days. Payments are transferred on the next day when the organization issues salaries or advances.

The employer also sends a package of documents regarding the employee to the Social Insurance Fund. The deadline for this is 5 calendar days. Social Insurance makes a decision on transferring benefits within 10 working days.

If an employee is registered on the State Services website, he can track the status of his application on the Social Insurance Fund website.

What remains the same

Under the old scheme, the employer was left to pay the funeral benefit for the deceased employee. Of course, these expenses can then be returned by contacting the Social Insurance Fund with an application and providing there the necessary set of documents, including an application and a death certificate.

Know that as soon as the FSS receives a complete package of documents, it has 10 working days to check everything and make a decision on the payment of benefits. Then, within 2 business days, the Fund must transfer the money to the employer’s current account.

In addition, benefits for the first 3 days of illness (confirmed by sick leave), as before, are paid by the employer from its own funds, without compensation from the Social Insurance Fund.

How are direct insurance payments from the Social Insurance Fund calculated?

The procedure for calculating direct payments is no different from the procedure for calculating benefits when paying benefits at the employer’s own expense. In any case, sick leave for a full month cannot be less than the all-Russian minimum wage, which from January 1, 2022 is 12,792 rubles. The amount of this part of the sick leave does not depend on the insurance period and the employee’s actual earnings.

The amount of sick leave for the first 3 days of temporary disability should be the maximum of all calculation options: depending on the employee’s insurance length, the current national minimum wage and the regional coefficient.

Pros and cons of direct payments

The transfer of functions for the calculation and payment of social insurance benefits from employers to the territorial bodies of the Social Insurance Fund made it possible to provide insurance payments:

- in a short time and without delays;

- regardless of the financial condition of employers.

At the same time, additional responsibilities appeared:

- employees of organizations to fill out voluminous applications for payments;

- accounting services for processing employee applications, creating registers and transferring them to the territorial bodies of the Social Insurance Fund.

What does an employer need to do for an employee to receive a direct payment from the Social Insurance Fund?

The method of submitting documents to the Social Insurance Fund depends on the average number of employees in the previous year. If it is more than 25 people, the form is submitted only electronically using a register, electronic signature, accounting application or online service. The employee gives the accountant a sick leave or a child’s birth certificate, after which the company has 5 days to send the documents to the Social Insurance Fund.

Important! There are three forms of the register; they can be found in FSS Order No. 579 dated November 24, 2022.

If the average number of employees is less than or equal to 25, documents can be submitted to the Social Insurance Fund on paper. After any decision is made by the Social Insurance Fund, all papers are returned to the employer. The set of paper documents must be accompanied by the inventory from Appendix No. 2 to FSS order No. 578 of the same date.

If everything goes well, you will receive a receipt confirming delivery in response to the package of documents. This means the Foundation is already considering the kit. If you receive an error log, you will have to correct the documents and send again.

Important! The employer must keep the original certificate of incapacity for work along with the benefit calculation for at least 5 years.

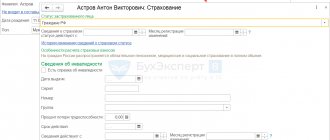

How to transfer information to the Social Insurance Fund for the assignment and payment of benefits

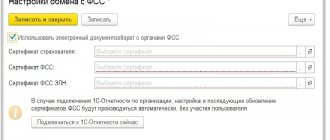

If the average number of employees for the last year is more than 25 people, an electronic register must be submitted to the Social Insurance Fund - a special form with information for the assignment and payment of benefits. You will need an electronic signature and an accounting program or service with the ability to exchange information with social insurance.

The online accounting system “My Business” has already set up an exchange with the Social Insurance Fund. You can create and send registers of sick leave directly from the service.

For different insured events there are three forms of the register; they are given in the FSS order No. 579 dated November 24, 2017:

- for temporary disability benefits, maternity benefits, when registering in the early stages of pregnancy - in Appendix No. 1;

- for benefits at the birth of a child - in Appendix No. 3;

- for child care benefits - in Appendix No. 5.

The register must be sent within five calendar days, counting from the date of receipt of sick leave from the employee.

If the average number of employees for the past year was 25 people or less , the employer can choose how to transfer information for sick leave payments to the Social Insurance Fund.

- Electronic register.

- In paper form. An inventory according to the form from Appendix No. 2 to FSS order No. 578 dated November 24, 2017 is attached to the set of documents for granting benefits.

Where are payments sent?

The Social Insurance Fund transfers money based on the employee’s details provided by the employer. Any debit bank account and MIR plastic card are suitable for this. You can also send money to the employee by postal order.

From July 1, 2022, part of the benefits will be transferred only to Mir cards (in addition to debit accounts without cards and cash transfers). These are “children’s” benefits, as well as payments to citizens affected by radiation due to accidents and tests.

If the benefit is transferred to the account details with another card, the bank will invite the citizen to come in person to receive the benefit or provide new details. If the employee does not respond to the offer within 10 working days, the bank will return the benefit back to the Social Insurance Fund.

What will change in reporting

After switching to direct payments, the accountant fills out the reports differently. New filling rules apply from the 1st quarter of 2021.

Calculation of insurance premiums:

- in Appendix 2 to Section No. 1 in line 002 “Payment attribute” write code “1”;

- in the same appendix 2 to section No. 1 in lines 070 and 080 the value “0” is written;

- Appendices 3 and 4 are not filled out and are not included in the calculation.

4-FSS:

- there is no need to fill out line 15 in table 2;

- no need to fill out table 3.

Taxes, accounting and reporting: what an accountant needs to know

The employer provides deductions for personal income tax only from that part of the sick leave that he pays himself. The mechanism for receiving them from the Social Insurance Fund is currently unclear, but there is an understanding that employees will be able to receive them at the end of the year by submitting 3-NDFL declarations. Also, starting from January 2022, the territorial body of the Social Insurance Fund will issue, at the employee’s request, a 2-NDFL certificate and information about direct payments made.

In personal income tax reporting (2-NDFL and 6-NDFL), the employer also reflects only the amounts paid to him. Besides:

- Employers must pay accrued contributions in full; there is no need to reduce them by the amount of direct payments;

- the reporting form 4-FSS is changing;

- The calculation of insurance premiums when paying benefits must be carried out taking into account a number of features that are set out in the Ready-made solution from Consultant+.

- Only the payment made by the employer for the first three days of illness is reflected in the payroll and payslips.

How to prepare for direct payments

- Explain to employees the new procedure and new terms for receiving benefits: to a debit “cardless” bank account, to a “MIR” card or by postal transfer.

- Ask them for their account or card details.

- Collect applications for benefits from employees on parental leave, prepare documents and registers for applicants.

- Submit to the Social Insurance Fund a list of employees for monthly child care benefits.

- For convenience, go to electronic sick leave and figure out whether your software generates electronic registers for the Social Insurance Fund.

Changes from 2022

First, the Ministry of Labor developed amendments to Federal Laws No. 125-FZ and No. 255-FZ, according to which direct payments from the Social Insurance Fund became mandatory for all constituent entities of the Russian Federation. This innovation will be introduced starting January 1, 2021 .

All employers are now required to send the information required by the updated legislation to the Social Insurance Fund. It will be the basis for payment of benefits.

We caution that both the employees themselves and their employers are subject to liability for false information sent to the Social Insurance Fund for unjustified receipt of benefits. If false information is provided that causes damage to the Social Insurance Fund, the perpetrators will have to compensate for this damage.

If the FSS discovers errors - for example, on a sick leave certificate - then the employee or employer will be sent a special notice that it is necessary to make corrections to the documents.

From 2022, the Social Insurance Fund can independently verify the information through which the employee received benefits. At the same time, the Fund can conduct its audits both jointly with the tax office and separately.

Also, from 2022, all employers have an obligation notices of termination of payment of any benefits to the Social Insurance Fund For example, a monthly child care benefit if the employee is on maternity leave or decides to quit.

And one more innovation: from 2022, the employer must advise employees on the payment of benefits. It is not yet clear how this should be implemented. Typically, HR and accounting departments have neither the time nor the desire to explain their rights to employees.

Perhaps, for these purposes, large companies will recruit methodologists into their staff who will prepare memos for employees on life situations. And small companies, in order to avoid increasing labor costs, will most likely entrust consulting to an accountant .

How to compensate for excess expenses from the Fund

When a region just joins a pilot project, the company may be left with an overpayment if the amount of insurance premiums payable is less than the amount of benefits already paid. The company can then refund or offset the overpayment.

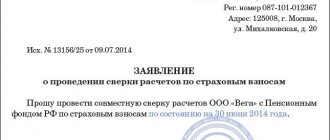

The policyholder contacts the local branch of the Fund with a package of documents:

- applications for compensation for each type of insurance;

- 4-FSS report or calculation certificate;

- copies of papers that indicate the correctness and validity of expenses.

When you set off, keep track of your balance to avoid debt in the future.

How to compensate for the costs of ensuring preventive measures from the Fund

The policyholder can use up to 20% of insurance premiums for the previous year to provide preventive measures: for example, medical examinations of employees in hazardous or hazardous industries.

The policyholder himself pays for preventive measures, after which he compensates for expenses from the Fund within the amount agreed with him. To receive compensation, you must submit an application for financing of preventive measures by August 1, along with a package of documents that justify their necessity. An application for reimbursement of expenses must be submitted by December 15.

The online service Kontur.Accounting will help you avoid errors when sending registers, fill out reports according to the new rules, calculate contributions and remind you of reporting and payment dates. The system makes it easy to keep records, pay salaries, and report via the Internet. We have other tools for accountants and directors. Test Accounting for free for two weeks.