Such expenses include, in particular:

- penalties for taxes and contributions to state extra-budgetary funds;

- contributions to some reserves;

- VAT amounts on excess expenses (Article 170 of the Tax Code of the Russian Federation);

- contributions to non-state pension funds (except for those listed in Article 255 of the Tax Code of the Russian Federation);

- contributions for some types of voluntary insurance (except for those mentioned in Articles 255, 263 and 291 of the Tax Code of the Russian Federation);

- the cost of gratuitously transferred property (work, services) and expenses associated with this transfer;

- any payments and rewards in favor of employees not provided for in labor or collective agreements, as well as financial assistance;

- negative differences from the revaluation of securities at market value;

- part of the costs of training, for example, the company’s payment for entertainment and recreation for student employees;

- depreciation on fixed assets that are not involved in income-generating production.

Let's consider the procedure for accounting for permanent positive differences in connection with the reflection of certain types of expenses in accounting.

Penalties

For non-payment or late payment of taxes and contributions to state extra-budgetary funds, firms pay fines and penalties. They reduce accounting profit but do not affect the amount of taxable profit.

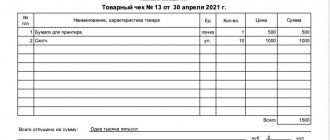

EXAMPLE In January of the reporting year, there were no differences in the accounting and tax records of Aktiv CJSC until the end of the month.

In both cases, income amounted to 800,000 rubles, and expenses - 500,000 rubles. On January 31, Aktiv paid penalties for late payment of taxes for last year in the amount of 850 rubles. In addition, one of the employees was accrued financial assistance in the amount of 10,000 rubles. The following entries were made in the accounting: DEBIT 90-9 CREDIT 99

– 300,000 rubles.

(RUB 800,000 – RUB 500,000) – reflects the company’s profit from its core activities; DEBIT 99 CREDIT 68 subaccount “Settlements of penalties”

– 850 rubles.

– penalties were charged for late taxes; DEBIT 68 subaccount “Settlements of penalties” CREDIT 51

– 850 rub.

– penalties have been paid; DEBIT 91-2 CREDIT 70

– 10,000 rub.

– financial assistance has been accrued to the employee; DEBIT 99 CREDIT 91-9

– 10,000 rub.

– loss is reflected.

Total profit for January was:

- in accounting – 289,150 rubles. (800,000 rub. – 500,000 rub. – 850 rub. – 10,000 rub.);

- in tax accounting – 300,000 rubles. (RUB 800,000 – RUB 500,000).

Thus, the constant difference in expenses is 10,850 rubles. (RUB 300,000 – RUB 289,150).

A conditional tax expense in the amount of RUB 57,830 was accrued from the accounting profit. (RUB 289,150 ×20%).

An entry was made in the accounting for the additional accrual of income tax:

DEBIT 99 subaccount “Permanent tax liability” CREDIT 68 subaccount “Calculations for income tax”

– 2170 rub.

(RUB 10,850 ×20%) – a permanent tax liability is reflected.

Thus, after adjustment according to PBU 18/02, the balance in account 68 of the subaccount “Calculations for income tax” amounted to 60,000 rubles. (57,830 rubles + + 2170 rubles) and equaled the amount of tax in the declaration.

Reserves

In accounting, a company can create the following reserves:

- to reduce the cost of material assets (this is taken into account in account 14);

- for depreciation of financial investments (accounting is kept on account 59);

- for the formation of estimated liabilities, for example, for legal proceedings, a reserve for vacation pay, as well as for warranty service and warranty repairs of sold goods (accounting is kept on account 96);

- doubtful debts (it is recorded in account 63).

Contributions to these reserves reduce accounting profit.

In tax accounting it is allowed to create the following reserves:

- to pay for vacations and benefits for long service (Article 255 of the Tax Code of the Russian Federation);

- for long and expensive repairs of fixed assets (clause 3 of Article 260 of the Tax Code of the Russian Federation);

- for warranty repairs and warranty service (clause 9, clause 1, article 264 of the Tax Code of the Russian Federation);

- doubtful debts (clause 7, clause 1, article 265 of the Tax Code of the Russian Federation) (in accounting, the creation of such a reserve is mandatory. Accounting is kept on account 63).

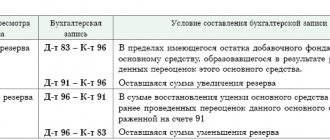

From a comparison of these lists, it follows that permanent positive differences appear if the company creates reserves in accounting:

- to reduce the cost of material assets;

- for depreciation of investments in securities;

- for the formation of estimated liabilities, with the exception of warranty repairs and warranty service of goods sold;

- doubtful debts, if they are not formed in tax accounting.

In these cases, it is also necessary to charge additional income tax in the amount of the permanent tax liability.

EXAMPLEAccording to the accounting policy, a trading company creates a reserve for reducing the value of material assets.

The amount of contributions to it is 40,000 rubles. This reserve is not provided for by the Tax Code. Therefore, a constant positive difference arises in accounting: DEBIT 91-2 CREDIT 14

- 40,000 rubles.

– a reserve has been accrued for reducing the cost of goods; DEBIT 99 subaccount “Continuous tax liabilities” CREDIT 68 subaccount “Calculations for income tax”

- 8000 rubles.

(RUB 40,000 × 20%) – a permanent tax liability has been accrued (additional income tax has been accrued).

Condition three: in the current tax period it is necessary to show profit

This condition was put forward by the Ministry of Finance in a letter dated 04/06/20 No. 03-03-06/2/27064. The authors once again recalled the content of paragraph 1 of Article of the Tax Code of the Russian Federation - correction of an error in the reporting period is possible only if there was an excessive payment in the previous period.

And then the officials made an unexpected conclusion:

“Thus, an organization has the right to include in the tax base of the current reporting (tax) period the amount of an identified error (distortion), which led to the excessive payment of corporate income tax in the previous reporting (tax) period, only if in the current reporting ( tax period, profit was made."

Financial department specialists did not say what this statement is based on.

Standardized expenses

Normalized expenses in accounting are written off completely, and the tax base is reduced only within the norms. The most common of these expenses are listed in the Accountant's Handbook

The amounts exceeding the standards form permanent positive differences. On them it is necessary to accrue permanent tax liabilities (PNO). Then the tax in accounting will increase to the amount indicated in the declaration.

For convenience, two sub-accounts can be opened for cost accounting accounts (20–26 or 44): “Expenses within the norm” and “Excess expenses”.

EXAMPLE In the first quarter of the reporting year, the production enterprise Burevestnik CJSC conducted a massive advertising campaign in which it raffled off prizes.

The company spent 82,600 rubles on their purchase. (including VAT - 12,600 rubles). In accounting, the cost of prizes is written off as expenses in full, and in tax accounting - within 1% of revenue. For the reporting quarter, revenue amounted to 3,500,000 rubles, expenses (except for standard ones) – 3,000,000 rubles. Therefore, to calculate income tax, expenses for the purchase of prizes can be taken into account in the amount of 35,000 rubles. (RUB 3,500,000 ×1% / / 100%). “Burevestnik” operates on the accrual basis in accounting and tax accounting. To simplify the example, we will not consider other operations of the company. The accountant reflected the standardized expenses by posting: DEBIT 26 subaccount “Advertising expenses within normal limits” CREDIT 60

– 35,000 rubles.

– advertising expenses are taken into account within the norms; DEBIT 26 subaccount “Excessive expenses” CREDIT 60

– 35,000 rub.

(70,000 rubles – 35,000 rubles) – advertising expenses above the norm are reflected; DEBIT 19 CREDIT 60

– 12,600 rub.

– VAT on advertising expenses is taken into account; DEBIT 68 subaccount “Calculations for VAT” CREDIT 19

– 12,600 rub.

– accepted for deduction of VAT on advertising expenses.

Thus, the company’s balance sheet profit at the end of the first quarter is equal to: RUB 3,500,000.

– 3,000,000 rub. – 70,000 rub. = 430,000 rubles. The tax was accrued from it by posting: DEBIT 99 CREDIT 68 subaccount “Calculations for income tax”

- 86,000 rubles.

(RUB 430,000 ×20%) – a conditional income tax expense has been accrued.

In tax accounting, the profit amounted to: RUB 3,500,000.

– 3,000,000 rub. – 35,000 rub. = 465,000 rubles. The amount of tax that must be paid to the budget is 93,000 rubles. (RUB 465,000 × 20%). Excessive advertising expenses in the amount of RUB 35,000. (70,000 rubles – – 35,000 rubles) form a permanent difference and a permanent tax liability, which the accountant accrued by posting: DEBIT 99 subaccount “Permanent tax liability” CREDIT 68 subaccount “Calculations for income tax”

- 7000 rubles.

(RUB 35,000 ×20%) – a permanent tax liability has been accrued.

Thus, the income tax in accounting amounted to 93,000 rubles. (RUB 86,000 + RUB 7,000), which corresponds to tax accounting data.

Next example.

EXAMPLE In August of the reporting year, to purchase a machine, Passiv LLC took out a loan from Aktiv CJSC for 90 days at 30% per annum. The machine costs 236,000 rubles. (including VAT – 36,000 rubles). I spent 28,600 rubles on the delivery and installation of the Passive machine. (including VAT - 3600 rubles), including:

- for delivery – 23,600 rubles. (including VAT – 3600 rub.);

- for installation of the machine on your own - 5,000 rubles.

“Passive” paid off the loan before the machine was put into operation.

The company uses the accrual method of accounting and tax accounting.

The accountant made the following entries in accounting:

DEBIT 51 CREDIT 66

– 236,000 rub.

– a loan was taken out to purchase a machine;

DEBIT 08-4 CREDIT 60

– 200,000 rub.

– purchased a machine;

DEBIT 19 CREDIT 60

– 36,000 rub.

– VAT on the machine is taken into account;

DEBIT 08-4 CREDIT 60

– 20,000 rub.

– delivery costs are taken into account in the cost of the machine;

DEBIT 19 CREDIT 60

– 3600 rub.

– VAT on delivery is taken into account;

DEBIT 08-4 CREDIT 70, 68, 69

– 5000 rub.

– wages with contributions to the Pension Fund, Social Insurance Fund, and Federal Compulsory Medical Insurance Fund were accrued to the workers who installed the machine;

DEBIT 91-2 CREDIT 66

– 17,458 rub.

(RUB 236,000 ×30%: 365 days ×90 days) – loan interest is written off as other expenses;

DEBIT 91-2 CREDIT 08-4

– 225,000 rub.

(RUB 200,000 + RUB 20,000 + RUB 5,000) – the machine was put into operation.

It is from the amount of 225,000 rubles. In accounting, depreciation will be charged, which will be written off as expenses.

In tax accounting, all of the listed costs also form the cost of the fixed asset. However, the interest on the loan is only within the normal limits.

Let us assume that “Passive”, in accordance with the accounting policy, calculates the maximum amount of interest recognized as an expense based on the refinancing rate increased by 1.8 times (for ruble loans). The maximum amount of interest for calculating income tax will be:

236,000 rub. ×12% ×1.8 : 365 days. ×90 days = 12,569 rub.

“Passive” will reduce taxable profit at the time of interest accrual by 12,569 rubles, and as depreciation is calculated - by 225,000 rubles. (200,000 rub. + 20,000 rub. + 5,000 rub.).

The remaining interest in the amount of 4889 rubles. (RUB 17,458 – RUB 12,569) will never be recognized in tax accounting. This is a permanent positive difference.

The Passiv accountant accrued a permanent tax liability from her:

– 978 rub. (RUB 4,889 × 20%) – a permanent tax liability has been accrued.

Organization of accounting

Organizations are required to keep records of accounting transactions in full in accordance with the Chart of Accounts and accounting standards.

Individual entrepreneurs are not required to keep accounting records and can limit themselves to maintaining tax records; in this case, no accounting entries arise.

A feature of the simplified taxation system is that both income and expenses are taken into account on a cash basis, that is, as payment is made. For the tax register - the book of income and expenses during simplification - paid income and expenses are selected.

Postings under the simplified tax system - “income”:

| Dt 51 Kt 62.02 | Receipt of advance payment from buyer |

| Dt 51 Kt 62.01 | Repayment of the buyer's debt |

| Dt 51 Kt 76 | Fines paid under business agreements |

| Dt 57 Kt 62 | Payment via the site |

| Dt 50 Kt 90 | Payment in retail |

Postings according to the simplified tax system - “income minus expenses”, examples:

| Dt 50 Kt 70 | Payment of previously accrued wages |

| Dt 26 Kt 60 | An act of previously paid rent has been received |

| Dt 51 Kt 60 | Payment for services provided |

| Dt 90 Kt 41 | Cost of goods shipped and paid for |

For tax purposes, when simplified, only expenses incurred and paid are taken into account, that is, if there are documents from the supplier and payment. For trade, there is an additional condition for including the cost of paid goods in expenses - the goods must be shipped. When calculating the simplified tax system with the taxable object “income minus expenses,” only those expenses listed in Art. 346.16 ch. 26.2 Tax Code of the Russian Federation.

Losses not recognized in tax accounting

Accounting profit is reduced by any losses, and tax profit by only some of them. Thus, taxable profit cannot be reduced by losses:

- from the gratuitous transfer of property, work, services and property rights (clause 16 of article 270 of the Tax Code of the Russian Federation);

- from the transfer of property to the authorized capital of another company or simple partnership (clause 1, clause 1, article 277 and clause 4, article 278 of the Tax Code of the Russian Federation);

- from the assignment of the right of claim before the maturity of payment under the contract in excess of the amount of interest calculated in accordance with Article 269 of the Tax Code;

- from the assignment of the right of claim by the financial agent.

EXAMPLE A company gave its employee a car. At the time of transfer, the residual value of the car was 25,000 rubles. The cost of the donated car should be reflected in accounting as part of other expenses. For profit tax purposes, the value of gratuitously transferred property is not taken into account (clause 16 of Article 270 of the Tax Code of the Russian Federation). The accountant made the following entries: DEBIT 91 CREDIT 01

– 25,000 rubles.

– the residual value of the car donated to the employee is written off; DEBIT 99 CREDIT 68 subaccount “Calculations for income tax”

– 5000 rubles.

(RUB 25,000 ×20%) – reflects the amount of permanent tax liability.

Acceptable and non-acceptable expenses for tax purposes

For accountants, accepted and not accepted expenses for the purpose of calculating income tax are:

- Accepted expenses are expenses that are reflected both in accounting and tax accounting;

- Not accepted are expenses that are reflected only in accounting. These expenses are not taken into account for calculating taxable profit.

The main expenses not accepted for calculating profit, which are often encountered in practice in the operation of an enterprise, are:

- Penalties, fines, penalties and other sanctions paid to the budget and extra-budgetary funds;

- Interest on loans in excess of established norms;

- Contributions for voluntary and pension insurance exceeding the norms established by law;

- Various types of payments to employees of the enterprise, in addition to payments prescribed in employment agreements or contracts;

- Expenses in excess of the normalized ones for the purpose of calculating profit: travel expenses, bonuses, compensation payments;

- Payment for sanatorium and resort vouchers, as well as expenses for maintaining non-production, cultural and social facilities. Carrying out festive and sporting events;

- Payment of expenses for notary services in excess of the approved tariffs. The notary fees are given in Art. 221 Fundamentals of the legislation of the Russian Federation on notaries dated February 11, 1993. No. 4462-1.