According to the rules that are defined in the Procedure for filling out the form - this is Appendix No. 5 to the PFR order No. 507p, in SZV-STAZH four types of leave must be separately distinguished:

- Additional allowance that an employee receives for working under special conditions.

- Study leave.

- Vacation without pay (at your own expense).

- Holiday to care for the child.

For 2022, a new form has been introduced; submit SZV-STAZH reports in the form approved by Resolution of the Pension Fund Board of December 6, 2018 No. 507p.

SZV-STAZH is taken a year in advance, once - on March 1. Sometimes SZV-STAZH is submitted to all schedules, for example, when calculating a pension and when an employee applies for an urgent or one-time pension payment. But if an employee quits during the current year, there is no need to take the SZV-STAZH early.

SZV-STAZH columns and vacation codes

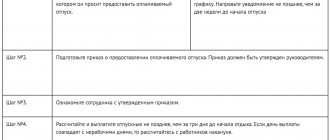

For information about leave in the SZV-STAZH form, several columns are highlighted:

- column 6 – start of vacation,

- column 7 – end of vacation,

- column 11 – code.

For all these types of leave, SZV-STAZH has its own codes:

- For vacation at your own expense - code “NEOPL”

- For study leave – code “UCHOTVUSK”

- For additional leave for hazardous working conditions - code “DLOTPUSK”

- For different parental leave - codes: “CHILDREN”, DLDETI”, “CHILDREN”

More on the topic:

SZV-STAZH for 2022: what changes to consider?

New codes for SZV-STAZH

Long-term admission to SZV-stazh - what is this code? – legal advice

When filling out the SZV-STAZH form, it is necessary to correctly reflect the regular annual vacations of employees in section 3. We will tell you in what cases the code “DLOTPUSK” is put in SZV-STAZH, what this means and how not to confuse this code with the codes of other vacations.

Codes for SZV-STAZH 2022 with decoding, period codes

— Business organization — Personnel — Codes for SZV-STAZH

The SZV-STAZH report includes the insurance period, as well as periods when the employee was on vacation. To correctly reflect information in it using SZV-STAZH codes, you must adhere to certain federal rules.

Where and by whom are SZV-STAZH reports submitted?

SZV-STAZH – a document that displays information about the employee’s vacation periods and insurance benefits paid. Reporting is submitted on the results of the past year until March 1st to the branches of the Pension Fund (PF). The report must be submitted to:

- Enterprises and their individual branches;

- IP.

Federal Law No. 27 of April 1, 1996 indicates that the document must be provided for all persons who work under the Labor Agreement in the form regulated by the legislative acts governing the reporting of the Pension Fund of Russia.

If employment agreements are signed, but no payments were made for the reporting period, the SZV-STAZH form is still filled out and submitted.

How to fill out SZV-STAZH

Requirements for filling out the form:

- Full name must be indicated using only the nominative case;

- Information and dates in the columns regarding the duration of the employee's work duties should be reflected only for the period during which the form was submitted.

In addition to them, there are some rules for filling out the sections that the SZV-STAZH form has.

Information about the policyholder

In the section it is necessary to indicate the PF number, identification number and reason code for registering the enterprise or individual entrepreneur, as well as an abbreviated name. According to the Filling Rules established by the Pension Fund of Russia, in this section it is necessary to note the corresponding type of document being submitted:

- “initial” – data is provided for the first time;

- “assignment of a pension” - relevant when the insured employee should use SZV-STAZH data for the period not yet provided to calculate pension payments;

- “supplementary” – used if the original document contains errors or incorrect information, the data was not recorded in the personal accounts of the insured entities.

The next section identifies the year for which information about employees is provided. Thus, when submitting a document for the first time in a new reporting year, it is necessary to indicate information from the past one.

Information about the working hours of insured employees

This section reflects the full names of subordinates, length of work, corresponding periods of duties and vacation codes.

Insurance premium data

The section should be completed only when the “Pension Assignment” form is used. That is, these sections do not need to be filled out in the “Original” form.

In the 4th and 5th sections, it should be noted the accrual and payment of insurance benefits for the time of work indicated earlier. The transfer of pension contributions in accordance with early private pension agreements (if any), as well as the period of such payments, is also reflected.

SZV-STAZH codes with interpretation

The period of work of persons who have insurance in the SZV-STAZH form should be encrypted using the appropriate encoding.

So, the vacation codes in SZV-STAZH are as follows:

- “AGREEMENT” - this code indicates the duration of the employee’s work in accordance with the employment agreement on the basis of which the payment was made. Codes “NEOPLDOG”, “NEOPLAVT” are used when insurance payments are accrued in a different period.

- "CHILDREN" - parental leave.

- “DECREE” is a leave due to the expectation and birth of a child.

- “QUALIFICATION” - leave due to the need to improve the employee’s qualifications, due to his temporary absence from the workplace.

- “UCHOTVUSK” is an additional leave granted to an employee during the exam period.

- “SIMPLE” - temporary downtime of production not due to the fault of a staff member.

- “NEOPL” - unpaid leave due to removal from work, downtime due to the fault of a subordinate, other types of leave without preservation of remuneration.

- "DOPVIKH" - additional days off for employees who have disabled children as their dependents.

- “SUSPENDED” - an employee is not allowed to work due to the fault of the employer.

- "SOCIETY" - fulfillment of social obligations.

- “DLOTPUSK” is a vacation that is paid.

Some special codes for territorial or individual working conditions must be applied using the Parameter Classifier.

Code "DLOTPUSK" in SZV-STAZH

This is a special code that encrypts the employee’s vacation period, provided to the employee on the basis of Articles 114 - 116 of the Labor Code, both annually and additionally and payable.

This leave interrupts the main period of service.

This code is reflected in the additional data.

In practice, in order to avoid receiving warnings from the Pension Fund, vacation periods should be allocated with the code “DLOTPUSK” for employees who have benefits due to special working conditions. In all other cases, length of service can be recorded without a code.

Error codes in SZV-STAZH

If an enterprise or individual entrepreneur does not provide the SZV-STAZH form in a timely manner, and also if the information contained in it is incorrect or erroneous, then penalties in the amount of 500 rubles will be applied to it for each employee in respect of whom an inaccuracy is discovered.

However, erroneous data can be corrected without serious consequences in the following forms:

- SZV-STAZH, type “Additional” - indicates that the “Original” form revealed incorrect information about the insured employee, which was not recorded in the individual’s individual account.

- SZV-KORR with “KORR” - it is indicated that in the SZV-STAZH form incorrect data was found on the corresponding insured employee (date of hire), but the data was recorded on the employee’s personal account.

- SZV-KORR with “OTMN” - indicates that information on the insured staffing unit, which was previously presented in the SZV-STAZH form, should be canceled.

- SZV-KORR with “SPECIAL” - information is recorded that was not entered into the SZV-STAZH “Initial” form (that is, if the insured employee was not recorded at all).

(28 voice., 4,80

Source: https://pravasovet.ru/dlotpusk-v-szv-stazh-chto-jeto-za-kod.html

Vacation at your own expense in SZV-STAZH

Leave without pay is indicated in section No. 3 of the form. There are no special nuances when reflecting such leave.

Columns 6 and 7 indicate the beginning and end of the vacation.

In column 11 - code “NEOPL”.

There is no need to specify other additional codes.

More on the topic:

Reasons for the discrepancy between RSV and SZV-M and SZV-STAZH

Vacations must be indicated

Let’s say right away that you need to celebrate your next vacation at SZV STAZH. Let's talk about how to do this without errors.

A paper report in the SZV-STAZH form can be submitted only if the number of employees employed by the employer does not exceed 24 people. If the number of personnel at the enterprise exceeds this number, then the only possible option for submitting information is an electronic form with an electronic signature (clause 2, article 8 of the Federal Law of 01.04.1996 No. 27-FZ, clause 1.7 of the Procedure, approved by the Decree of the Government of the Russian Federation dated 01/11/2017 No. 3p).

So, how is the next vacation reflected in SZV-STAZH? This information is indicated in section 3, which is devoted to information about the periods of work of the insured person. In particular, information about unworked periods (vacations, sick leave, etc.) must be indicated in column 11 of this section. To designate the specified periods, the appropriate codes from the Classifier should be used.

To indicate stay on paid leave, the code DLOTPUSK is used. It is clear that if an employee went on regular paid leave several times a year, then each of the vacation periods should be noted separately. Each entry must be made on the next line, assigning a serial number to each new entry. If several lines are used to reflect the period, then the serial number is indicated only in the first.

We hope that after reading this material, HR specialists will no longer be faced with the question of how to reflect the next vacation in SZV-STAZH.

Study leave at SZV-STAZH

Study leave, like all other leaves, is indicated in columns 6, 7 and 11. You must indicate the period of leave and enter a special leave code.

For study leave, SZV-STAZH indicates:

Columns 6 and 7 indicate the beginning and end of the vacation.

In column 11 - code “UCHOTUSK”.

If an employee is granted leave at his own expense during training, it is not considered educational. For example, in most cases, when studying under a second higher education program, an employee is not entitled to study leave.

Then this leave is reflected as leave without pay, with the code “NEOPL”.

If errors are found in the form, the territorial office of the fund will require corrections. To avoid fines, the employer will need to re-send the corrected information within 5 calendar days.

How to apply for long-term leave in SZV-stazh – Website about

The article contains the answer to when to reflect the code “DLOTPUSK” in SZV-STAZH in 2021. Should it be used for regular paid leave or only if the employee works under special conditions.

This is a special code that shows the period the employee is on paid leave. It is indicated in column 11 of the report. Fill out the code “DLOTPUSK” only for periods of work under special working conditions for which contributions at the additional tariff were not charged. It can only be specified in combination with special working conditions codes.

Table 1. When to fill out column 11 SZV-STAGE

Attention! For 2022, submit a new SZV-STAGE form. The Bukhsoft program has updated the form taking into account the new requirements of the Pension Fund. To fill out and send to the forum, log into the program.

Fill out the SZV-experience in the Bukhsoft program and send it to the Pension Fund of Russia

How and when to fill out the code “DLOTPUSK”

In the SZV-STAGE form, from January 1, 2022, enter the code “DLOTPUSK” only when the person worked in special working conditions and has the right to early old-age pension.

Read on the topic: SZV-STAZH: deadline for completion in 2022

Attention! For employees who were on annual paid leave, if they work under normal working conditions, there is no need to enter it in column 11 of section 3 of the SZV-STAZH form. There is no longer any need to separately highlight vacation periods in columns 6 and 7 of Section 3.

Other cases

There are two other special cases where you need to specify a code. First: use it if in any month the employee was on regular vacation, and received all vacation amounts in the previous month. Provided that in the month of full vacation and no contributions subject to contributions there were no payments.

Second: be sure to indicate the code “DLOTPUSK” when at the beginning of the calendar year the employee was on regular vacation in January, received vacation pay in December, and on the last day of vacation he quit his job and will not have any contributions at all in the current calendar year.

The Pension Fund of Russia has released a manual for filling out the SZV-STAZH. See the training manual with experts from the magazine “Salary”. We have provided examples of filling out the columns.

- See the manual from the Pension Fund of Russia

- 30% discount when subscribing to “Salary”!

30% discount when subscribing to “Salary”. Pay your invoice at a discount. Or pay by card on our website.

Download invoice

Source:

“DLOTPUSK” in SZV-STAZH: what does it mean?

“DLOTPUSK” in SZV-STAZH is a special code that is entered for periods when an employee is absent from work. Of course, not any period that was not worked out is taken into account. This code is entered according to special rules.

The personalized accounting form SZV-STAZH “information about the insurance experience of insured persons” appeared only last year. For the first time, everyone reported on it by March 1, 2022.

This form is filled out by all organizations and individual entrepreneurs (IPs) that hire employees under an employment or civil contract (for example, a contract or assignment).

Submit the form to the territorial office of the Pension Fund of the Russian Federation at the place of registration of the organization (or at the place of residence of the individual entrepreneur).

Test reporting to the Pension Fund online.

Here is a sample of the SZV-STAZH form

forms SZV-STAZH.

The form contains all the periods that are included in the employees’ length of service. Special codes have been established for these periods.

"DLOTPUSK" in SZV-STAZH: what is it

The SZV-STAZH form for 2022 indicates all periods during which the employee was on vacation. Moreover, all vacations are indicated. Paid or not, it doesn't matter. Therefore, both regular and administrative leaves are included in the form.

On the form you must indicate:

- vacation period in the format “from (dd.mm.yyyy.) to (dd.mm.yyyy.)”

- vacation code, which is necessary for the correct processing of the form by Pension Fund employees.

“DLOTPUSK” in SZV-STAZH is given according to those periods in which the employee was on annual paid leave. The same code is given for additional paid leave. In fact, the code in SZV-STAZH “DLOTPUSK” means the period of any paid vacation. For other vacations (for example, at your own expense), the form provides other codes.

What codes are available for other holidays?

We will summarize the codes for different types of leave in SZV-STAZH in the table

Codes for leave in SZV-STAZH

| No. | Code in SZV-STAZH | Type of vacation |

| 1 | DLOTPUT | Any paid leave |

| 2 | NEOPL | Any unpaid leave |

| 3 | DECREE | Maternity leave (for pregnancy and childbirth) |

| 4 | CHILDREN | Parental leave for a child up to 3 years old, if it is not a parent who takes it, but another relative (for example, a grandmother, grandfather) |

| 5 | DLCHILDREN | Parental leave from 1.5 to 3 years |

| 6 | CHILDREN | Child care leave up to 1.5 years |

| 7 | ACCEPTANCE | Study leave |

How to fill out SZV-STAZH with the code “DLOTPUSK”

In SZV-STAZH, the next vacation with the code “DLOTPUSK” is entered in column 11 “Additional information” of section 3 “Information about the periods of work of insured persons.” In the same column, other types of vacations taken by the employee are also listed.

“DLOTPUSK” in SZV-STAZH 2022: sample

Here is a sample for SZV EXPERIENCE on how to fill out the form with the code “DLOTPUSK”

Also read:

Source:

How to fill out information in SZV-STAZH during the period of paid leave?

One of the stages of filling out the form, which causes difficulties for specialists, is using the correct code for vacation taken in 2021 at your own expense in SZV-STAZH 2022.

The popularity of the question is due to the fact that this form must be submitted by all employers (organizations and entrepreneurs) who pay remuneration to individuals (clause 1.5 of the Procedure, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2021 No. 3p):

- within the framework of employment contracts;

- under civil law contracts;

- under copyright contracts and licensing agreements.

In turn, leave without pay is by no means uncommon. So how do you celebrate vacation at your own expense in SZV STAZH?

In general, legal entities submit the SZV-STAZH form to the territorial divisions of the Pension Fund of the Russian Federation at the place of their state registration.

Form SZV-STAZH - a report that reflects the employee’s retirement experience. From 01/01/2021, it was submitted to the Pension Fund at the end of the year; in 2021, reporting is submitted for the first time by all managers.

It contains information relating to the periods of work of employees, as well as information on the accrual and payment of pension contributions.

The form is filled out and submitted to the Pension Fund for all insured persons with whom the employer is in a relationship:

- in labor contracts, which also include drawn up employment contracts;

- in civil law, on the basis of which an employee is obliged to provide services or perform certain work.

Is vacation at your own expense included in the length of service for a pension?

Pension savings during vacation are calculated as follows: if the manager paid contributions to insurance funds, the length of service counts; otherwise, not.

Important Submission date – the day on which the document was sent. This is confirmed by the authorized representative of the Pension Fund of the Russian Federation or the EDF operator.

When submitting on paper, an individual entrepreneur must put a personal signature, a legal entity must put a stamp and signature. Additionally, attach information located on the disk or flash drive.

- If the certificate is sent by mail, the delivery date is the day indicated on the postmark.

- If the manager does not provide information by a certain date or provides incorrect information, a fine of 500 rubles is imposed , which the policyholder must pay.

- The data is entered as specified in the constituent documents.

- The “Information Type” block column defines the situation in which this report is submitted:

- O indicates that the report is being transmitted for the first time;

- O indicates that this report introduces new data or changes information in a previously submitted report;

- O indicates that the employee indicated in the report is retiring, and the length of service for this year must be taken into account when assigning payments.

Section No. 2 - Reporting period

There is a single graph of four squares here.

As for businessmen, individual entrepreneurs submit a report at their place of residence (Clause 1, Article 11 of the Federal Law of 04/01/1996 No. 27-FZ).

There is only one correct code

Let’s say right away that vacation at your own expense used in 2022 in SZV-STAZH 2022 is marked using the code NEOPL.

A paper report in the SZV-STAZH form can be submitted only if the number of employees employed by the employer does not exceed 24 people. If the number of personnel at the enterprise exceeds this number, then the only possible option for submitting information is an electronic form with an electronic signature (clause

2 tbsp. 8 of the Federal Law of 01.04.1996 No. 27-FZ, clause 1.7 of the Procedure, approved. Decree of the Government of the Russian Federation dated January 11, 2021 No. 3p).

The fact is that the validity of the ADMINISTER code is limited to 2021.

Attention

But if you don’t want unnecessary warnings, allocate the period of the next vacation separately with the code “DLOTPUSK” only for employees with preferential seniority - under special, difficult working conditions. In other cases, you can record the length of service without the “DLOTPUSK” code.

Attention! If the accountant has not entered the DLOTPUSK code for annual leave in SZV-STAZH, then you will have to pay a fine for this.

The courts have already begun to make decisions not in favor of accountants.

Let us recall that in March, when accountants asked how to write the DLOTPUSK code, the magazine “Simplified” warned accountants that the code was set for annual vacations.

This information was brought to the attention of accountants both in the magazine and on the magazine’s website 26-2.ru. And now those accountants who missed the news or used other recommendations paid with money.

The rule for this date is that if it falls on a weekend, the final filing deadline will automatically move to the first closest working day.

In 2022, this report was not required to be submitted. For the first time, business entities will do this until March 1, 2022 for the period of 2022.

However, there are also two cases in which it will be necessary to immediately issue a SZV-STAGE:

- If an employee applies for a pension and brings a notification of this event to his accounting department, then a form must be filled out for him and submitted within three days from the fact of the notification;

- It is necessary to draw up a SZV-STAGE upon dismissal of an employee.

In addition, upon retirement and timely notification of this to the company, the responsible employee will have to submit an electronic version to the fund within 3 days of the application.

Who should provide SZV-STAZH?

According to the developed rules, the new form will need to be submitted:

- Companies, as well as related divisions located in other regions;

- Entrepreneurs, licensed detectives, lawyers, notaries who have employees.

Deadline for passing SZV-STAZH in 2022

Entities that have hired employees must submit the document SZV-STAZH to the Pension Fund once every year. The deadline for submitting this document is March 1 of the year following the reporting year.

- SDKROV

- Downtime due to the employer's fault

- SIMPLE

- Suspension from work through no fault of the employee

- SUSPENDED

- Additional study leave

- ACCEPTANCE

- Additional days off for employees caring for disabled children

- DOPVIKH

- Additional leave for persons exposed to the Chernobyl disaster

- Chernobyl Nuclear Power Plant

- Article in the magazine on the topic: Five dangerous details in the new SZV-STAZH report

The procedure for indicating DLOTPUSK in SZV-STAZH in 2022

The “DLOTPUSK” code is provided to reflect paid leave:

- annual

- additional

- This code is entered in the “additional information” column.

- Vacation periods in the form of SZV-STAZH break the main length of service.

- On the other hand, if an agreement has been signed with him, but there is no activity, then it is necessary to submit a report to the Pension Fund, indicating only the director.

- At the moment, the Pension Fund has not given any explanations regarding the submission of a zero report by organizations.

Source: https://okarb.ru/otchetnost/kak-oformit-dlotpusk-v-szv-stazh.html

Parental leave in SZV-STAZH

For such vacations, SZV-STAZH provides several codes:

“CHILDREN” - leave for parents until the child reaches 1.5 years of age;

“CHILDREN” - leave for parents to care for a child from 1.5 to 3 years;

"CHILDREN" - parental leave for a child from 1.5 to 3 years, provided to grandparents, other relatives or guardians.

When reflecting parental leave in SZV-STAZH. Columns 6,7 and 11 are also filled in:

Columns 6 and 7 indicate the beginning and end of the vacation.

In column 11 - code depending on the type of children's leave (from the list above)

We rent for the first time

Let's start with the fact that the SZV-STAGE form is a new report to the Pension Fund, which discloses information about the pension experience of the organization's employees (individual entrepreneur). SZV-STAZH is an annual report and must be submitted for the first time for 2022. Everything new raises questions, and this form is no exception. Among other difficult points when filling it out: is it necessary to indicate the next vacation in SZV-STAZH.

The popularity of this issue is due to the fact that this form must be submitted by all employers (organizations and entrepreneurs) who pay remuneration to individuals (clause 1.5 of the Procedure, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p):

- within the framework of employment contracts;

- under civil law contracts;

- under copyright contracts and licensing agreements.

Since the deadline for submitting the form is March 1, 2022, there is not much time left to find an answer to whether the next vacation needs to be indicated in the SZV STAZH (Clause 2 of Article 11 of the Federal Law of April 1, 1996 No. 27-FZ).

In general, legal entities submit the SZV-STAZH form to the territorial divisions of the Pension Fund of the Russian Federation at the place of their state registration. As for businessmen, individual entrepreneurs submit a report at their place of residence (Clause 1, Article 11 of the Federal Law of 04/01/1996 No. 27-FZ).

How to fill out the SZV-STAZH form

We have prepared a cheat sheet for filling out the SZV-STAZH form. The numbers on the form correspond to the notes below.

1 - in the header of the form and in section 1, fill in the company’s TIN/KPP and registration number in the Pension Fund.

2 - indicate the type of information in accordance with clause 2.1.5 of the Procedure. For information with the “Initial” type, sections 4 and 5 are not filled in.

3 - reporting period - year (no division into quarters).

4 - Section 3 indicates the employee’s full name, SNILS, periods of his work, highlighting the periods included (temporary disability, leave for employment and labor regulations, etc.) and not included (vacation without pay) in the insurance period. For a dismissed employee, the last date in the work period is the day of dismissal. For an employee retiring, the end date of service should not be greater than the date of expected retirement.

5 - the code for special working conditions is not indicated if insurance premiums for additional tariffs have not been paid.

6 - in column 11 additional information is indicated, for example, “VRNETRUD”, “NEOPL”, “DLOTPUSK”, etc. Periods of incapacity for work, leave without pay and others must be reflected in separate lines.

7 - Column 12 indicates the corresponding code for the conditions for early assignment of an insurance pension.

8 - the period of work of the insured under the GPC agreement is reflected by one of the codes “AGREEMENT” - if payment under the agreement was made in the reporting period, “NEOPLDOG” or “NEOPLAVT” - if there is no payment for work under the agreement during this period (clause 2.3.5 of the Procedure ). If there are other periods, the period of work under the GPC agreement should be the first. If there were several GPC agreements with one person, it is necessary to separately reflect each period for which the agreement was concluded so that the dates correspond to the dates in the supporting documents.

What is the SZV-STAZH report

Such reporting to the Russian Pension Fund became mandatory only in 2022.

Now insurance companies are required to report annually on all employees and specialists who worked during the reporting period. Let us remind you that the work experience report is generated based on information for the past year and is submitted before March 1 of the next year.

More details: fill out and submit the SZV-STAZH form to the Pension Fund of Russia

IMPORTANT!

In 2022, continue to use the form approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p.

Dismissal note: no longer for everyone

In Sect. 3 forms SZV-STAZH there is column 14 “Information about the dismissal of the insured person.” Out of habit, many policyholders tried to fill out this column for all employees with whom they parted ways in 2017. But in the new SZV-STAZH report, marking is provided only in one single case - when an employee was dismissed on December 31 of the reporting year (Clause 2.3.

36 Appendix 5 to the Resolution of the Board of the Pension Fund of January 11, 2017 N 3p (hereinafter referred to as the Filling Out Procedure); clause 1.4.4.4 of Table 24 of the Information Format). Let us emphasize: not on the last working day of the year, but on December 31st. That is, in the SZV-STAZH report for 2022 there is no need to put a mark in relation to workers dismissed on December 29.

Please note that putting a mark in column 14 of section 3 of SZV-STAZH in the event of dismissal of an employee on or before December 31 is considered an error (code 30).

The procedure for filling out column 14 “Information about the dismissal of the insured person” section. 3 of the SZV-STAZH form is set out in paragraphs 2.3.36 and 6.6.6 of the Procedure for filling out the form “Information on the insurance experience of insured persons (SZV-STAZH)”, the form “Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) accounting (EFV-1)", form "Data on the adjustment of information recorded on the individual personal account of the insured person (SZV-KORR)", form "Information on earnings (remuneration), income, amount of payments and other remunerations accrued and paid by insurance contributions, periods of labor and other activities counted in the insurance period of the insured person (SZV-ISH)”, approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 3p.

According to these standards, the column “Information about the dismissal of the insured person” is filled in with the symbol “X” only for insured persons whose dismissal date falls on December 31 of the calendar year for which the SZV-STAZH form is being submitted.

Thus, it is not necessary to fill out column 14 “Information on the dismissal of the insured person” in the certificate of the resigning employee, except for the case when the employee resigns on December 31. If the date of dismissal of the insured person falls on December 31 of the calendar year for which the SZV-STAGE form is submitted to the Pension Fund, then the symbol “X” is entered in this column, meaning that the insured person has worked for a full calendar year.