Pay taxes in a few clicks!

Pay taxes, fees and submit reports without leaving your home!

The service will remind you of all reports. Try for free

Since 2022, insurance premiums have come under the control of the tax service, so all calculations for insurance premiums are now sent to the Federal Tax Service. But the Pension Fund must also receive information about the insured persons, so it has developed a whole list of other reports and personalized forms. Among them is the annual SZV-experience report, which we will discuss in this article.

SZV-STAGE for a part-time worker in 2022

The form for submission to the Pension Fund includes information about all insured persons who are in an employment relationship with the organization.

Employees working part-time must be shown in SZV-STAZH. SZV-STAZH must be taken for both internal and external part-time workers (clause 1.5 of the Procedure, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p).

Data on part-time workers in the SZV-STAZH form is reflected as for regular employees. The period of work under normal conditions is reflected in section 3 of SZV-STAZH in the general manner, in one line.

General rules

The document establishes general rules for filling out the SZV certificate form - length of service upon dismissal in paper forms:

- Information is entered with a ballpoint pen or ink of any color except green and red.

- The form must be filled out legibly, in block letters, without blots. Errors cannot be corrected, painted over, pasted over or crossed out on a line of the form. The form with errors is filled out again.

- All sections must be filled in capital letters.

- It is allowed to enter information using a computer (computer aids) subject to the requirements for ink color.

- All information is entered based on the documents of the employer (the policyholder):

— Information about income (salary, bonuses, incentives and other payments and remuneration) accrued to the employee, as well as withheld insurance premiums, is filled out based on accounting data.

— Information about the period of work is filled in on the basis of the employer’s personnel records.

The SZV-experience certificate during dismissals is filled out only for the dismissed employee. The form should not contain information about other employees.

SZV-STAZH upon dismissal of an employee

The procedure for passing SZV-STAZH upon dismissal of an employee depends on the reason for dismissal.

If an employee resigns due to retirement, the SZV-STAGE for it must be submitted to the Pension Fund within three calendar days from the date the employee submits the application. In column 7 SZV-STAGE for such an employee his last working day is indicated. (Clause 2.3.4 of the Procedure, approved by Resolution of the Pension Fund Board of December 6, 2018 No. 507p).

If an employee leaves in the middle of the year, the period of his work is indicated only in columns 6 and 7. From column 7 it will be clear that this employee no longer works for the company. For all working employees, column 7 will be December 31, the last day of the reporting year.

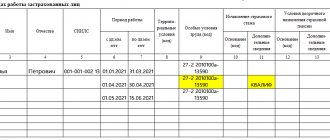

An example of a completed SZV-STAZH form in 2022

Form SZV-STAZH in 2022

How to hand over a report to those fired

The legislation does not explain exactly how the SZV-STAZH report must be handed over to the former employee upon dismissal: in person, by mail or electronically. In our opinion, you can use any of these options. The main thing is to have confirmation that the dismissal reports were provided. At the same time, there is no liability for failure to issue SZV-STAZH upon dismissal.

On the employee’s last day of work, pay him and give him:

- work book;

- a certificate of the amount of earnings in the form approved by order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n;

- copies of information in the SZV-M form;

- a copy of information in the form SZV-STAZH;

- a copy of section 3 of the calculation of insurance premiums;

- other documents (upon written application from the employee).

The only founder in SZV-STAZH in 2022

The sole founder - director - is included in SZV-STAZH, even if an employment contract is not concluded with him and he does not receive a salary.

Moreover, reporting must be submitted even to those companies that do not have any employees, there is only a director and he is also the only founder.

According to the procedure for filling out SZV-STAZH, approved. By resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p, organizations submit this form to insured persons working under an employment contract, including the sole founder or participant.

The founding director is an insured person for the purposes of compulsory pension insurance. He is in an employment relationship with the organization, regardless of whether an employment contract is concluded with him or not, whether he receives a salary or not.

The SZV-STAZH form must be submitted to the director - the sole founder or participant. This is confirmed by paragraph 1 of Article 7 of the Law dated December 15, 2001 No. 167-FZ, Article 11 of the Law dated April 1, 1996 No. 27-FZ, paragraph 1.5 of the Procedure approved by the resolution of the Pension Fund Board of December 6, 2018 No. 507p, letter of the Ministry of Labor of the Russian Federation dated March 16, 2018 No. 17-4/10/B-1846.

Moreover, for the sole founder you need to pass not only SZV-STAZH, but also SZV-M.

If the director does not receive a salary, SZV-STAZH is filled out for him with the code “NEOPL”. For directors working in the Far North and equivalent territories, fill out columns 8–10 in section 3.

An example of a completed SZV-STAZH form in 2022

Form SZV-STAZH in 2022

Who needs to take the SZV-experience?

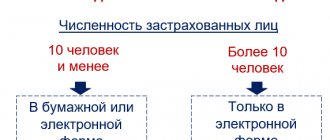

The report is filled out for each insured person, and in essence this form is personalized.

All organizations and their separate divisions, individual entrepreneurs with employees, as well as lawyers and notaries take the SZV experience. The report is submitted to each insured person with whom you have concluded an employment contract, a civil contract for the performance of work or provision of services, an author's order agreement, or a license agreement. The duration of the contract and the availability of payments under it do not matter. The SZV-experience must be passed, even if the contract was valid for only one day, and the insured did not receive payments subject to contributions under it.

Insured persons include:

- citizens of the Russian Federation, regardless of the place of activity;

- citizens of EAEU states, except for temporarily staying highly qualified specialists;

- highly qualified specialists with a temporary residence permit or residence permit;

- foreigners permanently or temporarily residing in the Russian Federation, temporarily staying in the Russian Federation;

- the director is the sole founder.

There is no need to submit a report for the self-employed and individual entrepreneurs who are executors under GPC agreements. There is no zero report on the SZV-experience form. If the organization has at least a manager who is the only participant and owner of the property, data about him must be included in the report. Data on an individual entrepreneur without employees is not included in the SZV-experience; he simply will not have to report on the form.

SZV-STAZH upon liquidation of a company

The SZV-STAZH form is submitted to the pension fund at the end of the year. So, for 2019 you need to report until March 1, 2022 inclusive, for 2020 - until March 1, 2022 inclusive. But, if the organization is liquidated, SZV-STAZH must be submitted without waiting for the end of the year.

Companies that have decided to liquidate submit SZV-STAZH within one month after they approve the interim liquidation balance sheet, and no later than the day when documents are submitted to the Federal Tax Service to register the termination of activities

Example: On February 9, 2022, the founders of Dynamics LLC at a general meeting decided to liquidate the Company. On April 11, 2022, the accounting department of Dynamics LLC formed an interim liquidation balance sheet. Dynamics LLC must submit the SZV-STAZH to the Pension Fund on May 10, 2022.

Information about special conditions for performing labor functions

Sections of the table from No. 8 to 13 are filled in with codes in accordance with the Classifier attached to the Procedure for issuing SZV-M certificates (see sample SZV-STAZH certificate upon dismissal):

- Column 8: codes “RKS”, “MKSR” and others are entered if during a given period the employee performed labor functions in the Far North or other special territorial zones.

- Column 9 and its clarifying Nos. 12 and 13 are filled out only if there is documentary evidence of work experience that gives the right to early assignment of a pension to this employee.

How to fill out the SZV-STAZH upon liquidation of an LLC in 2022

SZV-STAZH includes all employees who worked under an employment or civil contract, not forgetting those employees who were fired during the year.

If a company is liquidated, SZV-STAZH must also include employees of the liquidation commission, regardless of the form of the agreement concluded with them.

The report is compiled for the period from January 1 of the year to the day of liquidation of the company. The day of liquidation of an organization is considered to be the day on which an entry about liquidation was made in the Unified State Register of Legal Entities (clause 9 of Article 63 of the Civil Code of the Russian Federation).

Let us recall that the SZV-STAZH form was approved in Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p.

In section 2, enter the calendar year for which you are submitting reports. In a separate block “Type of information”. put o. When liquidating, you need to select the original one.

In section 3, enter the details of employees and the period of their work.

If employees performed work under a civil contract and received remuneration for this, enter “AGREEMENT” in column 11. This is exactly how you need to enter information about the services of a liquidator. If the company has not yet paid for his work, indicate “NEOPLDOG” or “NEOPLAUT” in the column.

Sections 4 and 5 of the form should be left blank; these sections are for reporting on retired employees.

An example of a completed SZV-STAZH form in 2022

Form SZV-STAZH in 2022

What is the report for?

The SZV-STAZH report and the procedure for its formation were approved by Resolution of the Pension Fund Board of January 11, 2022 No. 3p. In SZV-STAZH with the “initial” information type, you need to include all employees and performers (contractors) under civil contracts. Every year, such a report must be submitted to the Pension Fund authorities no later than March 1 of the year. See “SZV-STAZH: new reporting for all employers: 2022.”

Pension Fund bodies that have received SZV-STAZH reports will monitor the accrual of length of service of individuals to form their pension rights.

How to fill out SZV-STAZH when working part-time

Employees who work part-time under normal conditions at SZV-STAZH do not need to be allocated in any special way. It is enough to indicate in SZV-Experience: full name, SNILS and validity periods of employment contracts.

In the SZV-STAZH form, part-time work is reflected if the enterprise operates under special conditions and employees have the right to early retirement.

Where the SZV-STAZH form reflects data on part-time work

In section 3 of the SZV-STAZH report, you need to reflect the scope of work or the share of the rate in accordance with clause 2.3.6 of the Filling Out Procedure.

Information about part-time work reflects:

- or in column 8 “Territorial conditions (code)”. In this column, enter the code of territorial conditions and the share of the rate;

- or in column 9 “Special working conditions (code)”. In this column the special conditions code and the rate share are entered.

To indicate territory codes with special working conditions, you need to use the Classifier of parameters used when filling out information for maintaining individual (personalized) records. This Classifier is approved in the annex to the Procedure for filling out the SZV-STAZH.

We will set up any reports, even if they are not in 1C

We will make reports in the context of any data in 1C.

We will correct errors in reports so that the data is displayed correctly. Let's set up automatic sending by email. Examples of reports:

- According to the gross profit of the enterprise with other expenses;

- Balance sheet, DDS, statement of financial results (profits and losses);

- Sales report for retail and wholesale trade;

- Analysis of inventory efficiency;

- Sales plan implementation report;

- Checking of employees not included in the time sheet;

- Inventory inventory of intangible assets INV-1A;

- SALT for account 60, 62 with grouping by counterparty - Analysis of unclosed advances.

Order report customization

New codes in SZV-STAZH from 2022

When filling out the SZV-STAZH for 2022, you need to pay attention to the Resolution of the Pension Fund of the Russian Federation dated September 2, 2020 No. 612p. It contains new codes that are valid from October 13, 2022.

In section 3, in the field “Calculation of insurance period”, a new code is introduced - “VIRUS”. It is indicated by those health workers who are working to combat coronavirus. This code must be entered between January 1 and September 30, 2022.

In addition, in the same section you need to indicate new codes related to the application of preferential rates on insurance premiums. In particular, these include the codes “MS”, “VPMS”, “VZhMS”, “KV”, “VZhKV”, “VPKV”. The same encoding will be used when generating calculations for insurance premiums submitted to the Federal Tax Service.

The new encoding must be used when generating the annual SZV-STAZH based on the results of 2022 or if you need to fill out the report after October 13, 2022.

Still have questions? Book a consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

DLOTPUSK in the form SZV-STAZH

Paragraph 2.3.13 of Resolution No. 507p states that the code “DLOTPUSK” is indicated only for periods of work of the insured person under special working conditions, for which there is no data on the calculation of insurance premiums at an additional rate.

The “DLOTPUSK” code can be indicated in SZV-STAZH only in combination with codes for special working conditions.

In the SZV-STAZH form, section 3 reflects data on employees and periods of their work. This section should include employees with whom an employment or civil law contract was in force during the year.

Separately for each employee, you need to indicate the periods when he worked, did not work, was on vacation, was on sick leave, etc. In fact, the SZV-Experience form reflects the entire schedule of the employee’s professional life.

In columns 6 and 7 of the SZV-STAZH form, indicate the start date and end date of each vacation.

In column 11 “Additional information” of section 3 “Information on periods of work of insured persons” of the SZV-STAZH form, you must indicate the codes of each period. One of these codes is “DLOTPUSK”. The code “DLOTPUT” must be entered in column 11.

The “DLOTPUSK” code must be filled out only for periods when the employee works under special conditions and is entitled to early old-age pension. This refers to those periods for which insurance premiums were not calculated at the additional rate. The “DLOTPUSK” code is indicated only in combination with codes of territories with special working conditions.

For those employees who work under normal conditions, the code “DLOTPUSK” is not entered in column 11 of section 3 of the SZV-STAGE form. There is no longer any need to separately highlight vacation periods in columns 6 and 7 of Section 3.

Please note: if at the beginning of the year, in January, an employee went on another vacation, received vacation pay in December, and quit on the last day of vacation, he will not have any contributions at all in the current calendar year. In all other cases, contributions will be accrued and the code “DLOTPUSK” does not need to be entered.

An example of a completed SZV-STAZH form in 2022

Form SZV-STAZH in 2022

Who is required to issue a copy of the SLA to a dismissed employee?

Each insurer (employer) who provides such information to the Pension Fund of the Russian Federation has the obligation to draw up and issue SZV (STAZH, M) certificates upon dismissal of each employee. These include:

- Organizations, individual entrepreneurs who have concluded an employment contract with an employee, licensing agreements (publishing or for the use of copyrighted objects), a civil law contract for the provision of services (performing labor functions), licensing agreements (publishing or for the use of copyrighted objects) and similar agreements and contracts.

- Organizations with a single participant - owner, director, founder (the only member of the organization submits reports for himself)

- Employment Center (for unemployed citizens).

In other words, SZV-STAZH is filled out and sent only by employers, that is, organizations that hired at least one employee during the reporting period. This eliminates the obligation for private lawyers, notaries, members of associations, etc. to submit reports.

SZV-STAZH when assigning a pension to an employee

When an employee is going to retire, he must write a statement in which, along with a request to be dismissed in connection with retirement, he asks to submit personalized accounting information to the Pension Fund of the Russian Federation. The SZV-STAZH form and the procedure for filling it out were approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p.

For employees who are retiring, SZV-STAZH must be submitted to the Pension Fund within three calendar days from the date of submission of the application.

How to fill out SZV-STAZH when assigning a pension

When you submit SZV-STAZH for an employee retiring, in the upper right corner of the form, opposite the “Pension Assignment” field in the information type, you need to put o.

What to consider when preparing SZV-STAZH for a person retiring

Section 3

Section 3 of the SZV-STAGE reflects the employee’s periods of work, including periods of vacation, sick leave and other reasons for absence from work. Specific dates are indicated in columns 6 and 7.

SZV-STAGE is compiled for a calendar year. If an employee has been working in the company for a long time, the employment contract with him was concluded much earlier than the beginning of the year, the first date in column 6 will still be the first day of the reporting year “01/01/2019”. There is no need to indicate previous years in the report.

The last date in column 7 will be the day of retirement.

Please note: when submitting a retirement application, the employee must indicate the start date of the pension.

For employees who work in special conditions, in hazardous work part-time, the periods of work must be indicated in column 11. This applies to those who are eligible for early retirement.

Columns 8–10, 12 and 13 need to be completed only if the employee has the right to early retirement. In this case, it is necessary to indicate the codes of the relevant working conditions in column 12.

In column 10, write the code of the basis for calculating the insurance period of an employee who is entering early retirement.

Features when filling out a report

Let's go through the sections of the form.

Section 1 “Information about the policyholder” - indicate your registration number in the Pension Fund, TIN, KPP, abbreviated name of the organization. Pay attention to the field “Registration number in the Pension Fund of Russia”. In it, indicate the policyholder's registration number of 12 characters. In the “TIN” field, indicate the individual number of the organization or individual entrepreneur of 10 or 12 characters, and if there are empty cells left, put dashes.

In the “Information Type” field, mark the desired type of report with an “X”: initial, supplementary, or pension assignment. When submitting a report according to the latter type, the form is submitted without connection with reporting deadlines, and only for those employees who need to take into account their work experience for the current calendar year to establish a pension. We send a supplementary report to the Pension Fund for employees who for some reason were not included in the main report.

Section 2 “Reporting period” - indicate the year for which you are submitting the report. If you report when an employee retires, the current year.

Section 3 “Information about the period of work of insured persons” is presented in the form of a table with columns. Assign a serial number to each covered employee, even if the job information spans multiple lines.

- Column 1 indicates the serial number of the insured person. If data about the period of its operation is repeated on several lines, then subsequent lines are not numbered;

- in columns 2-5, indicate the full name and SNILS of the employee;

- in columns 6-7 the start and end dates of work. Indicate the dates within the reporting period that you indicated in the second section of the report. If there was a break in your work experience, start a new line, but do not duplicate the employee’s data and SNILS number.

- in column 8, indicate the code of territorial conditions in accordance with the section of the Classifier. For example, for the regions of the Far North the code is “RKS”.

- in column 9, indicate the code of special working conditions that give the right to early assignment of a pension. Codes of special conditions are indicated in accordance with the corresponding section of the classifier. The code must be indicated for the period of work giving the right to early retirement if the working conditions were classified as harmful or dangerous and contributions were paid for them at additional rates. This also includes periods during which the employer paid contributions for the employee under early non-state pension agreements;

- in column 10, provide the code of the basis for calculating the insurance period according to the Classifier. For example, for health workers who, from January 1 to September 30, 2022, provided assistance to patients with coronavirus or suspected cases of it, the code “VIRUS” must be indicated. For employees engaged in seasonal activities, the code “SEASON” is indicated.

- In column 11, indicate additional information for each period from columns 6-7: whether there were maternity leaves, leaves without pay, advanced training, etc. They are reflected in the form of the corresponding codes - “VRNETRUD” for the paid sick leave period, “Children” for parental leave up to 1.5 years.

- in columns 12 and 13 - indicate information about the conditions for early assignment of a pension

- Complete column 14 only if the employee resigns. Here you need to select an indicator: “12/31/yyyy” - for the insured who quit on December 31, “BEZR” - for the insured who received unemployment benefits, performed paid public works or moved to another area in the direction of the employment service for employment.

Sections 4 and 5 should only be completed when assigning a pension.