Regulatory regulation

Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages”

Letter of the Ministry of Health and Social Development of the Russian Federation dated December 7, 2005 No. 4334-17 “On the procedure for determining the number of calendar days of unused vacation”

Letter of Rostrud dated July 22, 2010 No. 2184-6-1

Regardless of the grounds for termination of the contract, even for guilty actions, the employee upon leaving the company must be paid money for all unclaimed vacation days (see letter of Rostrud dated July 2, 2009 No. 1917-6-1). How to calculate compensation upon dismissal, see the instructions below.

Vacation pay calculation

Leave is granted and paid in calendar days. With a fully worked month in the billing period, the indicator “Number of days in the billing period” includes 29.3 calendar days. For each incompletely worked period, the number of calendar days included should be determined by the formula:

The length of annual leave is 28 calendar days (Article 115 of the Labor Code of the Russian Federation). It may be provided in parts. The average daily income obtained by dividing the base by the number of calendar days in the billing period is multiplied by the number of vacation days.

Instructions on how to calculate compensation for vacation upon dismissal

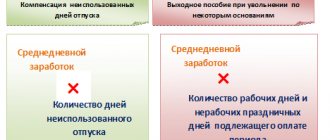

The general formula for calculating money: the number of unused vacation days should be multiplied by average earnings. We will show you how to calculate compensation upon dismissal in 2022.

Step 1. Determine the number of unused days

Option 1.

We calculate the vacation period - how many years and months the worker has worked for the company. The last month is calculated as follows:

- if 15 or more days are worked, it is counted as full;

- if less than 15 are worked, it is not taken into account completely.

For each year, a person is entitled to 28 calendar days of vacation (this is in general, but we must not forget that there are categories that are entitled to extended paid vacations, for example, for irregular working hours).

Naturally, when calculating length of service, round numbers will not work. There will be days remaining, which are taken into account in the calculation as follows: the number of remaining days (which are converted into full months) is multiplied by vacation days. The resulting figure is divided by 12. When receiving a fractional number, it is rounded up (see letter of the Ministry of Health and Social Development dated December 7, 2005 No. 4334-17).

Then from the resulting figure we subtract what the employee had already taken off by the date of dismissal. What remains is subject to compensation: the number of days is multiplied by the average daily income.

Option 2.

How is compensation calculated when dismissing an employee if the person worked for less than or a little more than one year and did not take vacation?

In this case, the following indicators are used in the calculation: for each month worked, 2.3 calendar days of vacation are due. But this is true only for those categories of employees whose paid annual rest is equal to 28 calendar days.

For teachers, for example, whose paid vacation period varies from 42 to 56 calendar days, this figure is 3.5 and 4.6, respectively.

For workers with whom they have entered into fixed-term employment contracts for a period of up to 2 months, this figure will be 2 days for each month of work.

Therefore, we take the number of months worked by a person and multiply by the required figure. What comes out is rounded according to the above rule. We multiply the resulting figure by the average daily earnings.

Nuances of calculations

If a person works for at least 11 months, the number of days of rest is equal to the annual one, as if he had worked for a whole year.

This rule also applies to personnel who have worked from 5.5 to 11 months if:

- liquidation of the enterprise or individual divisions has begun;

- the company's workforce is being reduced;

- the employee is drafted into the army.

If a person has worked for less than 11 months, the calculation is proportional to how much work has been done.

Step 2. Calculate average daily earnings

To do this, we take the amount that the worker earned in the 12 calendar months before dismissal and divide it by the number of days worked during this period:

- if the day of dismissal fell on the last day of the month, this period is included in the calculation period. If on any other day this monthly period is not taken into account, the 12 previous months are taken for the calculation period (see letter of Rostrud dated July 22, 2010 No. 2184-6-1);

- if a month is worked in full, it is considered equal to 29.3 days. If not, the number of days worked in this period is divided by the number of calendar days and multiplied by 29.3.

Step 3. Determine the payment amount

Average daily earnings are multiplied by the number of unused days of annual paid leave.

Step 4. Calculate taxes

Leave compensation upon dismissal is subject to personal income tax and insurance contributions in full. Personal income tax is due to be transferred the next day after the final payment is made.

Step 5. Pay out money

Money for unscheduled and unrealized vacations must be paid on the person’s last day of work. Late payment will result in penalties plus interest for each day of delay.

Step 6. Enter the necessary information into the 2-NDFL certificate

Cash compensation for unused vacation is entered into a certificate with income code 4800 (see letter of the Federal Tax Service dated September 19, 2016 No. BS-4-11/17537) and is given to the departing person along with other required documents.

ConsultantPlus experts sorted out what documents and within what time frame should be given to an employee upon dismissal. Use these instructions for free.

What exactly should be taken into account when calculating average earnings?

How average earnings are calculated is specified in the Regulations on the Calculation of Average Earnings. Average daily income is calculated based on wages for the previous 12 months. Its calculation includes all days and payments for the time when the employee was at work, and does not include for the time he was absent from work:

- disease;

- vacation;

- business trip;

- other absence, paid or unpaid.

One-time payments that are not related to the employee’s performance of work duties should not be included in the calculation: holiday incentives, financial assistance.

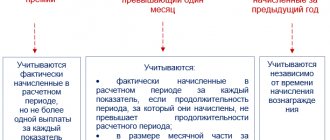

If bonuses were paid during the calculation period, they must be accounted for as follows:

| Type of award | The procedure for inclusion in the calculation |

| For a period less than the estimated period (monthly, quarterly) | Completely one for each bonus indicator (for example, revenue volume, number of sales) |

| For a period longer than the estimated period (for example, for fulfilling a long-term customer order) | In the amount of a monthly portion for each indicator for each month of the billing period |

| At the end of the year | Included in full, regardless of the date of actual accrual and payment |

If there was an increase in salaries throughout the company or in the department in which the employee works, then the payments included in the calculation after the increase must be adjusted by the coefficient:

Calculator for calculating compensation upon dismissal

How to calculate vacation compensation upon dismissal in 2020 online using a calculator.

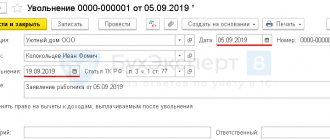

Step 1. Enter the hiring date and dismissal date into the calculator in the format XXXX-XX-XX (year-month-date) or select from the calendar.

Step 2. We indicate the number of vacation days the employee is entitled to per year.

The number of such days must be selected from the list. If you click on the arrow in the calculator, the following list will become visible:

- 28 - in most cases;

- 30 - disabled workers;

- 31 - minors with irregular working hours;

- 35 - employed in work with harmful (2, 3 and 4 degrees) and (or) dangerous working conditions;

- 44 - workers in areas equated to regions of the Far North;

- 52 - workers in the Far North;

- other.

If the category of employee does not fall into the proposed list (for example, teachers who are entitled to 42 or 56 days of rest), then select the last item “other” from the list of the calculator for calculating vacation pay upon dismissal in 2022 and indicate the number of days in the window that appears.

Step 3. Add to the calculator periods that are not included in the vacation period.

Please note the periods that are excluded from the calculation. If there were such, we note this in the calculator.

These periods include:

- vacation time at your own expense, if it exceeds 14 calendar days per year;

- child care time up to 3 years;

- time away from work without good reason;

- time of suspension from work due to the fault of the employee.

To mark a period in the calculator for calculating compensation for unused vacation upon dismissal in 2022, click the “Add period” button and enter the dates in the same format as you did in the first step.

Step 4. We indicate the number of vacation days for the entire period of work and SDZ and make a calculation.

General provisions on average earnings

Key concepts about average daily earnings are enshrined in Government Decree No. 922 of December 24, 2007 (as amended on December 10, 2016). Payment based on average earnings is used when calculating all types of payments arising within the framework of labor relations. These include:

- payment for the period of the next labor leave;

- amounts for the period of additional, educational, vacations;

- salary for the period of business travel;

- vacation compensation upon dismissal;

- payment for periods of downtime due to the fault of the employer;

- other types of accruals calculated based on average earnings.

The calculation of average daily earnings within the framework of an employment relationship is calculated for the 12 calendar months preceding the month in which the incident occurred. For example, an employee goes on vacation in April 2022, therefore, the calculation should include the period from 04/01/2019 to 03/31/2020.

Periods covered:

- days of illness (injury, maternity leave, illness of children and relatives);

- vacation days (paid and unpaid);

- days of downtime, regardless of the reasons;

- days of care for a disabled child;

- days of stay on a business trip;

- other days during which the employee retains the average daily salary in full or in part -

are not taken into account. It is not always possible to calculate average earnings using an online calculator. Accountants mainly do this with the help of special formulas and recommendations.

Taxation issues

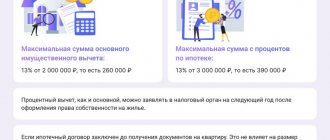

Cash compensation for unused vacation is subject to taxes. Personal income tax is accrued, according to Article 219 of the Tax Code of the Russian Federation, in the following cases:

- compensation payments are made to the employee directly on the last working day;

- compensation is paid on the day the salary is received, but the employee is not fired.

In other cases, personal income tax is not charged. Insurance contributions for pension, social and health insurance and against industrial accidents are not paid.

General provisions

Art. 127 of the Labor Code of the Russian Federation contains instructions on payment for unused vacation. Before stopping work, a worker may wish to use all of his or her leave. He retains this right if the dismissal does not occur in connection with his guilty actions.

When the decision to quit comes from the employee himself, according to the requirements of the Labor Code, he is obliged to inform his employer about this two weeks from the expected last working day. Notification occurs in writing - a statement is written. The deadline must be indicated.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

When dismissing an employee on his own initiative, he is entitled to the following payments:

| Indicators | Description |

| Wage | which includes work time for the last two weeks |

| Compensation | if you have unused vacation |

| Awards | specified in the collective agreement |

| Individual allowances | for special working conditions |

| Severance pay upon termination of an employment agreement | if they are provided for in the employment contract or additional agreement |

The basis for dismissal may be not only the voluntary desire of the employee, but also the following factors:

- Liquidation of the enterprise.

- Staff reduction.

- Conscription into the army.

Finally, he receives all the money due to the dismissed person on the last day of work. Along with them he should be given:

- a work book, which must contain a record of a personnel employee and be stamped;

- certificate 2-NDFL about income;

- reports on contributions to the Pension Fund of the Russian Federation;

- medical book.

All necessary payments will be pre-calculated in the company’s accounting department. The procedure for calculating wages depends on the number of days the dismissed person worked in the last month.

First, wages are calculated according to the established salary for one working day. It depends on the number of working days in the current month. This value is then multiplied by the number of days during which the fired person was present at work. Accrued premiums are added to this value.

In different regions there may be increasing factors. They range from 1.15 to 2. This coefficient is especially large in the regions of the Far North. The coefficient is taken into account before deduction for income tax.

There are deductions that are deducted when calculating due payments. These include:

- money that is paid according to writs of execution;

- alimony obligations;

- compensation for damages caused;

- voluntary pension insurance;

- repayment of loans;

- money paid as a result of an accountant's error.

The payroll is drawn up according to form T-61.

A sample of the T-61 form is available.

The calculation is made in accordance with the Labor Code of the Russian Federation. In addition to the accountant, it can be performed by personnel service employees and company managers. This situation can occur if the organization is an individual entrepreneur, and the personnel are managed by the director or business owner himself.

For a correct calculation, it is necessary to take into account whether the resigning employee was on sick leave in the current month. If the month is not fully worked, then the corresponding amounts of money are deducted.

For the calculation, two dates are taken into account - hiring and dismissal. It may be higher if the dismissed employee is disabled or a minor. Leave is also increased in difficult or harmful working conditions.

What it is

Termination of the contract leads the employer to the obligation to make a final settlement with the former employee. Dismissal is made both at will and for a number of other reasons. Regardless of the basis, the final calculation is carried out.

In his own interests, the resigning employee must verify the accuracy of all accruals before his last working day. The calculation sheet is subject to careful analysis. It is necessary to make sure that all applicable bonuses and supplements are taken into account.

Photo: Calculation sheet

For the remaining vacation days, the cash equivalent must be paid. This is regulated by labor laws.

In 2022, there were no changes in the algorithm for calculating compensation upon dismissal. As before, when calculating money for unused days, the average daily earnings are applied.

It happens that vacation was used prematurely. In this case, the accountant must recalculate and subtract the required amount from the last salary.

As a rule, the required vacation is 28 calendar days. If there are grounds for a longer vacation, this is taken into account in the calculations.

Photo: Vacation calculation

The following are excluded from working days:

- being on a business trip;

- paid or administrative leave;

- period of temporary incapacity for work;

- pregnancy and childbirth;

- additional days that are provided if there is a disabled child in the family;

- downtime that occurred through no fault of the employee;

- a strike that interfered with work, in which the person leaving did not take part.

Average daily earnings are calculated as accruals divided by the number of days.

Accruals include all labor income. Income does not include:

- Material aid.

- Compensation for travel costs for business trips.

- Payment for training.

- Money allocated for recreational activities.

- Funds to pay for a departmental kindergarten.

The calculation period is taken to be the twelve months that preceded the dismissal.

Who does it apply to?

The rules for calculation upon dismissal are established by the Labor Code. They must be carried out upon dismissal of one’s own free will, as well as in the following cases:

- violation of labor discipline;

- improper performance of one's official duties;

- liquidation of the enterprise;

- downsizing of the organization.

Regardless of the reason for dismissal, a final settlement with the employee must be made. An employee acquires the right to leave only if he has worked in this place for at least six months.

The following periods of time are not included in the vacation period:

| Indicators | Description |

| Truancy | Without good reason |

| Suspension from work | due to alcohol intoxication |

| Days when permission to work could not be carried out | due to lack of medical examination or safety training |

| Inability to start work | according to medical examination |

| Expiration of driver's license or gun license | — |

Special cases of compensation calculation

Dismissal of an employee on maternity leave

The issue of providing monetary compensation for women on maternity leave is regulated by:

- Article No. 127 of the Labor Code of the Russian Federation;

- rules on additional leaves, in particular, paragraphs 28 and 29.

For calculation use:

- the total number of vacation days for which accrual is made;

- daily average earnings of a pregnant woman.

Compensation for a part-time employee

The calculation procedure is the same as for regular employees.

Compensation for additional leave

The process of calculating monetary compensation, according to the Labor Code of the Russian Federation, is completely standard, as for regular main leave. The compensation payment is calculated as follows: the number of days of additional leave is multiplied by the average daily earnings.

Calculation algorithm

To calculate the average daily payout, in any case, we use the formula:

The average monthly salary in Russia for an employee should not be lower than the minimum wage.

An online calculator will help you correctly and quickly calculate your average earnings.

There are some specific features for different bases for paying average earnings. Below we will consider the most common cases when payment must be made based on average earnings.

Non-payment or underpayment of compensation

It must be remembered that for non-payment or underpayment of the final payment to an employee on the day of dismissal, the following sanctions are possible:

- an administrative fine in the amount of 120,000 rubles or in the amount of the employee’s average annual earnings;

- deprivation of the right to hold leadership positions for a period of 1 year;

- the court may decide on forced labor for up to several years; prison term up to 1 year;

- a fine of 100,000 to 500,000 rubles if the employer refuses to pay the final payment.