Definition of permanent differences

Permanent differences arise in income and expenses (clause 4 of PBU 18/02):

- forming the accounting profit (loss) of the reporting period, but not taken into account when determining the tax base either in the reporting period or in subsequent periods;

- taken into account in the tax accounting of the reporting period, but not recognized for accounting purposes as income and expenses of both the reporting and subsequent periods;

- determined for the reporting period;

- are formed by income and expenses (accounts 90, 91);

- do not create differences in assets and liabilities ( there are no permanent differences in the balance sheet! )

Constant difference

– a value that explains the relationship between income tax expense and accounting profit (loss) (clause 25 of PBU 18/02).

Income not taken into account for tax purposes

Educational program • Simplified taxation system • Income under the simplified tax system When determining the object of taxation, the following are not taken into account: 1) income specified in Article 251 of this Code;

When determining the object of taxation, the income specified in Article 251 of the Tax Code of the Russian Federation is not taken into account; here are the most common of them:

- in the form of property, property rights that are received in the form of a pledge or deposit as security for obligations;

- in the form of property, property rights or non-property rights with a monetary value, which are received in the form of a contribution to the authorized capital of the organization ;

- in the form of property, property rights that were received within the limits of the contribution by a company participant when leaving a business company, or when distributing the property of a liquidated business company among its participants;

- in the form of property (including money) received by a commission agent, agent and (or) other attorney in connection with the fulfillment of obligations under a commission agreement, agency agreement or other similar agreement, as well as for reimbursement of expenses incurred by the commission agent, agent and (or) by another attorney for the principal, principal and (or) other principal, if such costs are not subject to inclusion in the expenses of the commission agent, agent and (or) other attorney in accordance with the terms of the concluded agreements. The specified income does not include commission, agency or other similar remuneration;

- in the form of funds or other property received under credit or loan agreements, as well as funds or other property received to repay such borrowings;

- in the form of property received by a Russian organization free of charge:

- from the organization, if the authorized capital of the receiving party consists of more than 50% of the contribution of the transferring organization;

- from the organization, if the authorized capital of the transferring party consists of more than 50% of the contribution of the receiving organization;

- from an individual, if the authorized capital of the receiving party consists of more than 50% of the contribution of this individual.

- In this case, the received property is not recognized as income for tax purposes only if, within one year from the date of its receipt, the specified property (except for cash) is not transferred to third parties;

- in the form of amounts of payables of the taxpayer for the payment of taxes and fees, penalties and fines to budgets of various levels, for the payment of contributions, penalties and fines to the budgets of state extra-budgetary funds, written off and (or) reduced otherwise in accordance with the legislation of the Russian Federation or by decision Government of the Russian Federation;

- in the form of capital investments in the form of inseparable improvements to the leased property made by the lessee, as well as capital investments in fixed assets provided under a free use agreement in the form of inseparable improvements made by the borrower organization;

- other income specified in Art. 251 Tax Code of the Russian Federation.

Income of an organization subject to corporate income tax at tax rates of 0%, 9% and 15%, in accordance with paragraphs 3 and 4 of Article 284 of the Tax Code of the Russian Federation, are not included in the object of taxation of the simplified tax system, but are subject to income tax in the manner established Ch. 25 Tax Code of the Russian Federation.

The income of an individual entrepreneur, subject to personal income tax at tax rates of 35% and 9%, provided for in paragraph 2, paragraph 4 and paragraph 5 of Article 224 of the Tax Code of the Russian Federation, is not included in the object of taxation of the simplified tax system, but is subject to income tax in the manner established by Chapter .23 Tax Code of the Russian Federation.

Didn't find the answer?

FREE consultation! All questions and answers on the topic Income under the simplified tax system

- Income taken into account for taxation

- Income not taken into account for tax purposes

- Receipts that are not income and therefore not taken into account for tax purposes

- The procedure for recognizing income under the simplified tax system

- Peculiarities of income recognition when switching to the simplified tax system from the general taxation system

Letters and explanations

- Letter of the Ministry of Finance No. 03-11-09/393 dated December 10, 2009

The organization applies the simplified tax system with the object of taxation “income”. When calculating the tax paid in connection with the application of the simplified tax system, are amounts returned by budgetary organizations or specialized commercial organizations, previously paid as a deposit as security for an application, taken into account? - Letter of the Ministry of Finance No. 03-11-04/2/228 dated September 20, 2007

An organization applying the simplified tax system (the object of taxation is “income”) purchased a monitor that turned out to be defective. The seller returned money to the organization in the amount of the cost of the defective monitor. Are these funds taken into account as income for tax purposes? - Letter of the Ministry of Finance No. 03-11-04/2/231 dated 07.11.2006

On the accounting by an organization applying the simplified tax system as part of income when determining the object of taxation of funds: erroneously returned or transferred to it by a counterparty, erroneously credited by the bank to its current account, and about reflection of these transactions in the Book of Income and Expenses. - Letter of the Ministry of Finance No. 03-11-06/2/211 dated October 16, 2009

Does an organization applying the simplified tax system (the object of taxation is “income minus expenses”) have the right to take into account for the purposes of Ch. 26.2 of the Tax Code of the Russian Federation, as part of income, the amount of refund of overpaid corporate income tax and VAT that was paid by the organization before the transition to the simplified tax system? - Letter of the Ministry of Finance No. 03-11-06/2/192 dated December 22, 2010

In accordance with clause 6 of Art. 13 of the Law of the Russian Federation of 02/07/1992 N 2300-1 “On the Protection of Consumer Rights”, when the court satisfies the consumer’s demands established by law, the court recovers from the manufacturer (performer, seller, authorized organization or authorized individual entrepreneur,... - Letter of the Ministry of Finance No. 03-11-11/329 dated December 22, 2010

An individual entrepreneur applying the simplified tax system with the object of taxation “income” entered into a commission agreement with LLC-1, where LLC-1 is the principal and the entrepreneur is the commission agent. Under a commission agreement, the principal instructs the commission agent to buy and sell goods on his own behalf, but at the expense of the principal for a fee... - Letter of the Ministry of Finance N 03-11-11/1 dated January 14, 2011

What is the procedure for determining the amount of the income limit, exceeding which entails the loss of the taxpayer’s right to apply the simplified tax system in 2009? - Letter of the Ministry of Finance N 03-11-11/15 dated January 27, 2011

An individual entrepreneur (IP) applies the simplified tax system. The main activity of the individual entrepreneur is commission trading. Individual entrepreneurs enter into commission agreements with both legal entities and individual entrepreneurs, as well as with individuals. In accordance with commission agreements, the duties of the commission agent (IP) ... - Letter of the Ministry of Finance N 03-11-11/16 dated January 27, 2011

An individual entrepreneur (IP) applies the simplified tax system with the object of taxation “income” and plans to systematically issue short-term (for a period of no more than one year) interest-bearing loans to citizens (individuals) in cash. To ensure the repayment of issued loans, the individual entrepreneur plans... - Letter of the Ministry of Finance N 03-11-06/2/04 dated 01/19/2011

A non-profit educational private institution that uses the simplified tax system with the object “income reduced by the amount of expenses” carries out educational activities in accordance with state educational standards in accordance with the obtained license, for which it charges fees from students. Weight… - Letter of the Ministry of Finance N 03-11-06/2/107 dated 07/08/2011

The LLC applies the simplified tax system with the object of taxation “income minus expenses”. Until 2011, the LLC was engaged in servicing the common property of apartment buildings under an agreement with another management organization. Since January 2011, LLC began managing apartment buildings as a management organization… - Letter of the Ministry of Finance N 03-11-11/185 dated 07/15/2011

Are funds (payments) received from their members and homeowners who are not members of the partnership taken into account when calculating the tax base of HOAs that apply the simplified tax system to pay for utilities and house maintenance? - Letter of the Ministry of Finance N 03-03-06/4/77 dated 07/13/2011

The main goals of the charitable foundation are the formation of property on the basis of voluntary contributions and the use of this property to protect the rights of the child, strengthen the authority and role of the family, strengthen the social status of childhood in society, promote protection of motherhood, childhood and paternity... - Letter of the Ministry of Finance N 03-11-06/3/89 dated 07/29/2011

An LLC that uses the simplified tax system with the object of taxation “income” produces organic fertilizer based on chicken manure. In order to promote its own products on the sales market, the LLC periodically travels to other regions of Russia for exhibitions.Thus, from February 12 to February 14, 2010, the LLC participated in high...

Consultations

- Taxation of reimbursement of agent expenses under the simplified tax system

An organization applying the simplified tax system has concluded an agency agreement, according to which the agent enters into agreements with third parties, where they act on their own behalf, but at the expense of the principal. Principal in… - Is a loan considered income under the simplified

tax system? Is a loan received by an enterprise applying the simplified tax system to a current account recognized as “Income” of the enterprise or not? - If clients need VAT

, all my customers pay VAT, I switched to the simplified tax system from 01/01/2011 (income reduced by the amount of expenses), I pay VAT to the budget when selling, now it turns out that by paying VAT I do not make a profit... - Deductions under the simplified tax system

I am an entrepreneur, I pay simplified taxes, I am the guardian of a girl born in 2004. Am I entitled to receive any tax deductions? - Income under the simplified tax system

Hello. I read a lot of information, but I still couldn’t find a clear answer to my question. Please tell me if a legal entity that is on the simplified tax system (income) received from an individual... - Account movement under the simplified tax system

Hello! Our organization uses the simplified tax system “Income-expenses”. In 2010, a third-party organization transferred money to our account to pay for its needs. In our clause we indicated that the production... - USN income

Hello. We have a travel agency, this year we switched to the simplified tax system for income. It’s clear how to pay tax on tour operator commissions, but if we provided transport/tourist services (excursion) to... - Income of the simplified tax system - on the date of receipt

of the individual entrepreneur on the simplified tax system, income minus expenses, money from sales was received for settlement. account on December 22, 2011, but not withdrawn or used, are they taxed as income at 15%. Regards, Tatiana - Payment in kind - double taxation

Please help me solve the problem. The individual entrepreneur performs installation work (works on the simplified tax system). According to the terms of the contract, the Customer pays part of the amount in money, part - by transferring ownership of the... - Non-operating income under the simplified tax system

Hello. An enterprise on the simplified tax system has income minus expenses. When paying for communication services, both non-cash payments and payment through communication service terminals were used. There is not a single receipt from the terminal, follow… - Leasing a wholesale warehouse - USN

LLC on the simplified tax system (income). We rent out our own non-residential real estate (for warehouse space for conducting WHOLESALE trade only). Are we obligated to be UTII payers or can we calmly... - A loan is neither income nor expense.

Is an interest-free loan included in expenses and income? - Income under the simplified tax system

in the bank receipt, the source of income is indicated as “return of accountable amounts” and “interest-free loan agreement”, is this income? Is it subject to taxation? Is this recorded... - Income of the simplified tax system

Good day! I am an individual entrepreneur using the simplified tax system (income - 6%) I am going to open a bank account. I am interested in how the funds in the current account will be taxed? I understand so, … - Combination of modes

Hello. I have an auto parts store (UTII) and am going to sell motor oils (USN). How can I pay taxes separately? Or can I transfer everything to the USN when I start selling oils? - Transfer of materials to repay the loan

Non-operating income? LLC on the simplified tax system of 15% received a short-term interest-free loan from the unit. founder for the purchase of materials. Materials not sold. Is it possible for them to pay off the debt to... - A deposit is not an advance.

Is it possible, when applying the simplified tax system (USN), advances from the customer received in the form of a deposit for the purchase of equipment not to be taken into account in income in 2011? (the organization is engaged in installations of “Smart... - Income of the simplified tax system in settlements with the participation of the bank

Individual entrepreneurs are subject to taxation: simplified tax system income and UTII. Sells goods to individuals on credit through a bank. After receiving information on loans, the bank transfers funds to the current account, but not... - Non-operating income when combining modes

The organization combines two special modes - simplified tax system (STS) - rental of premises and UTII - cargo transportation. 1. We write off overdue accounts payable. It belongs to UTII-100%. Is this up to... - The construction of new housing is not subject to UTII

Our company - LLC - simplified tax system (income minus expenses), main activity 45-21 (construction works). there is a Customer - an individual (not an individual entrepreneur) - construction site - house, 2nd floor. IN… - Income simplified tax system 6%

simplified tax system 6%. The customer paid for the services provided in grain in August, we resold it in November and received payment in January. When should the tax be paid? - Taxes do not arise when receiving a loan.

Hello, please tell me that the individual entrepreneur is in the income-expenses taxation regime; he received an interest-free loan, should we pay taxes on this loan? - The loan received is not considered income for tax purposes.

Good afternoon! Should the received interest-free loan be taken into account in the ledger of income and expenses? SUMMARY INCOME. - UTII or USN

IP. USN 6%. I pay UTII. Retail trade of computers office equipment. There are also sales by bank transfer under retail trade agreements. Question. Is it legal for the Federal Tax Service to pay 6% of the simplified tax system (non-cash) to the UTII tax? - USN

It turns out that I will have to pay 1400 rubles per month to the pension fund, plus rent. And how much is the simplified tax system for 20 square meters of area? This is what we mean when selling motor oils and filters. Thank you... - Income of the simplified tax system

Hello, our organization (CJSC) is located on the simplified tax system “Income”. We sold the hangar and land and bought ourselves an office with the proceeds. Is this income?

Reflection of permanent differences in accounting

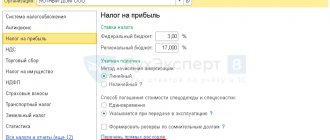

Depending on the chosen method for determining the current income tax (TNP):

- based on BU data - posting for formation: PNR - Dt 99.02.3 Kt 68.04.2

- PND – Dt 68.04.2 Kt 99.02.3

.

The chosen method should be fixed in the accounting policy (clause 22 of PBU 18/02).

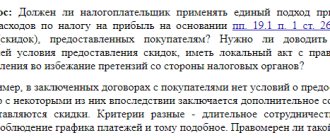

For the New Year's celebration, the organization ordered office decoration services and animator services for a corporate event from SMALL JOYS LLC.

On December 25, a work completion certificate was signed. The total cost of the event was 20,000 rubles. (without VAT).

For income tax purposes, expenses are not accepted.

In January, PNR was recognized in the amount of 2,000 rubles.

Document Receipt (act, invoice) type of transaction Services (act): Purchases – Receipt (acts, invoices).

Calculation of commissioning costs for December:

- PR = 20,000 rub.

PNR = 20,000 x 20% = 4,000 rubles.

Operations – Closing the month – Calculation of deferred tax according to PBU 18 – Income tax expense.

The explanations to the accounting (financial statements) indicate (clause b, clause 25 of PBU 18/02):

- conditional income tax expense (income) – amount;

- PNR (PND) – amount;

- applicable tax rates.

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C: Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge