Is it possible to take into account non-operating expenses that are not mentioned in paragraph 1 of Art. 265 of the Tax Code of the Russian Federation?

Yes it is possible.

The list of non-operating expenses in Art. 265 of the Tax Code of the Russian Federation is open. This is directly indicated by sub. 20 clause 1 of this article, relating to non-operating “other reasonable expenses”.

The main thing here is that the costs comply with the general requirements that the Tax Code imposes on expenses, namely:

- economically justified;

- documented;

- related to income generation.

For example, on this basis you can take into account:

- discounts provided under contracts for the performance of work and provision of services (see letters of the Ministry of Finance of Russia dated October 20, 2014 No. 03-03-06/1/52651, dated January 31, 2011 No. 03-03-06/1/40);

For more information about this, see the material “Can discounts and bonuses provided for work and services be considered non-operating expenses?” .

- expenses for maintaining the trade union.

E.S. Grigorenko, 2nd class adviser to the state civil service of the Russian Federation, answered some questions from taxpayers on the application of Art. 265 Tax Code of the Russian Federation. You can get acquainted with the change of official in ConsultantPlus:

If you don't have access to the system, get a free trial online.

We briefly explained the general points related to non-operating expenses. Now let's look at some of them. Let's take those on which officials or judges have recently spoken out.

Write-off of accounts receivable

Bad debts (debts that are impossible to collect):

- for which the statute of limitations has expired (Article 196 of the Civil Code of the Russian Federation, 197 of the Civil Code of the Russian Federation);

- for which the obligation has been terminated due to: impossibility of its fulfillment, liquidation of the organization, on the basis of an act of a state body. The basis for liquidation is an extract from the Unified State Register of Legal Entities (Letter of the Ministry of Finance of the Russian Federation dated March 14, 2014 N 03-03-06/1/11063). From September 1, 2014, exclusion from the Unified State Register of Legal Entities = liquidation (Article 64.2 of the Civil Code of the Russian Federation);

- when a bailiff makes a decision to terminate enforcement proceedings in the event that the writ of execution is returned to the claimant on the following grounds: the impossibility of establishing the location of the debtor, his property or obtaining information about the availability of funds and other valuables;

- if the debtor does not have property that can be foreclosed on, and all measures taken by the bailiff were unsuccessful.

In the opinion of YOU, a debt with an expired ID must be written off on time (i.e. in the reporting period in which the statute of limitations expired) (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 15, 2010 N 1574/10). The same position was recently voiced by the Ministry of Finance of the Russian Federation in Letter dated 04/06/2016 N 03-03-06/2/19410. But! There were also clarifications (Letter of the Federal Tax Service of the Russian Federation dated January 20, 2014 N GD-4-3/ [email protected] and the Ministry of Finance of the Russian Federation dated December 7, 2012 N 03-03-06/2/127), according to which there are no clear norms determining the moment of writing off the amount of bad debt as expenses (clause 3, clause 7, article 272 of the Tax Code of the Russian Federation). And the debt can be written off during the period of its discovery, citing an error under Art. 54 Tax Code of the Russian Federation.

are not automatically written off, including through the reserve - document Transaction entered manually .

Postings for writing off bad debts:

- through the reserve for doubtful debts:

Dt 63 Kt 62.01, 76;

- if the reserve has not been created or is not sufficient (clause 2, clause 2, article 265 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated 03/05/2010 N 03-03-06/1/117):

Dt 91.02 type for NU “Write-off of receivables (payables)” Kt 62.01, 76.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

How to account for banking services?

Bank commissions for conducting transactions on accounts are a classic example of expenses, the accounting procedure for which the taxpayer should choose independently, guided by clause 4 of Art. 252 of the Tax Code of the Russian Federation. The fact is that in the Tax Code of the Russian Federation these expenses are included both in production (subclause 25 clause 1 of Article 264 of the Tax Code of the Russian Federation) and in non-operating expenses (subclause 15 clause 1 of Article 265 of the Tax Code of the Russian Federation).

The presence of an appropriate condition in the accounting policy will allow you to avoid complaints from controllers. After all, even the Ministry of Finance is unable to clearly define the basis. For example, he recommended that the commission for transferring salaries to employee cards be classified as both production expenses (letter of the Ministry of Finance of Russia dated November 10, 2014 No. 03-03-06/1/56590) and non-operating expenses (letter of the Ministry of Finance of Russia dated March 2, 2006 No. 03-03-04/1/167).

Types of banking services

Before analyzing the procedure for recognizing expenses for banking services, let us explain what banking operations taxpayers have to pay for. The list of operations carried out by credit institutions is given in Art. 5 of the Law on Banks and Banking Activities . These include, for example:

- opening and maintaining accounts;

- transfers of funds on behalf of account holders;

- collection of funds (bills, payment and settlement documents) and cash services;

- purchase and sale of foreign currency in cash and non-cash form;

- issuance of bank guarantees.

In addition to the listed operations, the bank has the right, in particular:

- issue guarantees for third parties providing for the fulfillment of obligations in monetary form;

- provide for rent special premises, safes or cells for storing documents and valuables.

But these are no longer banking operations, but transactions ( Article 5 of the Law on Banks and Banking Activities ).

The list of services provided by a credit institution to a specific legal entity is determined by the relevant agreement. It determines the cost of banking services (including interest rates on loans and deposits), the timing of their implementation, the responsibility of the parties for violation of obligations, as well as the procedure for termination and other essential terms of the contract provided for by civil law ( Article 30 of the Law on Banks and Banking Activities ) .

What expenses include attorney fees?

Just like fees for banking services, services for representing an organization in court fall under 2 types of expenses provided for by the Tax Code of the Russian Federation. Thus, legal services are listed as production and sales costs (subclause 14, clause 1, article 264 of the Tax Code of the Russian Federation), and non-operating costs include legal services (subclause 10, clause 1, article 265 of the Tax Code of the Russian Federation).

According to the latest explanations from officials, services related to representing the interests of the organization in court and the services of lawyers should be qualified as non-operating expenses (letter of the Ministry of Finance of Russia dated July 10, 2015 No. 03-03-06/39817).

However, 2 years ago the ministry recommended classifying them as production and sales expenses (letter of the Ministry of Finance of Russia dated May 27, 2013 No. 03-03-06/1/18995).

If such expenses occur in your practice, decide on the accounting procedure by including it in your accounting policy.

Please note: the attribution of these expenses to a reduction in profit does not depend on the outcome of the litigation. If the costs are justified, they can be taken into account even if the dispute is lost. Officials do not argue with this.

We also note that the losing party may be required to reimburse its opponent for legal costs. These amounts can also be taken into account for profit as non-operating expenses (letter of the Ministry of Finance of Russia dated 04/08/2009 No. 03-03-06/1/227).

Registration

According to tax accounting rules, expenses that are not related to the production and sale of goods (work, services) are considered non-sales. Including those classified as other in accounting.

Non-operating expenses are listed in Article 265 of the Tax Code. This list is not closed. Non-operating expenses also include any expenses that are not taken into account as part of the costs of production and sale of goods (works, services), but which reduce taxable profit.

Non-operating expenses, in particular, include:

- costs of maintaining property leased (leasing);

- costs of paying interest on debt obligations (loans, credits, own bills and bonds, etc.), including restructured debt to the budget;

- negative exchange rate differences from the revaluation of foreign currency values (except for securities) and foreign currency debt;

- negative differences arising from the sale or purchase of foreign currency at a commercial rate that differs from the official rate of the Bank of Russia;

- fines and penalties accrued to the company for violating the terms of business contracts;

- costs of canceled production orders, as well as production that did not produce products;

- losses of previous years identified in the reporting year;

- losses from downtime due to internal production reasons;

- losses from natural disasters, fires, accidents and other emergencies;

- costs of liquidation of fixed assets;

- the amount of written off accounts receivable;

- costs of creating provisions for doubtful debts;

- discounts provided to customers if they fulfill certain conditions, or bonuses;

- court expenses;

- costs for banking services;

- expenses for operations with containers;

- costs of holding shareholder meetings;

- expenses for the creation of social infrastructure facilities transferred free of charge into state or municipal ownership;

- other reasonable expenses not related to production and sales.

For example, business travel expenses. In general, they are included in other expenses. But if expenses were incurred, but the business trip did not take place, amounts that can no longer be reimbursed are allowed to be written off as non-operating expenses. But only if they can be considered justified. And this is a case when the employee is not at fault for disrupting a business trip (see letter of the Ministry of Finance of the Russian Federation dated July 3, 2022 No. 03-03-06/1/57735).

Similar cases include individual salary payments. Expenses for paying wages to employees accrued for days officially established as non-working days with retention of wages can be taken into account as part of non-operating expenses when taxing profits. These, as you know, are the days of June 24 and July 1, 2020, declared non-working days with continued pay by decrees of the President. Such expenses cannot be considered as economically unjustified (letter of the Ministry of Finance dated May 18, 2022 No. 07-01-10/40375).

At the same time, the list of non-operating expenses is replenished by introducing amendments to the Tax Code. In 2022, Federal Law No. 172-FZ of June 8, 2022 included in the list of non-operating expenses listed in Article 265 of the Tax Code certain expenses related to the provision of gratuitous assistance in the field of preventing the spread and overcoming the consequences of the coronavirus epidemic:

- non-profit medical organizations, state authorities and management and (or) local governments, state and municipal institutions, state and municipal unitary enterprises (subclause 19.5, clause 1, article 265 of the Tax Code of the Russian Federation);

- socially oriented NPOs (SONCO), religious organizations, other NPOs included in the register of non-profit organizations most affected by the coronavirus, within 1% of sales proceeds (subclause 19.6, clause 1, article 265 of the Tax Code of the Russian Federation).

Can interest on a loan used to pay dividends be included in expenses?

The time has come to pay dividends, but the company has no money. Unfortunately, this situation is not uncommon. To fulfill obligations to participants, the company takes out a loan or loan. And, as you know, you have to pay interest on them.

A decrease in profit on interest on loans taken for obvious production purposes does not raise any questions. This type of expense is directly named in subparagraph. 2 p. 1 art. 265 of the Tax Code of the Russian Federation, and the procedure for their accounting is defined in Art. 269 of the Tax Code of the Russian Federation.

Here the loan is not related to production, but is aimed at dividends. Therefore, the question arises: what to do with interest?

Just 2 years ago, attributing these interests to expenses would have guaranteed to have resulted in claims from controllers and even legal proceedings, because the Ministry of Finance considered these expenses unjustified (see letters dated 05/06/2013 No. 03-03-06/1/15774 and dated 03/18/2013 No. 03 -03-06/1/8152).

However, in July 2013, this approach did not suit the highest court (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 No. 3690/13). The arbitrators emphasized that the payment of dividends cannot be regarded as an obligation not related to activities aimed at generating income, and pointed out that the Tax Code of the Russian Federation has no restrictions on the recognition of expenses associated with the payment of dividends.

The Ministry of Finance thought and agreed (see letter dated July 24, 2015 No. 03-03-06/1/42780). Even earlier, this was actually done by the Federal Tax Service of the Russian Federation (letter dated December 24, 2013 No. SA-4-7/23263).

Therefore, at the moment, attributing interest on “dividend” loans to expenses should be painless.

For information about what rates apply to the income of legal entities in the form of dividends, read the article “Art. 284 of the Tax Code of the Russian Federation: questions and answers.”

Classification of expenses for tax purposes

The list of income tax expenses and their classification are also defined in the Tax Code of the Russian Federation. First of all, they are divided:

- for production and sales costs;

- non-operating expenses;

- expenses that are not taken into account for income tax purposes.

They can be divided differently:

- into direct and indirect;

- taken into account and not taken into account when calculating income tax.

The correct attribution of expenses within a particular classification directly affects the amount of tax payable. Without exception, all materials in this section are designed to help you correctly determine the nature of expenses and the procedure for their accounting in the tax base. Let's look at some in a little more detail.

How to take into account interest if an operating system was purchased through a loan?

Definitely, as part of non-operating expenses (subclause 2, clause 1, article 265, article 269 of the Tax Code of the Russian Federation). There is no need to increase the initial cost of the fixed asset by the amount of this interest.

Of course, interest on a loan spent on the purchase of a fixed asset can be regarded as expenses associated with the acquisition of fixed assets, which, according to the rules of paragraph 1 of Art. 257 of the Tax Code of the Russian Federation are included in its initial cost.

However, interest is an independent type of expense, for which the Tax Code of the Russian Federation has provided a separate basis and its own clear accounting rules. They should be followed in this case. This has been confirmed more than once by officials (letter of the Ministry of Finance of Russia dated March 10, 2015 No. 03-03-10/12339, sent by letter of the Federal Tax Service of the Russian Federation dated March 23, 2015 No. GD-4-3/ [email protected] , letter of the Ministry of Finance of Russia dated June 28, 2013 No. 03-03-06/1/24671, etc.).

If you are interested in the position of the judges, see the material “How to take into account interest on a loan through which depreciable property was purchased?” .

We also recommend that you read the material “How to take into account the costs of liquidating an under-depreciated fixed asset in tax accounting?” . These expenses are also considered non-operating expenses.

Provisions for doubtful debts

In tax accounting, creating a reserve is the right:

- the taxpayer can create or don't create reserve for doubtful debts (accounting policy) (Letter of the Ministry of Finance of the Russian Federation dated May 16, 2011 N 03-03-06/1/295).

The reserve is created based on the results of the inventory of doubtful accounts receivable on the last day of the reporting period, in accordance with the rules of Art. 266 Tax Code of the Russian Federation.

The reserve for doubtful debts is used by the organization only to cover losses from bad debts recognized as such in the manner established by Art. 266 Tax Code of the Russian Federation.

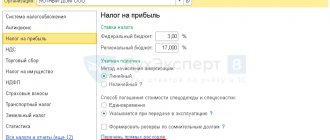

In 1C, the creation of a reserve is carried out automatically when settings are made in the accounting policy for NU:

The taxpayer has the right to refuse to create a reserve from the beginning of the new tax period by making changes to its tax accounting policy (Article 313 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation dated September 21, 2007 N 03-03-06/1/688).

Since 2022, the concept of counter-obligation of the counterparty has been introduced.

Doubtful debt is recognized as the corresponding debt of the counterparty to the taxpayer in the part that exceeds the specified counter-obligation. If there are debts to the taxpayer with different periods of occurrence, the reduction of such debts by the taxpayer’s accounts payable is made, starting from the first in time of occurrence (paragraph 1, clause 1, article 266 of the Tax Code of the Russian Federation).

The calculation of the reserve for doubtful debts is carried out in the following order (paragraph 5, paragraph 4, article 266 of the Tax Code of the Russian Federation):

- during the tax period for the reporting period, its amount cannot exceed the greater of: “10 percent of revenue for the previous tax period or 10 percent of revenue for the current reporting period”;

- for a tax period, the amount of the created reserve for doubtful debts cannot exceed 10 percent of the revenue for the specified tax period.