How to become a payer of the simplified tax system

A company or individual entrepreneur can become a “simplified” if it meets the following requirements (Article 346.12 of the Tax Code of the Russian Federation):

- The amount of income for the 9-month period of the year preceding the year in which the simplified tax system began to be applied is less than 112.5 million rubles. (criterion for organizations only). For example, if the transition is planned from 2022, the company’s income from January to September 2022 cannot exceed the specified amount.

NOTE! This income limitation is provided only for organizations. Individual entrepreneurs can switch to the simplified tax system for any amount of income, but in the future they must comply with the revenue limit of 150 million rubles. in a year.

- The average number of employees is no more than 100.

- The residual value of fixed assets is no more than 150 million rubles.

NOTE! This requirement applies to both companies and individual entrepreneurs.

- The percentage of participation in the organization of another taxpayer-legal entity is less than 25%.

- The payer category is not reflected in subparagraph. 1–13 p. 3 art. 346.12 Tax Code of the Russian Federation.

According to the requirements of Art. 346.13 of the Tax Code of the Russian Federation, in order to switch to the simplified tax system, an application should be sent to the tax authority with which the company or individual entrepreneur is registered:

- before December 31 of the year preceding the transfer, or

- within 30 calendar days - for newly registered payers.

For more information on how to become a payer on the simplified tax system, see the material “Who are the payers of the simplified tax system?” .

Where to pay tax under the simplified tax system if an individual entrepreneur does not work at his place of registration, find out here.

What taxes does an individual entrepreneur pay on NAP?

Individual entrepreneur who switched to NPD:

- is not recognized as a VAT payer (except for “import” VAT) Part 9 of Art. 2 of the Law of November 27, 2018 No. 422-FZ;

- does not pay insurance premiums for himself (Part 11, Article 2 of Law No. 422-FZ dated November 27, 2018).

Thus, an individual entrepreneur applying NAP pays:

- Personal income tax as a tax agent (Part 10, Article 2 of Law No. 422-FZ dated November 27, 2018). That is, individual entrepreneurs are required to keep records of tax payments, submit reports to the tax authorities and fulfill the duties provided for in Art. 24 Tax Code of the Russian Federation. For example, if an individual entrepreneur decides to hire workers under a contract;

- tax on income received at a rate of 4 percent when working with individuals and 6 percent when working with legal entities or individual entrepreneurs. That is, the individual entrepreneur must know who his customer is - an organization or an individual.

The amount of tax, according to Art. 11 of Law No. 422-FZ, tax authorities will calculate it independently. In this case, the tax is reduced by the amount of the tax deduction provided for in Part 1 of Art. 12 of Law No. 422-FZ. Its size is 10 thousand rubles. The tax is calculated on an accrual basis. The amount of the deduction depends on the tax rate (Parts 1, 2, Article 12 of Law No. 422-FZ dated November 27, 2018):

- if the tax is calculated at a rate of 4 percent - 1 percent of income;

- if the tax is calculated at a rate of 6 percent - 2 percent of income.

The deduction is provided once, the period of its use is not limited (Part 3 of Article 12 of the Law of November 27, 2018 No. 422-FZ).

In addition, the tax paid from 07/01/2020 to 12/31/2020 is reduced by the unused deduction, increased by a tax bonus of 12,130 rubles. The government provided for such an anti-crisis measure to support the self-employed in Resolution No. 783 dated May 29, 2020. The condition for receiving it is the absence of tax arrears or arrears of penalties. At the same time, the restrictions established by Parts 1, 2 of Art. 12 of the Law of November 27, 2018 No. 422-FZ, depending on the tax rate, do not apply. If there is a debt, the deduction is counted first against it, and then against the tax paid during the specified period (Part 2.1, Article 12 of Law No. 422-FZ of November 27, 2018).

The balance of the tax deduction not used in 2022 is applied from 01/01/2021 in an amount not exceeding the balance of the deduction as of 06/01/2020 (Part 2.2 of Article 12 of the Law of November 27, 2018 No. 422-FZ).

If an individual entrepreneur registered as an NPD payer for the first time after 06/01/2020, the balance of the deduction not used in 2022 is applied from 01/01/2021 in an amount not exceeding 10 thousand rubles (Part 2.2 of Article 12 of Law No. 422 dated 27.11.2018 -FZ).

The tax is due to be transferred at the end of each month. The first tax period will be the period from the moment of registration until the end of the calendar month following the month in which registration was carried out (Parts 1, 2, Article 9 of the Law of November 27, 2018 No. 422-FZ).

If it turns out that the tax is less than 100 rubles, this amount will be added to the amount of tax payable at the end of the next month.

The Federal Tax Service will notify the taxpayer about the amount of accrued tax through the “My Tax” mobile application no later than the 12th day of the next month. In this case, the details for its transfer will be indicated.

The deadline for payment of NAP is no later than the 25th of the next month.

There are several ways to transfer taxes:

- through the “My Tax” mobile application;

- through a bank or electronic platform operator (in this case, the Federal Tax Service will send a notification to them);

- through the Federal Tax Service, authorizing it to write off tax from a bank account and transfer it to the budget through the “My Tax” application.

Violation of the procedure and deadlines for transmitting information about settlements to the Federal Tax Service threatens with the accrual of fines (Article 129.13 of the Tax Code of the Russian Federation):

- in the amount of 20 percent of the settlement amount;

- in the amount of the settlement amount in case of repeated violation within six months.

How to become a UTII payer

IMPORTANT! UTII cannot be used from 2022. It has been canceled throughout the Russian Federation. A number of regions abandoned the special regime already in 2020. See details here.

The procedure for transition to imputation is specified in Art. 346.28 of the Tax Code of the Russian Federation and provides for:

- registration at the place of activity (or registration) of the company or individual entrepreneur;

- submitting a notice of transition to UTII no later than 5 days from the date of commencement of UTII application.

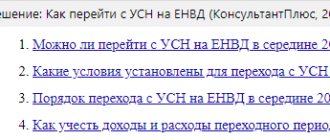

ConsultantPlus experts explained whether it is possible to switch to UTII in mid-2022 and answered the most common questions from taxpayers:

If you don't have access to the system, get a free trial online.

UTII payers can provide the following types of services:

- of a domestic nature;

- veterinary;

- repair and maintenance of cars and motorcycles;

- on the organization of parking lots;

- catering (the area of the premises should not exceed 150 sq. m);

- retail sale of food and non-food products (maximum area limitation - 150 sq. m);

- for transportation by road;

- outdoor advertising on special structures or on vehicles;

- leasing buildings and land plots for retail chains;

- for the placement and residence of people in an area of no more than 500 square meters. m.

Read more about the procedure for registering as a UTII payer here.

Registration of individual entrepreneurs on NAP

Individual entrepreneurs applying one or another tax regime (STS, Unified Agricultural Tax, UTII) have the right to switch to NAP if certain requirements are met. This is stated in Part 3 of Art. 15 of the Law of November 27, 2018 No. 422-FZ.

You cannot switch to paying NAP if the individual entrepreneur (Part 2 of Article 4 of Law No. 422-FZ dated November 27, 2018):

- resells property rights and goods (except personal belongings);

- sells excisable and subject to mandatory labeling goods;

- mines or sells minerals;

- hires workers under employment contracts. At the same time, there are no restrictions on attracting employees under the GAP. Work under contract agreements is also not prohibited (clause 3 of the letter of the Federal Tax Service of the Russian Federation dated October 12, 2020 No. AB-4-20 / [email protected] );

- engages in mediation activities;

- provides services for the delivery of goods with the acceptance of payments in favor of other persons (with the exception of delivery using a cash register registered by the seller of goods).

The income of an NPD user for a calendar year cannot exceed 2.4 million rubles. If the limit is violated, the person will lose the right to apply the special regime. From the day the limit is exceeded, income will need to be subject to personal income tax, and the individual entrepreneur can return to the previous one or switch to another special regime (letter of the Federal Tax Service of the Russian Federation dated December 20, 2019 No. SD-4-3 / [email protected] ). All income to which NPA was applied before the limit was exceeded will not need to be recalculated.

An individual entrepreneur cannot combine NPD with other special regimes or OSNO.

If all the conditions for the transition to the NPD are met and the individual entrepreneur decides to use it, it is necessary to go through the registration procedure as a NPD payer (Article 5 of the Law of November 27, 2018 No. 422-FZ).

There are several ways to register with the Federal Tax Service:

- through the mobile application of the Federal Tax Service of the Russian Federation “My Tax”, which can be downloaded for the Android platform through the Google Play service, and for the iPhone OS platform through the App Store. In this case, you will need to fill out an application with passport data and photo (Part 4, Article 5 of Law No. 422-FZ dated November 27, 2018);

- through your personal account on the Federal Tax Service website. This method only involves filing an application (Part 2 of Article 5 of Law No. 422-FZ dated November 27, 2018);

- through a credit institution, if information interaction with the Federal Tax Service has been established with its help. This method will require passport data and an application using the bank’s digital signature (Part 5, Article 5 of Law No. 422-FZ of November 27, 2018).

In the event of a transition to the NAP, an individual entrepreneur, within a month after registering as a self-employed person, must submit to the inspectorate a notice of termination of the previously used taxation system (Unified Agricultural Tax, simplified tax system, UTII, part 4 of article 15 of the Law of November 27, 2018 No. 422-FZ). Failure to send a notification or failure to comply with the deadline for sending it threatens to cancel the status of an NPD payer (Part 5 of the Law of November 27, 2018 No. 422-FZ).

Notification forms have not yet been approved. The recommended forms are given in the letter of the Federal Tax Service of the Russian Federation dated January 10, 2019 No. SD-4-3/ [email protected] and in the information of the Federal Tax Service of the Russian Federation “The Federal Tax Service of Russia reminds that when switching to NAP from other special regimes, it is necessary to send a notice of termination of their use.”

How to switch from simplified tax system to UTII

The transition from simplified tax system to UTII (here we are talking about replacing one mode with another, without combining, which we will talk about below) is carried out in the following ways:

- At the end of the year in which the taxpayer lawfully applied the simplified tax system. To do this, you must meet 2 deadlines. Before January 15 of the year following the year of application of the simplified tax system, the Federal Tax Service must be notified of the refusal to use this system. What happens if such notice is not submitted, see here. At the same time, no later than 5 working days from the date of commencement of application of UTII, you must inform the Federal Tax Service about this circumstance (see forms for individual entrepreneurs and for organizations). Accordingly, if you intend to apply UTII instead of the simplified tax system from the beginning of the year, you must submit both applications in compliance with both established deadlines. Such a transition cannot be made during the year, since there is an obligation to apply the simplified tax system throughout the entire tax period, unless the right to use this regime is lost.

- In case of loss of the right to use the simplified tax system during the year due to non-compliance with the requirements of Art. 346.12 of the Tax Code of the Russian Federation (these include both termination of compliance with the above requirements and exceeding the maximum allowable limit of possible income for the simplified tax system of 150 million rubles), the payer must stop charging tax under this system from the beginning of the quarter in which this occurred. The Federal Tax Service must be notified of this fact within 15 days following the quarter of loss. From the quarter of loss until the end of the year, taxes should be calculated in the manner in force for OSNO, since the Tax Code of the Russian Federation does not provide for the possibility of replacing the simplified tax with UTII before the end of the year in the event of loss of the right to the simplified tax system. If you intend and have the opportunity to apply UTII at the end of the year in which the right to the simplified tax system was lost, you must report this to the Federal Tax Service within 5 working days from January 1 of the year following the year of loss.

The form of notification of refusal to use the simplified tax system is contained in the order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/

It should also be noted that, by virtue of the norms of paragraph 7 of Art. 346.13 of the Tax Code of the Russian Federation, in the event of a transition to UTII from the simplified tax system back to the simplified tax system, the taxpayer can only transfer one year after the transition from the simplified tax system.

Possible dates for starting the use of UTII

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting. >> Try it now! It's free! <

The moment when you can switch to imputation depends on the mode in which the enterprise operated previously. The most common options are simplified and OSNO.

The first situation: an organization or individual entrepreneur works for OSNO and plans to change the regime to an imputation scheme. The Tax Code does not prohibit doing this at any time during the year.

Let's look at the second situation. Let's assume that a legal entity or individual entrepreneur works on the simplified tax system. Is it allowed to start operating on the imputation at any time at will? The Tax Code gives an unambiguous answer to this question. A voluntary transition from a simplified regime to another regime is possible only from the beginning of the next calendar year. Thus, it is not allowed to start working on the imputed tax system on any day. In this case, we are talking about changing the regime for the same type of activity. Alternatively, you can close the enterprise and register it again at imputation.

An enterprise can engage in several areas of business. It is allowed to switch to paying a single tax only for part of them. You can start combining imputation and simplification at any time during the year.

If you have just registered, then you are given 5 days after tax registration to decide whether to switch to UTII and submit an application.

Is it possible to combine simplified taxation system and UTII?

The Tax Code of the Russian Federation does not contain a ban on the simultaneous use of both regimes; Moreover, if the taxpayer calculates UTII for some types of activity, then the simplified tax system applies to all other types of activity (that is, there is no need to formalize withdrawal from simplified taxation). However, when combining these 2 modes, an individual entrepreneur or company must maintain separate records.

For more information about separate accounting, see the material “Separate accounting under the simplified tax system and UTII: maintenance procedure” .

About the nuances of these tax regimes, see the material “UTII or simplified tax system: which is better - imputation or simplified taxation?” .

Features of the transition from simplified to imputation

Due to some differences in accounting for income and expenses in a simplified manner, there are a number of features that you should definitely pay attention to when switching to UTII.

Let's consider several situations that taxpayers may encounter:

Situation 1

The taxpayer, using the simplified tax system, sold products for which payment was received while on UTII. What to pay - tax according to UTII or according to the simplified tax system?

There is no need to pay a simplified tax; you only need to pay UTII for the period of sale.

See also: “How to take into account for the simplified tax system goods purchased in the “imputed” period?”

Situation 2

The taxpayer received an advance payment during the period of being on the simplified tax system, and the implementation was reflected in the period of application of UTII. What should I pay - imputed or simplified tax?

You must pay tax according to the simplified tax system for the period in which the funds were received.

Situation 3

A taxpayer using the simplified tax system, not being a VAT payer, as a general rule usually does not use accounts 19 “Input VAT” and 68.2 “Accrued VAT” in accounting. Do I need to pay VAT when switching to imputation?

A taxpayer using UTII also does not have to pay VAT. There will be 2 situations as exceptions for both him and the simplified tax system payer:

- He is a tax agent for VAT.

- He issued a VAT invoice.

In both cases, non-payers of this tax must pay it to the budget. Therefore, when applying both the simplified tax system and UTII, the tax that needs to be paid will appear in account 68.2. In this case, account 19 will not be used, since tax evaders do not have the right to deduction.

For more information about the peculiarities of the work of VAT payers and non-payers, see the material “Basic rules when an organization without VAT works with an organization with VAT” .

The procedure for filling out reports on the simplified tax system and UTII

If a taxpayer, having decided to switch to UTII for certain types of activities, applies the simplified tax system and UTII in parallel, he will have to fill out the appropriate declaration for each type of activity and pay taxes to the budget.

The form of declaration under the simplified tax system is established by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/; At the same time, you should pay attention to the fact that for the objects “income” and “income minus expenses” the procedure for filling out the declaration is slightly different.

In accordance with Art. 346.23 of the Tax Code of the Russian Federation, organizations send reports to the tax authority according to the simplified tax system until March 31 after the end of the year, individual entrepreneurs - before April 30. However, in certain situations, the simplified tax system declaration should be submitted earlier: before the 25th day of the month following the one in which the activity on the simplified tax system was terminated at the initiative of the taxpayer, and before the 25th day of the month following the quarter of termination due to loss of the right to be in the specified regime .

Advance payments are due by the 25th day of the month of the next quarter. Payment of the simplified tax at the end of the year is made within the reporting deadlines.

This material will help you fill out the simplified tax return correctly.

Now about what concerns reporting on UTII. Currently, the declaration form is in force, approved by order of the Federal Tax Service dated June 26, 2018 No. ММВ-7-3/

For a sample of filling out a declaration using the new form, see here.

The deadline for submitting the declaration is regulated by clause 3 of Art. 346.32 of the Tax Code of the Russian Federation - no later than the 20th day of the month following the expired quarter.

Payment of UTII, according to clause 1 of Art. 346.32 of the Tax Code of the Russian Federation, is carried out before the 25th day of the month following the expired quarter.

Does the individual entrepreneur pay insurance premiums for NAP?

One of the advantages of using NAP by an individual entrepreneur is the absence of the obligation to pay fixed insurance premiums. According to part 11 of Art. 2 of Law No. 422-FZ Individual entrepreneurs are not recognized as payers of insurance premiums for themselves for the period of application of the NAP. Thus, in a year, an individual entrepreneur can save 40,874 rubles (clauses 1, 2, clause 1 of Article 430 of the Tax Code of the Russian Federation) plus 1 percent on the amount of income exceeding 300 thousand rubles.

In this case, individual entrepreneurs have the right to pay insurance premiums on a voluntary basis:

- on OPS (letter of the Federal Social Insurance Fund of the Russian Federation dated February 28, 2020 No. 02-09-11/06-04-4346);

- on OSS (Part 3 of Article 2 of Law No. 255-FZ dated December 29, 2006, letter of the Federal Insurance Service of the Russian Federation dated February 28, 2020 No. 02-09-11/06-04-4346).

Individual entrepreneurs who have lost the right to apply NAP are required to pay insurance premiums again. The start date of the billing period for their accrual will be the date of loss of the right to use NAP. If an individual entrepreneur refuses the NAP, contributions will have to be calculated from the date of deregistration as a self-employed person (Part 1, Article 15 of Law No. 422-FZ).

Results

When switching from the simplified tax system to UTII, the taxpayer must promptly notify the tax authority about this in order to avoid unpleasant consequences. Despite the fact that the simplified tax system and UTII are similar in some aspects, for a correct transition from one special regime to another, it is necessary to correctly distinguish between the periods of application of the simplified tax system and UTII.

And don’t forget that 2022 is the last year when you can work on UTII. And not everyone. We talked about the abolition of imputation here.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/

- Order of the Federal Tax Service of Russia dated June 26, 2018 No. ММВ-7-3/

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Conclusion

The transition from simplified tax system to UTII without restrictions is possible only at the beginning of activity. You can also submit an application at any time if a businessman decides to combine these tax regimes. It is important not to forget to submit a “simplified” declaration at the end of the “transition” year, even if there was no revenue within the framework of this special regime.

If the business is already operating, then you can completely abandon the simplified tax system and switch to “imputation” only at the end of the year.

If a taxpayer has lost the right to use the simplified tax system and “forcibly” switched to OSNO, then he can theoretically immediately switch to UTII without waiting for the new year. But because This issue is not regulated by the Tax Code of the Russian Federation, it is better to first find out the opinion of the tax authorities in your region.