The death of an employee is a sad event, in connection with which the management of the organization may have new responsibilities. It is known that, by law, wages must be handed over to the employee himself from the cash register or transferred to his bank account (Labor Code of the Russian Federation, Articles 22, 136). In this case, the payment is considered received. However, if an employee dies, the question arises: what to do with accrued and uncollected amounts of wages? What are the employer's responsibilities in this case? Who has the right to receive money and how to arrange such issuance? An important issue for accounting is the procedure for taxation and assessment of contributions for salary payments of a deceased employee.

Is it possible to pay the salary of a deceased employee to his salary bank card ?

Who has the right to receive payments for the deceased?

The general rule is that for an employee who has died, relatives and dependents can receive his payments (Labor Code of the Russian Federation, Article 141). However, in practice, determining who should receive the money is not so simple.

Example: the deceased’s wife and granddaughter applied to the accounting department for payment. At the same time, the marriage with his wife was dissolved, and his granddaughter is an adopted child. It is not possible to determine the whereabouts of blood children. What should the company management do?

Let's turn to the legislation. Family Code (RF IC) in Art. 2 family members include:

- spouse of the deceased - legal husband or wife;

- children of the deceased;

- his parents.

When determining the recipient of payments, you should first of all be guided by these provisions. At the same time, in Chap. 15 of the same document states that other relatives can also be recognized as family members: brothers, sisters, grandparents, grandchildren, non-natural parents and children. The employer decides what to do. He has the right to make a payment to the first of the applicants named in the Investigative Committee.

Question: Should an employer pay the wages of a deceased employee to his only relative (his aunt) and on the basis of what documents? View answer

If several people apply for money at once, considering themselves members of the deceased’s family or his dependents, the issue, as a rule, is resolved by agreement between relatives or by the latter’s appeal to the courts.

If the employer has doubts about who and how legally he will make the payment, it is advisable to transfer this money to the bank account of the deceased employee, notifying the bank of his death.

Thus, the money will become part of the inheritance mass, it will be received by the heirs according to the law, no matter who they are to the deceased. The organization will not be responsible for payment. But a transfer to a bank account with inclusion in the inheritance can be made only 4 months after the death of a citizen (Civil Code of the Russian Federation, Art. 1183). You can leave the money in the organization by depositing it until the moment when the already identified heirs apply for payments.

If you decide to give money to one of your relatives, you should remember that according to the Civil Code of the Russian Federation, only those of them who lived together with the employee or were dependents have this right, regardless of place of residence (Civil Code of the Russian Federation, the same article).

In the example we gave, none of the applicants has the right to receive the salary of the deceased.

On a note! The organization is not obliged to search for relatives and dependents of a deceased employee for the purpose of delivering uncollected amounts of wages and equivalents.

Additional payments to relatives of a deceased employee

In addition to the obvious amounts due to the employee, there are additional payments. These include financial assistance and funeral benefits .

To receive both payments, you must write an application. That is, there is a declarative procedure for receiving funds.

Financial assistance is issued at the discretion of the head of the organization. That is, this is not a mandatory payment. Financial assistance is issued if the manager wants to support seven deceased employees. Its size is discussed together with relatives.

The amount of funeral benefits is established at the legislative level. From February 1, 2022, its size is 5946.47 rubles. You need to know that the authorities of various regions can increase the amount of benefits at their discretion. Since the benefit is paid by the employer, he can also increase its amount on his own initiative. The benefit amount is paid to those relatives who were directly involved in the funeral and burial. To receive it, you need to write an application and attach all documents that confirm expenses.

All such payments must be documented in the internal documents of the organization.

Documentation

IMPORTANT! A sample application for payment of wages not received by an employee, funeral benefits and financial assistance in connection with the death of an employee from ConsultantPlus is available at the link

To receive a “dismissal” from a deceased employee, persons who have such a right by law are required to present:

- application requesting payment;

- death document;

- a document proving their identity;

- document confirming relationship with the deceased employee.

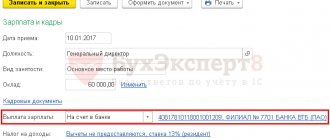

The recipient in the application, in addition to the request for the issuance of his payments in connection with the death of the employee, indicates the degree of relationship and the method of receiving payments. If the method of receipt is chosen not from the company’s cash desk, but non-cash, bank details are indicated. The application also indicates a list of attached documents.

Is it possible to transfer the salary of a deceased employee non-cash?

After the death of an employee, the transfer of funds to his card is illegal, since the fact of death is the basis for termination of the employment contract (Clause 6, Part 1, Article 83 of the Labor Code of the Russian Federation), and the procedure for issuing wages prescribed in the employment or collective agreement ceases to apply.

At the same time, the employer has an obligation to make the final payment. Payments are received by family members: spouses, parents (or adoptive parents) and children, including adopted children (Article 2 of the RF IC) or dependents if there are documentary grounds (Article 141 of the RF Labor Code).

Salary, compensation for unused vacation and other accruals due to the deceased employee are issued within a week from the date of presentation:

- death certificates;

- payment statements (where you need to indicate the recipient’s bank details if you want to receive money not in cash, but on a card);

- ID cards;

- a document confirming the right to receive payment (for example, a birth certificate).

Requirements for payment are made within 4 months from the date of death. Missing the deadline entails adding the amounts of the employer's debt to the inheritance (Article 1183 of the Civil Code of the Russian Federation).

Taxes and fees

There is no income tax on amounts due to a deceased employee. According to Art. 44 of the Labor Code of the Russian Federation, the death of an employee means the termination of his obligation to pay the specified tax, therefore, the tax is also not collected from relatives receiving payments from the deceased. Corresponding explanations have been given more than once in letters from the Federal Tax Service and the Ministry of Finance (letter No. 03-04-05/33652 dated June 10, 2015 from the Ministry of Finance and a number of others).

On a note! If wage payments are received by relatives through the inheritance procedure, the amounts will also not be subject to personal income tax. Exception: remunerations paid to the heirs (legal successors) of the copyrights of the deceased (Tax Code of the Russian Federation, Art. 217-18).

Payments for wages and equivalent payments are subject to insurance contributions. The latest clarifications on this matter are given by the Ministry of Finance in letter No. 03-15-07/53912 dated 08/22/17. Officials argue their opinion by the fact that at the time of calculating wages, the employee was alive and was an insured person, and contributions are calculated from the amounts accruals. Let us note that previously the Ministry of Labor and the Social Insurance Fund expressed a completely opposite opinion (attachment to the Fund’s letter No. 4 dated 04/14/15 No. 02-09-11/06-5250, letter of the Ministry of Labor dated 02/20/2013 No. 17-3/292) .

For income tax, the amounts of payments due to a deceased employee are taken into account when determining the tax base (Tax Code of the Russian Federation, 272-4; 255-2-1.8).

Payment procedure

Norm Art. 141 of the Labor Code of the Russian Federation states that it is necessary to pay the wages of a deceased employee , but payments are not limited to one salary.

According to the general rule of payments in connection with dismissal, the employee, in addition to salary, must also be paid compensation for unused vacation. This provision also applies in the event of death.

Funds are transferred to close relatives who submit the appropriate application to the head of the organization.

Sequencing

The payment algorithm itself is as follows:

- Drawing up an Order to terminate an employment contract and personnel documents.

This act is issued in the unified form T-8, but a company letterhead can also be used as a basis.

The main difference from the usual termination or termination of an employment relationship will be that the Order will not have the employee’s signature.

The date of dismissal is the day of the employee's death. The same applies to personnel documents (work book and personal card).

There is no need to require relatives to sign, but the employer may ask them to pick up the work book. In this case, relatives provide a written statement.

Reference. If none of the relatives come for the work book, the organization must store it together with the personal card for 75 years (Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558).

- Receiving an application from the relatives of the deceased for payment of his salary.

Family members of a deceased employee must apply in writing to the head of the organization to receive his wages accrued until the employee’s death. More details about the procedure and deadlines are below.

The amount of money must be paid within 1 week from the moment the manager receives the application (Article 141 of the Labor Code of the Russian Federation).

- Calculation of payment.

As mentioned above, wage balances and compensation for unused vacation are accrued as payments, but provided that the employee did not go on vacation in advance until the end of the working year. In this case, the employer does not have the right to collect the amount of debt from relatives or withhold a percentage of the remaining salary (clause 4, part 2, article 137 of the Labor Code of the Russian Federation).

The salary includes all bonuses, additional payments (for example, for work at night or “for harmfulness”), allowances (for example, the northern coefficient, etc.).

In addition to the above payments, relatives of a deceased employee may be paid:

- temporary disability benefits (if an employee died while on sick leave) - issued only to family members with whom the deceased lived together;

- maternity benefits (for employment and child care), if the employee died during the specified leave;

- travel expenses if the employee died during a business trip;

- financial assistance to relatives, provided that such payment is provided for by local acts of the organization or a collective agreement.

Important! Also, the relatives of the deceased must be paid a funeral benefit. In accordance with Part 2 of Art. 10 Federal Law of January 12, 1996 No. 8, this payment is the responsibility of the employer.

For example, from February 2022, the amount, taking into account indexation, is 5,946 rubles 47 kopecks (Resolution of the Government of the Russian Federation of January 24, 2019 No. 32).

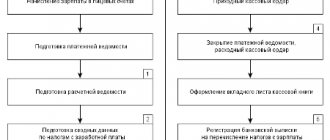

Deposit

If an employee who receives wages in person, that is, through the organization’s cash desk, and not to a bank account (card), but was unable to collect it for some reason, the amount must be deposited.

Depositing refers to the process of reflecting the salary in accounting as not received by the employee.

This also applies to the situation with deceased employees.

According to general rules, you can receive such a salary:

- on the day of the next issue;

- on a day specifically established by a local act of the organization as the period for receiving deposited salaries;

- upon the written application of the employee himself on the day specified by him (provided that such an amount is in the cash register).

The basis for issuing the deposited salary of a deceased employee is a written statement from his relatives. In this case, the general rule applies, according to which the amount must be issued within 1 week from the date of application.

Overdue

An employer who has not paid the deceased employee’s wages and compensation within 1 week from the date of receipt of the application will bear financial and administrative liability (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Financial liability, in accordance with Art. 236, is to charge interest for each overdue day. The amount of the penalty cannot be less than 1/150 of the rate of the Central Bank of the Russian Federation.

To whom and when is it paid?

First of all, it is necessary to determine the list of persons who are entitled to receive payments for a deceased relative. First of all, close relatives can claim this right (Article 14 of the RF IC):

- spouse);

- children (natural or adopted);

- parents (adoptive parents);

- siblings;

- Grandmothers and grandfathers.

Other relatives (aunts or uncles, nephews, stepfather or stepmother, stepson or stepdaughter, etc.), in the absence of the above, also have the right to apply to the employer for payment.

In addition to relatives, his disabled dependents also apply for wages.

In accordance with Art. 1183 of the Civil Code of the Russian Federation, family members were required to live together with the deceased, while this rule did not apply to disabled dependents.

They may also be relatives of the deceased who lived separately but depended on his earnings, for example, disabled parents.

Labor legislation does not determine the priority.

Important! Practice advises employers to pay wages to the relative (dependent) who submitted the application first.

The employer is not obliged to somehow divide the payment amount between relatives if several applications are submitted.

Deadline

In accordance with paragraph 2 of Art. 1183 of the Civil Code of the Russian Federation, relatives who lived with a deceased employee or dependents have the right to contact the employer within 4 months from the date of death of the employee .

If an application was not submitted within this period, the employer, in accordance with paragraph 3 of Art. 1183 of the Civil Code of the Russian Federation, payments are transferred to the inheritance estate. The employer must transfer it to the notary's deposit.

Relatives who submitted an application after 6 months must also be sent to a notary, since the salary will now be issued not in order of priority (who filed the application first), but in the order of legal or testamentary inheritance.

Documents and application procedure

First of all, a written application is required from relatives or dependents. It is drawn up in writing and must contain all the information necessary for the employer to confirm the existence of a relationship (dependency of the applicant).

- Statement header.

The applicant must submit the application to the deceased's employer. Thus, the following are indicated:

- full name of the organization;

- Name and position of the manager.

It is also necessary to provide information about the applicant himself:

- FULL NAME;

- passport details;

- address and contact details.

- Main part.

In the main part, it is necessary to express a request to transfer wages and other amounts due that were not received by the employee (full name, position) due to death. You must also indicate:

- who is the applicant’s relationship to the deceased (with reference to a document confirming relationship/dependency, as well as with reference to a document confirming cohabitation);

- details to which the amount should be transferred.

- List of documents attached to the application.

The application must include a list of attached documents.

To confirm your rights you will need:

death certificate (court decision declaring a citizen dead);- applicant's passport;

- a document confirming the relationship (birth certificate, marriage certificate, etc.);

- a document confirming that relatives live together (extract from the house register or a single housing document).

If, in addition to wages, the applicant requires a funeral benefit, the following must be attached to the documents:

- death certificate (not certificate) in form 33, issued by the registry office;

- a check or other document confirming payment for funeral services.

The application must contain the date of its submission and the signature of the applicant with a transcript.

Accounting

The accrual of the deceased’s “settlement” is made using standard entries Dt 20,23,44,25, etc. Kt 70. If the organization creates a reserve of expenses for upcoming vacations, then compensation for unused vacation is reflected in the posting Dt 96 Kt 70. For settlements with relatives of the dismissed person on occasion upon the death of an employee, account 76 “Settlements with various debtors and creditors” is used, since they were not and are not employees of the company: Dt 70 Kt 76. Payment and closing of settlements to relatives is reflected by posting Dt 76 Kt 50, 51.

When forming a vacation reserve (estimated liability) and paying compensation from this reserve for non-use of vacation time by the deceased, a temporary difference arises between the accounting and NU. After all, the amount of this liability was attributed according to the accounting system to expenses for ordinary activities at the time of formation. In this case, the actual amounts of costs incurred are reflected in the NU.

Deferred tax assets (repayment) arising in connection with this temporary difference should be reflected in accounting: Dt 68 Kt 09 - for the amount of income tax calculated based on the amount of compensation for unused vacation.

Results

- Wages not received by the deceased, compensation for unused vacation after the registration of the procedure for his dismissal upon death are given to his relatives or dependents. First of all, this is the spouse, parents, children, according to the RF IC.

- According to the Civil Code of the Russian Federation, only those relatives who lived with him or were financially dependent on him have the right to receive the funds of the deceased.

- Property disputes between relatives are resolved by them independently, without involving the organization where the employee worked.

- The law also does not oblige representatives of the organization where the employee worked to search for relatives of the deceased. If no one has applied for the money within 4 months or management has reasoned doubts about the recipient of the funds, the money is transferred to the bank to the account of the former employee or deposited. In the future, they are automatically included in the estate of the deceased and handed over to his legal heirs.

- Personal income tax is not taken from posthumous payments to relatives, but payments to funds are calculated. Settlements with recipients of funds are carried out through account 76 BU.

Taxation of posthumous payments: personal income tax and insurance premiums

Payments in favor of deceased employees are regulated by the Tax Code and letters of the Ministry of Finance. According to paragraph 3 of Article 44 of the Tax Code of the Russian Federation, as well as clarifications of the Ministry of Finance, those amounts that are due to a deceased employee and are issued to his relatives are not subject to personal income tax and insurance contributions.

At the moment of death, the employee ceases to be a personal income tax payer. The final payment is made on the day of dismissal, therefore, no matter for what period of time the funds are issued, personal income tax does not need to be withheld. Relatives receive in their hands the entire accrued amount of wages and other payments, taking into account the funds already issued.

Financial assistance is also not subject to personal income tax and contributions. Only those relatives who lived with the former employee can receive it.

Withholding personal income tax from financial assistance in the event of the death of an employee or a member of his family

The Tax Code of the Russian Federation has established a list of amounts received by individuals that are not subject to personal income tax. Among them are a number of types of financial assistance. Thus, the following types of financial assistance are not subject to this tax (clause 8 of Article 217 of the Tax Code of the Russian Federation):

- family members of a deceased employee/former employee regarding his death;

- to an employee/former employee in connection with the death of a member of his family.

For lawful non-payment of personal income tax, it is important to comply with the following conditions:

- The assistance is one-time.

- Assistance is provided to the spouse, child or parent of a deceased employee, or to an employee in connection with the death of any of these relatives and not any relatives.

- If assistance is received by a former employee or his relatives, then the basis for the dismissal of this employee is important. This should be retirement.