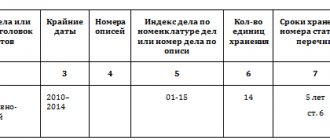

Storage periods for organizational documents

Please note: for periods that depend on the date of execution of documents, the designation “50/75 years” is used. A document drawn up after 2003 must be kept for 50 calendar years, and a document drawn up before 2003 for 75 years. The retention period means that after its expiration, the document can be selected for permanent storage.

| Documentation category | Type of documents | Previous terms | New terms |

| Tax accounting | Invoices | 4 years | 5 years |

| Tax accounting | Registers of information on the income of individuals submitted by tax agents | 75 years old | 5 years |

| Tax accounting | Books of accounting of income and expenses of individual entrepreneurs and organizations using the simplified tax system | Constantly | 5 years |

| Tax accounting | Calculations of insurance premiums for your employees | If there are personal accounts - 5 years If there are no personal accounts - 50 years (if documents were issued since 2003) / 75 years (if documents were issued before 2003) | 50/75 years |

| Tax accounting | Cards for individual accounting of accrued payments and insurance premiums | If you have personal accounts - 5 years If you have no personal accounts - 50/75 years | If you have personal accounts - 6 years If you have no personal accounts - 50/75 years |

| Accounting | Documents (acts, certificates, correspondence) on misappropriations, shortages and embezzlement | 5 years, for some of this documentation - permanently | 10 years after compensation for damage; in case of initiation of criminal cases are stored until a decision is made on the case |

| Accounting | Documents on wages and other payments (payslips, payslips) | If you have personal accounts - 5 years If you have no personal accounts - 50/75 years | If you have personal accounts - 6 years If you have no personal accounts - 50/75 years |

| Personnel accounting | Orders on disciplinary sanctions and documents that served as the basis for their issuance | 5 years | 3 years |

| Personnel accounting | Applications regarding the need for foreign employees | 5 years | 1 year |

| Personnel accounting | Documents on the status and measures to improve working conditions and labor protection and safety regulations | Constantly | 5 years |

| Personnel accounting | Account cards, books, magazines, vacation databases | 3 years | 5 years |

| Personnel accounting | Documents for recording accidents and incidents at work | Constantly | 45 years |

| Personnel accounting | Vacation schedules | 1 year | 3 years |

Document retention periods

With us all your documents are under reliable protection

Data transfer between your computer and the online accounting server is encrypted using the SSL level protocol, as in the largest banks. Every 15 minutes all data is copied to additional servers.

Get free access

Purposes of storing a vacation schedule

In what cases may a civil statement be required that has lost its relevance, but has been stored in the personnel service for 3 years? For example:

- to draw up a new State of the Union for the next years on its basis;

- if a conflict arises between the employer and the employee regarding the procedure for using the latter’s rest days, including in the event of the employee going on leave without authorization;

- if errors are identified when approving orders to provide employees with rest days;

- in case of incorrect calculation of vacation pay by the accounting department;

- to plan rest days for future periods;

- for the purpose of analyzing statistics regarding the planned rest days of employees and the days that were actually used by them;

- in case of inspection of the organization’s activities by government authorities.

ConsultantPlus talks about the form in which to draw up a vacation schedule in its ready-made solution. If you do not yet have access to the ConsultantPlus system, you can register for free for 2 days.

Table of storage periods for tax, accounting and personnel documents in 2022

The table shows the storage periods for the most common tax, accounting and personnel records, valid from 2022.

A complete list of standard management documents and their retention periods can be found here. You can find out from what point to calculate the storage period for documentation and what to do after the expiration of the temporary storage period from the instructions approved by the order of the Federal Archive No. 237 of December 20, 2019.

| Documentation category | Type of documents | Shelf life |

| Tax accounting | Documents on accrued and transferred amounts of taxes and debts on them | 5 years |

| Tax accounting | Tax returns and calculations for all types of taxes | 5 years |

| Tax accounting | Invoices | 5 years |

| Tax accounting | Documents accounting for amounts of income and employee income tax | 5 years |

| Tax accounting | Documents for accounting for the sale of goods, services and works, subject to and exempt from VAT | 5 years |

| Tax accounting | Certificates of fulfillment of the obligation to pay taxes, fees, contributions, penalties, penalties and the status of settlements with the budget | 5 years |

| Tax accounting | Books of accounting of income and expenses of organizations using the simplified tax system | 5 years |

| Tax accounting | Documents (correspondence, acts, objections, statements) regarding disagreements with the Federal Tax Service on issues of calculation and payment of taxes | 5 years |

| Tax accounting | Correspondence about tax debt restructuring | 6 years |

| Tax accounting | Calculations of insurance premiums for your employees | 50/75 years |

| Tax accounting | 2-NDFL certificates and calculations of personal income tax amounts | If there are personal accounts - 5 years If there are no personal accounts or salary slips - 50/75 years |

| Tax accounting | Registers of information on employee income submitted by tax agents to the Federal Tax Service | 5 years |

| Tax accounting | Cards for individual accounting of accrued payments and insurance premiums | If you have personal accounts - 6 years If you have no personal accounts - 50/75 years |

| Accounting | Primary accounting documents and related supporting documents (orders, time sheets, invoices, receipts, acts of acceptance, delivery and write-off of property) | 5 years subject to inspection; if disputes arise, disagreements remain until a decision is made on the case |

| Accounting | Accounting registers (general ledger, transaction journals, account cards, orders, statements, inventory lists) | 5 years subject to inspection |

| Accounting | Accounting policy documents (accounting standards, working chart of accounts) | 5 years after replacement with new ones |

| Accounting Accounting (financial) statements and audit reports | Annual financial statements | Constantly |

| Accounting Accounting (financial) statements and audit reports | Interim financial statements | 5 years. In the absence of annual reporting - constantly |

| Accounting Accounting (financial) statements and audit reports | Documents on consideration and approval of financial statements (acts, conclusions, minutes) | Constantly |

| Accounting Accounting (financial) statements and audit reports | Audit reports on the accounting (financial) statements: a) of the audited entity; b) from an audit organization, an individual auditor | A). 5 years; for annual accounting (financial) statements - constantly b). 5 years, subject to external quality control testing 10 years after compensation for damage; in case of initiation of criminal cases are stored until a decision is made on the case |

| Accounting Accounting (financial) statements and audit reports | Documents (acts, certificates, correspondence) on misappropriations, shortages and embezzlement | A). 5 years; for annual accounting (financial) statements - constantly b). 5 years, subject to external quality control testing 10 years after compensation for damage; in case of initiation of criminal cases are stored until a decision is made on the case |

| Accounting Accounting (financial) statements and audit reports | Documents on wages and other payments (payslips, payslips) | If you have personal accounts - 6 years If you have no personal accounts - 50/75 years |

| Personnel accounting | Documents on the personnel of the organization | 50/75 years |

| Personnel accounting | Collective agreements | Constantly |

| Personnel accounting | Lists of professions | At the place of approval - permanently, in other organizations - until new ones are approved. |

| Personnel accounting | Vacation schedules | 3 years |

| Personnel accounting | Originals of the employee’s personal documents (work book, diploma, certificate, etc.) | On demand, but not more than 50/75 years |

| Personnel accounting | Documents on employee bonuses | 5 years |

| Personnel accounting | Orders on personnel transfers | 50/75 years |

| Personnel accounting | Personal cards of employees | 50/75 years EPC |

| Personnel accounting | Books, magazines, accounting cards, databases of work record forms, vacations, issuance of official foreign passports, certificates of salary, place of work, length of service. | 5 years |

| Personnel accounting | Documents (conclusions, acts, protocols) on accidents, injuries and industrial accidents a) at the place of preparation; b) in other organizations | a) 45 years old; associated with major material damage and human casualties - constantly b) 5 years |

| Personnel accounting | Documents (orders, instructions) on disciplinary sanctions | 3 years |

| Personnel accounting | Applications regarding the need for foreign workers | 1 year |

| Personnel accounting | Documents on the status and measures to improve working conditions and labor protection (certificates, justifications, proposals) | 5 years |

| Personnel accounting | Applications from employees for the issuance of work-related documents and their copies | 1 year |

| Personnel accounting | Documents (magazines, books) recording labor safety training (introductory and on-the-job training) | 45 years |

Storage periods for the most common documents in 2021

These deadlines are established by order of the Federal Archive. At the same time, for some documents the deadlines are regulated by regulations of other departments. If regulations set different deadlines for the same documents, we recommend choosing a longer one for safety.

The same applies to documents that you created or received before the retention periods changed. Based on them, too, be guided by the longest period.

In the “My Business” service, all your documents are saved automatically

Accounts, acts, contracts and all reports are stored in your personal account, which you can access at any time

Free consultation on document storage

Normative base

The employer’s obligation to draw up a vacation schedule follows from Article 123 of the Labor Code of the Russian Federation. It must be approved for the next year no later than 2 weeks before the end of the current year. For example, the vacation schedule for 2022 had to be approved no later than December 17, 2021.

All employers create a vacation schedule. Only micro-enterprises that have refused to adopt internal regulations can not do this (Article 309.2 of the Labor Code of the Russian Federation). However, in this case, it is necessary to conclude a written agreement with each employee and record this fact in clause 22 of the Model Employment Contract.

Before drawing up a vacation schedule, you need to take into account that in addition to the main paid rest period of 28 days (Articles 114-115 of the Tax Code of the Russian Federation), some categories of workers are entitled to additional days (Articles 116-119 of the Tax Code of the Russian Federation).

If an employee has been working for the first year, he has the right to count on rest after 6 months. But there are cases when it should be provided earlier if the employee has expressed such a desire (Article 123 of the Labor Code of the Russian Federation). Women before and immediately after maternity leave, minors, persons who have adopted a child under three months old, and some others have the right to count on this (Article 122 of the Labor Code of the Russian Federation).

These categories of employees also have the right to receive leave at any time convenient for them. In addition, one of the parents/guardians of a disabled minor child, veterans, Chernobyl victims, blood donors, spouses of military personnel, part-time workers and other categories have this right.

It is impossible not to provide an hired person with leave for two years in a row (Article 124 of the Labor Code of the Russian Federation), even if he himself requests it. If the rest period for the previous year was not fully used, the remaining days must be included in the vacation schedule for the next year. First, the document reflects the previous year’s period, and then the period corresponding to the year in which it is compiled.

The annual rest period can be divided into parts, but one of them should not be less than 14 calendar days (Article 125 of the Tax Code of the Russian Federation).

Storage periods for accounting documents

The storage periods for accounting documentation are regulated by the Federal Law “On Accounting” No. 402-FZ dated December 6, 2011. Article 29 of this law establishes no less than a 5-year retention period for all accounting documents, with the exception of those that must be kept for the entire time the organization carries out its activities. At the same time, according to paragraph 1 of this article, specific deadlines for various types of documentation must comply with the rules for organizing state archival affairs. Therefore, in 2022 we must proceed from the deadlines established by the Federal Archive on February 18, 2020, but they should not be less than 5 years.

Retention periods for personnel documents

The storage periods for such documents from February 18, 2020 are regulated by clause 8 of section II of the order of the Federal Archive. For certain documents, the retention period depends on the date they were issued. The storage period for documents issued before 2003 is 75 calendar years, starting from the year following the year of their creation. Personnel documents created after 2003 must be kept for at least 50 years. The list of personnel documentation includes employment and civil law contracts, author's contracts, personal cards of employees, as well as unclaimed originals of their work books, diplomas, military IDs, identification cards, and certificates.

For some documents, a special storage period was established that did not exist before:

Storage

The vacation schedule does not provide for any special storage conditions. But the employer should not forget about the provisions of Federal Law No. 152 “On Personal Data” of 2006. In this regard, the employer must ensure adequate protection of the personal data of employees contained in the vacation schedule and avoid their leakage.

It is important for the employer to focus on ensuring the safety of the vacation schedule during the storage period. Responsibility for violation of this rule arises on the basis of Art. 90 of the Labor Code.

To ensure the safety of the vacation schedule, the employer can store them in metal boxes, cabinets and safes, as well as in a furniture cabinet that is locked with a key. In addition to the vacation schedule, you can store other personnel documents here.

Also, the vacation schedule can be stored on the shelves of cabinets with limited access to the specified premises by third parties.

In order to store vacation schedules, it is advisable to create a separate folder in which all vacation documentation will be collected in chronological order or other documents with a similar shelf life.