What is 6-NDFL?

You must report for withheld and transferred personal income tax.

To do this, every quarter employers submit a 6-NDFL report. Until 2022, we also submitted an annual 2-NDFL report, which included certificates for all employees. Now the separate 2-NDFL report has been cancelled, and the data from it is included in the 6-NDFL report for the year. In addition to employee salaries, personal income tax must be paid on other income that individuals receive from you:

- remuneration under civil law contracts,

- dividends,

- interest-free loans,

- gifts, the total value of which exceeds 4,000 rubles during the year.

If the physicist received income from you at least once during the year, you need to submit 6-NDFL.

In the report, indicate general data for all physical entities. persons who received income from you. Provide information about each employee in the appendix to the annual report 6-NDFL.

Submit 6-personal income tax in Elba in a few clicks: this opportunity is included in the trial period of 30 days.

Report form 6-NDFL

Rules for filling out 6-NDFL

Deadlines for submitting 6-NDFL

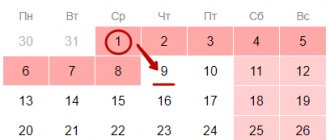

6-NDFL should be submitted once a quarter:

- for the 1st quarter - until May 4,

- for half a year - until August 1,

- 9 months before October 31,

- for a year - until March 1 of the next year.

If you paid an individual for the first time only in the 2nd quarter, submit 6-NDFL for six months, 9 months and a year.

Anton is an individual entrepreneur and works alone. In June, he turned to a copywriter who wrote 5 articles for the site. Everything was formalized under a copyright contract. Anton paid 10,000 rubles to the copywriter and 1,495 rubles in personal income tax to the state. In July, Anton needs to submit 6-NDFL for six months, 9 months, and then report for the year.

How to fill out section 1 of the 6-NDFL report?

Indicate only those payments for which the personal income tax payment deadline falls within the reporting quarter, separately for each month.

Line 020 is the tax withheld for the quarter for all employees. This is the sum of rows 022.

Line 021 – tax payment deadline. In this line, indicate the date by which personal income tax must be transferred to the budget. For wages, calculation upon dismissal, payments under GPC agreements and dividends, this is the next working day after the date of payment. For vacation and sick pay - the last day of the month in which they were issued. If you paid an employee’s salary on March 10 and transferred personal income tax to the budget on the same day, then indicate March 11 in line 021.

Line 022 - the amount of personal income tax withheld.

Calculation of insurance premiums for 9 months of 2022

When generating calculations for insurance premiums (DAM) for 9 months of 2020, the version of the form given in Appendix No. 1 to the order of the Federal Tax Service of Russia dated September 18, 2019 No. MMV-7-11/ [email protected]

When filling out the report, you should take into account the amendments regarding insurance premiums that were introduced into the Tax Code of the Russian Federation by Federal Law No. 102-FZ dated April 1, 2020.

Preferential rates

In the third quarter of 2022, preferential rates of insurance premiums established by Law No. 102-FZ for organizations and individual entrepreneurs included in the register of small and medium-sized enterprises (SMEs) continue to apply.

1C:ITS

For more information about who is considered a SME and about benefits for SMEs, see the section “Legislative Consultations”.

You can check whether an organization is included in this register on the website of the Federal Tax Service of Russia.

During the period from 04/01/2020 to 12/31/2020, the following insurance premium rates apply to the above payers:

1. For payments in favor of individuals that do not exceed the minimum wage (determined based on the results of each month), contributions are calculated according to general tariffs (Article 425 of the Tax Code of the Russian Federation):

- for pension insurance - 22% (for payments not exceeding the maximum contribution base) and 10% (for payments above the maximum contribution base);

- for health insurance - 5.1%;

- for social insurance in case of temporary disability and in connection with maternity - 2.9% or 1.8% (for payments to certain categories of individuals, for example, temporarily staying foreigners).

2. For payments in favor of individuals in excess of the minimum wage (determined based on the results of each month), contributions are calculated at reduced rates (Article 6 of Law No. 102-FZ):

- for pension insurance - 10% (for payments not exceeding the maximum contribution base) and 10% (for payments above the maximum contribution base);

- for health insurance - 5%;

- for social insurance in case of temporary disability and in connection with maternity - 0%.

The federal minimum wage as of January 1, 2020 is 12,130 rubles. (Federal Law dated December 27, 2019 No. 463-FZ).

The specified payers of insurance premiums have the right to apply insurance premium rates from the 1st day of the month in which information about them is entered into the SME register, but not earlier than 04/01/2020 (letter of the Federal Tax Service of Russia dated 04/29/2020 No. BS-4-11/ [ email protected] ).

If the payer of insurance premiums is excluded from the SME register, then he loses the right to apply reduced tariffs from the 1st day of the month in which this event occurred (letter of the Federal Tax Service of Russia dated April 29, 2020 No. BS-4-11 / [email protected] ).

In the program "1C: Salary and Personnel Management 8" edition 3, to calculate insurance premiums at a preferential rate in the organization's accounting policy, you must indicate the type of tariff For small and medium-sized businesses and the month from which this tariff is applied (Fig. 1).

Rice. 1

When calculating contributions in the documents Calculation of salaries and contributions, Dismissal, no additional columns appear. The columns display the total contribution amounts.

Features of calculating contributions at reduced rates

In some cases, there are features of calculating contributions at reduced rates.

If an employee has several types of accruals, then to calculate the base within the minimum wage, the amount is calculated proportionally from each type of accrual subject to contributions (Fig. 2).

Rice. 2

If an employee works part-time, adjustment of the minimum wage to the number of positions occupied is not provided (Clause 9, Article 2, Article 6 of Law No. 102-FZ).

Example

An employee works at 0.5 rate with a salary of 20,000 rubles.

Accrued for April - 10,000 rubles, the amount of accruals within the minimum wage (12,130 rubles) - 10,000 rubles, the amount of contributions to the Pension Fund - 10,000 rubles. x 22% (basic tariff) / 100 = 2,200 rub. If an employee works in several positions, for example, 0.5 rate in the main position and another 0.2 rate in a part-time position, the base for calculating contributions is summed up for the individual and compared with the minimum wage, i.e. the reduced rate is applied as a whole to the amount of accruals for an individual (Article 6 of Law No. 102-FZ). If an organization uses a regional coefficient or a northern bonus, adjustments to the minimum wage for these indicators are not provided. The procedure for calculating contributions is the same for all regions.

When calculating insurance premiums for 9 months of 2020, payers who are SMEs in relation to payments taxed at reduced rates must use tariff code “20” (letter of the Federal Tax Service of Russia dated 04/07/2020 No. BS-4-11 / [ email protected] ).

This code is not specified in Appendix 5, approved. by order of the Federal Tax Service of Russia dated 09/18/2019 No. ММВ-7-11/ [email protected] , however, specialists of the Federal Tax Service of Russia recommend indicating this until appropriate changes are made to the Procedure for filling out the calculation (letter dated 04/07/2020 No. BS-4-11/ [email protected] ).

Several tariffs during the reporting period

If more than one tariff was applied during the billing (reporting) period, then the calculation includes as many Appendix 1 to Section 1 (or only individual subsections of Appendix 1 to Section 1) as the number of insurance premium rates applied during the billing (reporting) period ( clause 5.4 of the Procedure for filling out the calculation, approved by order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected] ).

Therefore, in the report for 9 months of 2022, two Appendix 1 to Section 1 will be generated: one Appendix with tariff code “01” and a second Appendix with tariff code “20” (Fig. 3).

Rice. 3

Also in the calculation, two Appendices 2 to Section 1 will be generated (with tariff code “01” and with code “20”), with the exception of lines 070–090.

Lines 070–090 reflect information in general about the payer of insurance premiums.

Appendix 2 with payer tariff code “01” reflects the calculation of insurance contributions for compulsory social insurance at general tariffs. The Appendix with tariff code “20” reflects the calculation of insurance contributions for compulsory social insurance at reduced rates. Please note that the amount of accrued contributions for compulsory social insurance will be equal to zero (dashes are indicated in the columns), since the tariff is 0%.

Codes of categories of insured persons in subsection 3.2.1

When filling out Subsection 3.2.1 “Information on the amount of payments and other remuneration accrued in favor of an individual” of Section 3 of the DAM, payers must indicate the following category codes of the insured person (letter of the Federal Tax Service of Russia dated 04/07/2020 No. BS-4-11 / [email protected ] ):

- "MS" - individuals;

- “VZhMS” - persons insured in the compulsory pension insurance system from among foreign citizens or stateless persons temporarily residing on the territory of the Russian Federation, as well as foreign citizens or stateless persons temporarily staying on the territory of the Russian Federation who have been granted temporary asylum in accordance with the Federal Law of February 19, 1993 No. 4528-1 “On Refugees”;

- “VPMS” are foreign citizens or stateless persons (with the exception of highly qualified specialists in accordance with Federal Law No. 115-FZ of July 25, 2002 “On the legal status of foreign citizens in the Russian Federation”) temporarily residing in the territory of the Russian Federation.

In this case, for each insured person, the amounts of payments and calculated contributions are reflected in two lines with different categories of the insured person (Fig. 4).

Rice. 4

Accruals for general tariffs are reflected with the category code “НР”. In this case, on line 150 of subsection 3.2.1 in the second quarter of 2022, a value of no more than “12,130” should be indicated (i.e., the value of the current federal minimum wage).

With the category code “MS” (“VZhMS”, “VPMS” for foreigners) accruals at a reduced tariff are reflected in the part above the minimum wage.

Tax authorities will check the availability of information about the employer in the “Unified Register of SMEs” at the beginning of each month for which contributions are calculated using reduced tariffs, to verify the legality of applying such a benefit.

Zero contribution rate

The zero tariff for insurance premiums is established by Federal Law No. 172-FZ of June 8, 2020 and applies only to income accrued for the second quarter of 2022.

Therefore, organizations that previously received the right to apply a zero tariff, from 07/01/2020, in the organization’s accounting policies, must remember to set the tariff that was applied by the organization before 04/01/2020.

In addition, the zero tariff does not apply to additional tariffs for insurance premiums established by Articles 428 and 429 of the Tax Code of the Russian Federation (contributions for payments to employees engaged in hazardous and hazardous work, flight crew members of civil aviation aircraft, as well as certain categories of employees of coal industry organizations) . The Ministry of Labor of Russia warns about this in letter dated 08/07/2020 No. 21-3/10/B-6512.

When filling out the DAM, if more than one tariff was applied during the settlement (reporting) period, the calculation includes as many Appendices 1 to Section 1 (or only individual subsections of Appendix 1 to Section 1) and Appendices 2 to Section 1 as there are insurance premium rates applied during the settlement (reporting) period.

For example, the organization applied the following tariffs:

- from 01/01/2020 - the basic rate of insurance premiums;

- from 04/01/2020 - the tariff established for industries affected by coronavirus;

- from 07/01/2020 - for small or medium-sized businesses.

In the DAM for 9 months of 2022, three Appendices 1 to Section 1 with tariff codes “01”, “20”, “21” will be formed, as well as three Appendices 2 with tariff codes “01”, “20”, “21”.

The control ratios (CR) for the current form of the DAM are given in the letter of the Federal Tax Service of Russia dated 02/07/2020 No. BS-4-11 / [email protected] (with amendments and additions).

In particular, in a letter dated May 18, 2020 No. BS-4-11/ [email protected], tax service specialists clarified the list of control ratios for checking the calculation of contributions with tariff code “20”. The letter dated June 23, 2020 No. BS-4-11/ [email protected] clarified KS 1.197–1.199, which take into account the possibility of SME employers applying reduced insurance premium rates in relation to payments to employees exceeding the minimum wage at the end of the month.

Additional KS 2.11–2.13 are given in the letter of the Federal Tax Service of Russia dated June 10, 2020 No. BS-4-11/9607. They check the mandatory compliance with the conditions for the application by SMEs of reduced insurance premium rates provided for by Law No. 172-FZ

1C:Enterprise supports the ability to check the calculation indicators for insurance premiums for compliance with the developed CS. For implementation deadlines, see “Legislation Monitoring”.

Deadline for submitting the report DAM

Calculation of insurance premiums for 9 months of 2022 must be submitted no later than October 30, 2020 (Clause 7, Article 431 of the Tax Code of the Russian Federation).

1C:ITS

For more information on preparing calculations for insurance premiums in 1C programs, see the reference book “Reporting on insurance premiums” in the “Consultations on Legislation” section.

How to fill out section 2 of the 6-NDFL report?

Summarizes data for all months of the reporting period - from January 1 to the last day of the reporting quarter.

Line 110: indicate the income of individuals from the beginning of the year - before personal income tax was deducted from income. For the second quarter - salary from January to June, including salary for June, which you paid already in July. Vacation pay and sick leave benefits paid from January to June - it doesn’t matter for what period. Other income that the physicist received from January to June and from which you must withhold personal income tax.

Lines 111, 112 and 113 are responsible for different types of accruals: dividends, payments under employment contracts and under civil servants' agreements. Enter total amounts since the beginning of the year.

Line 120 - the number of people whose income you reflected in 6-NDFL.

Line 130 - the amount of deductions for income from line 110. For example, children's, property, social deductions.

Line 140 - the amount of personal income tax on income from line 110.

Line 141 - the amount of personal income tax only on dividends, if they were paid.

Line 150 - fill in if there are foreign workers with a patent.

Line 160 is the amount of personal income tax that has been withheld since the beginning of the year. It may not coincide with the amount in line 140. For example, it is not possible to withhold personal income tax until the end of the year, or income was received in one quarter, and tax was withheld in another.

Line 170 is personal income tax, which you will not be able to withhold until the end of the year. For example, personal income tax on a gift worth more than 4,000 rubles to a person who does not receive cash income from you.

Line 180 - fill out if you withheld more personal income tax than you were supposed to.

Line 190 - fill in if tax was returned to employees.

You can submit a report on paper if you have no more than 10 employees. And only electronically - if there are more than 10 employees.

Sanctions for failure to submit a report

The fine for 6-NDFL, not submitted or submitted late, is determined according to the rules of clause 1.2 of Art. 126 of the Tax Code of the Russian Federation. Its text prescribes a fine of 1,000 rubles. for each full or partial month, counted from the last day of the due date.

However, if the delay exceeds 20 working days, the violator may also be deprived of the opportunity to use a current account (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

For unreliability of the data included in the calculation, the report submitter will be fined 500 rubles. in relation to one report with such data (clause 1 of Article 126.1 of the Tax Code of the Russian Federation).

Violation of the method of submitting a report will result in a fine of 200 rubles. for each such report (Article 119.1 of the Tax Code of the Russian Federation).

In addition, it is possible to apply administrative sanctions to officials of the employer-organization. Their value will be from 300 to 500 rubles. (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

What do tax authorities consider to be errors and unreliable data in 6-NDFL and in what case is there a chance to reduce the amount of the fine, ConsultantPlus experts explained. Get trial access to the K+ system and go to the Ready-made solution.