Freight transportation services are especially relevant at the present time. This is due to the rapid development of trade, industry, construction and other areas of social life. They have a large number of subtleties and features. Loading the cargo into a vehicle and delivering it to its destination is only a small part of the entire process. It is required to comply with legal and legal regulations, obtain permits and licenses. All this is offered by modern freight forwarding companies. They offer a wide range of services to accompany transported products, guarantee safety, security, and compliance with the standards established by law. Clients highly value such enterprises and trust them to transport a wide variety of cargo, including dangerous, large and fragile ones.

The forwarding company has a wide range of functional features. It is significantly greater than the capabilities of a conventional transport company that carries out transportation exclusively. Expedition assistance includes:

- full legal support: filling out contracts, forms, delivery notes;

- providing legal assistance when passing state customs points;

- obtaining a special permit for transportation, transportation of special products.

Specialists of the forwarding company provide clients with the opportunity to track shipments. Modern vehicles are equipped with a GPS system. It is possible to clarify the exact location of the truck and calculate the estimated time of arrival. It is also secured by an agreement on the provision of assistance by the forwarding company. If the order is not delivered on time, penalties and interest may be imposed on the carrier. The amount and procedure for payments are regulated by generally accepted norms and are fixed by agreement of the parties.

Forwarding services when transporting products are the best solution. Such assistance will help save the client’s money, save him from multiple filling out of official papers and documents, and will guarantee compliance with legal and legal norms.

Transport expedition: features of accounting and preparation of invoices

Carriage of goods is a complex process from a legal point of view, with a large number of subtleties. To obtain permission to transport products, the forwarder:

- determines the tax basis for VAT in the amount charged from the client for transportation;

- concludes an agreement for the provision of transport and forwarding services;

- prescribes in the agreement clauses on the reimbursement of expenses by the client to the forwarder.

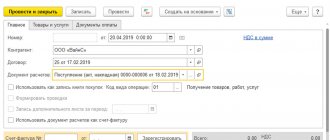

When providing forwarding assistance, invoices are used. They are issued within five working days from the date of provision of the transport service. The account displays:

- the cost of work performed by the forwarder without additional services;

- the full cost of the work performed, including additional assistance, activities of third parties involved in transportation. This could be lifting and loading equipment, special types of transport.

The invoice is drawn up in two copies. One is for the client, the other is for registration. They are recorded in the journals “Issued invoices” and “Received invoices”. Each invoice is assigned an individual serial number and the date of issue is recorded.

In order for the client to make VAT deductions, it is necessary to attach copies of all receipts and invoices received from third parties transporting products to the invoice copy.

Transport expedition agreement: how to avoid problems with VAT

According to the transport expedition agreement, the participants are two parties: the forwarder and the client. The carrier undertakes to deliver the products to the specified address, for which he receives a reward. The amount is indicated in the issued invoice.

To avoid problems with VAT deductions, you should issue an invoice for all services provided, including additional ones. These include:

- fees for obtaining certificates according to which products can be imported or exported;

- customs clearance fees, payment of government duties;

- loading and unloading, checking the integrity of products along the entire route;

- other assistance described in the contract for the provision of transport services.

The procedure for transportation is strictly regulated by current legislation. A complete list of documentation required for delivery is established. It is important to strictly follow the established norms and rules and take a responsible approach to filling out invoice forms and invoices. All this will help avoid problems associated with VAT deductions.

Nuances of customs clearance of goods

The list of transport forwarding services in international traffic is quite extensive, so the question of taxation of services for customs clearance of goods is quite natural. The answer to this can be found in Letter of the Ministry of Finance of Russia dated January 20, 2011 N 03-07-08/16, which is devoted to the application of the 18% rate when assessing VAT on services for customs clearance of goods exported outside the territory of the Russian Federation in the customs export procedure, provided by a Russian organization .

The Financial Department reminds that one of the conditions for applying the zero rate is that the point of departure or destination of goods is located outside the territory of the Russian Federation. In this case, on the basis of paragraphs. 2.1 clause 1 art. 164 of the Tax Code of the Russian Federation in the updated version, the zero rate applies to transport and forwarding services, which, in particular, include services for organizing customs clearance of goods and vehicles provided on the basis of a transport expedition agreement when organizing international transportation. The legality of applying the zero rate in relation to customs clearance of goods is confirmed by the documents provided in general for all transport forwarding services (clause 3.1 of Article 165 of the Tax Code of the Russian Federation).

However, services for customs clearance of goods exported outside the territory of the Russian Federation in the customs export procedure do not apply to the specified services for organizing customs clearance of goods and vehicles provided on the basis of an international transport forwarding agreement. This means they are taxed at the traditional rate. Why did officials come to this conclusion? Let us remind you that from January 1, 2011, the Customs Code of the Russian Federation lost its force, and the Customs Code of the Customs Union now applies. It reveals the content of the customs export procedure. Its essence is that goods of the customs union are exported outside the customs territory of the customs union and are intended to be permanently located outside of it. The territory of the customs union is not only the Russian Federation, but also Kazakhstan and Belarus, so it is possible that exported goods are exported to far and near abroad not from the Russian Federation, but from the territory of neighbors in the customs union. In this case, we can agree with the opinion of the financial department. But if goods are exported from the territory of the Russian Federation outside the customs union, we can say that customs clearance services are associated with international transportation of goods in the meaning that is used for the purpose of their imposition of VAT and the application of a zero rate. What has been said goes beyond the explanations of officials, but allows the reader to reflect on a difficult issue and form his own point of view on the taxation procedure for such services.

Features of the transport expedition agreement

Currently, more and more organizations are giving preference to large freight forwarding companies when transporting. This is due to the wide range of assistance provided at an affordable, reasonable cost. It is important that the relationship between the client and the forwarder is documented. For this purpose, a transport expedition contract is drawn up - an agreement between the parties that ensures the protection of the rights of the participants. It describes the main aspects of transportation:

- subject of the contract - transported products;

- list of services provided: basic and additional;

- delivery terms;

- the full cost of the services provided, taking into account additional options;

- procedure for termination, compensation payments.

The general idea of the contract: the forwarder is obliged to deliver the client’s products on time. In this case, the basic norms and rules established by current legislation must be observed. An important nuance is that the cargo can be delivered by another transport company chosen by the forwarder. Not all transportation companies are ready to act as both a forwarder and a carrier of products.

A transport expedition agreement may specify the route. It may be offered by the shipping company or the customer

Service agreement or intermediary agreement

The freight forwarding company itself can provide assistance in transporting certain products. There are situations when transporting products requires special equipment that has a large carrying capacity or has the ability to maintain a certain temperature in the cabin. Not all forwarding companies have one. There is a need to involve third parties.

In such situations, the agreement is of a mediation nature. The forwarder enters into an agreement with the transport company on behalf of the customer or his own. The agreement is of an expanded nature and includes the following clauses:

- the procedure for paying for the services of a forwarder for selecting an additional organization;

- procedure for reimbursement of expenses incurred by the carrier along the route. These include payment of government duties, fines, and various commissions.

The second scenario is that the contract for the provision of forwarding assistance is not intermediary. Moreover, the entire range of services is provided by the transport company or third parties cooperating with freight forwarders.

An agreement on the provision of forwarding assistance is a special type from a legal point of view; it can have either an intermediary or a regular form. It is important to correctly spell out each item and clearly assign responsibilities to each party.

Accounting and income tax

The provisions established by the contract have a direct impact on the accounting procedure. The procedure for taxation depends on them.

Based on the cost of services specified in the contract, the company’s accountant calculates the amount of profit and expenses incurred. The following features are available:

- According to the contract for the provision of transport and forwarding assistance, the proceeds will be the full cost of the services provided. Including basic and additional. The cost of the trip will include the entire list of transportation costs.

- If the agreement is of an intermediary type, the calculation of income has a different form. It is required to deduct the cost of services performed by third parties from the total amount received from the client.

The income received must be reflected in the tax return. According to it, tax deductions will be calculated.

Current legislation obliges to provide tax returns and strictly report on payments received. Failure to comply with the norms and rules established by the code leads to the imposition of penalties on the enterprise and may lead to the closure of the company or criminal prosecution.

All by myself...

If the forwarder undertakes to carry out all the work individually, then he takes on his shoulders not only the solution of organizational issues, but also deals directly with transportation.

In this case, the contract price is determined as the single cost of the forwarder’s services. Based on Article 249 of the Code, funds received from the client are taken into account in the freight forwarder’s income for profit tax purposes in full. It is quite logical that all expenses arising in the process of the forwarder providing services under the contract will be taken into account when taxing profits according to the general rules.

According to Article 154 of the Code, the VAT taxable base for this cooperation scheme is determined as the total cost of services provided. At the same time, quite often freight forwarders transport goods not only within Russia, but also transport goods abroad. True, international travel is fraught with many problems.

The fact is that work directly related to the export of goods is subject to VAT at a rate of 0 percent (subclause 2, clause 1, article 164 of the Tax Code). Such services include: organization and support of transportation, transportation and transportation, organization, support, loading and reloading of exported goods.

However, the forwarder is also able to provide other services, for example, obtaining the necessary documents or completing a number of customs formalities. In general, tax authorities perceive related freight forwarding services as activities not related to foreign trade activities. As a result, inspectors regularly refuse to apply a preferential rate on the grounds that the work in question is not expressly provided for in Chapter 21 of the Code.

Fortunately for taxpayers, judges think differently. Arbitrators indicate that the forwarder undertakes to perform or arrange for the performance of any services related to the carriage of goods. At the same time, the list of “export services” is not limited. Therefore, the use of a zero rate is legal. This is precisely the conclusion contained in the decisions of the FAS Volga District dated November 20, 2008 in case No. A55-8864/08, the FAS Moscow District dated September 1, 2008 No. KA-A40/7988-08 in case No. A40-1703/08-107- 6 and FAS North Caucasus District dated June 10, 2008 No. F08-2708/2008 in case No. A32-20879/2007-46/419.

Accounting for transport forwarding services

Accounting for the services of a freight forwarding company includes:

- establishing a procedure for calculating the cost of services for transporting products;

- the procedure for determining expense items for the provision of transport services.

These items are regulated by legislation, federal laws, charters, norms, and rules.

There are a number of basic provisions establishing the procedure for registering vehicles and the procedure for pricing products. These include the following points:

- The price of the product must include the cost of transportation services. This will help reimburse the client's transportation costs.

- The goods must be sold at the discount price - the forwarder must write out transport costs as a separate item.

- The amounts spent must be reflected in the relevant documents.

- Each provision of vehicle accounting and the complete procedure for determining product prices must be documented in accounting documents.

- According to established standards, transport services include: full payment for transportation, weighing and packaging of products, payment to third parties performing loading and unloading.

Strict adherence to the norms established by law will help to avoid various kinds of problems and the imposition of compensation payments.

Transport services

The services offered by transport companies can be varied. Depends on the conditions of cargo delivery, customer wishes and other factors. The following services can be provided:

- Participation in negotiations. Owners of transport companies can, along with customers, develop timing and routes for cargo delivery.

- Paperwork. This includes shipping documents, packaging of packages, execution of acts necessary in the process of work confirming surplus, shortage or damage to goods, presentation of documentation for export and loading.

- Import and export of goods from warehouses and storage areas to the territory of the consignee.

- Loading and unloading works, warehouse services. Loading and unloading goods from storage areas, sorting, picking, packaging, packing into containers and other containers, checking availability, picking, plating, labeling, repairing containers and all kinds of packaging.

- Information services - transmission of dispatch notifications, movement tracking, information about border crossings and delivery to ports.

- Preparation of additional equipment necessary for transportation. Checking equipment for further work, cleaning after unloading work, preparing and providing sealing devices.

- Insurance services for transported goods (drawing out contracts, receiving insurance payments, paying required insurance premiums).

- Financial services consisting of payment of expenses arising during the delivery of goods.

- Customs clearance procedures if necessary to cross borders. Control over the preparation of customs declarations and other related documents, transfer of customs duties.

- Other services arising depending on the specifics of the goods and the conditions of movement.

VAT and invoices

The procedure for calculating VAT directly depends on the clauses of the contract for the provision of transportation. Forwarding services have their own subtleties when charging:

- When concluding an agreement for the provision of services, the VAT base will be absolutely all income described in the paragraphs. The forwarder’s task is to correctly issue an invoice and describe the cost of the services provided;

- when concluding an agreement in mediation form, the carrier is obliged to pay VAT only on the work performed. Third party services and additional features are not included here. It is required to issue two invoice sheets. The first is based on the amount of payment received for the work performed. The second is in terms of the amount of additional costs and wages for workers of intermediary firms.

An invoice for payment for the work of third parties is not registered in the internal database of the forwarding company, and VAT is not charged.

Specifics of transportation costs

When taking into account the costs associated with transportation, the following things deserve attention:

- The vehicles used must be reflected in the accounting: on the balance sheet, if they are owned or leased and taken into account on the balance sheet of the recipient, or off the balance sheet, if they are rented or leased and taken into account on the balance sheet of the lessor. This will allow us to reasonably take into account all the costs of their maintenance.

We will talk about off-balance sheet account 001 “Leased fixed assets” in this article.

- Vehicles must be registered with the carrier: permanent, if the vehicles are owned, or temporary, if they are rented or leased. The presence of this registration (even when it is temporary) obliges the carrier to charge and pay transport tax.

Find out how to calculate transport tax by following the link.

ATTENTION! From January 2022, starting with the payment for 2022, tax authorities will independently calculate the amount of tax for your company. You no longer need to submit a transport tax return. Details are here.

What to do if you do not agree with the tax calculation is described in a typical situation from ConsultantPlus. Get free demo access to the K+ legal reference system to find out all the details of this procedure.

- The inclusion of fuel and lubricants necessary for the operation of vehicles into expenses is carried out in accordance with the approved standards for their write-off. These standards are either approved by law (and must be applied to certain industries) or developed by the company independently. This requires the organization of accounting for fuel consumption for each vehicle and the application of an appropriate write-off algorithm with attribution of excess consumption to costs that do not reduce the profit base.

For the procedure for accounting and writing off fuel and lubricants, see here.

- The safety of vehicles in winter conditions depends on the use of special tires designed for more than one winter. It will become necessary to organize not only the repeated issuance of these tires from the warehouse, but also their acceptance for storage for the summer period with the appropriate reflection of these operations in accounting.

- Indispensable components of costs will be the following expenses: for vehicle insurance, which will be included in the costs in parts during the validity period of the insurance policy;

- periodic technical inspection of vehicles;

- carrying out regular maintenance;

- mandatory initial (upon hiring) and pre-trip medical examinations of persons driving vehicles;

Learn the nuances of medical examinations for transport company employees from the material “Pre-trip medical examination of drivers.”

- payment for special breaks in work intended for rest for persons driving transport;

- services for loading and unloading, weighing cargo, cleaning vehicles;

- payment for travel on toll roads, for entering the territory of enterprises, storage of goods, use of access roads, delivery of wagons.

Features of accounting and taxation of forwarding services

Taxation of forwarding services has its own characteristics. The procedure for taxation depends on the correctness of creating an agreement for the provision of services.

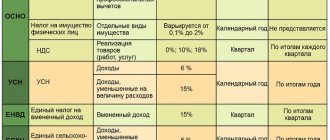

The taxation procedure is regulated by current legislation. There are the following main provisions:

- The freight forwarding company undertakes to deliver the products on time. For this, the client must pay the fee described in the agreement.

- For a fee, the forwarder undertakes to fulfill all the points described in the agreement, including the provision of additional services.

- Taxation applies to the items described in the agreement.

- A mixed taxation system is applied in accordance with the norms established by law.

The procedure for providing forwarding assistance is a complex process that requires broad knowledge from various fields. It is especially important to have fresh legal knowledge and take into account existing amendments and subtleties. A good solution would be to contact a professional transport company.

VAT on transport services: for intermediary activities

When conducting intermediary activities, freight forwarders are required to keep a log of received and issued invoices if they are recognized as VAT payers. The tax base in such cases is determined as the amount of income from the remuneration received. Forwarding transport services when transporting goods across the country are taxed at a standard rate of 18%.

If forwarders are not recognized as tax payers or have an exemption from its assessment, they also maintain a Journal of received and issued documents, which records income from activities.

Read more about tax accounting for VAT in the article:

When preparing invoices, intermediary organizations indicate the costs of paying for services to third parties. These documents are not registered in the sales book, since there is no obligation to calculate tax on the cost of services received by the forwarder.

Example . The transport company, under the terms of the concluded contract for forwarding services, received the following amounts from the client: 2,500 rubles for processing documents for removal from the storage warehouse. The amount of 38,000 rubles is provided as a reward for transporting goods.

Chaika LLC issued an invoice for its services to the client in the amount of 38,000 rubles, including VAT 18% - 5,796.61 rubles. Transferred funds in the amount of 2,500 rubles for paperwork during the delivery process are not considered as remuneration for the work done and are not revenue of the transport company.