General information about the simplified tax system

Chapter 26.3 of the Tax Code of the Russian Federation is devoted to the procedure for applying the simplified tax system. To obtain the right to use it, the following conditions must be met:

- annual revenue - no more than 150 million rubles;

- residual value of fixed assets - no more than 150 million rubles;

- number of employees - no more than 100 people;

- the share of participation in other organizations should not exceed 25%;

- lack of branches.

The system assumes the possibility of choosing two tax bases:

- income;

- income minus expenses.

The taxpayer has the right to choose one of them. The choice determines the recognition of income under the simplified tax system, the procedure for recognizing costs, as well as the applicable tax rates.

Simplified taxation system “income – expenses”

When forming the taxable base “income – expenses”, a rate of 15% is applied. It can be lowered by regional authorities in the range from 5 to 15%. Or establish a differentiated rate for different categories of taxpayers. For example, in St. Petersburg, for all taxpayers using the simplified tax system “income-expenses”, the tax rate is 7%.

Tax payable is calculated as follows:

A special feature of this type of simplified taxation system is the need to pay a minimum tax. It is 1% of the proceeds received. It must be paid even if the company suffered a loss as a result of its activities.

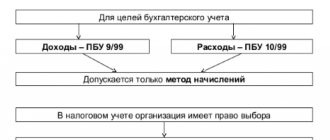

Revenue recognition rules

The moment of recognition of income under the simplified tax system “income” does not differ from the procedure for their recognition under the simplified tax system “income - expenses”. The procedure for recognizing income under the simplified tax system is prescribed in paragraph 1 of Art. 346.17 Tax Code of the Russian Federation. For the simplified taxation system, the cash method is used.

The date of recognition of income under the simplified tax system “income - expenses” is the day the money is received in a bank account or at the cash desk. If repayment of debt or other material benefit is received in the form of other property, work, services or property rights, then it must be taken into account at the time of their receipt.

For example, when repaying a buyer's debt for goods by offset, the receipt of funds must be taken into account on the date of offset of counterclaims.

UrDela.ru

Part 1. Expenses accepted for tax purposes taking into account the provisions of this chapter are recognized as such in the reporting (tax) period to which they relate, regardless of the time of actual payment of funds and (or) other form of payment and are determined taking into account provisions of Articles 318 - 320 of this Code.

Expenses are recognized in the reporting (tax) period in which these expenses arise based on the terms of the transactions. If the transaction does not contain such conditions and the relationship between income and expenses cannot be clearly defined or is determined indirectly, the expenses are distributed by the taxpayer independently.

If the terms of the agreement provide for the receipt of income over more than one reporting period and do not provide for the phased delivery of goods (work, services), expenses are distributed by the taxpayer independently, taking into account the principle of even recognition of income and expenses.

The taxpayer's expenses, which cannot be directly attributed to the costs of a specific type of activity, are distributed in proportion to the share of the corresponding income in the total volume of all income of the taxpayer.

Part 2. The date of material expenses is recognized as follows:

date of transfer of raw materials and materials into production - in terms of raw materials and materials attributable to the goods (work, services) produced; date of signing by the taxpayer of the certificate of acceptance and transfer of services (works) - for services (works) of a production nature.

Part 3. Depreciation is recognized as an expense on a monthly basis based on the amount of accrued depreciation, calculated in accordance with the procedure established by Articles 259, 259.1, 259.2 and 322 of this Code.

Expenses in the form of capital investments provided for in paragraph 9 of Article 258 of this Code are recognized as indirect expenses of the reporting (tax) period on which, in accordance with this chapter, the start date of depreciation (date of change in the original cost) of fixed assets in respect of which capital investments have been made.

Part 4. Labor costs are recognized as an expense on a monthly basis based on the amount of labor costs accrued in accordance with Article 255 of this Code.

Part 5. Expenses for the repair of fixed assets are recognized as an expense in the reporting period in which they were incurred, regardless of their payment, taking into account the specifics provided for in Article 260 of this Code.

Part 6. Expenses for compulsory and voluntary insurance (non-state pension provision) are recognized as an expense in the reporting (tax) period in which, in accordance with the terms of the agreement, the taxpayer transferred (issued from the cash register) funds to pay for insurance (pension) benefits. contributions. If the terms of an insurance contract (non-state pension provision) provide for the payment of an insurance (pension) contribution in a one-time payment, then under contracts concluded for more than one reporting period, expenses are recognized evenly over the term of the contract in proportion to the number of calendar days of the contract in the reporting period. If the terms of the insurance contract (non-state pension provision) provide for payment of the insurance premium (pension contribution) in installments, then under contracts concluded for more than one reporting period, expenses for each payment are recognized evenly over the period corresponding to the period for payment of contributions (year, half-year, quarter, month), in proportion to the number of calendar days of the agreement in the reporting period.

Part 7. The date of non-operating and other expenses is recognized, unless otherwise established by Articles 261, 262, 266 and 267 of this Code:

1) date of accrual of taxes (fees) - for expenses in the form of amounts of taxes (advance payments for taxes), fees and other obligatory payments;

2) date of accrual in accordance with the requirements of this chapter - for expenses in the form of amounts of deductions to reserves recognized as expenses in accordance with this chapter;

3) the date of settlements in accordance with the terms of concluded agreements or the date of presentation to the taxpayer of documents serving as the basis for making settlements, or the last date of the reporting (tax) period - for expenses:

in the form of commission fees;

in the form of expenses for payment to third parties for work performed (services provided);

in the form of rental (leasing) payments for rented (leased) property;

in the form of other similar expenses;

4) date of transfer of funds from the current account (payment from the cash desk) of the taxpayer - for expenses:

in the form of amounts of paid allowances; in the form of compensation for the use of personal cars and motorcycles for business trips;

5) date of approval of the advance report - for expenses:

on business trips; for the maintenance of official transport; for entertainment expenses; for other similar expenses;

5) excluded. — Federal Law of May 29, 2002 N 57-FZ;

6) the date of transfer of ownership of foreign currency and precious metals when carrying out transactions with foreign currency and precious metals, as well as the last day of the current month - for expenses in the form of negative exchange rate differences on property and claims (liabilities), the value of which is expressed in foreign currency, and negative revaluation of the value of precious metals;

7) the date of sale or other disposal of securities, including the date of termination of obligations to transfer securities by offsetting counter similar claims - for expenses associated with the acquisition of securities, including their cost;

the date of recognition by the debtor or the date of entry into legal force of the court decision - for expenses in the form of amounts of fines, penalties and (or) other sanctions for violation of contractual or debt obligations, as well as in the form of amounts of compensation for losses (damage);

9) date of transfer of ownership of foreign currency - for expenses from the sale (purchase) of foreign currency;

10) date of sale of shares, shares - for expenses in the form of the cost of acquisition of shares, shares.

Part 8. For loan agreements and other similar agreements (other debt obligations, including securities), the validity of which falls on more than one reporting period, for the purposes of this chapter, the expense is recognized as incurred and is included in the relevant expenses at the end of the month of the corresponding reporting period period.

In the event of termination of the agreement (repayment of the debt obligation) before the expiration of the reporting period, the expense is recognized as incurred and is included in the corresponding expenses on the date of termination of the agreement (repayment of the debt obligation).

8.1. Expenses for the acquisition of leased property specified in subparagraph 10 of paragraph 1 of Article 264 of this Code are recognized as an expense in those reporting (tax) periods in which, in accordance with the terms of the agreement, rental (leasing) payments are provided. In this case, these expenses are taken into account in an amount proportional to the amount of rental (leasing) payments.

Part 9. The amount difference is recognized as an expense:

for the taxpayer-seller - on the date of repayment of receivables for sold goods (work, services), property rights, and in the case of advance payment - on the date of sale of goods (work, services), property rights; for the taxpayer-buyer - on the date of repayment of accounts payable for purchased goods (work, services), property, property or other rights, and in the case of advance payment - on the date of acquisition of goods (work, services), property, property or other rights.

Part 10. Expenses expressed in foreign currency are recalculated for tax purposes into rubles at the official rate established by the Central Bank of the Russian Federation on the date of recognition of the corresponding expense.

Obligations and claims expressed in foreign currency, property in the form of currency values are recalculated into rubles at the official rate established by the Central Bank of the Russian Federation on the date of transfer of ownership when carrying out transactions with such property, termination (fulfillment) of obligations and claims and (or) on the last date of the reporting (tax) period, depending on what happened earlier. ‹ Article 271 (Tax Code of the Russian Federation). The procedure for recognizing income using the accrual method Up Article 273 (Tax Code of the Russian Federation). The procedure for determining income and expenses using the cash method ›

Expense recognition rules

Costs under the simplified taxation system are recognized in accordance with the closed list established by clause 1 of Art. 346.16 Tax Code of the Russian Federation.

For most expenses, the moment of recognition of expenses under the simplified tax system is recognized as the date of actual payment.

But there are exceptions to this rule. simplified tax system 15%: recognition of expenses

| Type of expenses | What's included | Date of recognition | The basis on which expenses are recognized under the simplified tax system |

| Material | Purchase of production materials, raw materials, components. | For postpayment - on the date of payment. For prepayment - when the prepaid goods arrive. | pp. 1 item 2 art. 346.17 Tax Code of the Russian Federation. |

| Items for resale | Purchased goods that are intended for subsequent sale and will not be used in production or economic activities. | As purchased goods are sold. One of the assessment methods must be used:

| pp. 2 p. 2 art. 346.17 Tax Code of the Russian Federation. |

| Wage | Remuneration based on salary, tariff rate, bonus, allowance, etc. | Payday. | pp. 1 item 2 art. 346.17 Tax Code of the Russian Federation. |

| Personal income tax | Income tax withheld from employees (and other individuals). | Transfer date. | pp. 3 p. 2 art. 346.17 Tax Code of the Russian Federation. |

| Insurance premiums | Social insurance contributions calculated from accrued wages. | Transfer date. | pp. 3 p. 2 art. 346.17 Tax Code of the Russian Federation. |

| Third party services | Rent, utility payments, information, consulting and legal services, certification services, repairs, postal services, etc. | For postpayment - on the date of payment. In case of prepayment - when the prepaid services will be provided. | pp. 1 item 2 art. 346.17 Tax Code of the Russian Federation. |

| Interest on borrowed funds | Interest accrued by a bank or other lender under credit (loan) agreements. | Date of transfer of interest debt. | pp. 1 item 2 art. 346.17 Tax Code of the Russian Federation. |

| Business trips | Travel and accommodation costs for employees on business trips. | Transfer date. | Clause 2 Art. 346.17 Tax Code of the Russian Federation. |

| Advertising in the media, outdoor advertising (banners, shop windows), participation in exhibitions, printed advertising products (brochures, catalogues, leaflets). | Transfer date. If advertising costs are normalized (cost of prizes, organization of incentive lotteries, placement of information in third party catalogs, etc. (clause 4 of Article 264 of the Tax Code of the Russian Federation)), then they are taken into account within 1% of paid revenue. | Clause 2 Art. 346.17. Paragraph 2 p. 2 art. 346.16. Clause 4 art. 264 Tax Code of the Russian Federation. | |

| Receipt of fixed assets and intangible assets | Costs of acquisition, production, construction of fixed assets and intangible assets. Similarly, the costs of modernization, retrofitting or reconstruction of the operating system are taken into account. | Fully within the year of payment and commissioning. During the year, costs are written off in equal parts at the end of each quarter. | pp. 4 p. 2 tbsp. 346.17 Tax Code of the Russian Federation. |

Article 272 of the Tax Code of the Russian Federation. Procedure for recognizing expenses using the accrual method (current version)

To obtain this license, the licensing authority provided the organization with consulting services on licensing issues and the procedure for preparing and submitting the necessary documents, as well as checking the correctness of the documents provided; a third-party organization provided engineering services, licensing expertise, and preparation of a package of documents.

In accordance with subparagraph 15 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, expenses for consulting services and other similar services are classified as other expenses associated with production and (or) sales.

In accordance with paragraph 1 of Article 272 of the Tax Code of the Russian Federation, expenses accepted for tax purposes are accepted as such in the reporting period to which they relate, based on the terms of the transactions, regardless of the time of actual payment of funds. Expenses must be distributed by the taxpayer independently, taking into account the principle of uniform recognition of income and expenses.

Based on the foregoing, the courts correctly concluded that the applicant, in violation of paragraph 1 of Article 272 of the Tax Code of the Russian Federation, unlawfully reflected the costs of acquiring a license as expenses for production and sales. The organization should have written off the above expenses as indirect costs of production and sales in proportion to the duration of the license.

(Based on the materials of the Resolution of the Federal Antimonopoly Service of the Volga Region dated February 14, 2008 N A65-9200/2007.)

Attention!

Here it should be borne in mind that at the same time there is an opposite position. Thus, the Ministry of Finance of Russia in a letter dated October 15, 2008 N 03-03-05/132 noted that the costs of paying the state duty for issuing a license are not distributed over several tax periods, since the provisions of paragraph 1 of Article 272 of the Tax Code of the Russian Federation apply only within the framework of civil law contracts In relation to expenses incurred for other reasons (state duty for issuing a license, etc.), the provisions of paragraph 1 of Article 272 of the Tax Code of the Russian Federation do not apply.

This position is supported by the courts.

The crux of the matter.

Based on the results of the on-site inspection of the organization, the tax authority drew up an act and made a decision, in the contested part of which the organization was held accountable under paragraph 1 of Article 122 of the Tax Code of the Russian Federation for non-payment (incomplete payment) of income tax in the form of a fine, the taxpayer was also asked to pay the arrears of tax and accrued penalties.

In the contested decision, the tax authority pointed out the unlawful attribution to expenses that reduce taxable profit of the costs of paying state fees and consulting services related to obtaining a license to carry out activities for the construction of buildings and structures.

According to the tax authority, these expenses, in accordance with paragraph 2 of paragraph 1 of Article 272 of the Tax Code of the Russian Federation, are subject to write-off in equal shares during the validity period of the license - five years.

The court's position.

The organization, in accordance with subparagraph 71 of paragraph 1 of Article 333.33 of the Tax Code of the Russian Federation, paid the state fee for the provision of a license and consideration of the corresponding application.

Also, the applicant, under an agreement concluded with the organization, was provided with consulting services on issues related to obtaining a construction license, preparing the documents required for submission, and others.

In accordance with subparagraphs 1 and 15 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, these expenses relate to other expenses associated with production and sales, which, in turn, by virtue of paragraph 1 of Article 318 of the Tax Code of the Russian Federation are recognized as indirect.

According to paragraph 2 of Article 318 of the Tax Code of the Russian Federation, the amount of indirect costs for production and sales incurred in the reporting (tax) period is fully included in the expenses of the current reporting (tax) period.

Clause 7 of Article 272 of the Tax Code of the Russian Federation determines that the date of other expenses is the date of accrual of taxes (fees) - for expenses in the form of amounts of taxes (advance payments for taxes), fees and other obligatory payments; the date of settlements in accordance with the terms of concluded agreements or the date of presentation to the taxpayer of documents serving as the basis for making settlements, or the last date of the reporting (tax period) - for expenses in the form of expenses for payment to third-party organizations for the work performed (services provided) by them.

Thus, the applicant rightfully included the amount of costs for paying the state fee and consulting services associated with obtaining a license to carry out activities for the construction of buildings and structures as expenses when calculating the tax base for income tax.

At the same time, the tax authority’s reference to paragraph 2 of paragraph 1 of Article 272 of the Tax Code of the Russian Federation is untenable, since the state duty is recognized as a mandatory contribution levied on organizations, the payment of which is one of the conditions for state bodies and other authorized bodies and officials to carry out legally significant actions, including the provision of certain rights or issuance of permits (licenses).

The conclusion by an organization of an agreement for the provision of consulting services is associated with the need to obtain a license to carry out the construction of buildings and structures, the terms of which do not provide for the receipt of income for more than one reporting period.

A license to carry out the construction of buildings and structures has been obtained.

(Based on materials from the Resolution of the Federal Antimonopoly Service of the Moscow District dated August 12, 2009 N KA-A40/7313-09.)

Example 4.

The Ministry of Finance of Russia in letter dated September 30, 2010 N 03-03-06/1/622 came to the conclusion that interest on all types of borrowing is recognized as part of non-operating expenses evenly throughout the entire term of the loan agreement, regardless of the maturity of the actual payment of interest , at the end of each month of use of the provided funds.

Example 5.

As explained in the letter of the Ministry of Finance of Russia dated 07/08/2010 N 03-03-06/1/454, payments (contributions) under open-ended non-state pension agreements providing for the payment of pensions for life can be taken into account in expenses for tax purposes of corporate profits evenly based on the order and the conditions for making pension contributions (in particular, for what period the contributions are paid), contained in the pension agreement and the pension rules of the fund, but for at least five years.

Attention!

There is no consensus among official and judicial bodies on the issue of whether fees for obtaining licenses and patents are distributed over the period of their validity.

Thus, in the letter of the Ministry of Finance of Russia dated August 16, 2007 N 03-03-06/1/569 it is stated that the state fee for consideration of an application for a license and the state fee for issuing a license are taken into account as part of other expenses associated with production and (or) sales, evenly throughout the license period.

As explained in the Resolution of the Federal Antimonopoly Service of the Volga Region dated May 3, 2007 N A49-7142/2006, the taxpayer decides how to write off expenses.

Based on the position of the Ministry of Finance of Russia, set out in letter dated December 24, 2008 N 03-03-06/1/718, the costs of paying for services related to obtaining licenses, patents, certificates, etc. are taken into account in equal shares over the period established by the taxpayer term.

At the same time, it should be noted that some courts come to the opinion that such expenses are taken into account at a time (see, for example, Resolution of the Federal Antimonopoly Service of the North-Western District dated January 10, 2007 N A56-20957/2005).

Attention!

As follows from the clarification of the Ministry of Finance of Russia in letter dated August 17, 2009 N 03-03-06/1/526, the costs of acquiring the program, if the contract does not establish a period for the transfer of non-exclusive rights, must be taken into account evenly over the period established by the taxpayer independently.

At the same time, the letter of the Office of the Federal Tax Service of Russia for Moscow dated June 28, 2005 N 20-12/46408 contains a position according to which such expenses can be taken into account at a time.

Attention!

As follows from the explanations of the tax authorities set out in the letter of the Department of the Ministry of Taxes of the Russian Federation for Moscow dated June 30, 2004 N 26-12/43524, expenses in the form of taxes (advance payments for taxes), fees and other obligatory payments are taken into account in that reporting ( tax) period for which the declaration (calculation) is submitted.

Judicial practice, however, contains an approach according to which the date of accrual of taxes is the date of reflection of tax payments in accounting (see, for example, Resolution of the Federal Antimonopoly Service of the North-Western District dated 06.06.2005 N A26-12323/04-211).

Attention!

The Ministry of Finance of Russia (see, for example, letter of the Ministry of Finance of the Russian Federation dated January 26, 2007 N 03-03-06/2/10) and the Federal Tax Service of Russia (see, for example, letter of the Federal Tax Service of Russia dated July 13, 2005 N 02-3-08/530 ) on the question of what moment should be considered the date of presentation of the document serving as the basis for the calculations, they are unanimous - this is the date of preparation of these documents.

In connection with the entry into force of the Federal Law of November 21, 2011 N 330-FZ “On Amendments to Part Two of the Tax Code of the Russian Federation, Article 15 of the Law of the Russian Federation “On the Status of Judges in the Russian Federation” and the recognition as invalid of certain provisions of legislative acts of the Russian Federation” The norms of Article 272 of the Tax Code of the Russian Federation have undergone changes.

Thus, the norm of Article 272 of the Tax Code of the Russian Federation is supplemented with clause 5.1.

As established by the norms of paragraph 5.1 of Article 272 of the Tax Code of the Russian Federation, in the case when the taxpayer incurs costs for standardization at his own expense, then these costs are taken into account for profit tax purposes in the tax period following the period in which these standards were approved.

Attention!

Federal Law dated July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds” introduced insurance contributions to the Pension Fund from January 1, 2010 the Russian Federation for compulsory pension insurance, the Social Insurance Fund of the Russian Federation for compulsory social insurance in case of temporary disability and in connection with maternity, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds for compulsory medical insurance (hereinafter referred to as insurance premiums).

As the Ministry of Finance of Russia explained in letter dated December 23, 2010 N 03-03-06/1/804, these insurance premiums are taken into account as part of other expenses associated with production and (or) sales, on the basis of subparagraph 1 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation according to Federal Law of July 27, 2010 N 229-FZ.

When determining the moment of recognition of insurance premiums in tax accounting, due to the fact that they are obligatory payments, subparagraph 1 of paragraph 7 of Article 272 of the Tax Code of the Russian Federation should be applied.

Thus, the date of expenses in the form of insurance premiums is the date of their accrual.

Current problem.

Disputes arise between taxpayers and tax authorities over the question of in what period tax expenses are recognized, since its payment is made in the tax period following the one to which the tax relates.

Here it should be taken into account that the provisions of the Tax Code of the Russian Federation have not established any specifics regarding the procedure for accounting for expenses in the form of taxes for the purposes of taxing the profits of organizations, in addition to their accrual in the manner established by the legislation of the Russian Federation.

The Ministry of Finance of Russia in letters dated 02/16/2009 N 03-03-06/2/22 and dated 09/26/2007 N 03-03-06/2/185 indicates that the tax accrual date should be understood as the date on which a certain type of tax, in accordance with the Tax Code of the Russian Federation, is recognized as actually accrued.

As explained by the Moscow Department of the Ministry of Taxes and Taxes of Russia in letter No. 26-12/35053 dated May 21, 2004, taxes subject to accounting as expenses for profit tax purposes are taken into account in the period for which the declaration is submitted. The accrual date is the date on which a certain type of tax, in accordance with the Tax Code of the Russian Federation, is recognized as actually accrued, i.e. the last day of the reporting period for which the tax is calculated.

A similar position is set out in the letter of the Ministry of Finance of Russia dated March 28, 2008 N 03-03-06/1/212.

In judicial practice there is no uniform position on this issue. Some courts support the above position of official bodies (see, for example, Resolution of the Federal Antimonopoly Service of the West Siberian District dated May 15, 2006 N F04-4554/2005(22397-A27-40)).

Other courts indicate that tax cannot be accrued before the end of the tax (reporting) period; therefore, it is necessary to recognize the tax as expenses after the tax (reporting) period (see, for example, Resolution of the Federal Antimonopoly Service of the West Siberian District dated August 24, 2009 N F04-3852 /2009(9731-A81-41), F04-3852/2009(12616-A81-41), F04-3852/2009(12617-A81-41), FAS Ural District dated July 27, 2009 N F09-5313/09- C3)).

Attention!

By virtue of Article 272 of the Tax Code of the Russian Federation, rent is recognized in the reporting (tax) period to which it relates, regardless of the time of actual payment of funds and (or) other form of payment.

Here it should be taken into account that the Federal Antimonopoly Service of the North-Western District, in Resolution No. A21-2740/2009 dated January 27, 2010, came to the conclusion that the Tax Code of the Russian Federation does not establish the taxpayer’s right to recognize rent as an expense that reduces the tax base for income tax, in dependence on its actual transfer to the lessor.

At the same time, the court proceeded from the fact that from the lease agreement and additional agreements to it it follows: payment deadlines can be postponed to a later date by oral agreement of the parties, while the postponement of the payment date does not entail penalties for the tenant. At the court hearing, the company presented documents confirming the fact that rental payments had been paid in full.

The court indicated that the mere consistency in the actions of the parties (failure to pay rent, failure to issue invoices for payment) does not contradict the requirements of the law, since by virtue of paragraph 1 of Article 420 and paragraph 1 of Article 423 of the Civil Code of the Russian Federation, such coordination is assumed among the parties to the agreement. Accordingly, the law does not prohibit the parties from agreeing to pay rent even after the lease agreement has been terminated and ownership of the leased property has been transferred to the lessee. Failure to go to court to forcibly collect rent payments cannot indicate a sham transaction.

Thus, an organization can expense rent within the terms stipulated by the contract, subject to the requirements of Article 252 of the Tax Code of the Russian Federation.

Attention!

In letter dated 08/25/2010 N 03-03-06/1/565, the financial department considered the issue regarding the procedure for accounting for the costs of an audit for 2009, if the certificate of completion of work was provided in 2010.

Considering that the certificate of completion of work was issued to the organization in 2010, expenses for the organization’s purchase of services, in the opinion of the Ministry of Finance of Russia, should be taken into account in expenses for tax purposes of the profits of organizations on the date of settlement in accordance with the terms of the concluded agreement or on the date of presentation to the taxpayer of documents serving the basis for making calculations, or on the last date of the reporting (tax) period, depending on what happened earlier.

Attention!

As noted in the letter of the Ministry of Finance of Russia dated December 10, 2010 N 03-03-06/4/122, remunerations based on the results of work for the year accrued at the beginning of the year following the reporting year are taken into account for profit tax purposes in the period of accrual of these bonuses, subject to their compliance with the provisions of Article 252 of the Tax Code of the Russian Federation.

Remunerations based on the results of work for the month are taken into account in the same way. If the accrual is made in the month following the reporting month, the remuneration, provided that it meets the criteria of Article 252 of the Tax Code of the Russian Federation, is taken into account in the month of accrual, that is, the month following the month on the basis of which the remuneration was accrued.

Attention!

In a letter dated December 3, 2010 N 03-03-06/1/757, the Russian Ministry of Finance indicated that the costs of liquidating an unfinished construction project are subject to inclusion in non-operating expenses in the tax period in which the liquidation was actually carried out.

At the same time, the cost of liquidated unfinished construction projects does not reduce the tax base for corporate income tax.

Attention!

When considering the procedure for accounting for expenses related to fixed assets, one should also take into account the provisions of the letter of the Ministry of Finance of the Russian Federation dated August 16, 2010 N 03-03-06/1/550.

As explained by the financial department, Chapter 25 of the Tax Code of the Russian Federation does not contain provisions allowing the calculation of depreciation, as well as taking into account the depreciation bonus in expenses for the purposes of taxation of profits of organizations only after full payment of the costs of construction of a fixed asset.

Thus, if the right to a property is subject to state registration in accordance with the legislation of the Russian Federation, then such a property is included in the corresponding depreciation group from the moment of documented submission of documents for registration of the specified right.

Attention!

Organizations using the accrual method take into account the costs of purchasing a computer program as part of other costs associated with production and (or) sales in the following order:

if, under the terms of the agreement for the acquisition of non-exclusive rights, a period for using computer programs is established, then expenses related to several reporting periods are taken into account when calculating the tax base evenly during these periods;

if the terms of the agreement for the acquisition of non-exclusive rights or the requirements of the civil legislation of the Russian Federation (Article 1235 of the Civil Code of the Russian Federation) cannot determine the period of use of computer programs, then, in our opinion, the expenses incurred are distributed taking into account the principle of uniform recognition of income and expenses; In this case, the taxpayer has the right to independently determine the period during which these expenses are subject to accounting for profit tax purposes.

According to the Minin of Russia, set out in letter dated December 30, 2010 N 03-03-06/2/225, taking into account the provisions of Article 252 of the Tax Code of the Russian Federation, expenses for acquired non-exclusive software licenses are taken into account for profit tax purposes on the date the taxpayer begins using the software to carry out its activities, that is, from the moment the software is put into commercial operation.

Attention!

Many questions in practice arise regarding the procedure for accounting for expenses relating to previous tax periods.

In accordance with paragraph 1 of Article 54 of the Tax Code of the Russian Federation, if errors (distortions) are detected in the calculation of the tax base relating to previous tax (reporting) periods, in the current tax (reporting) period, the tax base and tax amount are recalculated for the period in which they were made. specified errors (distortions).

If it is impossible to determine the period of errors (distortions), the tax base and tax amount are recalculated for the tax (reporting) period in which the errors (distortions) were identified. The taxpayer has the right to recalculate the tax base and the amount of tax for the tax (reporting) period in which errors (distortions) relating to previous tax (reporting) periods were identified, also in cases where the errors (distortions) led to excessive payment of tax .

The Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolution No. 4894/08 dated 09.09.2008 in case No. A40-6295/07-118-48, came to the conclusion that in all cases, costs related to previous tax periods must be taken into account taking into account the requirements of Articles 54 and 272 Tax Code of the Russian Federation.

Other courts came to similar conclusions (see, for example, Resolutions of the FAS Moscow District dated March 17, 2009 N KA-A40/1737-09, FAS West Siberian District dated August 24, 2009 N F04-3852/2009(9731-A81- 41), F04-3852/2009(12616-A81-41), F04-3852/2009(12617-A81-41)).

At the same time, other courts take the view that late receipt of documents cannot be considered an error due to the lack of documents, and such expenses should be reflected in the period of receipt of documents, and not in the period of provision of services (performance of work) (see, for example, , Resolutions of the FAS Moscow District dated March 11, 2009 N KA-A40/1255-09, FAS Volga District dated April 27, 2009 N A12-15000/2008, FAS Central District dated February 16, 2009 N A35-1590/08-C21.