Cash register service life

Cash register equipment belongs to the fourth depreciation group, so its useful life can be more than seven years. After 7-10 years the device is replaced with a new one. According to the law, you cannot simply throw away equipment: it is disposed of according to government-approved rules.

The company that decided to write off the cash register draws up an act. It records:

- device data - model, serial and serial number;

- inventory number;

- Term of the work;

- reason for write-off;

- the cost of the device taking into account depreciation.

The written-off cash register is deregistered with the tax office. If this is an old-style equipment, the business owner removes the electronic cash register tape from it and takes it to the tax office for inspection. Online cash registers transmit tax data in real time, so there is no need to carry them to checkout.

Conditions for recognizing a cash register as an operating system in accounting and tax accounting

To recognize a cash register as part of fixed assets in accounting, it is necessary that such a cash register:

- was intended for use in core or managerial activities

- was intended for use over a long period of time (more than 12 months)

- was able to provide benefit (economic benefit)

- the organization had no plans to sell it in the future.

These are the conditions for recognizing equipment as a fixed asset that are established in PBU 6/01 “Accounting for fixed assets.”

To recognize a cash register as part of depreciable property in tax accounting, it is necessary that such a device belongs to the organization by right of ownership and is used in activities aimed at generating income. Its cost must be repaid through depreciation. The period of use must be more than 12 months, and the initial cost must be more than 100,000 rubles (

When and why is a cash register deregistered?

The procedure is described in detail in Art. 4.2 Federal Law No. 54. The owner can deactivate and remove the cash register from tax registration on his own initiative if:

- decided to replace it with a newer model;

- the tax depreciation period has expired - 7 years have passed (to the day) from the date of registration with the Federal Tax Service of Russia;

- the model has been excluded from the CCP register;

- the device is sold, transferred free of charge or leased to another owner - an entrepreneur or company;

- further use of CCP is not planned;

- cash register equipment is broken, lost or stolen;

- a decision was made to close the individual entrepreneur or legal entity that used the cash register.

Tax authorities have the right to deregister a cash register only in three cases:

- The activities of the owner of the cash register (individual or legal entity) have already been terminated, and a corresponding entry has been made in the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs.

- The device does not meet the requirements of Federal Law No. 54, for example, it was removed from the cash register register and/or its tax depreciation period has expired.

- The validity period of the key for the fiscal attribute of the FN, registered with the Federal Tax Service of Russia along with the cash register, has expired.

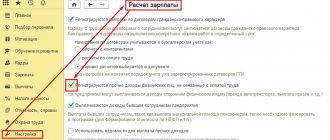

Reflection of the acquisition of a cash register in accounting

Basic accounting entries when accounting for costs associated with the acquisition and operation of a cash register, which is planned to be taken into account as part of the operating system (cost more than 40,000.00). Postings are given without VAT:

| Contents of operation | Wiring | Notes | |

| Dt | CT | ||

| The cost of the cash register is reflected | 08 | 60 | |

| The cost of software configuration services is reflected | 08 | 60 | Included in the cost of the CCP as the costs necessary to bring the OS to a state suitable for use |

| The cost of a barcode scanner is reflected | 10 | 60 | It is not included in the OS, because can be connected to another cash register |

| Putting CCP into operation | 01 | 08 | |

| Depreciation is calculated monthly, from the month following commissioning | 20,26,44 | 02 | |

| Cost of fiscal data operator (FDO) services – monthly | 20,26,44 | 76 (60) | It is not recommended to take into account deferred expenses |

| The cost of the cash register program is reflected (licenses for the right to use for 1 year) | 97 | 60 | |

| Costs of using the cash register program monthly | 20,26,44 | 97 | |

How to recycle cash registers

Cash registers, terminals, currency detectors and other trading equipment are disposed of by companies with a special license. The business owner enters into an agreement with such a company and when the disposal deadline comes, he calls specialists.

Recycling companies take care of the transportation, collection and destruction of waste. If necessary, the device will be neutralized from heavy metals, precious metals will be removed, and the waste will be buried in a landfill.

In exchange for recycled equipment, the business owner receives a waste passport.

FAQ

General issues

- Why do you need an agreement with the central service center?

- What is the difference between: KKT, KKM and FR?

- Why do you need a cash register?

- Does an individual entrepreneur need a cash register?

- What is included in the delivery of a cash register?

- Is it possible to buy a used cash register?

Questions about KKM registration

- Is it possible to register a cash register if a current account is not opened?

- How long does it take to register a cash register?

- Which cash desks are allowed for registration?

- What documents do you need to have to register a cash register?

- Where should I register a cash register?

- Is it possible to operate an unregistered cash register?

- How and where can a non-resident businessman register a cash register?

Questions about the operation of the cash register and its maintenance

- What is an X report?

- What is a Z report?

- What to do if the cash register is broken? How to work?

- How to process a return if payment for an item was made by credit card?

- How much does it cost to service a cash register?

- What is included in Scheduled Maintenance?

- Why won't the cash drawer open?

Automation questions

- What is automation?

- What is included in the comprehensive automation of a retail enterprise?

- What is a POS system and how is it different from a regular cash register?

- How to carry out inventories using a data collection terminal?

- How long does it take to automate one store?

- How much will store automation cost?

General issues

Why do you need an agreement with the central service center?

An agreement with the central service center on the maintenance and repair of cash register equipment is a mandatory document when registering a cash register with the Federal Tax Service. In accordance with current legislation, commissioning, maintenance, and repair of cash registers must be carried out by manufacturing plants or technical service centers (TSCs) that have permission from the state for this type of service and accreditation from the manufacturer of the cash register. More information about the central service center KKMka.ru

TOP

What is the difference between: KKT, KKM and FR?

The term cash register (CCM) was introduced by the federal law “On the use of cash registers when making cash settlements with the population” in 1993.

In May 2003, the term was replaced by “cash register equipment” (CCT) by the federal law “On the use of cash register equipment when making cash payments and (or) payments using payment cards.” In fact, the terms KKM and KKT are synonyms .

A fiscal registrar (FR) is a cash register that can only work as part of a computer cash register system, receiving data through a communication channel. That is, the FR does not generate a receipt and does not download the items - for this it needs a third-party device with the appropriate software.

TOP

Why do you need a cash register?

A cash register is a tool for control by the tax authorities over the cash flow of an enterprise that carries out cash payments with the buyer or payments using payment cards. Select cash register

TOP

Does an individual entrepreneur need a cash register?

A natural question for all aspiring entrepreneurs is: do I need a cash register? It does not matter whether you registered as an individual entrepreneur or became the founder of an LLC or a shareholder of an OJSC or CJSC. In accordance with the Federal Law on the use of cash registers, when making cash payments to the population, you are required to use a cash register. In this case, the taxation system you use does not matter. But if an individual entrepreneur (or LLC) does not take cash from customers, then he does not need a cash register. Cash registers have been canceled only for activities that qualify for UTII - for them there are special inexpensive printers for UTII. Select a printer for UTII

TOP

What is included in the delivery of a cash register?

Package Included:

- Directly cash register;

- version passport and additional sheet to it,

- instructions for the user and the tax inspector;

- form and passport for EKLZ.

The version passport, an additional sheet to it, and the form must contain the EKLZ registration number and the cash register number.

TOP

Is it possible to buy a used cash register?

It is possible, but you need to take into account that when re-registering with the Federal Tax Service you will have to replace the EKLZ, and this is a large part of the cash register price. Most often, it is not profitable to buy a used cash register - the cost is almost like a new one, but without a guarantee, it may be faulty, not approved for use, with an expired depreciation period, or not included in the cash register register at all. Sales of cash registers

TOP

Questions about KKM registration

Is it possible to register a cash register if a current account is not opened?

When registering a cash register, the Federal Tax Service does not check whether the applicant has a current account, but there are other regulatory documents, for example, documents from the Ministry of Finance of the Russian Federation, indicating the need to open a current account, both as a legal entity and as an individual entrepreneur.

TOP

How long does it take to register a cash register?

On average, it takes 10-15 days to register a cash register with the Moscow Federal Tax Service. However, it can offer you a service - Registration of cash register with the Federal Tax Service without the participation of the customer in 1 day.

TOP

Which cash desks are allowed for registration?

Cash register equipment that is in the state register of cash register devices approved for use on the territory of the Russian Federation is allowed for registration. You can register either a new cash register or a used one that has not expired its depreciation period. The depreciation period of KKM is 7 years from the date of first registration.

TOP

What documents do you need to have to register a cash register?

To register cash register with the Federal Tax Service, the following documents are required:

- Application in the prescribed form (for individual entrepreneurs with a note about the absence of debt)

- Original TIN (organization, individual entrepreneur) (original and copy)

- Original OGRN (original and copy)

- Lease (sublease) agreement, where the cash register will be installed + a copy (the Federal Tax Service No. 21 and No. 22 in Moscow also requires a lease agreement for the legal address of the organization + a document confirming that the lessor is the owner)

- Maintenance contract with the service center (original and copy)

- Magazines KM-4 and KM-8 (laced and numbered)

- Form for cash register

- Version passport, additional sheet to the version passport (original and copy)

- Passport for EKLZ

- Power of attorney, if not registered by the general director and a notarized power of attorney from an individual entrepreneur

TOP

Buy documents for KKM registration

Where should I register a cash register?

Before use, cash register equipment must be registered with the tax office (IFNS) at the place of registration of the organization. If the actual address does not coincide with the accounting address, it is necessary to open a separate division in the tax office in whose territory the actual address of the enterprise is located. Individual entrepreneurs place a cash register at the Federal Tax Service at the place of registration. Registration is carried out by the operational control departments of the relevant territorial branches of the Federal Tax Service.

TOP

Is it possible to operate an unregistered cash register?

No. The cash register must be registered with the Federal Tax Service. Otherwise, when conducting an inspection, you will be subject to a fine in accordance with Art. 14.5 Code of Administrative Offenses of the Russian Federation. Those. in fact, it makes no difference whether you work without a cash register or at an unregistered cash register - the fine will be the same. The exception is the case when UTII is applied. When using a UTII check printer (ASPD - an automated document printing system), you do not need to register it with the tax office. More information about the KKM registration service

TOP

How and where can a non-resident businessman register a cash register?

For a legal entity: Before starting the cash register registration procedure, it is necessary to create and register a separate division for tax purposes. More details – Registration of a separate subdivision. For an individual entrepreneur: the cash register is registered at the place of permanent registration of the individual entrepreneur.

TOP

Questions about the operation of the cash register and its maintenance

What is an X report?

An X-report is an interim report that can be taken multiple times throughout the day. Closing a shift does not entail the removal of an X-report. The X-report allows you to view daily revenue, the amount of cash on hand, credit card payments, returns, check cancellations, and at the end of the day, reconcile the reported amount of cash on hand with the actual amount.

TOP

What is a Z report?

— this is the final report, which is taken at the end of the trading day once. The Z-report entails closing the shift. Based on the readings of the Z-report, the cashier-operator's journal is filled out.

TOP

What to do if the cash register is broken? How to work?

Call a service center technician and repair the cash register. The answer is obvious, because working without a cash register entails significant fines. If you want to take a risk and continue trading, then you take full responsibility for possible unpleasant consequences. As a rule, organizations have backup cash registers in case the main cash register breaks down. About purchasing a cash register

TOP

How to process a return if payment for an item was made by credit card?

The refund amount is necessarily transferred to the buyer's card. In this case, cash cannot be returned.

TOP

How much does it cost to service a cash register?

The cost of service depends on the type of cash register equipment and the selected tariff plan. When choosing a tariff plan, you should take into account the intensity of use and the condition of cash register equipment, as well as the presence or absence of a replacement cash register. More details - Tariff plans for KKM maintenance.

TOP

What is included in Scheduled Maintenance?

Maintenance is carried out in order to maintain the functionality of the CCP throughout its entire service life. Maintenance involves the following work:

- Visual inspection of the cash register for the absence of mechanical damage to the cash register, the safety of mastic seals and CTO seal marks, marking plates, and “Service” holograms.

- Cleaning the printing mechanism.

- Cleaning the keyboard (if available).

- Checking the reliability of external connections of the cash register.

- Checking the serviceability of the CCP using tests.

- Checking the accuracy and quality of printing of all required details, in accordance with the Technical Requirements and regulatory documents for the use of cash register equipment.

- Adjustment and configuration of CCP (if necessary).

Tariffs for KKM servicing at KKMka.ru"

TOP

Why won't the cash drawer open?

Cash drawers are designed to work with equipment from a specific manufacturer. There are cash drawers that are designed to work with Atol fiscal registrars, and there are ones for Shtrikh-M. If the FR does not support this box, then you can re-crimp the connector and the box will open.

TOP

Automation questions

What is automation?

Automation is a need not only for large companies, but also for small businesses. Thanks to the automation of operational accounting, management receives a reliable picture of what is happening at the enterprise in real time, which allows them to effectively manage the assortment, combat theft, manage costs and inventories, and control mutual settlements with counterparties. In modern conditions, with a high level of competition in the market, it is no longer possible to manage an enterprise “the old fashioned way”, carrying out all operations manually. Business automation is a way to increase efficiency and an opportunity to conquer new markets in a highly competitive environment. Despite the obvious advantages of automation, many owners still hesitate to implement a new system at their enterprise, justifying themselves with a small store area, lack of money, small assortment, difficulties in implementing and maintaining the system, and a small number of customers and employees. Trade automation proposal from KKMka.ru

TOP

What is included in the comprehensive automation of a retail enterprise?

The main objects of automation of a retail trade enterprise are:

- Pre-sale preparation of goods;

- Goods accounting;

- Storage facilities;

- The work of a cashier-operator;

- Sales planning.

TOP

What is a POS system and how is it different from a regular cash register?

The POS system allows you to increase the speed of customer service and prevent many manual input errors by the cashier-operator. The POS system consists of the following elements:

- POS computer;

- fiscal registrar;

- specialized software;

- display;

- programmable keyboard;

- magnetic card reader.

All these items can be purchased in the sections of the catalog:

- POS systems;

- POS peripherals.

TOP

How to carry out inventories using a data collection terminal?

The product directory is loaded into the TSD, then barcodes are read from the inventory item, and quantities can be entered manually. Next, the data is uploaded to the commodity accounting system.

TOP

How long does it take to automate one store?

The timing of store automation is affected by:

- Store area;

- Type of assortment, number of items;

- Computer network status;

- Level of personnel training;

- Other factors.

The exact deadlines are determined after the technical specifications are prepared. Read more about store automation

TOP

How much will store automation cost?

You can obtain this information after preparing a preliminary automation project. Submit a request for automation.

TOP