Section I. Non-current assets

Fixed assetsBy types of fixed assetsAmortization of fixed assetsIncome investments in tangible assetsBy type of tangible assetsIntangible assetsBy type of intangible assets and by expenses for research, development and technological workAmortization of intangible assets…………………………………………………………… ……06Equipment for installationInvestments in non-current assets1. Acquisition of land plots 2. Acquisition of environmental management facilities 3. Construction of fixed assets 4. Acquisition of fixed assets 5. Acquisition of intangible assets 6. Transfer of young animals to the main herd 7. Acquisition of adult animals 8. Carrying out research, development and technological works Deferred tax assetsChart of Accounts Structure

A chart of accounts is a scheme according to which the facts of an entity’s activities are grouped and recorded.

It contains first-order accounts - they are called synthetic. Each such account has its own number and name. All first-order accounts are divided into 3 types:

- active - increase by debit, decrease by credit, balance only by debit;

- passive - increase by credit, decrease by debit, balance only by credit;

- active-passive - increase and decrease both in debit and credit; the balance can be in both debit and credit.

In addition to first-order accounts, second-order accounts are used - they are called sub-accounts. They are opened to a specific first-order account, and several of them can be opened to one synthetic account.

Section II. Productive reserves

Materials1. Raw materials and materials 2. Purchased semi-finished products and components, structures and parts 3. Fuel 4. Containers and packaging materials 5. Spare parts 6. Other materials 7. Materials transferred for processing to third parties 8. Construction materials 9. Inventory and household supplies 10. Special equipment and special clothing in the warehouse 11. Special equipment and special clothing in operationAnimals being raised and fattened………………………………………………………12……………………… ………………………13 Reserves for reduction in the value of material assets Procurement and acquisition of material assets Deviation in the cost of material assets………………………………………………17…………………… …………………………18Value added tax on acquired assets191. Value added tax on the acquisition of fixed assets 2. Value added tax on acquired intangible assets 3. Value added tax on acquired inventoriesSection III. Production costs

Main productionSemi-finished products of own production21………………………………………………………22Auxiliary production23………………………………………………………24General production expenses25General expenses26……… …………………………………27 Defects in production 28 Service industries and farms 29 ………………………………………………………… 30 ……………………………… ………………31……………………………………………32………………………………………………………33……… …………………………………34………………………………………………………35……………………………………………………… …36………………………………………………………37…………………………………………………………38………………………… ……………………39Section IV. Finished products and goods

Output of products (works, services)40Goods411. Goods in warehouses 2. Goods in retail trade 3. Containers under goods and empty 4. Purchased items Trade margin 42 Finished products 43 Selling expenses 44 Goods shipped 45 Completed stages of work in progress 46 ……………………………………………………… 47 …… …………………………………………48………………………………………………………49Section V. Cash

Cashier1. Cash desk of the organization 2. Operating cash desk 3. Cash documents Current accounts Currency accounts………………………………………………………53……………………………………………………………54 Special bank accounts1. Letters of credit 2. Check books 3. Deposit accounts………………………………………………………56 Transfers in transit Financial investments 1. Units and shares 2. Debt securities 3. Loans provided 4. Deposits under a simple partnership agreement Reserves for impairment of financial investmentsPlan for state employees

The unified chart of accounts for accounting in budgetary institutions for 2022 is regulated by Order of the Ministry of Finance of Russia No. 157n dated December 1, 2010. Instruction 157n regulates the financial and economic activities of institutions operating in the Russian budget system.

All budgetary organizations are divided into autonomous, budgetary and state-owned. For each structure, various regulations have been approved that are responsible for accounting within a given organizational form:

- Order of the Ministry of Finance of the Russian Federation No. 162n dated December 6, 2010 - for government institutions, extra-budgetary funds and government bodies;

- order No. 174n dated December 16, 2010 - for BU;

- order No. 183n dated December 23, 2010 - for AU.

Clause 21 of Order No. 157n of the Ministry of Finance states what a budget accounting chart of accounts is (with explanations and entries) - this is a register used by government agencies, extra-budgetary funds and government bodies. That is, those organizations that operate within the framework of order 162n.

IMPORTANT!

The Ministry of Finance approved changes to Order 162n (Order of the Ministry of Finance No. 246n dated October 28, 2020). Now, when maintaining budget accounting, business transactions are reflected in the accounts of the working PS, approved by the institution as part of the formation of the institution’s accounting policy, using the financial security code in the 18th digit of the account number. When financed from the budget of the Russian Federation - code 1, from funds at temporary disposal - 3. This rule is used starting from 01/01/2021. Another important innovation is accrual accounting. According to the rules of this method, all operating results are recognized upon completion of transactions.

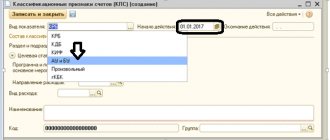

All other state employees use accounting software in their work. This difference arose in connection with the possibility of budgetary and autonomous institutions conducting business activities and receiving income from it (clauses 2, 3 of Article 298 of the Civil Code of the Russian Federation). Budgetary organizations formulate a work plan based on instruction No. 157n. The numbering of working accounts consists of 26 digits, which reflect the analytical accounting code, the type of cash security, the synthetic accounting account code and the code of the financial and economic transaction according to KOSGU.

The budget plan consists of balance sheet and off-balance sheet accounts. It is carried out in accordance with funding sources: budgetary and extra-budgetary.

Section VI. Calculations

Settlements with suppliers and contractors60………………………………………………………61Settlements with buyers and customers62 Provisions for doubtful debts63……………………………………………………………64 ………………………………………………………………65Calculations for short-term credits and borrowingsBy types of credits and borrowingsCalculations for long-term credits and borrowings67By types of credits and loansCalculations for taxes and fees68By types of taxes and feesCalculations for social insurance and security691 . Settlements for social insurance 2. Settlements for pensions 3. Settlements for compulsory medical insurance Settlements with personnel for wages Settlements with accountable persons 71……………………………………………………………72 Settlements with personnel for other transactions 731. Settlements for loans provided 2. Settlements for compensation of material damage………………………………………………………74 Settlements with founders751. Settlements for contributions to the authorized (share) capital 2. Settlements for the payment of income Settlements with various debtors and creditors 761. Settlements for property and personal insurance 2. Settlements for claims 3. Settlements for dividends due and other income 4. Settlements for amounts deposited Deferred tax liabilities77……………………………………………………………78 Intra-business settlements791. Settlements for allocated property 2. Settlements for current operations 3. Settlements under a property trust management agreementLegislative framework of the Russian Federation

not valid Edition from 07.05.2003

detailed information

| Name of document | ORDER of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n (as amended on May 7, 2003) “ON APPROVAL OF THE PLAN OF ACCOUNTS FOR FINANCIAL AND ECONOMIC ACTIVITIES OF AN ORGANIZATION AND INSTRUCTIONS FOR ITS APPLICATION” |

| Document type | order, instruction |

| Receiving authority | Ministry of Finance of the Russian Federation |

| Document Number | 94N |

| Acceptance date | 01.01.1970 |

| Revision date | 07.05.2003 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | It does not work |

| Publication |

|

| Navigator | Notes |

ORDER of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n (as amended on May 7, 2003) “ON APPROVAL OF THE PLAN OF ACCOUNTS FOR FINANCIAL AND ECONOMIC ACTIVITIES OF AN ORGANIZATION AND INSTRUCTIONS FOR ITS APPLICATION”

CHART OF ACCOUNTS FOR FINANCIAL AND ECONOMIC ACTIVITIES OF ORGANIZATIONS

(as amended by Order of the Ministry of Finance of the Russian Federation dated 05/07/2003 N 38n)

| Account name | Account number | Subaccount number and name |

| 1 | 2 | 3 |

Section I. NON-CURRENT ASSETS

| Fixed assets | By type of fixed assets | |

| Depreciation of fixed assets | ||

| Profitable investments in material assets | By type of material assets | |

| Intangible assets | By type of intangible assets and by expenses for research, development and technological work | |

| (as amended by Order of the Ministry of Finance of the Russian Federation dated 05/07/2003 N 38n) | ||

| Amortization of intangible assets | ||

| ………………………. | 06 | |

| Equipment for installation | ||

| Investments in non-current assets | 1. Acquisition of land plots 2. Acquisition of environmental management facilities 3. Construction of fixed assets 4. Acquisition of fixed assets 5. Acquisition of intangible assets 6. Transfer of young animals to the main herd 7. Acquisition of adult animals 8. Carrying out research and development work and technological works | |

| (as amended by Order of the Ministry of Finance of the Russian Federation dated 05/07/2003 N 38n) | ||

| Deferred tax assets | ||

| (as amended by Order of the Ministry of Finance of the Russian Federation dated 05/07/2003 N 38n) | ||

Section II. PRODUCTIVE RESERVES

| Materials | 1. Raw materials and materials 2. Purchased semi-finished products and components, structures and parts 3. Fuel 4. Containers and container materials 5. Spare parts 6. Other materials 7. Materials transferred for processing to third parties 8. Construction materials 9. Inventory and household supplies 10. Special equipment and special clothing in the warehouse 11. Special equipment and special clothing in operation | |

| (as amended by Order of the Ministry of Finance of the Russian Federation dated 05/07/2003 N 38n) | ||

| Animals being raised and fattened | ||

| ………………………. | 12 | |

| ………………………. | 13 | |

| Reserves for reduction in the value of material assets | ||

| Procurement and acquisition of material assets | ||

| Deviation in the cost of material assets | ||

| ………………………. | 17 | |

| ………………………. | 18 | |

| Value added tax on purchased assets | 1. Value added tax on the acquisition of fixed assets 2. Value added tax on acquired intangible assets 3. Value added tax on acquired inventories | |

Section III. PRODUCTION COSTS

| Primary production | |

| Semi-finished products of our own production | |

| ………………………. | 22 |

| Auxiliary production | |

| ………………………. | 24 |

| General production expenses | |

| General running costs | |

| ………………………. | 27 |

| Defects in production | |

| Service industries and farms | |

| ………………………. | 30 |

| ………………………. | 31 |

| ………………………. | 32 |

| ………………………. | 33 |

| ………………………. | 34 |

| ………………………. | 35 |

| ………………………. | 36 |

| ………………………. | 37 |

| ………………………. | 38 |

| ………………………. | 39 |

Section IV. FINISHED PRODUCTS AND GOODS

| Release of products (works, services) | |

| Goods | 1. Goods in warehouses 2. Goods in retail trade 3. Containers under goods and empty 4. Purchased items |

| Trade margin | |

| Finished products | |

| Selling expenses | |

| Goods shipped | |

| Completed stages of unfinished work | |

| ………………………. | 47 |

| ………………………. | 48 |

| ………………………. | 49 |

Section V. CASH

| Cash register | 1. Cash register of the organization 2. Operational cash register 3. Cash documents | |

| Current accounts | ||

| Currency accounts | ||

| ………………………. | 53 | |

| ………………………. | 54 | |

| Special bank accounts | 1. Letters of credit 2. Check books 3. Deposit accounts | |

| ………………………. | 56 | |

| Transfers on the way | ||

| Financial investments | 1. Units and shares 2. Debt securities 3. Loans provided 4. Deposits under a simple partnership agreement | |

| Provisions for impairment of financial investments | ||

| (as amended by Order of the Ministry of Finance of the Russian Federation dated 05/07/2003 N 38n) | ||

Section VI. CALCULATIONS

| Settlements with suppliers and contractors | ||

| ………………………. | 61 | |

| Settlements with buyers and customers | ||

| Provisions for doubtful debts | ||

| ………………………. | 64 | |

| ………………………. | 65 | |

| Calculations for short-term loans and borrowings | By type of credits and loans | |

| Calculations for long-term loans and borrowings | By type of credits and loans | |

| Calculations for taxes and fees | By type of taxes and fees | |

| Calculations for social insurance and security | 1. Calculations for social insurance 2. Calculations for pensions 3. Calculations for compulsory health insurance | |

| Payments to personnel regarding wages | ||

| Calculations with accountable persons | ||

| ………………………. | 72 | |

| Settlements with personnel for other operations | 1. Calculations for loans provided 2. Calculations for compensation for material damage | |

| ………………………. | 74 | |

| Settlements with founders | 1. Calculations for contributions to the authorized (share) capital 2. Calculations for payment of income | |

| Settlements with various debtors and creditors | 1. Settlements for property and personal insurance 2. Settlements for claims 3. Settlements for dividends due and other income 4. Settlements for amounts deposited | |

| Deferred tax liabilities | ||

| (as amended by Order of the Ministry of Finance of the Russian Federation dated 05/07/2003 N 38n) | ||

| ………………………. | 78 | |

| On-farm settlements | 1. Settlements for allocated property 2. Settlements for current operations 3. Settlements under a property trust management agreement | |

Section VII. CAPITAL

| Authorized capital | |

| Own shares (shares) | |

| Reserve capital | |

| Extra capital | |

| Retained earnings (uncovered loss) | |

| ………………………. | 85 |

| Special-purpose financing | By type of financing |

| ………………………. | 87 |

| ………………………. | 88 |

| ………………………. | 89 |

Section VIII. FINANCIAL RESULTS

| Sales | 1. Revenue 2. Cost of sales 3. Value added tax 4. Excise taxes 9. Profit / loss on sales |

| Other income and expenses | 1. Other income 2. Other expenses 9. Balance of other income and expenses |

| ………………………. | 92 |

| ………………………. | 93 |

| Shortages and losses from damage to valuables | |

| ………………………. | 95 |

| Reserves for future expenses | By type of reserves |

| Future expenses | By type of expense |

| revenue of the future periods | 1. Income received for future periods 2. Gratuitous receipts 3. Upcoming receipts of debt for shortfalls identified in previous years 4. The difference between the amount to be recovered from the guilty parties and the book value for shortfalls of valuables |

| Profit and loss |

Off-balance sheet accounts

| Leased fixed assets | 001 |

| Commodity - material assets accepted for safekeeping | 002 |

| Materials accepted for recycling | 003 |

| Goods accepted for commission | 004 |

| Equipment accepted for installation | 005 |

| Strict reporting forms | 006 |

| Debt of insolvent debtors written off at a loss | 007 |

| Security for obligations and payments received | 008 |

| Security for obligations and payments issued | 009 |

| Depreciation of fixed assets | 010 |

| Leased fixed assets | 011 |

APPROVED

by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n

Section VII. Capital

Authorized capital Own shares (shares) Reserve capitalAdditional capitalRetained earnings (uncovered loss)………………………………………………………85 Targeted financingBy type of financing…………………………………… …………87………………………………………………………88………………………………………………………89Chart of accounts table with subaccounts: correlation with the balance sheet

So, a significant part of Russian companies are required to work with a standard chart of accounts. The full accounting plan is reflected in order No. 94n in the form of a table. Its structure consists of 8 sections. Let's consider the connection between these sections, including accounts and subaccounts, with sections of the balance sheet.

The accounts of section 1 of the accounting plan are intended to reflect transactions with non-current assets. The balances on these accounts are the source of data for the formation of balance sheet lines in terms of non-current assets.

How to record entries for accounting for fixed assets, read the article “Accounting for fixed assets - accounting entries.”

The accounts of section 2 of the accounting plan are used to reflect business transactions on inventories. The account balance of section 2 is used to fill out the section reflecting current assets in the balance sheet. For a similar purpose, data from sections 3 “Production Costs”, 4 “Finished Products and Goods” and 5 “Cash” of the accounting plan is used.

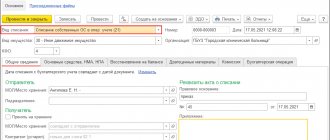

The working chart of accounts must be fixed in the accounting policies of the organization.

The nuances of forming accounting policies are described in detail in a typical situation from ConsultantPlus. There you will also find an example of a working chart of accounts. If you do not have access to the K+ system, get a trial online access for free.

Read about the reflection of individual transactions in the accounts in our materials:

- “Account 26 in accounting (nuances)”;

- “Accounting for a corporate bank card”;

- “Special equipment in accounting - features and nuances”;

- “Business inventory in accounting is...”.

The indicators reflected in the accounts included in section 6 “Calculations” are used to reflect information about receivables and payables (including long-term ones).

How debt on contributions to the authorized capital is reflected, read the article “Accounting entries on contributions to the authorized capital.”

How to reflect the issuance of imprest amounts, look in the material “Transfer of subaccounts to an employee’s card from a current account.”

Sections 7 “Capital” and 8 “Financial Results” of the chart of accounts contain accounts that reflect data on capital, target financing, and the financial result of the organization.

For entries on accounting for financial results, see the article “Accounting and analysis of financial results.”

The procedure for reflecting retained earnings can be found in the article “Retained earnings in the balance sheet (nuances).”

Section VIII. Financial results

Sales1. Revenue 2. Cost of sales 3. Value added tax 4. Excise taxes 9. Profit/loss from sales Other income and expenses1. Other income 2. Other expenses 9. Balance of other income and expenses………………………………………………………92……………………………………………………………… 93Shortages and losses from damage to valuables94………………………………………………………………95Reserves for future expenses96By type of reservesDeferred expenses97By type of expensesDeferred income1. Income received for future periods 2. Gratuitous receipts 3. Upcoming receipts of debt for shortfalls identified in previous years 4. The difference between the amount to be recovered from the guilty parties and the book value for shortfalls of valuables Profits and lossesWho is required to use the chart of accounts?

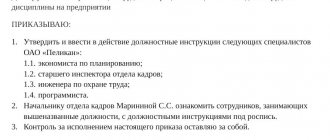

All economic entities that maintain accounting records are required to apply the chart of accounts. Exemptions are provided only for individual entrepreneurs and private practitioners. Other commercial firms, government agencies and enterprises are required to maintain accounting.

But merchants also have the right to organize accounting as part of their activities. There is no prohibition on conducting. Individual entrepreneurs make decisions independently. If accounting is necessary, you will have to comply with the current rules:

- Develop and approve accounting policies.

- Appoint responsible persons.

- Maintain primary and accounting documentation.

- Conduct audits, inventories and inspections.

- Prepare financial statements.

Some economic entities have the right to conduct accounting in a simplified form. For example, non-profit organizations, small businesses, representatives of Skolkovo. But even the transition to a simplified method does not exempt you from using a single PS.

IMPORTANT!

The use of a chart of accounts is mandatory for all economic entities that must maintain accounting records. There are no exceptions even for simplifiers.