- Purpose of the article: reflection of information about borrowed funds.

- Line number in the balance sheet: 1410, 1510.

- Account number according to the chart of accounts: credit balance of 66, 67 accounts.

Borrowed funds are considered to be money received from third-party sources, which will need to be returned back under certain conditions. Such funds serve enterprises as financial support in times of crisis or other situations when their capital is insufficient.

What is considered borrowed funds?

Depending on the type of organization that lent financial resources, they can be divided into two types:

- Loans.

- Loans.

The difference between types lies in the source of funding. Loans can only be provided by specialized organizations, that is, banks and other financial organizations. Loans can be issued by almost any legal entity and even an individual.

A loan is issued for the purpose of generating income for the lender, that is, at monetary interest. Loans can be interest-free. There is no benefit for a lender to risk their money without even receiving additional income. Therefore, an interest-free loan is found among affiliated and interdependent persons when several companies are united:

- to a corporation;

- holding;

- group.

Thus, you can divide the loans:

- external;

- internal.

Solvency and liquidity indicators

Indicators of this group characterize the possibility of making debt payments.

The overall degree of solvency is calculated as the ratio of the sum of long-term and current liabilities (i.e., the amount of borrowed funds) to average monthly revenue:

$$\text{Total solvency} = \frac{\text{Dorrowed capital}}{\text{Average monthly revenue}}=\frac{ \text{form No. 1 page 1400+1500-1530}}{\text{ f#2 page 2110/12 months}}$$

Revenue may not necessarily be calculated for a year; the calculation period can be 3, 6, 9 months; it all depends on how often the analyst plans to calculate this indicator and what reporting forms (annual or quarterly) are used for analysis.

This indicator has the dimension “months” and characterizes how many months the company needs to pay off all long-term and short-term obligations while maintaining the current level of revenue in a hypothetical case, if no other payments are made.

The degree of solvency for current liabilities is determined as the ratio of only current liabilities to average monthly revenue:

$$\text{Current solvency liabilities} = \frac{\text{Current liabilities}}{\text{Average monthly revenue}}=\frac{ \text{form No. 1 line 1500-1530}}{\text{form No. 2 line 2110/12 months}}$$

This indicator, like the previous one, has the dimension “months” and characterizes how many months the company needs to pay off short-term obligations while maintaining the current level of revenue without making other payments.

The recommended value for this indicator is . If this condition is met, the enterprise is considered solvent, otherwise it is insolvent. The three-month period is justified by the fact that for most enterprises, a sign of bankruptcy is the presence of debt, the repayment period of which expired exactly three months ago.

For enterprises that are subjects of natural monopolies (fuel and energy enterprises, etc.), strategic enterprises, the list of which is approved by the Government of the Russian Federation, and for credit institutions (banks), the signs of bankruptcy differ in the timing of delayed payments. Therefore, the recommended values of the indicator change accordingly, which are:

How to take into account other people's funds

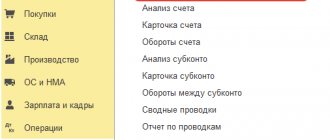

Funds received, regardless of the type and source of financing, are accounted for by enterprises in accordance with the Chart of Accounts approved by the legislator:

- Account 66 “Settlements for short-term loans and borrowings”;

- Account 67 “Settlements for long-term loans and borrowings.”

Sharing of debt capital

As the name suggests, loans can be divided according to repayment periods:

- for long-term, that is, over 12 months;

- and short-term, that is, up to 12 months.

Loans, in addition to cash, can be received as debt securities:

- bonds;

- bills.

In this case, the company pays the lender not interest, but a discount, that is, the difference between the nominal and real value of the security.

The liability on accounts 66 and 67 is accounted for in two ways:

- Based on actual loan amount plus interest.

- At par value of debt securities.

In this case, the valid entry is the one generated at the time the borrowed funds are received into the organization’s current account:

- Debit 51 of the “Current account” account Credit 66, 67 – a loan or credit was received.

What to do with interest on loans

In addition to the main body of the loan, interest on the loan, which is the income of the lender, is taken into account in separate subaccounts 66 and 67 of the account. Accrued interest is reflected on account 91 “Other income and expenses” as expenses, or on account 08 “Investments in non-current assets” as an increase in the cost of fixed assets:

- Debit 91.02 Credit 66, 67 – monthly interest accrued.

- Debit 08 Credit 66, 67 – the cost of the object under construction has been increased by the amount of interest.

Note from the author! Before putting an object into operation, all costs during construction are accumulated on capital investments, that is, on account 08. After completion of construction or additional equipment, the objects are entered into account 01 “Fixed Assets”.

For example, a company took out a loan for the construction of a bridge in the amount of 1,000,000 rubles for one year. The bank's annual interest rate is 18%. You need to calculate how much deductions to take into account each month:

- 1,000,000 * 18% = 180,000 rubles per annum;

- 180,000 / 12 months = 15,000 rubles – monthly interest accrual.

Since the loan term is one year, it is considered short-term, which means it will be displayed on account 66:

- Debit 51 Credit 66.01 – a loan was received in the amount of 1,000,000 rubles.

- Debit 08 Credit 66.02 – interest was accrued on the increase in the cost of the bridge in the amount of 15,000 rubles.

- Credit 66.02 Debit 51 – monthly payment to the bank of 15,000 rubles is transferred.

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Usually a negative factor

If the indicator decreases

Usually a positive factor

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- IV. LONG-TERM LIABILITIES Section IV. Long-term liabilities are the fourth section of the balance sheet. At the same time, it is also the second section of the liability side of the balance sheet, which shows the sources of financing for the property. AND…

- V. CURRENT LIABILITIES Section V. Current liabilities is the fifth section of the balance sheet. At the same time, it is also the third section of the liability side of the balance sheet, which shows the sources of financing for the property. AND…

- Balance sheet liability The balance sheet liability is the second part of the balance sheet. It contains a list of those financial resources that were used to acquire property, that is, assets that...

- II. CURRENT ASSETS Current assets are property used in the activities of an enterprise for less than a year or used in one production cycle, which also does not exceed one year. Its entire cost...

- I. NON-CURRENT ASSETS Non-current assets are property used in the activities of an enterprise for more than a year. Its value is transferred in parts to the cost of finished products. A sign of assets is the ability to generate income for the organization.…

- III. CAPITAL AND RESERVES Section III Capital and Reserves is the third section of the balance sheet. But what is more important is the first section of financial sources, that is, the liability side of the balance sheet. By this he...

- Horizontal and vertical analysis of the balance sheet and income statement (profit and loss) Good afternoon, my dear reader. In this article we will consider such a topic as horizontal and vertical analysis of the balance sheet and financial results statement (income and...

- Analysis of the financial condition of the enterprise Hello. This page contains an updated service for free analysis of the financial condition of an enterprise online. In 2019-2020, some lines in the income statement changed, so...

- Analysis of the financial condition and performance of the bank online for free Hello, dear visitor. This service is the next update of the bank’s financial performance analysis service for 2022 and later until new changes appear. On the…

- Absolute economic indicators of an enterprise's activity Absolute economic indicators of an enterprise's activity are indicators that allow us to judge several things: The size of the enterprise and the scale of its activities The level of income and expenses...

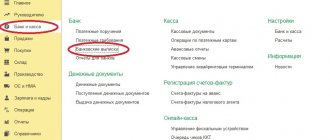

Reflection of borrowed capital in the balance sheet

Debt on borrowed capital is shown in a separate line of the balance sheet, which all companies are required to submit at the end of the reporting period:

- line 1410 is intended for long-term loans and borrowings;

- line 1510 – for short-term obligations on loans and borrowings.

According to the instructions for drawing up a balance sheet contained in PBU 4/99, the accounts payable balance for 66 and 67 accounts is used. Including in Form No. 1, which is called the balance sheet in Order No. 66 n, all accrued interest is reflected in the indicated lines.

Note from the author! Interest on long-term debt is shown in line 1510 along with short-term liabilities if the payment period is less than 365 days.

For example, a company has a long-term loan for 5 years in the amount of 5,000,000 rubles with an annual interest rate of 12.1%, received in April 2022. According to the terms of the agreement, interest is paid monthly. In addition, at the end of the year, 500,000 rubles of the principal debt must be returned to avoid debt growth. As of December 31, 2022, the company submits its balance sheet to the Federal Tax Service. First you need to calculate the amount of monthly interest:

- 5,000,000 * 12.1% = 605,000 rubles for 5 years;

- 605,000 / 5 years = 121,000 rubles per annum;

- 121,000 / 12 months = 10,083, 33 monthly accruals.

Since the company received the loan on April 1, 2022, the calculation must be made before December 31, 2022:

- 10,083 rubles * 9 months = 90,749.97 rubles accrued interest for 2022.

According to the terms of the agreement, interest is paid on the 1st working day of the month following the reporting month.

Table No. 1. Movements on the 67th count.

| Name of the operation in RAS | Turnovers in debit account 67 | Loan turnover 67 accounts | Debit balance of account 67 | Loan balance 67 accounts |

| Loan received | 5 000 000,00 | 5 000 000,00 | ||

| Interest accrued | 90 749,97 | 5 090 749,97 | ||

| Interest transferred to the lender | 80 666,64 | 5 010 083,33 | ||

| The debt was returned to the lender | 500 000,00 | 4 510 083,33 |

Since interest on the balance sheet must be taken into account among short-term debts, the report lines look like this:

Table. No. 2. Reflection of loans in the company’s balance sheet.

| Balance section | Name of balance sheet item | Balance line number | Amount in lines |

| long term duties | Borrowed funds | 1410 | 4 500 |

| Short-term liabilities | Borrowed funds | 1510 | 10 |

In the balance sheet, amounts are reflected in thousands of rubles, according to Order No. 66 n.

Decoding the amount in lines 1410 and 1510

It is not difficult to decipher balance sheet lines 1410 and 1510. They include short-term and long-term borrowed funds, which are reflected in the balance sheet along with interest accrued on them. The enterprise's reporting must display the following information:

- Amounts and terms of repayment of newly acquired liabilities.

- Balances of outstanding debt on existing loans.

- Data on interest due to creditors.

- Information about additional expenses associated with servicing loan agreements.

- Information about securities issued and acquired by the company.

- Data on the effectiveness of investments made with borrowed funds in the formation of an enterprise asset.

Attention! Payment of remuneration to the lender for the use of borrowed funds can be taken into account as part of the investment asset, if such exists on the balance sheet.

Balance line 1510 what contains

< 6 months for strategic enterprises and natural monopolies, for credit organizations - < 14 days.

The absolute liquidity ratio is the ratio of the value of quick assets to current liabilities:

As you already know, short-term financial investments and cash in the company’s accounts are considered quick-liquid assets.

$$К_\text{abs. liquidity} = \frac{\text{Highly liquid assets}}{\text{Current liabilities}}=\frac{ \text{form No. 1 line 1240+1250}}{\text {f№1 pp. 1500-1530}}$$

This indicator characterizes what part of short-term liabilities can be repaid almost immediately (within a few days). As a rule, at domestic large and medium-sized industrial enterprises it amounts to a few percent.

The intermediate liquidity ratio is the ratio of the sum of quick assets and short-term receivables to current liabilities:

$$К_\text{industrial liquidity} = \frac{\text{Highly liquid assets+Accounts receivable}}{\text{Current liabilities}}=\frac{ \text{form No. 1 line 1240+1250+1230 +1260}}{\text{f№1 pp. 1500-1530}}$$

This indicator characterizes what part of short-term liabilities can be repaid using current assets not involved in production, i.e. what part of the obligations can be repaid quickly enough (within a few months). It follows that in order to be able to repay the debt without any complications for current activities, all short-term liabilities must be covered by the specified assets. The recommended value of the indicator is .

The current ratio is calculated as the ratio of current assets to current liabilities:

$$К_\text{current liquidity} = \frac{\text{Current assets}}{\text{Current liabilities}}=\frac{ \text{form No. 1 page 1200}}{\text{form №1 pp. 1500-1530}}$$

It shows the portion of current assets covered by current liabilities. Indicator value > 2 (for countries with developed market economies).

In Russia in the late 1990s. the average value of the indicator was about 1. If it is > 1.5, then the enterprise is considered solvent.

The group of solvency and liquidity indicators allows you to assess the organization’s ability to pay its obligations through income from its activities (the first two indicators) and through the sale of existing property (the last 3 indicators).