FSBU 27/2021 “Documents and document flow in accounting” comes into force on January 1, 2022: until this point, its application on a voluntary basis is allowed. One of the most significant innovations is the requirement to store accounting documents and the data contained in them, as well as to locate databases of these data on the territory of the Russian Federation.

We will discuss the most important changes in the standards below.

Document storage

So, according to FSB 27/2021, all business entities covered by it (and this is virtually all, with the exception of public sector organizations) will be required to organize the storage of accounting documents and the data contained in them, as well as place databases of these data on territory of the Russian Federation .

Of course, such changes will primarily affect Russian organizations that are part of international groups of companies (MGK). This is due to the fact that many international companies use “global” IT solutions (SAP, Oracle, etc.) as an accounting system, as well as an IT architecture, which in most cases involves placing databases and storage on servers abroad.

At first glance, it is obvious that in this situation the implementation of the new requirement will require:

- revision of a number of operational and administrative processes (in particular, data management in systems, document archiving and IT support);

- changes in IT architecture and infrastructure to accommodate databases of accounting and other company systems on hardware located in the Russian Federation.

In this regard, we would like to note the following important points.

Firstly, it is not entirely clear what is meant by “database” and what kind of data we are talking about: for example, data in accounting documents that are mandatory due to the requirements of the Federal Law “On Accounting” of December 6 2011 No. 402-FZ, or about all the data available in the documents, but at the same time not affecting the reflection of the facts of economic life in accounting?

Secondly, the FSB does not decipher what exactly is meant by “hosting” databases. In particular, the text of the standard does not directly prohibit maintaining a database abroad with the subsequent placement of a copy of such a database on Russian servers.

Additionally, it is worth noting that the localization of databases also does not mean that the process of entering data into the databases should also be localized, which means that it will not be necessary, for example, to form a staff of employees involved in operational data entry on the territory of the Russian Federation, if such employees are currently located abroad abroad.

Thirdly, the requirement to store documents in Russia applies only to accounting documents, which are understood as primary documents and accounting registers. This requirement does not apply to any other documents/information (for example, supporting documents - contracts, invoices for payment not used as primary accounting documents, etc.).

In addition, the FSB requirements do not apply to accounting maintained in accordance with the requirements of foreign legislation, as well as to tax and management types of accounting.

Fourthly, at the moment, liability for violating the FSB requirements for storing documents in Russia has not been determined. Taking into account the current norms of the Code of Administrative Offenses, organizations can theoretically be held liable for such a violation:

- according to Art. 15.11 of the Code of Administrative Offenses of the Russian Federation “Gross violation of accounting requirements, including accounting (financial) reporting” (the offense covers “the absence of primary accounting documents for an economic entity”);

- or according to Art. 13.25 of the Code of Administrative Offenses of the Russian Federation “Violation of legal requirements on the storage of documents and information contained in information systems.”

The fine for these violations is relatively small - from 5 to 10 thousand rubles. for gross violation of accounting requirements and from 200 to 300 thousand rubles. for violation of the law on document storage.

At the same time, we do not rule out that before the application of the FSBU, special rules may appear in the Code of Administrative Offenses that establish liability specifically for violation of the requirements for the storage of accounting documents and the data contained in such documents, as well as for the placement of a database of said data on the territory of the Russian Federation.

It is worth noting that during the development of the FSBU, the text of the provisions analyzed above has undergone significant changes. The draft document stated that Russia should host databases in which “collection, recording, systematization, accumulation, storage, clarification (updating, changing), retrieval of information and documents (copies of documents) of accounting” are carried out. And in the final version of the text, all that remained was the requirement “to store accounting documents, as well as the data contained in such documents, and to place databases of said data on the territory of the Russian Federation.”

It can be assumed that initially legislators had the idea to oblige business entities to host the systems in which accounting is kept on Russian servers in order to ensure access to them for inspectors, regardless of any features of cross-border data management, but later it was decided to somewhat soften these requirements.

Thus, it is obvious that the new requirements give rise to a large number of questions, the answers to which will largely determine the significance of how companies change their technological solutions. Complete localization of accounting and other systems containing documents and data in them controlled by this standard will eliminate the risks associated with violation of this standard, but may lead to significant costs.

Alternative options - for example, creating and storing copies of databases and document storage systems in Russia - seem to be more risky and not always optimal, but also much easier to implement from a practical point of view.

In any case, it is quite difficult to draw any clear conclusions in the absence of clarifications from the responsible departments at this stage. We hope that such clarifications will be published soon.

In addition to the issue of localization of storage, it is also worth noting that the current edition of the FBU allows the storage of documents only in the form in which they were originally compiled. We believe that if the bill is adopted, which proposes to allow the creation and storage of electronic duplicates and converted documents, amendments will be made to the text of the FBU.

Where to store

Organizations are required to ensure the integrity of documents arising in the course of their activities during the storage period (Part 1, Article 17 of Federal Law No. 125-FZ).

402-FZ (Part 3, Article 29) obliges to comply with and create safe conditions for maintenance in the accounting department. The current legislation does not define specific places of detention in the organization, therefore different units are included in the process. Institutions have the right, but are not obliged (clause 2 of article 13 of the Federal Law No. 125-FZ of October 22, 2004) to organize an archive. Various types of document storage have been established: organizations accept papers from the Archive Fund of the Russian Federation (Article 5 of Federal Law No. 125-FZ), according to personnel and with temporary periods of more than 10 years. Papers with maturities of less than 10 years are kept in departments of organizations, and upon expiration they are destroyed (upon receipt of the results of the value examination). It is prohibited to destroy papers until it is completed.

Document date

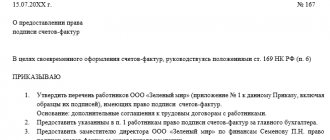

Another innovation concerns the date of compilation of the primary accounting document. This date will be understood as the date of its signing by the person who completed the transaction/operation and is responsible for its execution, or the person responsible for the execution of the event.

Thus, the date of preparation of the primary accounting document will be the date of completion of its execution - in fact, this will be the date of the last signature.

At the same time, the FSB separately provides that the date of the occurrence of a fact of economic life may differ from the date of drawing up the document by which this fact of economic life is formalized. In this case, the FSB regulates that both of these dates will need to be indicated in the document. This, in turn, means that from the primary document it will be clear whether the company fulfills the requirement to draw up the document immediately at the time of the business transaction or immediately upon its completion.

This innovation will be especially relevant for companies using EDI, since the date of signing electronic documents is recorded automatically and cannot be changed subsequently.

It is interesting to note that the date that is present in the so-called “header” of a document on paper, and the date of generation of the exchange file that is present in electronic documents, are not regulated in any way by the FSB, which may indicate that for regulatory authorities these dates will not be considered significant and in fact can only indicate the beginning of documenting the fact of economic life.

Company archive and third-party archive

Documents that have a permanent storage period and temporary ones, but more than 10 years, are transferred to the company archive. Completed cases are transferred according to their inventory. When sending cases to a third-party archive (most often a state or municipal institution), they are accompanied by the following:

- a letter of relationship with a request addressed to his supervisor, which indicates the number of cases and their last dates;

- inventory in 3 copies;

- historical information about the company (only for the first application);

- a certificate documenting the incomplete preservation of files or individual documents in them, if necessary.

Cases are handed over according to the act according to the inventories. After passing the examination, the cases are accepted by the archive for storage.

Supporting documents

The FSBU introduces the concept of a supporting document. It is understood as a document containing information about a fact of economic life, on the basis of which mandatory details are included in the primary accounting document. It is assumed that, unlike the primary accounting document, the source document is not intended to document the fact of economic life for accounting purposes and therefore may not contain all the mandatory details inherent in the primary accounting document.

Examples of supporting documents are contracts, cash receipts, invoices for payment, judicial acts, etc. The FSB provides that if the supporting document served as the basis for the formation of a primary accounting document, then information about the specified supporting document will need to be included in the primary accounting document.

How long to keep accounting documents

The enterprise determines the algorithm for the circulation of securities, the location and duration of its stay independently. For example, the police, by order No. 333 dated May 4, 2010, established where KUSP materials are subject to archival storage - they are subject to transfer from the duty station to the secretariat and maintenance there for 5 years. But Rosarkhiv Order No. 236 determined new deadlines for a number of accounting documents.

| View | Shelf life |

| Invoices | 5 l. |

| About receiving a salary (if you have personal accounts) | 6 l. |

| Register of information about the income of an individual | 5 l. |

| Books of accounting of income and expenses under the simplified tax system | 5 l. |

| Different types of contracts: | |

| Gifts of property | Before the liquidation of the organization |

| Leasing | Upon expiration of the agreement or repurchase period |

| About real estate pledge | 10 l. |

| Real estate exchanges | Before the liquidation of the organization |

| Orders | 15 or 10 l. (depending on the type of property) |

| Credit or loan (subject to collateral of property) | 10 l. |

| About accounts receivable and payable | 5 l. (term applicable subject to debt repayment) |

| Primary accounting | 5 l. (if there are disputes - before a court decision is made) |

| Employee's personal accounts for receiving salary | 50 l. (upon completion of office work after 01/01/2003) or 75 l. (if completed before 01/01/2003) |

| On the revaluation of fixed assets and depreciation | 5 l. after retirement |

| Acts of acceptance and transfer of real estate | 5 l. after retirement |

| On the transfer of property by the owner | Before the liquidation of the institution |

| Reports and conclusions on inspections of the Accounts Chamber, regional and local control and accounting bodies | 10 l. |

| FHD plan | 5 l. - at the place of approval. Permanently - at the development site |

| Reports on the implementation of FCD plans | Annual - constantly. Quarterly - 5 l. Menstruation - 1 year. |

| Reports on the implementation of agreements for the provision of grants and subsidies. | 5 l. |

| Certificates of fulfillment of the obligation to pay taxes, fees, contributions, penalties and fines, according to the status of settlements with the budget. | 5 l. |

| Calculations for insurance premiums. | 50 l. (upon completion of office work after 01/01/2003) or 75 l. (upon completion of office work before 01/01/2003) |

Electronic documents

The FSB expresses its position regarding the use of electronic signatures for electronic documents:

- if in relation to certain types of documents the law provides for a specific type of electronic signature, then this type of signature is used for electronic documents;

- •if such a requirement is not established by law, then any type of signature can be used: simple electronic, enhanced unqualified or enhanced qualified electronic signatures.

It is interesting to note that the FSBU stipulates that the specific type of signature must be established in an agreement between participants in the document flow. This requirement applies to all types of signatures, including a qualified electronic signature, despite the absence of a similar requirement directly in the law on electronic signatures.

Correcting documents

Acceptable ways to correct documents are defined:

- the correction must be accompanied by the signature of the persons who compiled the primary accounting document and must contain a number of mandatory details (date of correction, positions and surnames of the signatories, etc.). It is worth noting that this wording directly assumes that only the person who prepared the original document can correct the document (in some cases this is impossible, since this employee may, for example, no longer work for the company or be on vacation). We believe that in the near future, in the course of generalizing practice, additional clarifications from the responsible departments on this issue may appear;

- making corrections to paper documents is permitted only by corrective means: by crossing out the erroneous text or amount and indicating the corrected text or amount above the crossed out;

- correction of electronic documents allows for the preparation of a new document, and the new (corrected) document must contain an indication that it was compiled to replace the original electronic document;

- means of reproducing a new (corrected) electronic document must ensure that it cannot be used separately from the original electronic document. It is worth noting that currently there are little known reproduction tools on the market with similar control functionality, which may create additional difficulties when implementing this requirement;

- making corrections in an accounting register compiled on paper is permitted either by correction or by making a corrective entry in the accounting accounts.

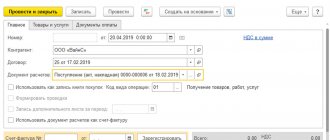

Movement of storage objects during warehouse accounting

Thus, goods and materials arrive at the warehouse with a set of documents from the supplier - a bill of lading, a TORG-12 form, an invoice and other documents accepted from the counterparty. Based on invoices, values are received at the warehouse: a receipt order M-4 is drawn up, a warehouse accounting card M-17 is created for each item. In the future, form M-4 serves as the basis for carrying out incoming transactions in accounting, and the data on M-17 cards is verified with accounting data at the end of the month.

The release of goods and materials into production is carried out on the basis of invoice requirements (form M-11), limit cards (form M-8) with recording of movements in cards M-17.

Other changes

In addition to the above provisions, the text of the FSBU provides for:

- the possibility of registering several interconnected transactions with one primary document, as well as the possibility of registering primary documents not at the same time - at the time of a business transaction - but at a certain frequency;

- maintaining the features of document translation in case of carrying out activities abroad: if local legislation provides for the obligation to compile documents and registers in a foreign language, then line-by-line translation of only registers is needed; If such a requirement is not established, then line-by-line translation of both registers and source documents will be required.

How long to store personnel documents

The instructions to Order No. 237 explain that organizations must ensure that documents are stored for no less than the established periods, and defines the meaning of the terms “until the need passes,” “permanently,” “until liquidation,” “until they are replaced with new ones.” Rosarkhiv Order No. 236 updated the storage periods for personnel documents.

| View | Storage period |

| Vacation schedule | 3 years |

| Books, magazines, accounting cards, vacation databases | 5 l. |

| For disciplinary action | 3 years |

| Appeal about the need for foreign labor | 1 year |

| On the status and measures to improve working conditions and safety | 5 l. |

| Books, registration logs, databases on industrial accidents, logs of accidents, labor safety briefings | 45 l. |

| Labor agreements | 50 l. (upon completion of office work after 01/01/2003) or 75 l. (upon completion of office work before 01/01/2003) |

| Documents for admission, transfer, dismissal | 50 l. (upon completion of office work after 01/01/2003) or 75 l. (upon completion of office work before 01/01/2003) |

| Personal cards of employees | 50 l. (upon completion of office work after 01/01/2003) or 75 l. (upon completion of office work before 01/01/2003) |

| Notifications, employee warnings | 3 years |

| Applications from the employee for the provision of work documents and their copies | 1 year |

conclusions

Obviously, one of the most significant changes introduced by the new FSBU is the requirement for storing documents and placing databases on the territory of the Russian Federation. In our opinion, the introduction of this requirement was dictated by the goal of ensuring timely and unhindered access to accounting documents and databases in the event of control activities.

At the same time, the question of whether the changes lead to the need for complete localization of accounting systems and whether the most optimal approach for all parties has been chosen remains open. We hope that the Russian Ministry of Finance will issue clarifications on this issue in the near future.

In any case, the Federal Accounting Standards will begin to apply on January 1, 2022, which gives businesses a short time (six months) to prepare for the new requirements.

In addition, this standard demonstrates the consistent development of accounting standards following evolving practices, such as the preparation of consolidated documents, the use of electronic and source documents, which helps businesses gain more confidence in the correctness of their practices.

When the shelf life has expired

In accordance with the above-mentioned rules of the Federal Archive, it is necessary to conduct an annual examination of the value of documents . As a result, those papers are selected that are no longer necessary to be stored. They should be destroyed.

The examination of documents has another purpose - to check the lists of documents to be stored and the relevance of the deadlines. The examination is carried out by personnel department employees, the head of the organization is responsible for it. When checking documents for expiration, it is unacceptable to simply look at their title pages and headings - each of them needs to be flipped through.

Based on the results of the examination, a Certificate of allocation for destruction of documents not subject to storage is left. Its form is defined in Appendix No. 4 to the rules of the Russian Archive. Documents are included in the act under a general heading, indicating their number in each group. The act is signed by the head of the company.

Now all expired papers should be destroyed. How exactly to do this? This issue is not regulated, so the company can resolve it independently. Documents can be shredded, recycled, burned - any method will do. Alternatively, you can send the papers for recycling to a specialized organization. Their transfer is accompanied by the execution of an invoice, in which you need to indicate the date, number of documents and their weight. The employee responsible for their safety must monitor the removal of papers subject to destruction.