The company incurs various types of expenses to ensure its own functioning. Not all of them have a direct connection with the main activity. However, they also need to be taken into account and recognized. Since 2006, the gradation of expenses has been simplified: in addition to expenses for core activities, other expenses are allocated. Operating rooms also fall into this category.

What is included in other expenses for accounting purposes?

What costs can be attributed to this article, how to correctly calculate and take into account operating expenses, as well as evaluate the success of their management, read in this article.

What are operating expenses?

All indirect costs of the enterprise are classified as operating expenses. Previously, there was a division of costs into the following:

- non-operating;

- emergency;

- operating rooms.

Since 2006, according to Order 116n of September 18, this division has ceased to be mandatory, but for the convenience of the enterprise it can continue to be applied. Now it is customary to divide all expenses into two large groups.

What expenses are included in other non-operating expenses when calculating income tax?

If we imagine the entire complex of expenses of an enterprise, then at one pole there will be funds intended directly for the production of products, and at the other - other expenses, which include operating costs, that is, additional expenses for providing capital.

FOR EXAMPLE. The company purchased a beverage production apparatus - this is a capital expenditure. Operating funds derived from it will be funds for the purchase of tea and coffee for refilling, sugar, cups, payment for electricity and equipment maintenance, as well as, if the device was purchased on credit, money for paying bank interest.

So, operating expenses (in English literature “operating expenses”, abbreviation “NUT”) are the costs of daily maintaining the functioning of the enterprise.

Difference between capital and operating expenses

The difference between capital expenditure and operating expenditure is how the investment will be made by a company that wants to increase its profits.

A simple example to understand the difference between capital expenditures and operating expenses is movies. Until a few years ago, people bought DVDs, which were physical objects that belonged to the buyer.

Today you buy a movie streaming service that pays monthly. Once a person does not pay, he will no longer use this service.

Consider the example of a company that needs more equipment but doesn't have much money. In this case, the company can choose operating expenses and lease equipment.

This way, in addition to not having to immobilize a large amount of money that could be detrimental to the financial health of the business, she does not have to worry about maintaining the equipment, which is the company's contractual responsibility.

Composition of operating expenses

The current accounting plan 10/99 in paragraph 11 of Chapter 3 provides a complete list of the enterprise’s expenses classified as operating. These include:

- assets provided for rent or other form of temporary use or ownership for a fee;

- intellectual property rights leased out for temporary use;

- contributions to the authorized capital of other LLCs;

- all forms of alienation of one’s property, including products (sale, lease, write-off);

- created monetary reserve funds;

- commissions and interest paid to banking organizations.

NOTE! These expenses will be recognized as operating expenses only if they do not relate to the main activities of the organization, in which case they should be considered ordinary.

Operating expenses classified as other

These include expenses not included in the previous list:

- payment of fines for violation of the conditions specified in the contract;

- compensation for losses caused by the fault of the company;

- losses from financial obligations that can no longer be recovered;

- the size of the difference in exchange rates;

- amounts from the write-off of discounted assets.

Operating and non-operating expenses are...

Before the start of annual reporting for 2006, other costs were divided:

- for operating expenses;

- non-operating;

- emergency.

Operating expenses, by their nature, are contrasted with direct costs for the immediate production of products and capital costs. As an example, the purchase of a coffee machine is a capital expense. And operating costs include the cost of purchasing coffee itself, sugar, water, electricity, and equipment maintenance costs.

Operating expenses include costs aimed at:

- to pay bank interest and commissions;

- creation of cash reserves;

- participation in management companies of other companies;

- provision of copyright for a fee;

- provision of their assets for temporary paid use;

- sale and other disposal/write-off of goods, fixed assets and finished products.

Non-operating costs - costs to cover fines, penalties, interest, losses from previous years identified in the reporting period, exchange rate differences, etc.

Extraordinary – costs arising as a result of extraordinary circumstances.

But after the adoption of Order of the Ministry of Finance dated September 18, 2006 No. 116n, this gradation was abolished and now, according to clause 4 of PBU 10/99, the expenses of any enterprise are divided into costs:

- from normal activities;

- others.

Find out what costs are classified as other in the article “Other expenses in accounting are...”.

A complete list of other costs is given in clause 11 of PBU 10/99. You can find the list in the Ready-made solution from ConsultantPlus:

If you don't have access to K+, you can get a full access trial for free.

Let's consider the procedure for accounting for other income and expenses in accounting.

Accounting for operating expenses

Operating expenses, as they relate to others, are reflected in accounting account 91 (on debit). To account for expenses, a first-order subaccount 91.2 is opened.

For this sub-account, the accountant keeps records throughout the reporting period on a cumulative basis. At the end of the month, the total is summed up: the difference between other income and expenses is displayed on account 91.9.

FOR YOUR INFORMATION! An accountant must keep records in such a way that a specific result can be tracked for each financial transaction.

Accounting entries for accounting for operating expenses

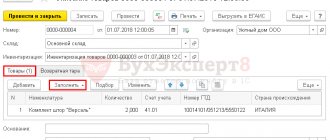

Let's look at operating expenses using a specific example.

Rafflesia LLC sold a machine that had been in use for 3 years (a fixed asset) for 40,000 rubles, including VAT of 6,153 rubles. The initial cost of the fixed asset was 100,000 rubles. According to the documents, the useful life of such a machine is 6 years. For three years of use, a depreciation amount of 55,000 rubles was accrued. The machine was delivered to the buyer at the expense of Rafflesia LLC, which hired transport from a third-party company for this purpose, the costs for this amounted to 15,000 rubles, including VAT of 2,307 rubles.

Let's consider the reflection of this operation in accounting:

- debit 76 “Settlements with various debtors and creditors”, credit 91.1 – 40,000 rubles. – reflection of the buyer’s debt for the sold machine (fixed asset item);

- debit 91.2, credit 01.1 “Fixed assets” – 6,153 rubles. – accrual of VAT on the sale of an object from fixed assets;

- debit 01.2 “Disposal of fixed assets”, credit 01.1 – 100,000 rubles. – reflection of the disposal of fixed assets;

- debit 02 “Depreciation of fixed assets”, credit 01.2 – 55,000 rubles. – write-off of depreciation of fixed assets;

- debit 91.2, credit 01.2 – 45,000 rub. (100 thousand – 55 thousand) – write-off of the residual value of the sold fixed asset item;

- debit 91.2, credit 60 “settlements with suppliers and contractors” – 15,000 rubles. – write-off of transportation costs for delivery of purchased fixed assets to the buyer;

- debit 19 “VAT”, credit 60 – 2307 rub. – reflection of VAT for payment of the organization that carried out the delivery;

- debit 51 “Cash accounts”, credit 76 “Settlements with various debtors and creditors” - 100,000 rubles. – repayment of the buyer’s debt for the purchased fixed asset.

Question: An organization leases a retail space under a lease agreement. According to the agreement, the monthly rent is determined as a certain percentage of the tenant's revenue minus the tenant's operating expenses (operating expenses include amounts for equipment maintenance and personnel wages), the resulting value is increased by the amount of VAT. In the current month, operating expenses exceeded the percentage of revenue, that is, when calculating the amount of rent, a negative value is obtained. Under the terms of the agreement, the tenant issues an invoice to the landlord for reimbursement of expenses. At the end of the year, it is planned to receive revenue from this lease. Is the amount of compensation received subject to VAT for the tenant? View answer

Collection and distribution accounts

They are needed in order to collect indirect costs and distribute them by type of product. The debit of the collection and distribution accounts reflects indirect costs for the month; from the credit they are distributed to costing accounts or directly to the cost of sales of specific products. In any case, indirect costs are no longer written off from the loan as a whole, but separately for each type of product. This group includes accounts 25, 26 and 44, all of which are active.

A feature of the structure of collective and distribution accounts: at the end of each month they do not have a balance, since all indirect costs of the month are distributed by type of product. An exception is account 44, if the company’s accounting policy has decided to partially capitalize selling expenses.

Analysis of the effectiveness of operating expenses

In addition to the purposes of recording monetary transactions, accounting for operating expenses helps to solve additional tasks to improve the efficiency of business activities. This type of cost, along with capital costs, makes up a significant part of the financial costs of any organization.

What can you learn from operating expense metrics?

By comparing these costs with revenue from sales of products, we can draw a conclusion about how expensive it is for the enterprise to produce these types of goods. This ratio is called the operating expense ratio .

It allows you to understand how much percent of the income received goes to support the current activities (operations) of the organization, that is, how effective it is.

If you study this coefficient over time, you can track the potential to increase production and/or sales without unnecessary costs. A decreasing ratio indicates a decrease in operating expenses with a constant or even increasing sales volume. This indicates an increase in revenue, and therefore a net increase in the profit of the enterprise.

What factors influence the operating expense ratio?

The reasons that influence the increase or decrease in operating costs can be either external (independent of the organization itself) or internal.

External factors influencing operating costs:

- the level of inflation in the state: the more intense the inflationary processes, the greater will be the operating costs associated with the recalculation of wages, loan payments, costs for contractors’ services, etc.;

- changes in mandatory payments, as well as tax rates - the higher the taxes, the higher the operating costs.

Internal factors (those that can be changed through the efforts of the company itself):

- volume of production of products and their sales - even if, as a result of an increase in volumes, operating expenses increase, the cost per unit of production will significantly decrease, since operating expenses in their constant part will not change;

- duration of the production cycle - the shorter it is, the faster the assets will turn over, as a result of which operating costs will be reduced due to, for example, storage of goods, its natural loss, management costs, etc.;

- labor productivity - the more products each worker produces per unit of time, the lower the operating costs for settlements with personnel will be;

- state of production assets - less worn-out equipment requires less money for maintenance and repairs;

- the number of current assets owned by the organization - a company that owns more property will spend less on rent, leasing and contracts, which will also reduce operating costs.

RESULT. Operating expenses—the day-to-day expenses to keep the business running—are classified as “other expenses.” Reducing these costs leads to increased profits for the organization.

Calculating operating accounts

Such accounts are used to determine the cost of manufactured or purchased assets. The process of determining the cost of an asset through costs is called costing - hence the name of this type of account.

In relation to the balance, all calculation accounts will be active. The costing account collects the cost from the costs and then transfers it to the asset inventory account. It also happens that the calculation account is an inventory account.

The debit of the calculation account includes costs associated with the production and acquisition of assets. Their cost is written off from the loan:

- when commissioning non-current assets;

- when releasing current assets from production.

This includes accounts. 08, 10, 15, 20, 21, 23, 28, 29, 40. The balance of these accounts increases the valuation of the corresponding assets: fixed assets, intangible assets, profitable investments in materiel, inventories.