Having analyzed the changes in the field of income tax that come into force on January 1, 2022, we can come to the conclusion that the most significant of them are:

- introduction of a new classifier of fixed assets,

- changes in the area of controlled debt criteria;

- replenishment of the list of expenses with costs for assessing the qualifications of employees.

Some other innovations related to individual industries and types of activities are also planned. Let us dwell on each moment for a more detailed analysis.

New OKOF classifier

From January 1, 2022, organizations will determine depreciation groups and depreciation periods for fixed assets according to the new classifier of fixed assets.

At the moment, the fixed assets classifier OKOF OK 013-94 is in effect, approved by Decree of the State Standard of the Russian Federation of December 26, 1994 N 359.

From 2022, the new classifier OK 013-2014 (SNS 2008), approved by Order of Rosstandart dated December 12, 2014 N 2018-st, will come into force.

Thanks to the new OKOF, not only will new classification codes begin to be applied, but also depreciation groups for some fixed assets will change, which in turn will entail a change in their useful life.

The correspondence between the old and new OKOF codes is established by Rosstandart Order No. 458 dated April 21, 2016.

Attention! For fixed assets put into operation before January 1, 2022, there will be no need to recalculate the depreciation rate, even if, according to the new classifier, these fixed assets will belong to a different depreciation group. At the same time, for those fixed assets that will be put into operation from January 1, 2022, taxpayers will be required to apply depreciation groups and useful lives in accordance with the new handbook.

Has the base rate changed?

Organizations that are engaged in activities that are not classified as preferential or special by tax legislation, from January 1, 2022, will continue to pay tax at the basic rate, equal to, as before, 20%. Income tax in Russia is regulatory, that is, distributed between the federal and local budgets. It is in this regard that changes have occurred:

- until the beginning of 2022, organizations transferred 2% of their profits to the federal budget and 18% to the local budget;

- by the end of 2022, legal entities will direct 3% of profits to the federal budget and 17% to the local budget.

Tax accounting of controlled debt

From January 1, 2022, Federal Law No. 25-FZ dated February 15, 2016 will introduce significant changes to Article 269 of the Tax Code of the Russian Federation.

The criteria for recognizing the debt of a Russian company as controlled, the interest on which, as is known, is subject to rationing for tax purposes, will change. As a result, the number of situations in which debt can be considered controllable will increase significantly.

From the beginning of 2022, the amount of controlled debt will be calculated based on the totality of all taxpayer obligations that have signs of such debt.

Law No. 25-FZ, in addition, will make clarifications to paragraph 4 of Art. 269 of the Tax Code of the Russian Federation. According to them, if the capitalization ratio changes in the subsequent reporting period or at the end of the tax period compared to previous reporting periods, the maximum amount of interest to be included in expenses on controlled debt for the previous reporting period is not subject to change.

(The capitalization ratio depends on the amount of debt, the amount of equity capital of the borrower and the share of participation of the foreign company controlling the debt in its capital.)

Income tax rate in 2022

Income tax is transferred to two budgets – federal and regional. Each budget has its own income tax rate. So, in 2022, income tax is charged:

- to the federal budget - at a rate of 3%;

- to the regional budget - at a rate of 17%.

This breakdown is set for the period from 2022 to 2022. Until January 1, 2022, the breakdown was as follows: 2% to the federal budget, 18% to the regional budget.

note

Operators of a new offshore field and holders of relevant licenses apply a 20% rate to the tax base generated when carrying out activities related to the production of hydrocarbons. At the same time, they must transfer the entire amount of income tax to the federal budget (clause 6 of Article 284 of the Tax Code of the Russian Federation). But the amounts of income tax paid by organizations in Crimea and Sevastopol, information about which is included in the Unified State Register of Legal Entities, are credited to the budgets of these entities in full (Clause 4, Article 13 of the Federal Constitutional Law of March 21, 2014 No. 6-FKZ).

Taxable profit is the difference:

- between income that is subject to income tax, received during the reporting or tax period (for example, the first quarter, half a year, 9 months, a year);

- expenses that reduce tax profit incurred during the reporting or tax period (for example, the first quarter, half a year, 9 months, a year).

Firms determine the amount of income tax on their own. Let us recall the formula by which tax is calculated.

Read also: “New income tax return form”

Formula for calculating the amount of income tax

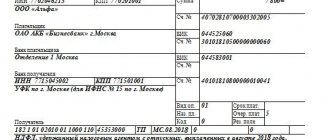

EXAMPLE OF CALCULATION OF INCOME TAX BEFORE JANUARY 1, 2022.

The income of JSC Aktiv, subject to income tax, for the reporting year 2016 amounted to RUB 4,200,000. Expenses that reduce taxable profit for the same period - 3,000,000 rubles. Taxable profit is equal to: 4,200,000 rubles. – 3,000,000 rub. = 1,200,000 rubles. In the region where Aktiv operates, the profit tax rate is: - to the federal budget - 2%; - to the regional budget - 18%. At the end of the year, the company must charge income tax: - to the federal budget – 24,000 rubles. (1,200,000 rubles × 2%); - to the regional budget - 216,000 rubles. (RUB 1,200,000 × 18%). The total amount of income tax will be: RUB 1,200,000. × 20% = 240,000 rub.

Redistribution of income taxes in favor of the federal budget reduces tax revenues to regional budgets. The specified redistribution of the profit tax rate between budgets for the period from 2022 to 2022 was established by Federal Law No. 401-FZ of November 30, 2016.

Read also “Changes in income tax: rates in 2022”

EXAMPLE OF CALCULATION OF INCOME TAX AFTER JANUARY 1, 2022.

The income of JSC Aktiv, subject to income tax, for the reporting year 2017 amounted to 4,200,000 rubles. Expenses that reduce taxable profit for the same period - 3,000,000 rubles. Taxable profit is equal to: 4,200,000 rubles. – 3,000,000 rub. = 1,200,000 rubles. In the region where Aktiv operates, the tax rate is: - to the federal budget - 3%; - to the regional budget - 17%. At the end of the year, the company must charge income tax: - to the federal budget - 36,000 rub. (1,200,000 rubles × 3%); - to the regional budget - 204,000 rubles. (RUB 1,200,000 × 17%). The total amount of income tax will be: RUB 1,200,000. × 20% = 240,000 rub.

Regional authorities can reduce the income tax rate in the part that goes to their budget. However, in any case, it cannot be lower than 12.5% (set for 2017–2020, until January 1, 2022 - 13.5%).

Beginning in 2022, this reduction could result in an overall increase in the amount of income tax an organization pays.

Read also “Writing off overpayments of income taxes”

EXAMPLE OF DISTRIBUTION OF INCOME TAX AMONG BUDGETS

In one of the regions of Russia in 2016, the income tax rate in the part that goes to the regional budget was reduced to 14%. In this case, companies that operate in this region must pay income tax at a general rate of 16% (2% + 14%). In 2017–2020, the situation will be different. If the income tax rate in the part that goes to the regional budget is also reduced to 14%, in this case, firms that operate in this region must pay income tax at a general rate of 17% (3% + 14%).

Read in the taker

What other factors influence the amount of income tax, read in the berator

Stay up to date with the latest changes in accounting and taxation! Subscribe to Our news in Yandex Zen!

Subscribe

Tourist assistance for Russian tour operators

Having examined the changes that are relevant to most business entities, let’s move on to innovations affecting individual areas of business.

Starting next year, innovations in legislation in the field of outbound tourism will come into force, expanding the functions of the association of Russian tour operators, called “Tour Pomosch”.

Thus, from January 1, 2022, instead of a compensation fund, tour operators will create a reserve fund and a personal liability fund.

Accordingly, changes have been made to the Tax Code. According to the new edition of paragraphs. 18 clause 2 art. 251 of the Tax Code of the Russian Federation, funds received by an association of tour operators in the field of outbound tourism in the form of contributions transferred to the reserve fund and personal liability funds will be considered as targeted income for the maintenance of non-profit organizations.

According to the amendments to paragraph 48.15 of Art. 270 of the Tax Code of the Russian Federation (as amended), expenses incurred from both of these funds will also not be taken into account when taxing profits.

What are the special rates?

The range of special “profitable” rates is quite large - from 0 to 30%.

The minimum rate, for example, can be applied by medical companies or companies in the education sector, and since 2015 - by social service enterprises. It also works in a number of other cases.

You can find out whether the 0 rate applies to your company from the materials collected in this subsection of the site. For example, from this article .

It provides a complete list of benefit organizations. Look for yourself in it. What if you overpay into the budget in vain!

Or maybe you are entitled to a 0% rate on “equity” income, that is, on dividends? Or do you pay them to a company that has such a right? Read the article “Conditions for applying a zero rate on income tax when receiving dividends” and you will know the answers to these questions. If you do not have the right to 0%, but there are dividends, let us remind you that the current rate on them is 13%.

By the way, the “dividend” rate is also one of the special ones. Find information about the sizes of other specific bets in this article

Changes in the declaration

Other innovations include changes to the income tax return. Both the procedure for filling out this declaration and its form have changed. When submitting a declaration based on the results of last year, you must use the new declaration. You should pay close attention to the following changes when filling out:

- Taxation of profits of foreign companies. The changes are related to controlling persons - residents of the Russian Federation pay taxes for a controlled foreign company and fill out a declaration.

- A section has also appeared for trade tax payers, who have the right to reduce the tax by the amount of the tax actually paid.

- In the declaration on sheet 02, the formula for calculating the tax base has changed, and new lines have been added. It is necessary to indicate the volume of investments in investment projects. These amendments apply to residents of the free economic zone in Crimea, the free port of Vladivostok and territories of rapid socio-economic development, reflecting zero and reduced rates.

- The norm for making symmetrical price adjustments from 2022 is reflected in the declaration, but the changes occurred in the summer of 2015.

Provisions for doubtful debts

Also, from January 1, 2022, the rules for calculating the reserve for doubtful debts, updated in Art. 266 Tax Code of the Russian Federation.

Firstly

, the very concept of “doubtful debt” has changed, the law clarified it. Doubtful debt is any debt that is not repaid within the agreed period and is not secured by a surety, bank guarantee, or collateral. If the company has accounts payable to the counterparty, then the amount of accounts receivable is reduced by this amount.

Secondly

, amendments introduced by Federal Law No. 401-FZ of November 30, 2016 affected the amounts of reserves and their purpose. The authorities also considered that the taxpayer has the right to use such a reserve only to cover losses from bad debts. It must be remembered that in the current tax period the reserve for doubtful debts, which is 10%, is compared with the revenue of the current reporting period or the previous one. The balance amount based on the results of the previous reporting date is compared with the amount as of the reporting date in accordance with Federal Law No. 405-FZ dated November 30, 2016.

According to the new rules, you can choose the larger of two limits when determining the amount of the reserve created at the end of the reporting periods:

- 10% of revenue for the previous tax period;

- 10% of revenue for the current reporting period.

Further, if the amount of the reserve is less than the balance, it is included in non-operating income, but if it is more, then it is included in non-operating expenses.