L. V. Sologubova author of the article, consultant to Askon on accounting and taxation in budgetary organizations

From January 1, 2022, new federal accounting standards come into force. But not all institutions will need to apply new standards and adjust accounting policies.

- Reserves

(Order No. 256n dated December 7, 2022 “On approval of the federal accounting standard for public sector organizations “Inventories”).

- Long-term contracts

(Order of the Ministry of Finance of Russia dated June 29, 2018 N 145n “On approval of the federal accounting standard for public sector organizations “Long-term agreements”).

- Reserves. Disclosure of contingent assets and contingent liabilities

(Order of the Ministry of Finance of Russia dated May 30, 2018 N 124n “On approval of the federal accounting standard for public sector organizations “Reserves. Disclosure of information about contingent liabilities and contingent assets”).

- Concession agreements

(Order of the Ministry of Finance of Russia dated June 29, 2018 N 146n “On approval of the federal accounting standard for public sector organizations “Concession agreements”).

- Budget information in financial statements

(Order of the Ministry of Finance of Russia dated February 28, 2018 N 37n “On approval of the federal accounting standard for public sector organizations “Budget information in accounting (financial) statements”).

Standard "Inventories"

From January 1, 2022, the FSBU “Reserves” will come into effect.

According to this standard, the NFA will include inventories and work in progress (clause 7 of the “Inventories” Standard).

Work in progress before this standard was accounted for, as is known, on account 109 (clause 137 of Instruction 157n).

According to this standard (clause 7 of the Inventories Standard), inventories must meet the criteria of an asset - owned, beneficial and controlled

.

When preparing for the implementation of this standard, also pay attention to the Methodological recommendations for its application - letter of the Ministry of Finance of the Russian Federation dated August 1, 2022 No. 02-07-07/58075.

If the facility has biological products (derived from biological assets), then this will be subject to the Inventory standard.

Biological assets are regulated by a different standard.

Starting from the new year, it is necessary to distinguish 4 groups of supplies:

- materials;

- finished and biological products;

- goods;

- other supplies.

According to paragraph 117 of Instruction No. 157n there are 9 groups.

The standard allows the use of material supplies for a period of more than 12 months (clause 7 of the Standard “Inventories”).

The generalizing group will be other inventories (clause 7 of the Standard “Inventories”).

“Unfinished” will now be an independent group.

According to Instruction 157n, “unfinished” means materials for production (clause 137).

It would be advisable to group, obviously, inventories in accordance with the requirements of the new standard and reflect them in the accounting policies.

According to the new standard, “inventories” are not only unfinished products, but also works and services.

In universities, colleges, and institutes, the financial year does not coincide with the academic year and, accordingly, the service should be considered as work in progress.

It should also be noted that there is a possibility of inventory reclassification - a transfer from one group to another.

If the transfer is carried out for the needs of the institution, then accounting is kept at the actual cost, which is recognized as the original

Please also note that the standard does not apply to library collections, biological assets, construction in progress, cultural heritage and financial instruments.

Balances at the beginning of the year will need to be carried over inter-reporting period using the 401 30,000 account.

To use these standards, an institution must adjust its accounting policies for 2022.

Federal standard "Intangible assets"

The new Standard will be applied when maintaining budgetary and accounting records from January 1, 2022, as well as when preparing budgetary and accounting reporting, starting with reporting for the specified year.

What objects are recognized as intangible assets?

The standard provides for the division of assets into two subgroups:

- Intangible assets with a certain useful life;

- Intangible assets with an indefinite useful life.

Please note that the standard will not be used in relation to certain accounting objects (for example, financial assets and investments, results of intellectual activity acquired for resale, rights to use an asset arising under lease agreements).

How to apply the standard for the first time

The institution recognizes intangible assets that were not previously recognized, but were reflected off the balance sheet, at fair value. This will be the book value.

The financial result from the recognition of intangible assets that were not previously recognized in accounting and reporting is taken into account as an adjustment to the opening balance of the financial result of previous reporting periods in the period in which the objects were recognized for the first time. The results of this adjustment are disclosed once in the annual accounting (financial) statements.

Upon initial recognition of intangible assets, any accumulated impairment losses that were associated with such items are recognized. Comparative information on intangible assets for the years preceding the first application of the standard is not recalculated.

Intangible assets that were previously recorded on an off-balance sheet account are recorded on the corresponding balance sheet accounts at fair value if they meet the criteria for recognizing an asset. The financial result from the recognition of such intangible assets is recognized as an adjustment to the opening balance of the financial result of previous reporting periods in the period in which their initial recognition occurred. The results of the adjustment are disclosed once in the annual financial statements (clauses 49, 50 of the GHS “Intangible assets”).

Registration of intangible assets

An object of non-financial assets is taken into account as part of a group of intangible assets if the following conditions are met:

- the institution anticipates obtaining economic benefits or useful potential from its use;

- the institution can reliably estimate the original cost of the object.

Intangible assets are accepted for accounting by the institution that actually uses (has the right to use) such an object. Whether the asset was assigned by the owner (founder) or received in the course of financial and economic activities does not matter.

The procedure for writing off intangible assets

The disposal of an intangible asset from accounting is carried out in the following cases (clause 39 of the GHS “Intangible assets”):

- the institution has transferred all significant operational risks and benefits associated with the disposal (ownership, use) of the asset;

- the institution no longer manages or uses the intangible asset;

- the amount of income (expense) from disposal of an intangible asset can be reliably estimated;

- the projected economic benefits or utility potential of the intangible assets, as well as the costs incurred or expected to be incurred in connection with the operations of the intangible assets, can be reliably estimated.

Simultaneously with the write-off of the book value of intangible assets, the amount of accumulated depreciation and accumulated impairment loss on these objects is subject to write-off.

Income received as a result of disposal of intangible assets is subject to initial recognition at fair value.

When alienating assets of intangible assets not in favor of public sector organizations, they are reflected in accounting at fair value, determined by the market price method. In this case, the result of revaluation to fair value is reflected in accounting and disclosed separately in the financial statements as part of the financial result of the current period (clauses 24, 25 of the GHS “Intangible assets”).

The financial result arising from the disposal of an intangible asset is reflected as part of the income or expenses of the current period at the time of derecognition of the asset and is determined as the difference between the proceeds from disposal, if any, and the residual value of this asset (clauses 42, 43 of the GHS “Intangible Assets”) ").

Reflection of information about intangible assets in reporting

For each subgroup of intangible assets, it is necessary to reconcile the residual value at the beginning and end of the period separately for objects that were created in-house and for other objects. In this case, be sure to highlight the license agreements.

In addition, the reporting discloses the nature and consequences of changes in estimates of intangible assets that affect the reporting period or those that will affect subsequent periods:

- for the useful life of intangible assets;

- methods for calculating depreciation of intangible assets.

The annual reports also additionally (if any) disclose:

- the book value of intangible assets that are in use and have zero residual value;

- the amount of R&D costs recognized as an expense during the period.

Standard “Long-term contracts”

The “Long-term agreements” standard will be relevant, for example, for universities, colleges, and technical schools, since the period for providing services by these institutions can be more than a year, and the institution is the executor (clause 3 of the “Long-term agreements” standard, approved by Order of the Ministry of Finance of Russia dated June 29. 2018 N 145n). The amount of income and expenses under long-term contracts will need to be reflected on balance sheet accounts, but off-balance sheet accounts will also need to be introduced.

This standard can be applied if the contract begins in one year and ends in another.

If the organization has long-term construction contracts, then the accounting policy will also need to specify how and by whom the percentage of the organization’s fulfillment of obligations is determined, as well as the composition of the document flow on these issues.

Please also pay attention to the list of contracts to which this standard cannot be applied (research and development contracts, etc.).

Now, when conducting an annual inventory, it is advisable to compile a list of long-term agreements of the institution.

When applying this standard for the first time, it will be necessary to reflect deferred income (account 401 40 000) and previously unaccounted income from sales (use account 205, which will correspond with account 40110).

Types of accounting standards

Federal Law “On Accounting” No. 402-FZ dated December 6, 2011, part 1 of Art. 21 identifies the following types of accounting standards:

- federal - established by the legislation of the country, relevant for any organizations operating on the territory of the Russian Federation;

- industry - adopted by regulatory documents for the relevant field of activity;

- internal - adopted by local acts of each individual enterprise.

IMPORTANT! Federal and industry standards are mandatory. When developing internal standards, the organization must ensure that they do not contradict industry and federal ones.

Standard “Reserves. Disclosure of information about contingent assets and contingent liabilities"

Standard » Reserves. Disclosure of information about contingent assets and contingent liabilities”, 5 new types of reserves were approved:

- reserves for warranty repairs,

- restructuring,

- claims,

- unprofitable contractual obligations,

- dismantling (decommissioning) of fixed assets.

Please note that this standard does not regulate the reserve for vacation pay. Now this issue is regulated by Instruction No. 157n (Order of the Ministry of Finance of Russia dated December 1, 2010 N 157n “On approval of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state ( municipal) institutions and Instructions for its use").

From 2022, this issue will be regulated by the FSBU “Payments to Personnel”.

We recommend

Public sector accountant: accounting and taxation in budgetary, autonomous and government institutions, taking into account the changes that came into force in 2019-2020. Transition to federal accounting standards. Course in St. Petersburg + Online broadcast

The course is devoted to the study of issues the knowledge of which is necessary for a public sector accountant: changes in legislation, including issues of transition to federal accounting standards, accounting and reporting, taxation, practical aspects of entrepreneurial activity.

Standard “Concession Agreements”

A concession agreement is a mutually beneficial partnership between the state and business, in which the former relieves itself of part of the burden, for example, on the construction of some facility, and the latter gets the opportunity to earn money. The parties to the agreement are the grantor and the concessionaire.

Grantor

- the one who transfers the rights to the objects of the agreement. It can be a state, a subject of the Russian Federation, a municipality and some state-owned companies.

Concessionaire

- the one to whom rights are transferred. It can be an organization, individual entrepreneur or several companies that have entered into a simple partnership agreement.

In 2022, in preparation for the transition to the “Concession Agreements” standard, it is necessary to conduct an inventory.

When making an inventory of objects arising during the execution of concession agreements for the reporting year as of January 1, 2020, accounting data should be synchronized with monitoring data on the conclusion and implementation of concluded concession agreements. Rules for monitoring have been approved.

In accordance with the “Concession Agreements” standard, the transfer under this agreement of the property of an institution under operational management is reflected in account 101 and in off-balance sheet account 24.

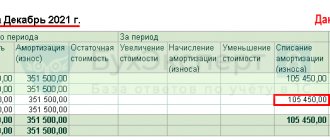

Depreciation will be charged by the public sector organization as balance holder.

It will be necessary to form the cost of the created object on an off-balance sheet account.