Briefly about the history of the taxation system in Russia

The tax system of the Russian Federation began to take shape after the collapse of the USSR, namely in December 1991.

Then the law “On the Fundamentals of the Tax System of the Russian Federation” was adopted. He introduced new taxes and fees, for example, VAT, income tax, excise taxes on alcohol and tobacco products and others. In 1998, the 1st part of the Tax Code of the Russian Federation was approved, in 2000 - the 2nd part. This code has become the main legislative act in the Russian tax system. The Tax Code of the Russian Federation determined the relationship between the state and taxpayers, the structure and elements of the Russian tax system. Separately, it is worth highlighting the formation of state bodies to supervise taxation in the Russian Federation. In 1990, the State Tax Inspectorate was created, which was then transformed into the State Tax Service. In 1998, the Ministry of Taxes and Duties appeared. In 2004, it was reorganized, and its functions were transferred to the Ministry of Finance of the Russian Federation. From the same year, the well-known Federal Tax Service began to function, which continues to operate to this day.

The tax system is... (concept and structure)

The tax system of the Russian Federation can be defined as the totality of all taxes and fees adopted in Russia, as well as administrators of taxes and fees (government bodies) and their payers.

The structure of the Russian tax system implies a complex interaction of all its constituent elements: taxes (and, since 2017, also insurance premiums) and fees, their payers, the legal framework and government bodies.

The structure of the tax system of the Russian Federation has 3 levels:

- federal;

- regional;

- local.

The tax level determines the corresponding budget level to which it is credited.

Since the tax system of the Russian Federation has a 3-level structure, the legislative framework on taxes and fees is also divided into 3 levels:

- Federal legislation is the highest level of the legislative framework. It operates throughout the Russian Federation. By-laws and other normative legal acts must not contradict it. This category includes both parts of the Tax Code of the Russian Federation, federal laws that are consistent with the provisions of the Tax Code of the Russian Federation, decrees of the President of the Russian Federation, resolutions of the Government of the Russian Federation and, of course, the Constitution of the Russian Federation.

- Regional legislation includes the laws of the constituent entities of the Russian Federation on taxation in a specific region of our country.

- Local legislation consists of normative legal acts that are adopted by representative bodies of local government (councils of deputies, legislative assemblies).

Research staff of Nizhny Novgorod State University named after. N.I. Lobachevsky conducted a study assessing the risks and effectiveness of various tax systems at different levels of the budget system. You can get acquainted with the conclusions of Doctor of Economic Sciences M. Yu. Malkina and her assistants in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

In addition, on the basis of the Tax Code of the Russian Federation, the Ministry of Finance of the Russian Federation and the Federal Tax Service of the Russian Federation develop orders, clarifications, clarifications, letters and other similar documents. They are necessary to specify the provisions and articles of the Tax Code of the Russian Federation and other federal laws of the Russian Federation in the field of taxation. Such documents clarify situations that are unclear from the point of view of taxpayers and can be drawn up on the basis of their requests.

Read more about federal, state and local taxes in this article.

Types of double taxation

There are two types of double taxation:

- Internal. Assets are taxed domestically. Tax collection is carried out at various administrative levels. This form of taxation can be vertical. In this case, collection is carried out at the local and state level. The vertical form is relevant for Sweden. There is also a horizontal form. In this case, tax collection is carried out at one level. This form is relevant for the USA. Some states only tax income earned there, while others tax income earned in other states.

- External. External double taxation arises from the difficulty of identifying either the taxpayer or the tax base.

IMPORTANT! The external form involves taxation outside the state.

What are the reasons for double taxation?

Double taxation occurs in the following cases:

- The company has dual residence. That is, she is recognized as a resident in two countries.

- The same income is taxable in two states. For example, in one country, income is recognized as taxable based on the residence of the company, and in the second - based on the norm on the source of income.

- Company expenses are counted differently in different states.

- The source of income is located in several states.

The main reason for the formation of double taxation is different regulations in different states, different regulation of the tax base. In addition, the regulation can be interpreted in several ways.

Let's look at an example. In the US, inaccurate declarations can result in fines of up to $10,000. In Switzerland, incorrect information in the declaration, if the violations are minor, is treated more favorably. Inaccuracies will not be considered violations. In this case, an international agreement is necessary. It is required to harmonize interpretations of regulations.

Elements of the tax system of the Russian Federation

As noted earlier, the tax system of the Russian Federation involves the interaction of all its elements and an integrated approach to solving tax problems. All constituent elements form the tax structure of the Russian Federation.

The structure of the Russian tax system includes:

- all taxes, insurance premiums and fees accepted on the territory of our country in accordance with the Tax Code of the Russian Federation;

- subjects of taxes and fees;

- regulatory framework;

- government authorities in the field of taxation and finance.

Now let's look at each element of the Russian tax system in more detail.

Taxes and fees established in Russia are obligatory for those categories of taxpayers who are responsible for their payment in accordance with the provisions of the Tax Code of the Russian Federation. The concept of tax and fee is defined in the Tax Code of the Russian Federation.

The subjects of taxation are taxpayers (legal entities and individuals) and tax agents, that is, those who, according to the Tax Code of the Russian Federation, pay taxes and fees. As an example of tax agents, we can cite enterprises and organizations that calculate and transfer personal income tax on the accrued income of their personnel, and also submit the corresponding tax reports (6-NDFL) after the end of the tax period (year).

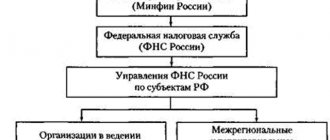

The system of tax authorities of the Russian Federation includes:

- Ministry of Finance of the Russian Federation.

- Federal Tax Service of the Russian Federation.

The Ministry of Finance of the Russian Federation determines the main directions of the tax policy of our state, forecasts tax revenues and makes proposals for improving the tax system of the Russian Federation as a whole. His department includes the Federal Tax Service of the Russian Federation as an executive body of state power.

The main functions of the Federal Tax Service of the Russian Federation are:

- accounting of taxpayers and fees;

- control over compliance with tax legislation requirements;

- supervision and verification of tax accruals, their payment to the relevant budget and tax reporting.

Read about tax audits in our section of the same name “Tax Audits”.

The Federal Tax Service of the Russian Federation is a unified system of all tax authorities. The unified centralized system of tax authorities consists of:

- Management in each subject of the Russian Federation. The territorial tax authorities and inspectorates of the Federal Tax Service of the Russian Federation are subordinate to him.

- Interregional inspections of the Federal Tax Service for each federal district. Subordinate to them are interregional inspectorates for the largest taxpayers, for centralized data processing (DPC), as well as interdistrict inspections.

Tools to eliminate double taxation

To eliminate DN, use two methods:

- One-sided. Involves measures on the part of one state. This changes tax regulations in one country. The first method of unilaterally eliminating DV is a tax credit. It involves offsetting taxes paid in another country against the payer’s obligations within the state. The second method is a tax discount. It involves deducting from the amount of taxes within the state the amount of taxes paid in another country.

- Multilateral. Involves the conclusion of international agreements and conventions. That is, to implement this method, the efforts of two states are needed. The most relevant method is distribution. In this case, assets in one state cease to be taxed in favor of another country.

FOR YOUR INFORMATION! As a rule, both of these methods are used to eliminate double taxation.

What are the taxes in the Russian Federation?

In total, there are 14 taxes in our country: 8 federal, including state duty, 3 regional and 3 local. There are 5 special taxation systems that stand a little apart. We will also highlight insurance premiums and the new experimental taxation regime for self-employed persons, introduced in 2022.

Read more about the experiment on taxation of the self-employed here.

Federal taxes throughout the territory of our state have the same tax rates, calculation rules and transfers in accordance with the Tax Code of the Russian Federation. These include:

- personal income tax;

- corporate income tax;

- VAT;

- excise taxes;

- water tax;

- mineral extraction tax;

- state duty.

Special tax systems also fall into this category: simplified tax system, production division, unified agricultural tax and PSN (patent).

Regional taxes are also approved by the Tax Code of the Russian Federation at the federal level. Regional authorities have the opportunity to change taxation conditions at their discretion and within the limits adopted by the Tax Code. For example, regions can set a tax rate, but not more than the amount prescribed in the Tax Code of the Russian Federation. All changes are fixed by the laws of the constituent entities of the Russian Federation. This includes transport tax, gambling tax, and corporate property tax. Regional government bodies can also introduce special tax regimes and make their own changes to them, but in accordance with the provisions of the Tax Code of the Russian Federation.

Local taxes, however, like other taxes and fees in Russia, are also approved by the Tax Code of the Russian Federation. Local self-government bodies can make changes and additions to them within the framework of the Code. Local taxes include:

- land tax;

- property tax for individuals;

- trade fee.

Depending on the manner of collection, taxes can be divided into 2 main categories: direct and indirect. Direct taxes are charged directly on the income or value of the taxpayer's property. Indirect taxes are included in the cost of goods, services and works. In fact, they are paid by the buyer of the product, and the seller acts as an intermediary between the indirect tax and the state. In the Russian Federation there are only 2 indirect taxes: VAT and excise taxes. All others are direct.

For more information about direct and indirect taxes, read the article “What taxes are classified as direct and indirect (table)?”

Salary payments

If the taxpayer’s staff includes hired workers, then special “salary” fees will have to be assessed and paid. Such payments to the budget include:

- Personal income tax. This obligation is calculated from the income of employees. However, accruing, withholding and transferring funds to the budget is the direct responsibility of the company. In this case, the company acts as a tax agent.

- Insurance contributions to the Federal Tax Service. This type of encumbrance includes payments for compulsory medical and pension insurance, as well as fees for temporary disability and maternity benefits.

- Insurance contributions to the Social Insurance Fund. Payments form an off-budget fund, through which benefits are paid to citizens for accidents and occupational diseases.

It is worth noting that the employer may pay additional contributions to the insurance coverage of citizens. Such payments are typical for hazardous and hazardous industries. In addition, voluntary insurance of citizens is also provided. When an employer transfers part of an employee’s salary to a funded pension.

Types of taxation systems in the Russian Federation: basic, simplified taxation system, etc.

Choosing a taxation system in Russia for business entities is an important event that allows you to determine the tax burden for business. Let's look at the main types of taxation in Russia.

The tax system of the Russian Federation includes 5 tax regimes plus another experimental one (from 2022):

- Basic taxation system (OSNO).

This mode is assigned to a business entity automatically immediately after registration with the Federal Tax Service. It can be used by both LLCs and individual entrepreneurs. The taxpayer has the right to switch to a special regime subject to compliance with the conditions established by tax legislation.

- Simplified taxation system (USNO).

The simplified tax system has the right to be used by taxpayers who:

- the average number of employees does not exceed 100 people;

- the residual value of depreciable fixed assets does not exceed 150 million rubles;

- income for 9 months do not exceed the amount of 112.5 million rubles, adjusted by the deflator coefficient (according to the latest clarifications of the Ministry of Finance in 2022, for the transition to the simplified tax system from 2022, taking into account indexation, it is equal to 123.3 million rubles).

- Unified Agricultural Tax (USAT).

Only agricultural producers have the right to use this regime.

Read about the details of using the Unified Agricultural Tax in the section “Unified Agricultural Tax”.

- Patent (PSN).

PSN has the right to be used exclusively by individual entrepreneurs. The meaning of this regime is that a merchant buys a patent for a certain period not exceeding 12 months.

See here for details.

How to choose the best tax system

- BASIC.

This regime has the highest tax burden:

| Tax | OOO | IP |

| Income tax | 20% | – |

| Personal income tax | – | 13% |

| VAT | 10 or 20% of the markup amount depending on the type of goods | |

| Excise taxes | The rate depends on the type of product | |

| Property tax | The rate is set by regional authorities | |

| MET | The rate depends on the type of minerals | |

| Transport tax | The rate is set by regional authorities and depends on the power of the vehicle | |

| Water tax | The rate depends on the type of water body | |

If your business is just starting to develop, we recommend paying attention to special modes. Let's consider the main one - the simplified tax system.

- USNO

The taxpayer must first decide on the type of taxable object. With the simplified tax system there are 2 of them:

- Income from which 6% is paid to the budget.

- The difference between income and expenses, from which 15% should be transferred to the state.

| pros | Minuses | ||

| Income (6%) | Income minus expenses (15%) | Income (6%) | Income minus expenses (15%) |

| The single tax replaces the income tax (personal income tax for individual entrepreneurs), VAT, property tax (with the exception of the tax calculated from the cadastral value of real estate) | A closed list of expenses that can be used to reduce income received for the year | ||

| One year-end declaration is submitted to the Federal Tax Service | In case of loss, a minimum tax of 1% of income is paid | ||

| Accounting is carried out in a simplified version | |||

| The tax amount can be reduced by the amount of the transferred insurance premiums | Opening branches is not available | ||

To decide which type of simplified tax system to choose, you need to study the amount of documented expenses. If it is at least 60% of the amount of income, then a simplified tax system of 15% is more profitable; if less, then it is better to choose a simplified tax system of 6%.

For the nuances of using the simplified tax system, see the “STS” section.

Practical recommendations on choosing the optimal taxation system for organizations and individual entrepreneurs are provided by ConsultantPlus experts. Get free access and go to Ready-made solutions using the links provided.

The essence of the OSNO, USN, UTII modes

OSNO is a generally established taxation system to which almost the entire Tax Code of the Russian Federation is dedicated. Using this system, if there is an appropriate object of taxation, the taxpayer must pay all taxes in force on the territory of Russia.

At the request of the taxpayer, the Tax Code of the Russian Federation allows the use of special tax regimes, which can either replace OSNO or be used along with it. Such special regimes, in particular, include the simplified tax system and UTII, which are widespread in small and medium-sized businesses.

The simplified tax system can only be used instead of OSNO, and UTII can either replace OSNO or simplified tax system, or be used in conjunction with each of these modes.

Despite a number of similarities, the essence of the special regimes of the simplified tax system and UTII is fundamentally different. The simplified tax system is a simplified version of the OSNO, which, subject to the restrictions established by law, can be used by small organizations and individual entrepreneurs for any type of activity. UTII is applicable only to certain types of activities of companies and individual entrepreneurs, but it almost does not depend on the scale of this activity.

When both special regimes are applied, instead of the 3 taxes obligatory for payment on OSNO (profit, property and VAT), 1 tax (single) is paid. Although in some cases, along with this tax, there may also be a need to make payments for the taxes it replaces.

The algorithms for calculating this single tax under the simplified tax system and UTII are also completely different. Payment of other taxes and insurance contributions for the simplified taxation system and UTII systems, if there is an object of taxation, is just as mandatory as for the OSNO.

When applying all 3 taxation systems, firms are required to maintain accounting and prepare financial statements. SMP can do this using simplified options. Individual entrepreneurs are exempt from accounting and submission of accounting reports.

Both companies and individual entrepreneurs must keep tax records using OSNO and the simplified tax system.

With all options for combining modes, it is necessary to organize separate accounting and tax accounting.

Results

The Russian tax system involves a complex interaction of all elements that form its structure. The elements of the tax system of the Russian Federation include: taxes and fees, their payers, the regulatory framework and government authorities in the tax field. The structure of the Russian Federation system in the field of taxation has 3 levels: federal, regional and local. At each of these levels, relevant legislative acts are adopted, which should not contradict the provisions of the Tax Code and the Constitution of the Russian Federation.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Interstate agreements

The first interstate agreement was signed between France and Belgium in 1843. At this time, there are more than 400 such agreements. However, almost all of these regulations are based on the principles of the Pareto optimum. The main criterion: the optimal option is the one that benefits one party, but does not harm the other party. Based on this, we can say that interstate agreements should not worsen the position of the participating country. It is on the basis of the agreement that tax jurisdiction is established.

Based on various international conventions, these methods of eliminating double taxation are distinguished:

- Formation of precise concepts that are used within the framework of regulations. Interpretation of terms.

- Development of a scheme for eliminating DV, in which each country chooses a separate tax base. The tax is levied on specific income.

- Formation of a mechanism for eliminating DV in cases where both states impose taxes on all income.

- Elimination of taxation that discriminates against the payer in another country.

- Exchange of up-to-date information to prevent evasion of mandatory fees or abuse of the law.

- Establishing optimal methods for liquidating DV in relation to residents’ income.

States should assist each other in taxation.