Direct and indirect expenses in tax accounting

The Tax Code does not clearly define the terms “direct” expenses and “indirect” expenses.

However, from the wording of Articles 318 and 320 of the Tax Code of the Russian Federation, we can conclude that direct costs are those that have a clear connection with the process of production of goods (performance of work, provision of services). Indirect costs do not have such a direct connection. The composition of direct and indirect costs in each organization will be individual. It is necessary to determine a comprehensive list of direct expenses and consolidate it in the accounting policy. For information on how to draw up and approve it, see “Accounting policies of the organization: samples for 2021, how to draw up, examples.”

Get a free sample accounting policy and do accounting in a web service for small LLCs and individual entrepreneurs

Expenses that are not specified in the accounting policy as direct will be considered indirect (Article 318 of the Tax Code of the Russian Federation). At the same time, there is no need to divide non-operating costs into direct and indirect (clause 1 of Article 318, paragraph 3 of Article 320 of the Tax Code of the Russian Federation).

Important

Only those organizations that operate on the accrual basis should distribute expenses into direct and indirect ones. Taxpayers who determine income and expenses using the cash method do not make such divisions.

How to reduce production costs

Reducing costs will allow the company to operate more efficiently and, depending on its goals, earn more or have a competitive price. Mikhail decided to find out if he could reduce the cost of his products and calculated different savings options in the table:

Option 1. Reducing the cost of raw materials

You can buy larger quantities, negotiate a discount, or find a new supplier. Mikhail’s most expensive direct cost item is minced meat; reducing its cost by 5% results in a reduction in cost by 3 rubles.

Option 2. Increasing labor productivity

The more products are produced, the lower the indirect costs per unit of production. You can make workplaces more convenient, optimize work and motivate employees. If you increase the number of dumplings produced by 20%, then the cost will fall by 13 rubles. Plus, production will require more raw materials, therefore, you can ask the supplier for more favorable conditions.

Option 3. Automation of production

This method will allow you to replace employees with equipment and save on labor costs. Of course, you need to maintain a balance; too expensive equipment may not pay for itself with small volumes. Mikhail plans to buy an automatic machine for 150,000 rubles for making dumplings. Its installation will eliminate the need for one of the kitchen workers. Despite the high cost, its depreciation will be 6,250 rubles with an estimated service life of 24 months. This is significantly less than the employee's salary. As a result of production modernization, the cost of dumplings will decrease by 13 rubles.

Option 4. Saving electricity, water, reducing rent

They will also lead to a reduction in indirect costs and a reduction in production costs. Reducing these costs by 25% will reduce the cost of production by 5 rubles.

Oksana Bondarenko, director:

“With the help of cost, you can not only formulate a pricing policy, but also monitor the success of your business. For example, if the cost goes down, this is a good sign. The more a business produces, the smaller the share of expenses in expenses begins to be taken up by renting premises and depreciation. Costs are also reduced by increasing the efficiency of employees: we produce more, but we pay the same as before.”

What are direct costs

Direct costs are those costs that can be attributed to specific goods, work or services. For example, in production these are usually the cost of raw materials and supplies, workers' wages, as well as depreciation of production equipment (machines, machines, workshops). In trade, direct costs can be considered the cost of goods and their delivery, insurance costs, customs duties and other transportation and procurement costs.

Check the financial condition of your organization and its counterparties

What is included in production costs?

Production cost includes:

- raw materials - what a product is made from;

- wages and insurance contributions of employees in production;

- workshop rental;

- public utilities;

- depreciation of equipment or building.

In the simplest case, if a company produces only one type of product, all these expenses for a month can be summed up and divided by the volume of products produced. Production costs include only those raw materials and supplies that were used. If a ton of raw materials was purchased, and three hundred kilograms were used for production in a month, only their cost is included in the cost price. The rest is reserves that do not affect the calculation.

Mikhail has a dumpling production company, the business is profitable, there are regular customers and trusted suppliers. At a certain stage, I wanted to know whether it was possible to sell products cheaper in order to capture a larger market share and squeeze out competitors. To do this, we decided to calculate the cost of production. Mikhail records all operations in the PlanFact service, so it was easy to understand how much was spent on production. The expenses were collected in a table:

To calculate the depreciation of the refrigeration chamber, its price was divided by the expected service life in months. The purchase price is 36,000 rubles. Estimated service life is 3 years or 36 months. Depreciation per month: 36,000: 36 = 1,000 (rub.)

In March, Mikhail’s company produced 2,000 kilograms of dumplings, the cost of one kilogram was 164 rubles: 328,000 : 2,000 = 164 (rubles)

Mikhail entered this amount into the discount calculator to estimate what price he could offer customers in order to increase market share.

What to do if some of the products have not gone through all stages of production, and production is not completed at the end of the month? How, then, is the cost calculated? For example, at the beginning of the month, work in progress amounted to 50,000 rubles. 200,000 rubles were spent per month, and at the end of the month the amount of work in progress was 20,000 rubles. 1000 units of products were produced.

Calculating the cost of production in this case will look like this:

Unit cost = (Work in process at the beginning of the month + Money spent on production for the month - Work in process at the end of the month) : Quantity of goods produced

Unit cost of production = (50,0000) : 1000 = 230 (rub.)

What are indirect costs?

All costs that are not fixed in the accounting policy as direct and are not non-operating (clause 1 of Article 318 of the Tax Code of the Russian Federation) can be considered indirect.

Attention

The decision about the impossibility of classifying a particular expense as direct (and, accordingly, recognizing it as indirect) must be made in each specific case, taking into account economically sound indicators and features of the technological process. This has been repeatedly explained by the regulatory authorities (letters from the Ministry of Finance dated 09.05.18 No. 03-03-06/1/63428, dated 03.13.17 No. 03-03-06/1/13785, dated 05.19.14 No. 03-03-RZ/23603 and letter of the Federal Tax Service dated February 24, 2011 No. KE-4-3 / [email protected] ). The courts adhere to a similar position (decision of the Constitutional Court of the Russian Federation dated April 25, 2019 No. 876-O).

List of indirect expenses for income tax

The Tax Code does not contain a clear list of indirect costs. The only expense that is directly named in the Tax Code of the Russian Federation as indirect is the depreciation bonus. This is recognized as part of the cost of a fixed asset, which is written off at a time during the period of putting the object into operation (clause 9 of Article 258, paragraph 2 of clause 3 of Article 272 of the Tax Code of the Russian Federation).

In practice, indirect costs are usually considered to be the salaries of management personnel and employees of departments not directly involved in production. This category of expenses also includes expenses for repairs and rental of non-production facilities, expenses for business trips or advertising. Depreciation on fixed assets that are not used to produce products (for example, office equipment, computers, furniture, vehicles intended for management personnel) is also an indirect expense.

Maintain tax and accounting records of fixed assets according to current rules Try for free

Examples of direct and indirect costs (table)

Here are examples of the most common direct and indirect costs

| Direct | Indirect |

|

|

Fill out, check and submit your income tax return online for free

Costing formula: direct costs

In general terms, costing involves determining direct costs and what proportion of indirect costs is attributable to a given product.

Determination of the volume of direct costs related to a specific type of product:

Direct = Р1 + Р2 + … + Рn,

Where:

Directly - direct costs;

P1, P2…Pn - expense 1, 2 and further by costing items or cost elements (materials, depreciation of fixed assets, wages of production personnel, etc.).

Costing is usually carried out in relation to a unit of output (pieces, liters, etc.). This is due to the fact that during the production process, component costs, such as raw materials and materials, may undergo various changes - quantitative and qualitative.

For example, 1 kg of wheat flour, 300 g of water and 30 g of yeast will yield approximately 1.5 kg of bread. How to calculate the direct costs of raw materials for 1 loaf?

For these purposes, there are special calculation tables - technological and calculation cards. Technological maps reflect the quantitative and qualitative changes that occur with raw materials during the production process. The input is the raw materials (for example, flour and yeast), the output is the finished product in physical units of measurement. In calculation cards, a cost expression is added at the input.

Example

The company bakes bread. According to the technology used, 1.5 kg of bread is obtained from 1 kg of wheat flour, 300 g of water and 30 g of yeast.

The weight of one loaf is 500 g.

According to calculation cards (with current prices from suppliers):

- 1 kg of flour - 30 rubles;

- 300 g of water - 1 rub.;

- 30 g of yeast - 2 rubles.

Material costs in value terms for 1 loaf: (30 + 1 + 2) / (1500 / 500) = 11 rubles.

Why is it necessary to separate direct and indirect costs?

You can recognize direct expenses that fall on goods, works, and services sold in the same period as expenses of the current period. This means that in most cases, direct expenses incurred in a quarter will not be fully taken into account when assessing profits for that period. The costs attributable to work in progress, balances of finished products in the warehouse, as well as to shipped but not sold products will remain unaccounted for (Clause 2 of Article 318, Article 319 of the Tax Code of the Russian Federation).

Important

Direct expenses are written off gradually - as products, works, and services are sold. Indirect costs can be taken into account in full during the period of their implementation. There is no need to wait for implementation (clause 2 of Article 318 of the Tax Code of the Russian Federation).

What is more profitable for the organization?

Obviously, it is more profitable for taxpayers to recognize as many expenses as possible as indirect. This will allow you to write off related expenses faster and reduce your current tax liability. However, as already noted, costs must be divided reasonably, taking into account production technology. It is permissible to recognize one or another type of cost as indirect only if it really cannot be classified as direct. If an organization violates this requirement, it faces additional tax charges (rulings of the Supreme Court of the Russian Federation dated November 24, 2017 No. 303-KG17-17016 and dated September 19, 2018 No. 306-KG18-13685).

The exception is organizations engaged in the provision of services. They are allowed to completely write off both indirect and direct expenses during the implementation period (Clause 2 of Article 318 of the Tax Code of the Russian Federation). This means that, although such taxpayers must divide expenses into direct and indirect, they will not face any negative consequences of incorrectly classifying expenses as indirect.

Advice

Organizations providing services can use the general principle of writing off direct expenses only in the period when services are sold, the cost of which includes these expenses.

It is advisable to consolidate the chosen option for recognizing direct expenses when providing services in the accounting policy. In conclusion, let us remind you that the correct division of expenses into direct and indirect will allow taxpayers not only to avoid claims from the tax authorities, but also to optimize current tax obligations.

Blog

When automatically filling out a declaration in the 1C program, it is important to understand whether the program filled out certain fields correctly.

We have already written about how to check the data on SALT (turnover balance sheet), you can see the article HERE.

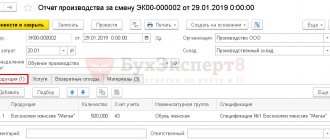

Today we will talk about what to do if you have already discovered that, for example, the program records expenses from the twentieth account (main production) as indirect.

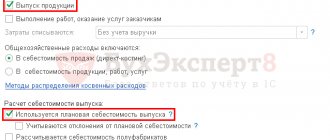

The first step is to check your income tax settings:

The setting is located in the main menu item “Main – Taxes and reports – Income tax”

Please note whether direct costs are indicated in this menu. When you click the “List of direct expenses” button, the program may ask you: “Fill out the list of direct expenses under Article 318 of the Tax Code of the Russian Federation,” feel free to click “YES ”.

After filling, delete unnecessary lines and save.

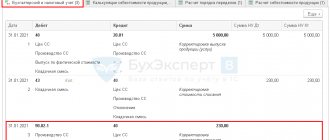

Create the SALT (turnover balance sheet) for account 20 “main production” in the context of accounting and tax accounting.

You can configure OSV using the “Show settings” button on the indicators tab.

If you see that some individual fields are reflected in the turnover on the Account Credit in the “Tax Accounting” column, this means these fields will be indicated in the declaration as indirect expenses (line 040 of Appendix 2, sheet 02) . The program will take into account the remaining expenses from account 20 as direct.

Related course

1C: Accounting 8.3

Find out more

You can ask for individual consultations on filling out or checking the correctness of filling out an income tax return by phone or email

/ “Accounting encyclopedia “Profirosta” 07/24/2019

Information on the page is searched for by the following queries: Income tax return, control ratios, how to draw up turnover, Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Salary training courses and personnel, Advanced training for accountants, Accounting for beginners Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services , Outsourcing, UTII reporting, Bookkeeping, Accounting support, Provision of accounting services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Organization of accounting, how to check, transport tax Krasnoyarsk, transport tax, response to the request of the Federal Tax Service, response to the request of regulatory authorities, control of the Federal Tax Service, on-site tax audit.